Concrete Surface Treatment Chemicals Market Size 2024-2028

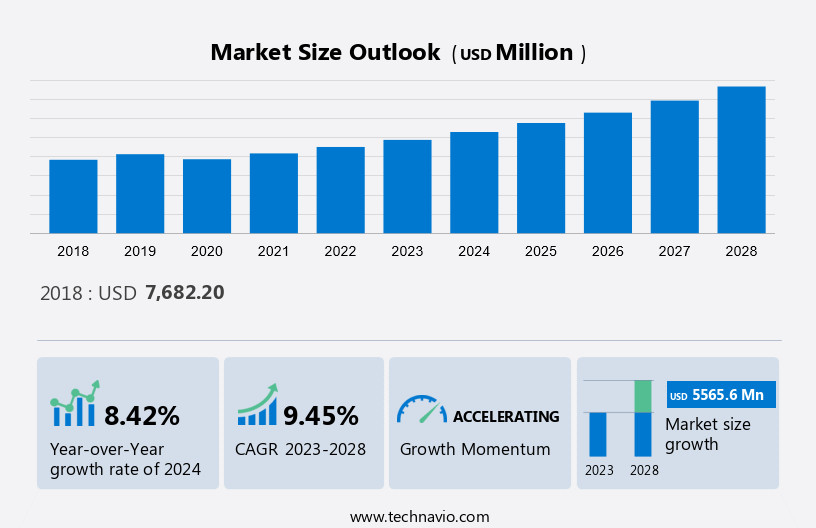

The concrete surface treatment chemicals market is estimated to grow USD 5.57 billion, at a CAGR of 9.45% between 2023 and 2028. The industry is experiencing significant growth due to increasing urbanization and rising disposable income levels. This trend is driving up the demand for various construction chemicals, including concrete curing compounds. Concrete curing compounds play a crucial role in ensuring the strength and durability of concrete structures. They help maintain optimal moisture levels during the curing process, which is essential for the formation of strong bonds between the cement particles. As a result, the market for concrete curing compounds is expected to grow at a steady pace in the coming years. This expansion is fueled by the increasing demand for infrastructure development and the construction of commercial and residential buildings in urban areas. Overall, the construction chemicals industry is poised for growth, with concrete curing compounds being a key offering.

What will be the size of the Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics and Customer Landscape

The market is driven by the increasing construction activities across the global construction sector. The market is focused on providing sustainable construction solutions with eco-friendly formulations, enhanced performance, durability, and aesthetic appearance. Protection against weathering, UV radiation, chemical exposure, abrasion, and blowholes are key factors driving the demand for advanced formulations. Sustainability goals and real estate regulations are influencing the market's growth, with a shift towards using harmless raw materials and reducing the carbon footprint. Mold release agents and sealants are essential products in the market, ensuring a smooth and even surface finish. The market caters to various end-use sectors, including residential, commercial, municipal, office buildings, retail outlets, and garages. The demand for concrete surface treatment chemicals is expected to grow significantly due to the increasing construction activities and the need for long-lasting, protective coatings.

Key Market Driver

The rising demand for concrete curing compounds is notably driving market growth. Concrete curing compounds help retain the moisture content in concrete. These curing compounds improve the strength of concrete. Concrete curing compounds are preferred in concrete structures because of their properties, such as water retention, high reflectance, short drying period, long-term setting, and the presence of non-volatile matter. These compounds are used to construct bridges, concrete pavements, runways, dams, and canal linings.

Further, moisture-curing adhesives are a type of concrete curing compound. They are chemical compounds that are used to absorb moisture in the concrete. The rising demand for moisture-curing adhesives will drive the demand for concrete-curing compounds during the forecast period, which will have a positive impact on the market growth and trends during the forecast period.

Significant Trend

A diversified product portfolio and strategic positioning of R&D centers are the primary market trends. Since most Companies in the market have diversified product portfolios, customers can easily choose products. BASF offers a diverse portfolio of concrete surface treatment chemicals, which includes products such as concrete curing compounds, concrete release agents, surface retardants, and dry-shakes and floor toppings. Chembond Chemicals has a diversified portfolio and offers products such as curing agents and water-repellant coatings in the surface treatment chemicals category.

