Directional Drilling Market Size 2024-2028

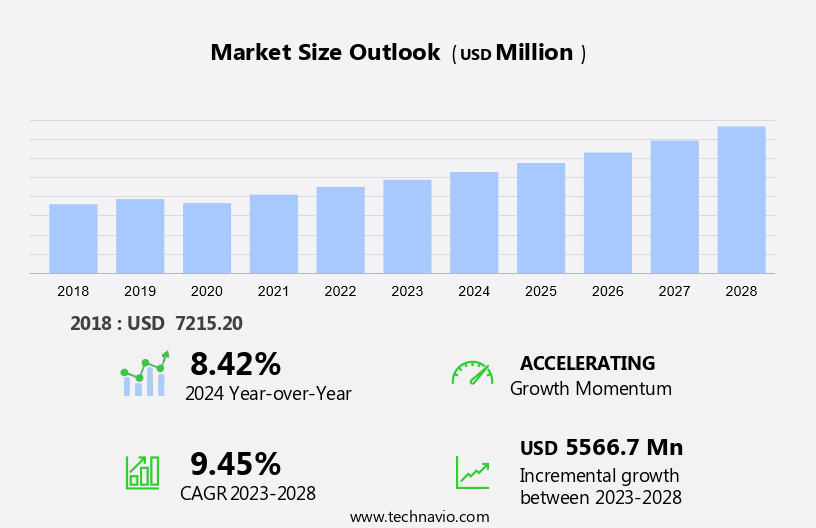

The directional drilling market size is forecast to increase by USD 5.57 billion at a CAGR of 9.45% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing consumption of oil and gas globally. This trend is expected to continue, as the energy sector remains a key contributor to economic development and industrialization. Another key driver is the automation of directional drilling techniques, which enhances drilling efficiency and reduces operational costs. However, the market is not without challenges. The increasing adoption of renewable energy sources, such as wind and solar, is expected to impact the demand for oil and gas, potentially slowing market growth. To capitalize on opportunities and navigate these challenges effectively, companies in the market should focus on innovation and technological advancements that enhance drilling efficiency and reduce environmental impact.

- One major driver is the increasing consumption of oil and gas for power generation and production units, particularly in regions such as OPEC, which is also contributing to the expansion of the Oilfield Services (OFS). Another trend is the automation of directional drilling techniques, including the adoption of Rotary Steerable Systems, which enhance operational efficiency and productivity. Additionally, there is a growing emphasis on safety measures in the industry. Furthermore, the increasing adoption of renewable energy production is expected to impact the market, as the industry shifts towards more sustainable energy sources.

What will be the Size of the Directional Drilling Market during the forecast period?

- The market encompasses the provision of drilling services for the exploration and production of various energy sources, including crude oil and natural gas. This market has experienced significant growth due to the increasing demand for efficient drilling methods, particularly in deep-water offshore fields and extended reach drilling applications. The directional drilling method enables the drilling of wells in complex geological formations, increasing the recovery of hydrocarbons and reducing the environmental impact compared to traditional vertical drilling. Environmental regulations continue to shape the market, with a focus on safety, evacuation plans, and minimizing the carbon footprint.

- The adoption of green energy sources, such as geothermal energy exploration, is also influencing the market dynamics. Despite the challenges posed by fluctuating crude oil prices and equipment costs, the market is expected to maintain its growth trajectory, driven by the ongoing exploration activities and the need for energy security.

How is this Directional Drilling Industry segmented?

The directional drilling industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Technique

