Oilfield Services Market Size 2025-2029

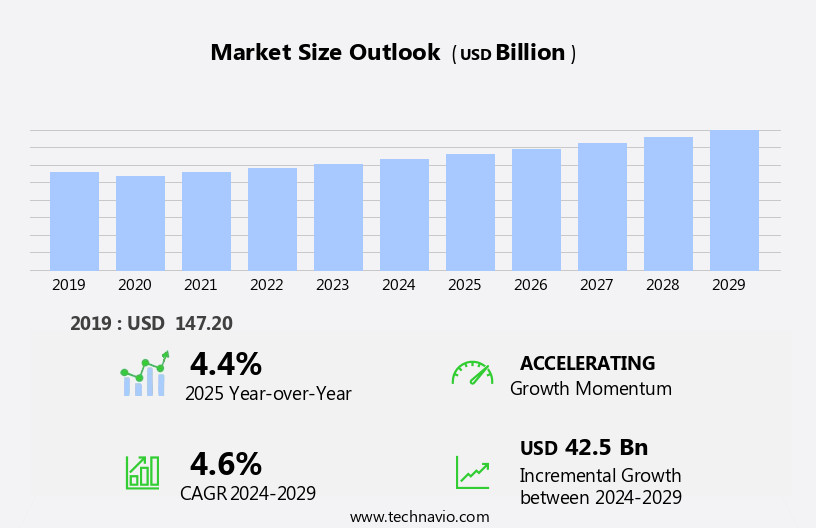

The oilfield services market size is forecast to increase by USD 42.5 billion, at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for oil and natural gas worldwide. This expanding need is fueled by ongoing energy consumption and the continuous development of new energy infrastructure projects. Technological innovations are playing a pivotal role in enhancing productivity and efficiency in the oilfield services sector, enabling companies to optimize their operations and reduce costs. However, the market is not without challenges. Fluctuations in crude oil prices pose a significant risk, as they can impact both the demand for oilfield services and the profitability of service providers.

- Effective risk management strategies and the ability to adapt to price volatility will be crucial for companies seeking to capitalize on market opportunities and navigate these challenges successfully.

What will be the Size of the Oilfield Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its various sectors. Production optimization remains a key focus, with artificial lift systems and workover services ensuring maximum output from existing wells. Offshore services are in high demand, as oil and gas companies explore new frontiers in deep waters. Environmental compliance is another critical area, with stringent regulations driving the need for corrosion control, hydraulic fracturing with enhanced environmental practices, and waste disposal solutions. Reservoir characterization and steam injection are essential for reservoir management, providing valuable insights into oil and gas reserves. Downhole tools and drilling automation are transforming drilling operations, enhancing drilling efficiency and reducing costs.

Production forecasting and well testing are integral parts of the production enhancement process, ensuring optimal performance from wells. Pipeline installation and maintenance, along with pressure pumping and wellbore pressure management, are crucial for ensuring the safe and efficient transportation of oil and gas. Remote monitoring and data analytics are revolutionizing the industry, providing real-time insights into well performance and enabling proactive intervention. Safety regulations and well integrity remain top priorities, with cementing services, well logging, and directional drilling ensuring the safe and effective completion of wells. Sand control and flow assurance are essential for maintaining production levels and maximizing revenue.

The ongoing unfolding of market activities continues to shape the oilfield services landscape, with new technologies and applications emerging to meet the evolving needs of the industry.

How is this Oilfield Services Industry segmented?

The oilfield services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Onshore