Moreover, the above-mentioned products are developed in the research and development centers of companies at different locations. Major chemical companies in Europe and North America have their R&D centers in APAC, owing to low labor costs and the availability of low-cost infrastructure in China, South Korea, and India. The region is home to the global headquarters of BASF's Advanced Materials and Systems Research Technology Platform, one of the major R&D centers of the company. Companies reduce their R&D cost and increase profits by setting up R&D centers in this region. Thus, the above-mentioned factors will boost the growth of the market during the forecast period.

Major Market Challenge

Regulations on VOC used for manufacturing mold release agents is the major challenge impeding market growth. The use of solvent-based mold release agents in concrete increases VOC emissions by many end-user industries, such as the construction, automotive, and packaging industries. Exposure to heavy VOC emissions can cause eye, nose, and ear irritation, liver damage, and cancer in humans. Risks associated with VOC emission depend on the volume of particles present in the air, the duration of their presence, and how often a person breathes in such conditions.

However, several studies have suggested that exposure to VOCs may result in health-related problems in people with asthma or individuals sensitive to chemicals. The use of mold-release agents in concrete leads to the release of high volumes of VOCs into the atmosphere. VOC emissions via solvent-based mold release agents exceeded 1,20,000 tons in 2020. With the high consumption of solvent-based mold release agents, the release of VOCs is expected to rise. Therefore, regulations on VOC in mold release agents will have a negative impact on the growth of the market during the forecast period.

Key Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market analysis and report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting growth strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Teknos Group Oy - The company offers Sikagard PU UR, Inertol Poxitar, and Sikagard 62.

The market growth analysis report also includes detailed analyses of the competitive landscape of the market and information about 15 market Companies, including:

- 3M Co.

- Akzo Nobel NV

- Altrad Group

- Arkema SA

- BASF SE

- BECO TREAT ApS

- BRENNTAG SE

- Chembond Chemicals Ltd.

- ChemCo Systems Inc.

- Croda International Plc

- Flowcrete Group Ltd.

- Fosroc International Ltd.

- Henkel AG and Co. KGaA

- LATICRETE International Inc.

- Lion Specialty Chemicals Co. Ltd.

Qualitative and quantitative analysis of Companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize Companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize Companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

The market share growth of the non-residential segment will be significant during the forecast period. Concrete surface treatment chemicals, such as mold release agents, concrete curing compounds, and etching solutions, are widely used in non-residential construction applications across the world. Projects such as the expansion of the Mohe airport in Mohe in northeast China's Heilongjiang Province and the Indian government's goal of developing 220 new airports by 2025 will require large volumes of concrete surface treatment chemicals. Thus, the demand for construction chemicals will increase significantly, which will fuel the demand in the non-residential segment.

Get a glance at the market contribution of various segments Request a PDF Sample

The non-residential segment was valued at USD 5.53 billion in 2018. In China and India, increasing infrastructure developments will drive the demand for concrete surface treatment chemicals during the forecast period. The rising demand due to the expansion of non-residential projects worldwide will foster the growth of the market in focus on the non-residential segment during the forecast period.

Regional Analysis

For more insights on the market share of various regions Request PDF Sample now!

