Hydrochloric Acid Market Size 2025-2029

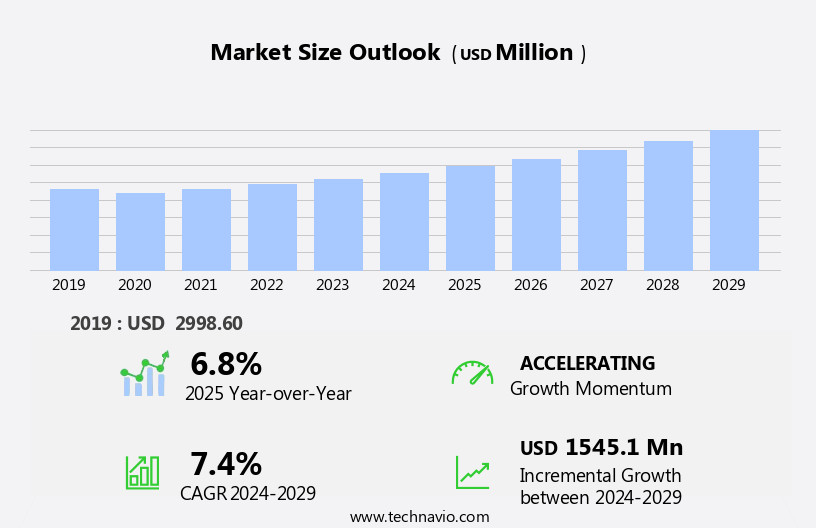

The hydrochloric acid market size is forecast to increase by USD 1.55 billion at a CAGR of 7.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for polyvinyl chloride (PVC). PVC is a widely used industrial plastic, and hydrochloric acid is a crucial raw material in its production process. The demand for PVC is projected to expand at a robust pace, thereby fueling the growth of the market. However, the market faces challenges as well. The availability of substitutes for hydrochloric acid poses a significant threat to its market share. Sulfuric acid and muriatic acid are some of the substitutes that can be used in various applications, limiting the scope of hydrochloric acid.

- Furthermore, the increasing demand-supply gap is another challenge that the market is grappling with. The input data indicates that the supply of hydrochloric acid is struggling to keep pace with the rising demand, leading to price volatility and potential supply disruptions. Companies seeking to capitalize on market opportunities and navigate challenges effectively must focus on enhancing their production capacity, exploring new applications for hydrochloric acid, and collaborating with suppliers to ensure a steady supply of raw materials.

What will be the Size of the Hydrochloric Acid Market during the forecast period?

- Hydrochloric acid, a strong mineral acid with the chemical formula HCl, plays a pivotal role in various industries due to its unique properties and versatile applications. In the oxidation-reduction process, it is used as a catalyst in the production of inorganic compounds, such as chlorides and inorganic salts. Its involvement in carbonate formations is evident in the neutralization process, where it reacts with calcium carbonate to form calcium chloride and water. The market is continually evolving, with new applications emerging in sectors like lithium-ion engines, metal stains, and carbon steel grades. In the steel industry, it is used for pickling steel alloys to remove rust and impurities, while in the paper industry, it is employed for table salt purification and water & wastewater treatment.

- The chemical's role extends to the food & beverage sector, where it is used in the production of sauces and canned goods, and in the textile industry for dyeing and finishing processes. Hydrochloric acid is also a crucial component in the mining sector for ore processing, and in the oil industry for acidizing oil wells and oil exploration. Moreover, hydrochloric acid is used in the production of chlorine, which is essential in water treatment and disinfection. Its role in environmental pollution mitigation is significant, as it is used to neutralize acidic waste and reduce emissions.

- Despite its widespread use, the market faces challenges such as energy consumption, shipping delays, and environmental regulations. The ongoing industrialization and climate change scenarios further complicate the market dynamics, necessitating innovative solutions and sustainable practices.

How is this Hydrochloric Acid Industry segmented?

