Rotary Steerable Systems Market Size 2024-2028

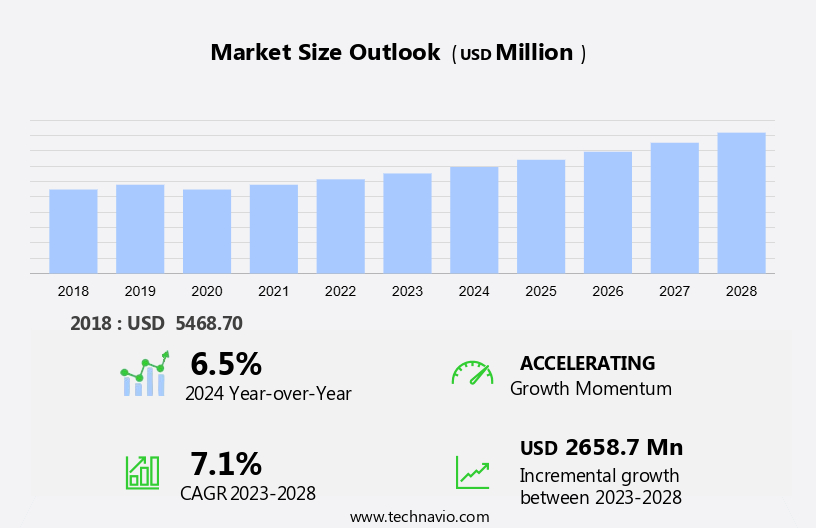

The rotary steerable systems market size is forecast to increase by USD 2.66 billion at a CAGR of 7.1% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The increase in investments toward directional drilling is driving market expansion, as this drilling technique allows for greater drilling accuracy and efficiency. Additionally, the adoption of integrated rotary steerable systems is on the rise, as these systems enable real-time monitoring and control of drilling parameters, including inclination and azimuth, through onboard control systems and mud pulse telemetry. The hydraulic fracturing process plays a significant role in extracting resources from unconventional rock formations. Furthermore, advanced technologies such as azimuthal gamma ray, multi-frequency resistivity, density, and porosity sensors are being integrated into rotary steerable systems to enhance drilling performance and optimize well completion. Despite these growth opportunities, market expansion is being hindered by the volatility of global crude oil prices, which can impact drilling budgets and profitability. Overall, the market is poised for continued growth, driven by technological advancements and the increasing demand for more accurate and efficient drilling solutions.

What will be the Size of the Rotary Steerable Systems Market During the Forecast Period?

- Rotary steerable drilling systems have gained significant importance In the oil and gas industry due to their ability to improve directional response and ensure well bore quality when drilling extended-reach wells. These systems are integral components of directional drilling systems, which enable drilling at desired angles and depths to maximize reservoir recovery. The rotating drill bit, a crucial element of the drilling assembly, interacts with the borehole wall during drilling. This interaction results in various dynamic phenomena such as backward whirl, traction, and rolling contact, which can impact the borehole wall and lead to premature fatigue damage.

- To mitigate these issues, rotary steerable drilling systems employ advanced technologies like pivot stabilizers and onboard control systems. Pivot stabilizers help maintain the stability of the drill bit by minimizing the lateral forces acting on it. Onboard control systems enable real-time monitoring and adjustment of the drill bit's orientation, ensuring accurate drilling and improved directional response. Mud pulse telemetry and azimuthal gamma ray sensors are essential components of the onboard control system. Mud pulse telemetry provides data on inclination and azimuth, while azimuthal gamma ray sensors offer valuable information about the geological formations being drilled. This data is essential for optimizing drilling parameters and ensuring wellbore quality.

- Additionally, advanced geophysical technologies like multi-frequency resistivity, density, porosity, and acoustic seismology are integrated into rotary steerable drilling systems to provide real-time subsurface information. This data is crucial for making informed decisions regarding drilling parameters and reservoir characterization. In summary, rotary steerable drilling systems play a vital role in enhancing directional response and ensuring well bore quality during the drilling of extended-reach wells. These systems employ advanced technologies like pivot stabilizers, onboard control systems, and geophysical sensors to mitigate dynamic phenomena and optimize drilling parameters. By improving directional response and wellbore quality, rotary steerable drilling systems contribute significantly to maximizing reservoir recovery and reducing drilling costs.

How is this Rotary Steerable Systems Industry segmented and which is the largest segment?