- Rotary steerable system

- Conventional methods

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Russia

- UK

- Middle East and Africa

- South America

- North America

By Application Insights

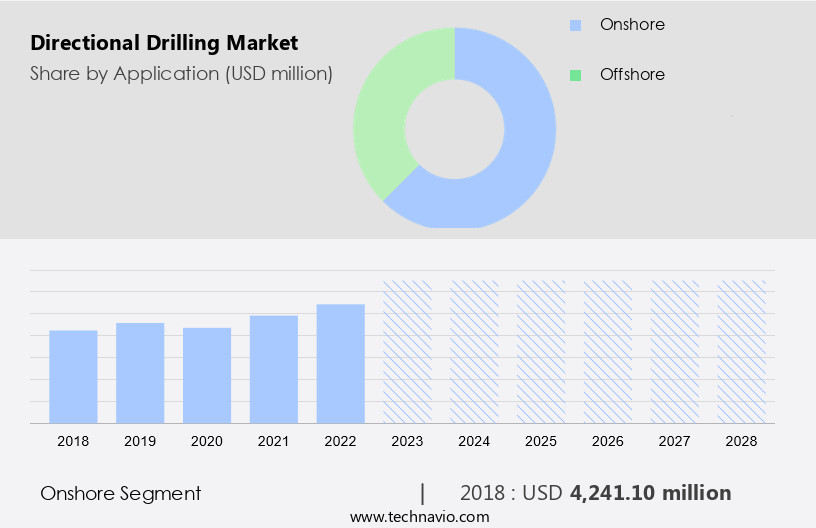

The onshore segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable expansion, with onshore drilling projects being a key contributor. Onshore drilling involves the process of drilling wells on land, which is economically viable and accessible. This method's popularity stems from its cost-effectiveness, making it an appealing choice for oil and gas companies. The US is among the leading countries driving the growth of the onshore market, with the shale revolution spurring increased drilling activities, particularly in regions such as the Permian Basin and Bakken Formation. Companies have invested substantially in onshore projects to capitalize on the abundant shale reserves in these areas.

Advanced methods and tools, including Horizontal Drilling, Rotary Steerable Systems, Measurements-while drilling (MWD), and Logging-while drilling (LWD), are being employed to enhance drilling efficiency and productivity. The market is further fuelled by the exploration of new reservoirs, including those in deep-water offshore fields and marine resource sites. The market's growth is influenced by factors such as population growth, energy demand, and the need for infrastructure development. Companies are also focusing on safety measures, including evacuation plans and maintenance, to ensure the sustainability of their operations. The market's expansion is expected to continue, driven by the increasing demand for energy sources, including fossil fuels, hydrocarbons, and renewable energy production.

The market's growth is also influenced by the lower cost of drilling services and equipment, as well as the faster installation of production units. The market encompasses onshore and Offshore drilling, with oil field operators seeking to optimize their production units and enhance productivity. The market's growth is further influenced by the crude oil prices, OPEC policies, and the operational cost of drilling. The market is expected to witness technological improvements, including the use of single pilot hole drilling and multilateral drilling, to further enhance efficiency and productivity.

Get a glance at the market report of share of various segments Request Free Sample

The Onshore segment was valued at USD 4.24 billion in 2018 and showed a gradual increase during the forecast period.

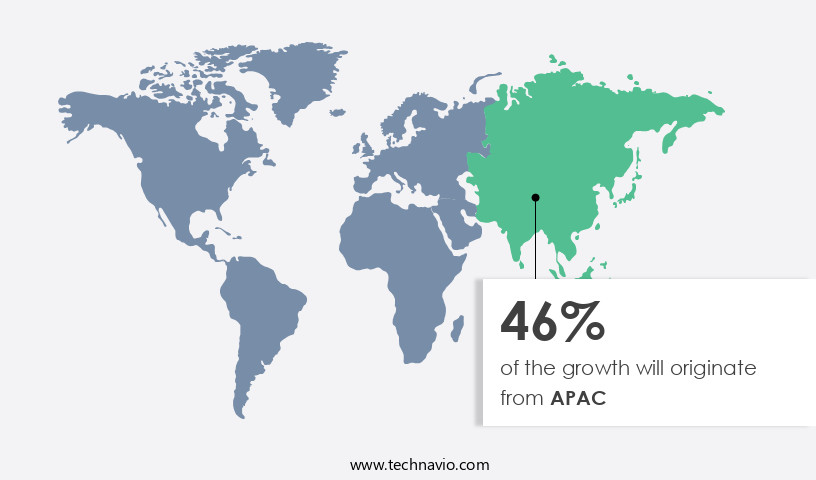

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Directional drilling is a crucial technique in extracting oil and natural gas from shale reservoirs, particularly in the US, which has vast shale reserves. This method, combined with hydraulic fracturing, enables the extraction of hydrocarbons from specific layers of shale formations. The US became a major exporter from a net importer due to the growth in oil and gas production in regions such as the Permian Basin, the Federal Offshore in the Gulf of Mexico, and the Bakken region. Advanced tools and methods, including Horizontal Drilling, Rotary Steerable Systems, Logging-while drilling (LWD), and Measurements-while drilling (MWD), have significantly increased drilling efficiency and productivity.

These advancements have reduced operational costs and the environmental impact of drilling operations. The offshore sector, including deep-water offshore fields, has also seen faster installation and lower maintenance costs due to technological improvements. The growth in energy production from unconventional sources, such as shale and tight oil reserves, has been a significant factor in population growth and urbanization, leading to increased demand for infrastructure and power generation. The energy industry continues to invest in new reservoirs, both onshore and offshore, to meet this demand. Safety measures, such as evacuation plans and surface disturbance minimization, are essential considerations in drilling operations. The energy sector's transition towards renewable energy sources, such as solar, wind, hydro, and geothermal energy exploration, is also driving innovation in drilling technologies.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Directional Drilling Industry?