The hydrochloric acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Food

- Steel

- Oil

- Chemicals

- Others

- Grade Type

- By-product grade

- Synthetic grade

- Application

- Chemicals and pharmaceuticals

- Food and beverage

- Steel and metal processing

- Water and wastewater treatment

- Others

- Geography

- North America

- US

- Canada

- South America

- Brazil

- Argentina

- Middle East and Africa

- UAE

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The food segment is estimated to witness significant growth during the forecast period.

Hydrochloric acid plays a significant role in various industries, including food processing. In the food segment, it is utilized in the production of corn syrups, such as high-fructose corn syrup (HFCS), primarily used in Soft Drinks. The hydrochloric acid consumption in the HFCS industry is mainly for regenerating ion exchange resins, essential for removing impurities. Additionally, hydrochloric acid is applied to acid-modify cornstarch and adjust the pH of intermediates, final products, and wastewater. Beyond food processing, hydrochloric acid is also employed in the production of soy sauce and hydrolyzed vegetable protein. This strong mineral acid is indispensable in numerous applications, including concrete treatment, pulp manufacturing, and oil & gas industries, where it serves as a crucial component in pickling steel, acidifying oil wells, and neutralizing wastewater.

Hydrochloric acid is also integral to the mining sector for ore processing and in the chemical industry for producing inorganic compounds and pickling steel alloys. Its usage extends to environmental applications, such as neutralizing hazardous waste and managing rust in various industries. In the oil industry, hydrochloric acid is employed as an acidifier for oil wells and in the storage and transport of Crude Oil. The versatile compound is also used in the production of lithium-ion batteries, tire ballasting, and carbon steel grades in the steel industry. Hydrochloric acid's applications are vast and essential, contributing to numerous industries' growth and efficiency.

The Food segment was valued at USD 918.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 70% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in APAC, where China holds a dominant position. China is the leading consumer of hydrochloric acid in the region due to its extensive use in the production of PVC and steel. The increasing demand for PVC, driven by various applications, is propelling the market in APAC and globally. Additionally, China is a significant producer of steel, further increasing the demand for hydrochloric acid in the region. Hydrochloric acid is used in various industries, including pulp manufacturing, concrete treatment, and oil & gas, among others. In the oil & gas sector, it is used for acidizing oil wells to enhance production.

In the chemical industry, hydrochloric acid is used for pickling steel and producing inorganic compounds. It is also used for pH control, neutralization, and table salt purification. The market trends include the increasing usage of hydrochloric acid in the production of lithium-ion batteries, tire ballasting, and carbon steel grades. However, environmental impacts and energy consumption are concerns in the market. The market is also subject to regulations aimed at reducing industrialization and corrosion of metals. The market dynamics are influenced by factors such as the oxidation-reduction process, carbonate formations, and sulfuric acid production. In the food industry, hydrochloric acid is used for pickling and processing various foods and beverages.

In the mining sector, it is used for ore processing and waste treatment. The market also includes the production of chlorides, sodium hydroxide, iron (III) oxide, and calcium chloride, among others. The market's future growth is expected to be influenced by factors such as the climate change scenario, smart gadgets, and dust management.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hydrochloric Acid Industry?

- The significant surge in demand for PVC (polyvinyl chloride) serves as the primary catalyst for market growth.

- Hydrochloric acid plays a significant role in various industrial processes, particularly in the production of PVC, an extensively used plastic. PVC consists of 57% chlorine and 43% carbon, with the former derived from industrial-grade salt and the latter primarily extracted from oil or gas via ethylene. Hydrochloric acid is instrumental in manufacturing organic compounds like dichloroethane and vinyl chloride, which subsequently form PVC. The versatile nature of PVC is attributed to its amorphous structure and chlorine atoms, granting it desirable properties such as fire-retardancy, oil and chemical resistance, abrasion resistance, lightweight, high mechanical strength, and toughness.