The rotary steerable systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Geography

- North America

- Canada

- US

- Europe

- APAC

- China

- Middle East and Africa

- South America

- Argentina

- North America

By Application Insights

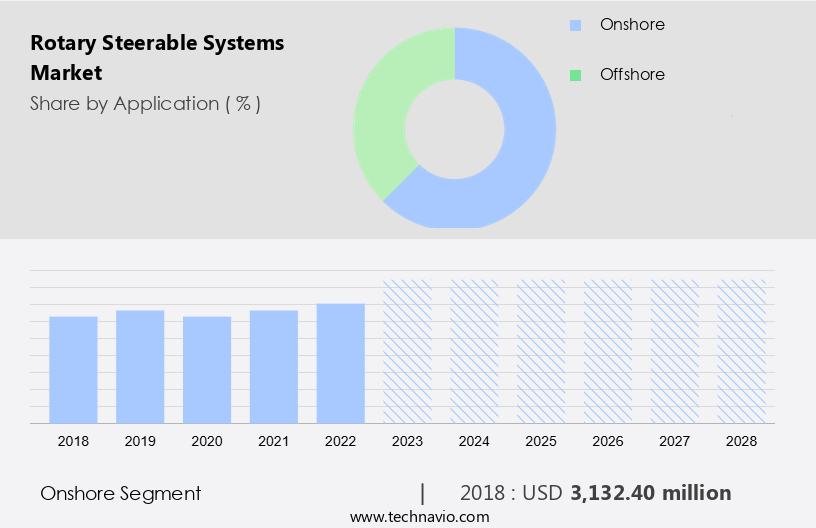

- The onshore segment is estimated to witness significant growth during the forecast period.

The Rotary Steerable Systems (RSS) market is witnessing significant growth due to the increasing investments made by onshore oil and oil gas companies in enhancing their production efficiency. This trend is driving the expansion of oil exploration and production activities worldwide, with key contributors being the US, Canada, and Middle Eastern countries. Additionally, emerging economies such as Russia and Mexico are also investing heavily in upstream oil and gas projects, providing lucrative opportunities for market participants. Shale oil and gas projects are gaining popularity as an alternative to traditional drilling methods. These projects employ directional drilling techniques, such as Rotary Steerable Drilling (RSD), which allow for more precise drilling and reduced drilling costs. However, the use of RSS in drilling applications comes with challenges, including the risk of premature fatigue damage. In summary, the increasing demand for efficient and cost-effective drilling solutions, coupled with the growing number of onshore oil and gas projects, is driving the growth of the market.

Get a glance at the Rotary Steerable Systems Industry report of share of various segments Request Free Sample

The onshore segment was valued at USD 3.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

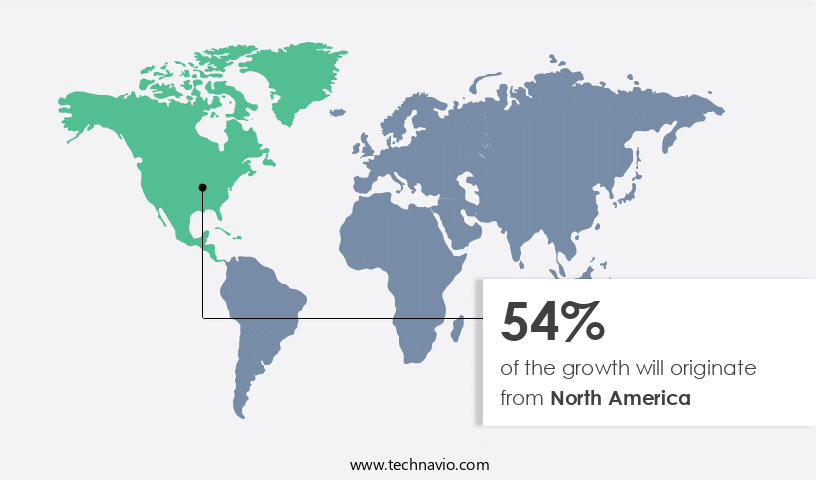

- North America is estimated to contribute 54% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the North American market, the United States led the systems sector in 2023. The resurgence of crude oil prices and the burgeoning shale oil production In the US were the primary catalysts fueling the market expansion in this region. The integration of advanced automation and Internet of Things (IoT) technology In the oil and gas industry has motivated drilling rig operators in the US to adopt sophisticated drilling solutions for onshore and offshore projects.