- Offshore

- Type

- Field operations

- Analytical and consulting services

- Equipment rental

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Russia

- Middle East and Africa

- Qatar

- UAE

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

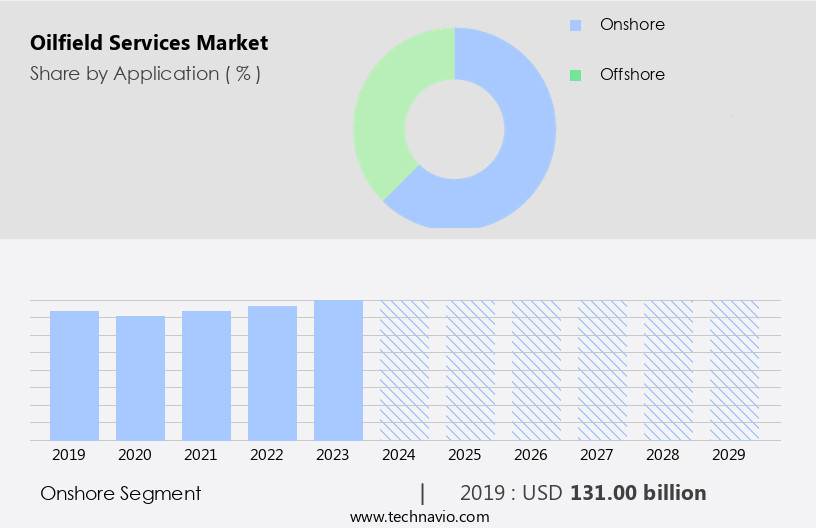

The onshore segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of technologies and services essential to the exploration and production of oil and gas. Key entities include chemical flooding, production monitoring, pipeline installation, production enhancement, horizontal drilling, completion services, subsea production, coiled tubing, wellbore stability, data acquisition systems, well intervention, data analytics, sand control, cementing services, production optimization, artificial lift, offshore services, environmental compliance, workover services, reservoir characterization, steam injection, corrosion control, hydraulic fracturing, enhanced oil recovery, wireline services, fracture modeling, flow assurance, remote monitoring, reservoir management, mud logging, reservoir simulation, water management, drilling optimization, pressure pumping, wellbore pressure, drilling fluids, drilling efficiency, carbon capture, reservoir simulation software, well stimulation, safety regulations, well integrity, well logging, and seismic data acquisition.

In 2024, the onshore segment held a significant market share due to the high volume of onshore drilling and production activities and the lower capital requirements compared to offshore projects. The onshore market is populated by various large to small-scale oilfield service providers. The growth of the onshore segment is fueled by the increasing upstream activities, such as new drilling and the adoption of enhanced oil recovery technologies, driven by the global energy demand surge. Oil and gas E&P companies in North America and the Middle East are actively pursuing new greenfield projects as mature fields reach the end of their production life cycle.

The Onshore segment was valued at USD 131.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

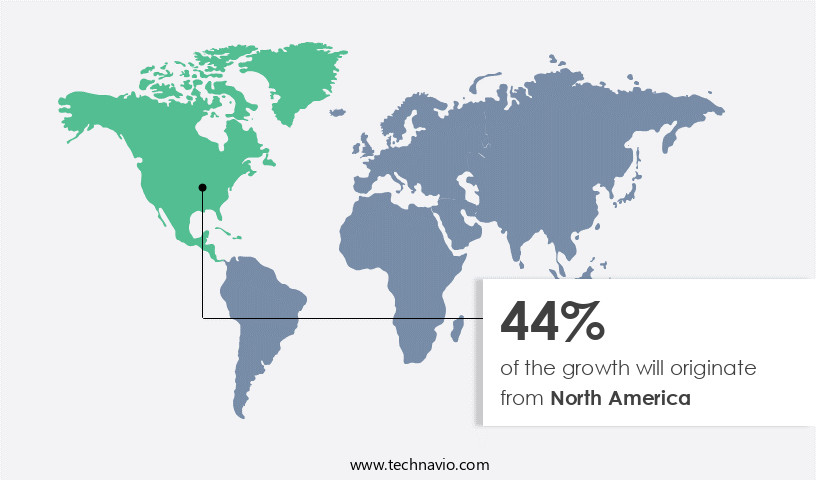

North America is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the US the market of North America, the country held a significant share in 2024. The recovery of crude oil prices and the surge in shale oil production in the US served as the primary growth drivers for the market in North America during this period. Technological advancements, particularly in automation and IoT, are influencing oil rig operators to implement automated drilling solutions for onshore and offshore oil and gas projects. Semi-automated technologies are increasingly being adopted by companies in the industry to access remote offshore oil wells, which present logistical challenges due to harsh weather conditions.