- These attributes make PVC a preferred material in major industries, including automotive, construction, packaging, electrical and electronics, and others. In industrial processing, hydrochloric acid is also employed in waste incinerators for the combustion of organic wastes, generating gaseous phase chlorides and hydrochloric acid. Additionally, it is used in water treatment for removing heavy metals, hardness, and other impurities through the precipitation of insoluble salts, such as those of calcium, magnesium, and iron. Moreover, hydrochloric acid is integral to the Kraft recovery furnace process in the production of sodium carbonate, a crucial ingredient in the manufacturing of glass, paper, and textiles.

- Furthermore, it is employed in oil recovery, where it is injected into reservoirs to enhance the extraction of crude oil. Environmental regulations mandate the application of hydrochloric acid in dust management and steel pickling operations, ensuring compliance with environmental standards. In the food and beverage industry, hydrochloric acid is used in the production of bisulfites and vegetable juices through the titration process. Lastly, hydrochloric acid is a vital component in the manufacturing of lubricant-based products and in water & wastewater treatment. In the context of the Climate Chain Scenario, the increasing industrialization and the growing demand for smart gadgets necessitate the production of more PVC, thereby driving the demand for hydrochloric acid.

- However, the stringent environmental regulations and the corrosive nature of hydrochloric acid pose challenges to its market growth.

What are the market trends shaping the Hydrochloric Acid Industry?

- Hydrochloric acid's market trend reflects an increasing availability of substitutes. Two noteworthy alternatives gaining traction are sulfuric acid and citric acid. These substitutes offer comparable performance in various industrial applications, making them attractive options for cost reduction and sustainability.

- Hydrochloric acid is a strong mineral acid extensively used in various industries, including medical device components production, concrete treatment, pulp manufacturing, and oil & gas. Its usage extends to pH control, oil extraction, chloride ion production, and pickling of steel. However, due to its corrosive and toxic nature, alternative acids such as emerald-safe acid, phosphoric acid, and sodium bisulfate are increasingly being adopted as substitutes. Emerald-safe acid, a non-corrosive chemical, is used in de-scaling boilers, evaporators, steam coils, and papermaking equipment. Phosphoric acid, another substitute, emits less vapor, making it less harmful to the environment.

- Sodium hydroxide and iron (III) oxide are also used as alternatives in certain applications. The chlorides segment, which includes hydrochloric acid, is a significant component in crude steel production. chlorine dioxide, a derivative of hydrochloric acid, is used in municipal solid waste treatment and oil well acidizing. Hydrogen chloride, another derivative, is used in organic compound synthesis and as a catalyst in chemical industries. The mining sector uses hydrochloric acid in ore processing and chloride ion production. In the oil & gas industry, hydrochloric acid is used in oil well acidizing and gas processing.

- Canned goods manufacturing utilizes hydrochloric acid as a preservative. In summary, hydrochloric acid's substitutes, including emerald-safe acid, phosphoric acid, sodium hydroxide, iron (III) oxide, and chlorine dioxide, have similar properties and are used in various applications, making them viable alternatives to hydrochloric acid.

What challenges does the Hydrochloric Acid Industry face during its growth?

- The industry's growth is significantly impacted by the expanding demand-supply disparity, which poses a substantial challenge.

- The market faces a significant demand-supply imbalance, posing a challenge to its growth. In Europe, countries like Spain, Germany, and Italy experience this issue prominently. Spain's hydrochloric acid scarcity is a major contributor to the demand-supply gap in the region. Meanwhile, in the US, the declining crude oil prices and fluctuating demand-supply gap have led to an increase in domestic crude oil extraction instead of imports. Hydrochloric acid plays a crucial role in various industries, including the production of sulfuric acid through the oxidation-reduction process, carbonate formations, and lithium-ion engines. It is also used in neutralization processes, table salt purification, and the paper industry.