As per the Energy Information Administration (EIA), over 129 refineries were operational In the US in 2023, making it the world's leading refiner and consumer of crude oil. The first-generation systems provided steerability for drilling holes in specific formations. However, the third-generation systems offer enhanced reliability and durability, enabling more accurate and efficient drilling. These advanced features are crucial for maximizing production and minimizing drilling costs in complex formations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Rotary Steerable Systems Industry?

An increase in investments toward directional drilling is the key driver of the market.

- Directional drilling is a crucial technique In the oil and gas industry, enabling the control of wellbore paths beneath the ground surface. This method includes drilling horizontal, multilateral, and extended-reach wells. Directional drilling is particularly popular in offshore and unconventional oil and gas production due to its ability to produce oil and gas from multiple underlying reservoirs through a single vertical well.

- This reduces the need for drilling numerous wells and enhances reservoir contact via horizontal drilling. This process involves injecting a mixture of water, chemicals, and sand into wells to fracture the rock and stimulate the release of natural gas and oil from the reserves. The integration of directional drilling and hydraulic fracturing has led to increased efficiency and productivity In the oil and gas sector.

What are the market trends shaping the Rotary Steerable Systems Industry?

An increase in the adoption of integrated rotary steerable systems is the upcoming market trend.

- Advanced oil and gas equipment is a priority for companies to decrease drilling time and costs, thereby boosting profitability. Integrated systems play a crucial role in this regard, particularly in multistage hydraulic fracturing. These systems offer a customized, high-performance drilling motor that can be navigated remotely through the reservoir by combining it with measurement-while-drilling (MWD) equipment.

- MWD tools provide essential data, such as inclination, azimuth, mud pulse telemetry, azimuthal gamma ray, multi-frequency resistivity, density, and porosity, for effective steering through the subsurface reservoir. By utilizing an onboard control system, drillers can optimize drilling parameters and improve overall drilling productivity.

What challenges does the Rotary Steerable Systems Industry face during its growth?

The volatility of global crude oil prices is a key challenge affecting the industry growth.

- The instability of crude oil prices poses a significant challenge to the expansion of the directional drilling systems market. The unpredictable nature of oil prices has led some upstream companies to experience financial hardships, resulting In the postponement or cancellation of exploration and production projects. In October 2019, the average crude oil price hovered around USD 57 per barrel. This price volatility can be observed on a monthly basis, making it difficult for businesses to maintain profitability and sustain their presence In the market.

- To mitigate this risk, there is a growing emphasis on the development of improved directional response systems for directional drilling. These systems enable the drilling assembly, including the rotating drill bit and pivot stabilizer, to maintain precise control over the well bore quality during extended-reach well drilling. By enhancing directional stability, drilling companies can minimize the impact of price fluctuations on their operations and optimize their drilling efficiency.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rotary steerable systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- APS Technology Inc.

- Baker Hughes Co.

- Compass Directional Guidance Inc.

- D Tech Rotary Steerable

- DoubleBarrel RSS

- Enteq Upstream Plc

- Gyrodata Inc.

- Halliburton Co.

- Huisman Equipment BV

- HXR Drilling Services

- INCO DRILLING BV

- LEAM Drilling Services

- NOV Inc.

- Schlumberger Ltd.

- Scientific Drilling International

- Turbo Drill Industries Inc.

- Weatherford International Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Rotary steerable drilling systems have revolutionized directional drilling, enabling the drilling industry to tackle extended-reach wells with improved directional response. These systems utilize a drilling assembly that includes a rotating drill bit, pivot stabilizer, and onboard control system to steer the drill bit in real time based on inclination and azimuth data. Mud pulse telemetry and other advanced sensors provide valuable information on formation properties such as density, porosity, and acoustic seismology, allowing for accurate results and reduced downtime. The system's ability to provide continuous drilling and real-time log data allows for precise bit selection and optimal drilling parameters.

Thus, the system's third-generation designs offer enhanced reliability and durability, minimizing premature fatigue damage caused by backward whirl, dynamic phenomenon, traction, and borehole impacts. Participating companies In the drilling services market offer product specifications and descriptions alphabetically organized for easy comparison. The mainstream service of drilling is now a standard practice In the industry, performing various jobs in various formation types, from shallow to deep and complex. The first-generation systems paved the way for this technology, but the current focus is on the third-generation systems that provide superior steerability and formation evaluation capabilities.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2024-2028 |

USD 2.66 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.5 |

|

Key countries |

US, China, Russia, Canada, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rotary Steerable Systems Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this systems market research report to meet your requirements.