Production monitoring, pipeline installation, and production enhancement are some of the key services in demand. Horizontal drilling, completion services, subsea production, coiled tubing, and well intervention are other significant areas of investment. Data acquisition systems, data analytics, sand control, cementing services, production optimization, artificial lift, and offshore services are essential components of the market. Environmental compliance, workover services, reservoir characterization, steam injection, corrosion control, hydraulic fracturing, enhanced oil recovery, and waste disposal are other evolving trends. Wireline services, fracture modeling, flow assurance, remote monitoring, reservoir management, mud logging, reservoir simulation, production decline, water management, drilling optimization, pressure pumping, wellbore pressure, drilling fluids, drilling efficiency, carbon capture, reservoir simulation software, well stimulation, safety regulations, well integrity, well logging, and seismic data acquisition are integral to the market's dynamics.

Directional drilling and drilling automation are also gaining traction.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Oilfield Services Industry?

- The global market is primarily driven by the increasing demand for oil and natural gas, which is a significant trend in the energy sector.

- The global oil and gas industry is experiencing significant growth due to increasing energy demand, leading to the exploration and production of new reservoirs. According to the US Energy Information Administration, global liquid fuel consumption averaged 102.8 million barrels per day in 2024, with over 70% of this growth expected to be met by oil, natural gas, and coal. With existing reservoirs maturing or depleting, there is a necessity to drill new wells. To optimize oil and gas production, various techniques and services are employed. Production enhancement methods such as chemical flooding, horizontal drilling, and completion services are commonly used to maximize reservoir output.

- Additionally, production monitoring through data acquisition systems and data analytics plays a crucial role in maintaining and improving production efficiency. Pipeline installation and subsea production systems are essential for transporting and processing oil and gas. Coiled tubing, well intervention, sand control, and cementing services are integral to maintaining wellbore stability and ensuring efficient drilling and completion operations. Well intervention and data analytics are also crucial for identifying and addressing production issues in real-time, ensuring optimal well performance. In conclusion, the market is experiencing significant growth due to the increasing demand for oil and gas.

- Technologies and services such as production enhancement, pipeline installation, and well intervention are essential for optimizing production and maintaining well performance. The market is expected to continue growing as the world's energy needs evolve.

What are the market trends shaping the Oilfield Services Industry?

- The market is experiencing a significant trend towards the adoption of technological innovations to enhance productivity. These advancements are essential for driving efficiency and competitiveness in the industry.

- The market is experiencing a significant focus on production optimization and cost reduction as pricing pressures mount from operators and E&P companies. To enhance productivity and profitability, service providers are embracing automation, advanced tools, and data-driven approaches. For example, some companies are investing in automated drilling systems, such as Nabors Industries' iRig, which automates drill pipe handling, thereby reducing labor costs and operational expenses. Additionally, there is a growing emphasis on environmental compliance, with service providers integrating technologies for steam injection, corrosion control, hydraulic fracturing, and enhanced oil recovery.

- Furthermore, wireline services, multilateral wells, and waste disposal are other areas of investment for oilfield service providers to improve operational efficiency and reduce costs. Overall, the oilfield services industry is undergoing a transformation, with a focus on innovation, efficiency, and cost savings.

What challenges does the Oilfield Services Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The market experiences significant fluctuations due to crude oil price volatility. Geopolitical tensions, OPEC production decisions, supply-demand imbalances, economic downturns, and energy transition policies are among the factors influencing oil prices and, consequently, the demand for oilfield services. When crude oil prices decline, E and P companies cut capital expenditures, leading to decreased demand for services like drilling, completion, and well intervention. This results in lower revenues and profit margins for oilfield service providers. On the other hand, rising crude oil prices trigger increased upstream investments, leading to heightened demand for oilfield services. However, sharp price surges can also bring about higher operational costs, supply chain constraints, and labor shortages, adding complexity to market dynamics.

- Well testing, production forecasting, drilling rigs, downhole tools, fracture modeling, flow assurance, remote monitoring, reservoir management, mud logging, reservoir simulation, production decline, water management, drilling optimization, and pressure pumping are essential services offered by oilfield service providers. These services contribute to enhancing efficiency, optimizing production, and ensuring safety and environmental compliance in oil and gas operations. Despite the challenges, the market continues to evolve, with advancements in technology and innovation playing a crucial role in improving operational efficiency and reducing costs. Companies are focusing on digitalization, automation, and remote monitoring to streamline processes and enhance productivity.