- In the steel industry, hydrochloric acid is employed for acidizing, inorganic compound production, pickling steel alloys, and rust removal. Lithium-ion batteries, tire ballasting, and carbon steel grades also rely on hydrochloric acid. Environmental pollution and energy consumption are concerns associated with hydrochloric acid production. It is an inorganic compound with the chemical formula HCl. Its production involves chlorine, which can lead to environmental hazards if not managed properly. Additionally, the energy-intensive production process contributes to high energy consumption. Despite these challenges, hydrochloric acid remains a vital chemical in numerous industries, and efforts are being made to improve its production processes and minimize its environmental impact.

- Shipping delays and the depletion of limestone formations are other factors affecting the market.

Exclusive Customer Landscape

The hydrochloric acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hydrochloric acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hydrochloric acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AGC Inc. - The company provides hydrochloric acid, a potent acid with acute toxicity and corrosivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- BASF SE

- Coogee

- Covestro AG

- ERCO Worldwide

- FSTI Inc.

- INOVYN Europe Ltd.

- Italmatch Chemicals Spa

- Jones Hamilton Co.

- Kemira Oyj

- Occidental Petroleum Corp.

- Olin Corp.

- PCC SE

- Qingdao Hisea Chem Co. Ltd.

- Shiva Group

- Sigma Aldrich Chemicals Pvt. Ltd.

- SPOLANA s.r.o.

- Tessenderlo Group NV

- W.K. Merriman Inc.

- Westlake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hydrochloric Acid Market

- In February 2023, Dow Inc. Announced the expansion of its hydrochloric acid production capacity at its Freeport, Texas, facility. This USD300 million investment aims to increase the site's output by 50%, making it the largest hydrochloric acid manufacturing complex in North America (Dow Inc. Press release).

- In August 2024, INEOS ChlorVinyls and Solvay signed a strategic collaboration agreement to jointly develop and commercialize a new hydrochloric acid production technology. This partnership is expected to enhance their competitive positions in the market by improving production efficiency and reducing costs (INEOS ChlorVinyls press release).

- In December 2024, the European Commission approved the merger of Tosoh Corporation's chlor-alkali business with INEOS ChlorVinyls. This deal is anticipated to create a leading global player in the market, with an estimated combined market share of 25% (European Commission press release).

- In March 2025, Wanhua Chemical Group unveiled its new hydrochloric acid plant in Nanjing, China, with an annual capacity of 1.2 million metric tons. This expansion strengthens Wanhua's position as a major global supplier of hydrochloric acid (Wanhua Chemical press release).

Research Analyst Overview

The market plays a pivotal role in various industries, including the steel industry and oil exploration. In steel production, hydrochloric acid is utilized for pickling steel alloys to remove rust and impurities, enhancing the surface quality of crude steel. This process is essential for industrial processing, particularly in the production of stainless steel. Oil well acidizing relies on hydrochloric acid for the neutralization of formation water, ensuring optimal drilling conditions. Furthermore, in ore processing, hydrochloric acid is used for acid usage in the mining sector to extract valuable minerals. Environmental pollution concerns have led to stringent regulations on the handling and disposal of hydrochloric acid.

As a result, industries are focusing on dust management and ph control to minimize environmental impact. Calcium chloride, a byproduct of hydrochloric acid production, is utilized in food processing and storage & transport industries for de-icing and as a food additive. The industrialization of developing countries is driving the demand for hydrochloric acid in various sectors, leading to increased usage and production. However, the market faces challenges due to the high production costs and potential hazards associated with handling and transportation. In summary, the market is a critical component in numerous industries, including steel pickling, oil exploration, ore processing, food processing, and industrialization.

Its usage in these sectors is driven by the need for improved product quality, optimized drilling conditions, and regulatory compliance. Despite the challenges, the market's versatility and essential role in industrial processes ensure its continued growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hydrochloric Acid Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2025-2029 |

USD 1545.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

China, US, Japan, India, South Korea, Germany, Australia, UK, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hydrochloric Acid Market Research and Growth Report?

- CAGR of the Hydrochloric Acid industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hydrochloric acid market growth of industry companies

We can help! Our analysts can customize this hydrochloric acid market research report to meet your requirements.