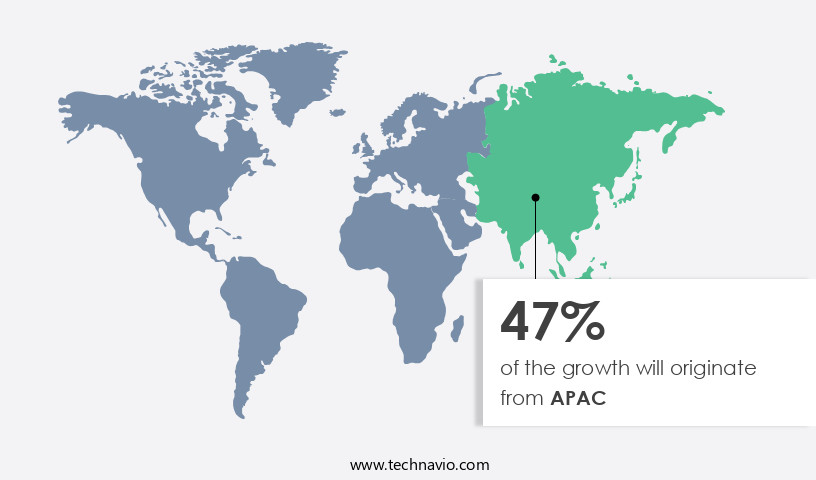

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional market trends and analysis and drivers that shape the market during the forecast period. Increased construction activities across APAC will drive the demand for concrete treatment chemicals during the forecast period. India and China, among other countries, are the major revenue contributors to the construction market in the region. China accounts for a significant market share in the global construction industry. In this country, numerous construction projects are likely to be completed during the forecast period, which will drive the demand for concrete surface treatment chemicals. New airports that began operation in 2021 comprised Jingzhou Shashi Airport, Jiujiang Lushan Airport, Heze Mudan Airport, Wuhu Xuanzhou Airport, Chengdu Tianfu International Airport, Chenzhou Beihu Airport and Shaoguan Danxia Airport, which are expected to be completed during the forecast period. Thus, the increasing number of construction projects in the country will drive the demand during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Non-residential

- Residential

- Product Outlook

- Mold release agents

- Curing compounds

- Sealants

- Region Outlook

- APAC

- China

- India

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Brazil

- Argentina

- APAC

You may also interested in below market reports:

- Construction Chemicals Market Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, India, Japan, Germany - Size and Forecast

- Hydrochloric Acid Market Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

- TMT Steel Bar Market Analysis APAC, Europe, North America, Middle East and Africa, South America - China, India, Japan, US, Russia - Size and Forecast

Market Analyst Overview

The market is driven by the increasing construction activities worldwide. The demand for sustainable construction solutions is propelling the market growth, with eco-friendly formulations gaining popularity due to their enhanced performance and durability. The aesthetic appearance of concrete surfaces is another significant factor fueling the market growth. Protection against weathering, UV radiation, chemical exposure, abrasion, and other environmental factors is crucial for the longevity of concrete structures. Advanced formulations, such as curing compounds, sealers, hardeners, and repair industries, offer superior protection against these factors. The Residential and Commercial construction segments are the major consumers of concrete surface treatment chemicals. The Residential segment holds a significant share due to the growing trend of sustainable construction practices in residential buildings. The Commercial segment is also expected to grow at a steady pace due to the increasing demand for energy efficiency, corrosion resistance, and longevity in commercial buildings. The manufacturing facilities sector is another significant consumer of concrete surface treatment chemicals. The market is expected to witness significant growth due to the increasing demand for durable concrete surfaces in various industries.

In addition, sustainability goals are driving the market towards the use of renewable ingredients and biodegradable additives in concrete surface treatment chemicals. The reduction of VOC emissions is a major concern for the industry, and the use of sustainable solutions is becoming increasingly important to meet environmental regulations and human health considerations. Polymers, solvents, and additives are the primary ingredients used in concrete surface treatment chemicals. The use of sustainable and environmentally friendly solutions is gaining popularity due to their reduced environmental impact and improved performance. In conclusion, the market is expected to grow significantly due to the increasing demand for sustainable construction practices, durability, and aesthetic appearance of concrete surfaces. The market is driven by the Residential and Commercial construction segments, and the manufacturing facilities sector is also expected to contribute significantly to the market growth. The use of renewable ingredients and biodegradable additives is becoming increasingly important to meet sustainability goals and reduce environmental impact.

|

Market Scope |

|

|

Market Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 5.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

China, US, India, Saudi Arabia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., Akzo Nobel NV, Altrad Group, Arkema Group., BASF SE, BECO TREAT ApS, BRENNTAG SE, Chembond Chemicals Ltd., ChemCo Systems Inc., Croda International Plc, Dow Chemical Co., Flowcrete Group Ltd., Fosroc International Ltd., Henkel AG and Co. KGaA, LATICRETE International Inc., Lion Specialty Chemicals Co. Ltd., Sika AG, Teknos Group Oy, The Euclid Chemical Co., and Wacker Chemie AG |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the industry across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch