Construction Films Market Size 2024-2028

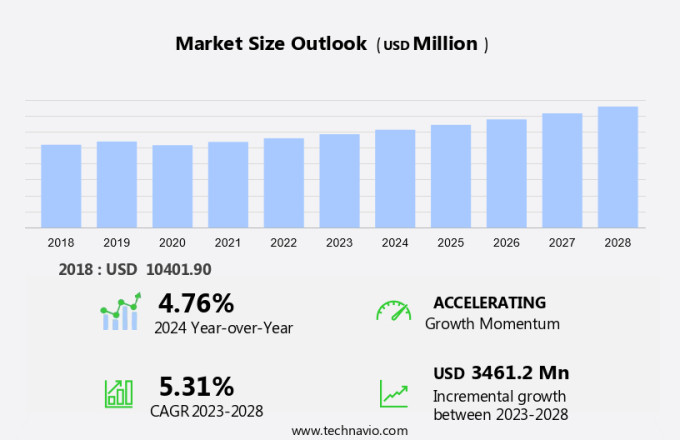

The construction films market size is forecast to increase by USD 3.46 billion at a CAGR of 5.31% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of the primary factors driving market expansion is the advancement in product innovation. Manufacturers are focusing on developing films with superior features, such as enhanced thermal insulation, improved UV protection, and increased durability. Additionally, there is a rising demand for sustainable and eco-friendly construction films, as the construction industry shifts towards more environmentally-friendly practices. However, challenges persist in the market, particularly with regards to quality control and durability issues in lower-grade films. Addressing these concerns through technological advancements and stricter quality standards will be crucial for market growth. Overall, the market is poised for steady expansion in the coming years, with a focus on innovation, sustainability, and quality.

What will be the Size of the Market During the Forecast Period?

- The market intersects with the healthcare industry in various ways, particularly in the context of medical imaging services. Chronic conditions and comorbidities, such as heart failure and cardiovascular diseases (CVD), are prevalent among Medicare beneficiaries, leading to an increased demand for diagnostic imaging. Radiology departments rely heavily on technologies like x-rays, CT scans, and MRI to detect and monitor these conditions. The contrast media industry plays a crucial role in medical imaging, with applications in various disease indications. Photon-counting CT scanners and digital solutions are transforming the industry, enabling earlier and more accurate diagnoses. Artificial intelligence (AI) is also revolutionizing diagnostic imaging centers by streamlining processes and improving diagnostic accuracy.

- However, the use of contrast media, including iodinated and nonionic types, comes with side effects and risks, such as allergic reactions. Nanosized agents and other advanced contrast media are being developed to mitigate these risks. The market for contrast media is expected to grow significantly due to the increasing prevalence of chronic medical conditions, including cancer, and sedentary lifestyles leading to an increased incidence of CVD. The market dynamics of the contrast media industry are influenced by several factors, including technological advancements, regulatory requirements, and consumer preferences. Angiography, fluoroscopy, and ultrasound imaging are other diagnostic techniques that utilize contrast media, further expanding the market scope. Overall, the healthcare set-up is undergoing significant changes, with a focus on early diagnosis and personalized treatment plans, driving the demand for advanced medical imaging solutions.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- LDPE and LLDPE

- HDPE

- Polypropylene

- PVC

- Others

- End-user

- Residential

- Commercial

- Industrial

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Type Insights

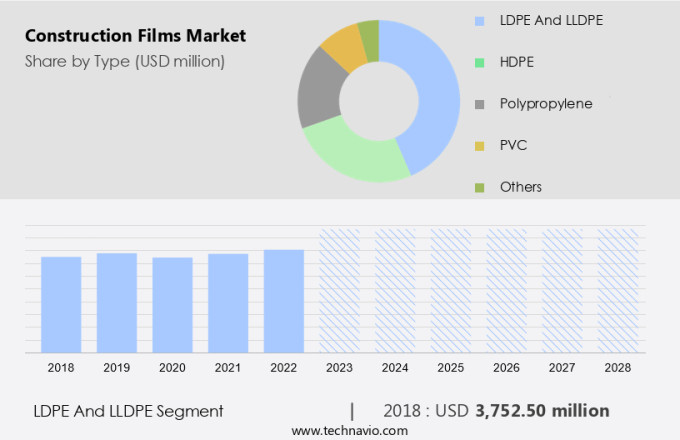

- The LDPE and LLDPE segment is estimated to witness significant growth during the forecast period.