- Additionally, the integration of artificial intelligence, machine learning, and data analytics is transforming the industry by providing valuable insights into reservoir performance, drilling optimization, and production forecasting. In conclusion, the market is subject to the volatility of crude oil prices, which impact investment cycles, operational budgets, and overall market stability. However, advancements in technology and innovation are helping companies navigate these challenges and improve operational efficiency, ensuring their long-term competitiveness in the industry.

Exclusive Customer Landscape

The oilfield services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oilfield services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oilfield services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Ltd. - The company specializes in providing comprehensive oilfield services, encompassing drilling operations, well integrity interventions, plug and abandonment, and decommissioning of infrastructure for the oil and gas industry. Our expertise lies in ensuring the highest standards of safety and efficiency in these critical areas. Through advanced technologies and proven methodologies, we deliver solutions that enhance production, minimize downtime, and promote sustainable operations. Our team of experienced professionals is dedicated to optimizing asset life cycles and maximizing returns for our clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Ltd.

- Baker Hughes Co.

- Calfrac Well Services Ltd.

- Caterpillar Inc.

- China Oilfield Services Ltd.

- Expro Group Holdings NV

- Halliburton Co.

- Helmerich and Payne Inc.

- Huawei Technologies Co. Ltd.

- Key Energy Services Inc.

- Nabors Industries Ltd.

- Nexans AmerCable

- NOV Inc.

- Oil States International Inc.

- Patterson UTI Energy Inc.

- Proserv UK Ltd.

- Saipem S.p.A.

- Schlumberger Ltd.

- Superior Energy Services Inc.

- TechnipFMC plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oilfield Services Market

- In January 2024, Schlumberger Limited, a leading oilfield services company, announced the launch of its new digital platform, "Oilfield Data Intelligence Hub," designed to optimize drilling operations and enhance data analytics for clients (Schlumberger press release, 2024). This innovative solution aims to improve operational efficiency and reduce costs for oil and gas companies.

- In March 2024, Baker Hughes, a GE company, and Saudi Aramco, the world's largest oil company, signed a strategic collaboration agreement to jointly develop and commercialize advanced technologies for the energy sector (Baker Hughes press release, 2024). This partnership focuses on digitalization, automation, and sustainable energy solutions, positioning both companies at the forefront of technological innovation in the oilfield services industry.

- In July 2025, Halliburton Company completed the acquisition of Danish firm, National Oilwell Varco, for approximately USD3.3 billion (Halliburton SEC filing, 2025). This merger strengthens Halliburton's position as a leading provider of oilfield equipment and services, expanding its product portfolio and enhancing its operational capabilities.

- In November 2025, the United States Bureau of Land Management (BLM) announced a new policy to encourage the use of hydraulic fracturing, or fracking, in federal lands, opening up new opportunities for oilfield services companies (BLM press release, 2025). This policy change is expected to boost demand for oilfield services, particularly in drilling, completion, and production activities.

Research Analyst Overview

- In the dynamic the market, service providers are leveraging advanced technologies to enhance drilling performance and ensure well integrity in the exploration and production of unconventional resources, including shale gas and tight oil. Blowout prevention and offshore safety remain top priorities, with machine learning and artificial intelligence used for drilling cost optimization and hazard mitigation. Environmental impact assessments are integral to field development plans, while reservoir simulation and production data analysis inform well abandonment and decommissioning strategies. Drilling permits are secured through data-driven decision-making, and equipment rental and waste minimization contribute to carbon footprint reduction. Arctic drilling and deepwater projects require specialized expertise, with wellbore clean-up and water recycling essential for sustainable operations.

- Safety training and well control are ongoing concerns, as is the integration of green energy and digital twin technologies to improve field optimization and reduce drilling hazards. Production optimization software and plugging and abandonment solutions are essential for maximizing efficiency and minimizing costs throughout the drilling lifecycle.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oilfield Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 42.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, Canada, Russia, Saudi Arabia, China, UAE, Japan, Qatar, Mexico, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oilfield Services Market Research and Growth Report?

- CAGR of the Oilfield Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Middle East and Africa, APAC, Europe, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oilfield services market growth of industry companies

We can help! Our analysts can customize this oilfield services market research report to meet your requirements.