- The growing consumption of oil and gas is the key driver of the market. The global oil and gas market is experiencing steady growth due to the rising energy demand worldwide. This trend is primarily driven by industrialization and urbanization in developing countries. Major oil and gas companies, such as SLB, are responding to this demand by increasing their exploration and production projects. In the last decade, natural gas consumption has seen significant growth due to its increasing adoption as a fuel.

- With the continued expansion of industries in developing countries like India and China, the demand for natural gas is anticipated to continue rising during the forecast period. The energy sector's focus on sustainability and reducing carbon emissions is also contributing to the increasing popularity of natural gas as a cleaner alternative to coal and oil. Overall, the oil and gas market is expected to remain a vital sector in the global economy, providing energy to power industries and households around the world.

What are the market trends shaping the Directional Drilling Industry?

- The automation in directional drilling technique is the upcoming market trend. The oil and gas industry's drilling process faces numerous challenges due to complex geologic conditions, interconnected well site systems, and operational variables. These factors necessitate continuous monitoring and adjustments, including addressing time lags between drilling control system sensors, bit rotational speed, and weight-on-bit.

- Despite these challenges, advancements in drilling process efficiencies and wellbore quality are anticipated to mitigate their impact, enhancing the drilling process. The industry is shifting towards a reduced human footprint and increased system automation to boost productivity, efficiency, safety, and equipment quality.

What challenges does the Directional Drilling Industry face during its growth?

- The increasing adoption of renewable energy is a key challenge affecting the industry growth. The shift towards renewable energy sources for power generation is gaining momentum globally. This trend is driven by the increasing adoption of clean energy initiatives by both developing and developed nations to minimize carbon emissions. Renewable energy sources, such as wind, geothermal, solar, and biomass, hold significant potential to become dependable, cost-effective, and secure alternatives to conventional fuels. The preference for renewable energy over traditional fuels is growing due to their eco-friendly nature, as they do not contribute to environmental pollution and, consequently, do not aggravate climate change.

- The significance of renewable energy sources is escalating as they align with global efforts to decrease greenhouse gas emissions. However, this transition towards renewable energy may have repercussions for the conventional fuel industry, as investments are progressively being diverted towards renewable energy.

Exclusive Customer Landscape

The directional drilling market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the directional drilling market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, directional drilling market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barbco Inc.

- CHTC Jove Heavy Industry Co.

- Goodeng International

- Granite Construction Inc.

- H.H. Drill Tech Drilling Machinery Co. Ltd.

- Halliburton Co.

- Herrenknecht AG

- Jiangsu Dilong Heavy Machinery Co. Ltd.

- Jindal Drilling and Industries Ltd.

- Nabors Industries Ltd.

- NOV Inc.

- Prime Drilling GmbH

- Radius HDD Direct LLC

- Schlumberger Ltd.

- Scientific Drilling International

- Terra AG

- Tracto Technik GmbH and Co. KG

- Vermeer Corp.

- Xinyu FeiHu Pipeline Technical Equipment Co. Ltd.

- Xuzhou Construction Machinery Group Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the advanced methods and tools employed in drilling operations to access hydrocarbon reservoirs and other energy sources in various formations. This technique enables drilling multiple wells from a single location, reducing surface disturbance and the need for extensive infrastructure development. Directional drilling has gained significant traction due to its efficiency and ability to optimize field operations. The process involves the use of advanced equipment, such as downhole motors and rotary steerable systems, to navigate complex geological formations and reach reservoirs that were previously inaccessible. The energy industry's shift towards exploring new reservoirs and enhancing production from existing ones has fueled the demand for directional drilling.

This trend is particularly noticeable in the offshore sector, where deep-water offshore fields and marine resource sites offer vast potential for hydrocarbon production. Technological improvements have played a crucial role in the advancement of directional drilling. Measurements-while-drilling (MWD) and logging-while-drilling (LWD) systems provide real-time data on drilling conditions, enabling drillers to make informed decisions and improve operational efficiency. The increasing focus on reducing operational costs and enhancing productivity has led to the adoption of multilateral drilling, which allows the drilling of multiple laterals from a single wellbore. This approach has proven particularly effective in the exploration and production of tight oil reserves and shale gas reserves.

The market dynamics of the directional drilling industry are influenced by several factors, including the cost of equipment and labor, safety measures, and the regulatory environment. The industry is also impacted by broader trends, such as population growth, urbanization, and the transition towards renewable energy sources. The efficiency gains and cost savings offered by directional drilling have made it an essential component of the energy industry's exploration and production activities. As the industry continues to evolve, the focus on technological advancements and operational excellence is expected to drive growth in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 5.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, China, Russia, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Directional Drilling Market Research and Growth Report?

- CAGR of the Directional Drilling industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the directional drilling market growth of industry companies

We can help! Our analysts can customize this directional drilling market research report to meet your requirements.