The market, specifically low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE), is experiencing notable growth due to their extensive applications within the construction industry. These films offer desirable features such as flexibility, durability, and exceptional barrier properties, making them suitable for various applications including vapor barriers, foundation linings, and concrete masking. The construction sector's evolution and adaptation to new trends have highlighted the significance of LDPE and LLDPE films in areas like building envelopes, roofing, flooring, walls, ceilings, windows, and HVAC systems. Green building initiatives and natural resource conservation have further fueled demand for these films, with property tax credits offering incentives for their use.

Get a glance at the market report of share of various segments Request Free Sample

The LDPE and LLDPE segment was valued at USD 3.75 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

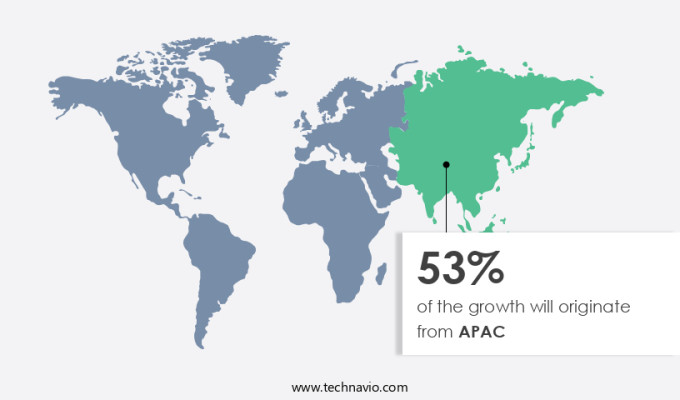

- APAC is estimated to contribute 53% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific (APAC) is the largest and fastest-growing market globally, driven by urbanization and the expansion of the construction industry. China is a significant contributor to this growth. Global companies, particularly those in the manufacturing sector, are investing in APAC due to favorable government policies, low-cost resources, a skilled workforce, and affordable operating and labor costs. Energy-efficient systems and green building practices are increasingly being adopted in both residential and infrastructure projects, fueling the demand for high-performance and recyclable construction films. The region's focus on recycling plastic waste to produce low-cost films is also contributing to market growth. The market in APAC is expected to continue its expansion during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Construction Films Market?

Advancements in product innovation is the key driver of the market.

- The market is experiencing notable advancements as manufacturers prioritize innovation to meet the evolving needs of the construction industry. These developments are enhancing the functionality and safety of construction films, contributing to market growth. One such innovation is Fragment Retention Films, which hold glass fragments together upon breakage, ensuring occupant safety in high-rise buildings and severe weather conditions. Another trend is the integration of Energy-efficient systems, including Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Polypropylene (PP), Polyethylene Terephthalate (PET), and recycled plastic films, in Green Building Practices. These materials promote energy efficiency, natural resource conservation, and reduce carbon footprints. Moreover, the use of Vapor Retarders, Gas/Moisture Barrier, Reinforced Enclosure, and Building Systems in Residential, Industrial, and Commercial projects, such as LNG terminals, Power plants, and Real Estate Development, is gaining popularity.

- Additionally, UV protection and Bomb explosion protection films offer enhanced security and safety. The recovery and recycling of Plastic Waste into Recycled Plastic Films, including PVB and PVC, is a significant step towards Plastic Waste Management. Moisture barriers, Gas barriers, Sound barriers, and Housing Projects further expand the application scope of Construction Films. The market dynamics are influenced by factors such as Building Enveloping, Solar Control Films, and the increasing adoption of Green Building Initiatives.

What are the market trends shaping the Construction Films Market?

Increasing adoption of sustainable and eco-friendly construction films is the upcoming trend in the market.

- The market is witnessing a notable shift towards energy-efficient and sustainable films. This trend is being driven by increasing environmental consciousness and the adoption of green building practices in both residential and commercial projects. To minimize their carbon footprint, manufacturers are focusing on producing films from recycled or bio-based materials, such as Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Polypropylene (PP), Polyethylene Terephthalate (PET), and Polyolefin resins. These sustainable films offer several benefits, including improved interior air quality, reduced waste production, and enhanced energy efficiency. They also contribute to green building certifications like LEED, aligning with the construction industry's commitment to sustainability and the broader goal of minimizing environmental impact.

- In addition, these films offer various functionalities such as vapor retarders, gas/moisture barriers, reinforced enclosures, and barrier protection for building systems, including roofing, flooring, walls and ceilings, windows, and HVAC, electrical, and plumbing systems. Furthermore, recycled films, such as PVB and PVC, are increasingly being used in moisture barriers, gas barriers, sound barriers, and housing projects. The adoption of these films is also essential for infrastructure projects, including LNG terminals, power plants, and civil engineering projects, as they provide UV protection, bomb explosion protection, and fragment retention. Overall, the market is expected to grow significantly due to the increasing demand for sustainable building materials and practices, natural resource conservation, and property tax credits.

What challenges does Construction Films Market face during the growth?

Quality control and durability issues in lower-grade films is a key challenge affecting the market growth.

- In the market, energy efficiency and sustainability are driving forces for growth. Construction activities across residential, industrial, and commercial sectors are increasingly adopting green building practices, leading to a higher demand for energy-efficient systems. Plastic sheets, including low-cost films and high-performance films made from recycled plastic waste, are gaining popularity as they offer excellent insulation, moisture and gas barrier properties, and UV protection.

- Moreover, manufacturers prioritize the use of recycled plastic waste in the production of recycled films such as PVB, PVC, and LDPE, HDPE, PP, and PET. These films are used in various building applications, including vapor retarders, reinforced enclosures, and building systems. Property tax credits and incentives for green building initiatives further encourage the adoption of recycled plastic films in various construction projects.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Avient Corp.

- Berry Global Inc.

- Compagnie de Saint Gobain

- Cortec Corp.

- DuPont de Nemours Inc.

- Fastenal Co.

- Industrial Development Co. sal

- Inteplast Group

- International Plastics Inc.

- Layfield Group Ltd.

- Magical Film Enterprise Co. Ltd.

- Muraplast d.o.o.

- Napco National

- PLASTA

- POLIFILM GmbH

- Sealed Air Corp.

- Sigma Plastics Group

- TECHNONICOL India Pvt. Ltd.

- Tilak Polypack Pvt. Ltd.

- W.W. Grainger Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The construction industry is continuously evolving, with a growing focus on energy efficiency, sustainability, and protective measures. One of the key areas of innovation is the use of construction films, which offer various benefits for residential, industrial, and commercial projects. These films are essential components of building envelopes, providing insulation, UV protection, and barrier protection. Construction films are available in different types, including energy-efficient systems made from low-density polyethylene (LDPE), high-density polyethylene (HDPE), polypropylene (PP), and polyethylene terephthalate (PET). These films are recyclable, making them an eco-friendly alternative to traditional building materials.

In addition, the recycling of plastic waste is a significant trend in the construction industry, contributing to the reduction of natural resource consumption and the promotion of green building practices. The use of construction films extends to various applications, such as vapor retarders, gas/moisture barriers, reinforced enclosures, and building systems. In residential projects, these films contribute to energy efficiency, reducing heating and cooling costs. In infrastructure projects, they offer protection against UV radiation, bomb explosion protection, and moisture infiltration. Green building initiatives, which prioritize natural resource conservation and energy efficiency, have increased the demand for construction films. The market includes various types of films, such as PVB, PVC, and recycled films.

Furthermore, moisture barriers, gas barriers, sound barriers, and housing projects all benefit from the use of these films. Building envelopes, which include roofing, flooring, walls and ceilings, windows, and HVAC systems, are essential components of any building, and construction films play a crucial role in their effectiveness. The adoption of construction films is not limited to residential and commercial projects. They are also used in industrial projects, such as LNG terminals, power plants, and civil engineering projects. The films offer UV protection, insulation, and barrier protection, ensuring the longevity and efficiency of these structures. The use of construction films contributes to the reduction of carbon footprints by minimizing the need for natural resources and promoting the recycling of plastic waste.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.31% |

|

Market growth 2024-2028 |

USD 3.46 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.76 |

|

Key countries |

China, US, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch