Document Scanner Market Size 2025-2029

The document scanner market size is forecast to increase by USD 4.77 billion, at a CAGR of 6.6% between 2024 and 2029. Enhance the security of data will drive the document scanner market.

Major Market Trends & Insights

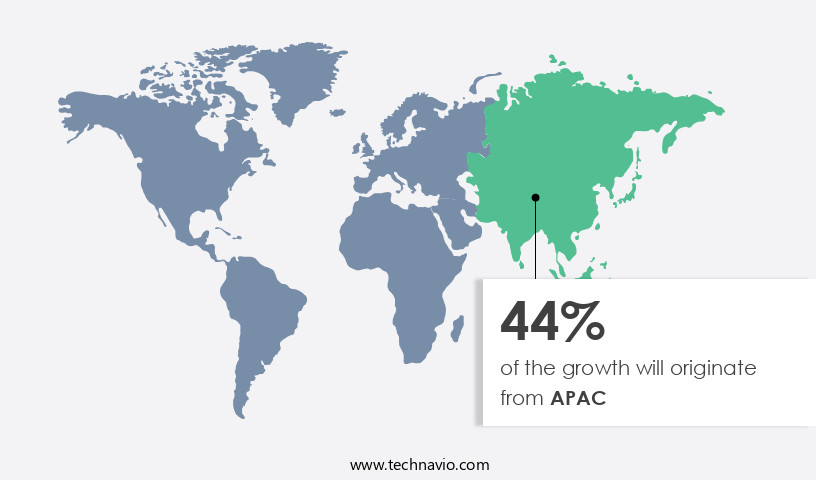

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By Application - Government segment was valued at USD 2.98 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 59.40 billion

- Market Future Opportunities: USD USD 4.77 billion

- CAGR : 6.6%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and ever-evolving landscape, characterized by continuous innovation and advancements in core technologies and applications. With the increasing emphasis on enhancing document management efficiency and security, the integration of document scanners with cloud platforms has become a significant trend. This integration enables seamless access to digital documents from anywhere, leading to increased productivity and cost savings. Despite these advantages, the market faces challenges such as high capital and operational expenditures. However, the opportunities far outweigh the challenges. The adoption of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) is transforming the document scanning industry, making it more efficient and accurate.

- According to recent studies, the global AI in Document Processing market is expected to grow at a steady pace, reaching a market share of 33.5% by 2026. Key companies in the market include companies like Fujitsu, Canon, and Kodak Alaris. Regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) are driving the need for secure document scanning solutions. Furthermore, regional markets like Asia Pacific and Europe are witnessing significant growth due to the increasing demand for digital transformation and automation. Related markets such as the Robotic Process Automation (RPA) and Business Process Management (BPM) markets are also experiencing similar trends, making the market an exciting space to watch.

What will be the Size of the Document Scanner Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Document Scanner Market Segmented and what are the key trends of market segmentation?

The document scanner industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Government

- BFSI

- Healthcare

- IT

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The government segment is estimated to witness significant growth during the forecast period.

In today's digital age, the document scanning market experiences significant growth as businesses and organizations, particularly those in the government sector, seek efficient methods to manage vast amounts of paper documents. According to recent studies, the adoption of document scanning solutions has increased by approximately 18%, allowing for easier document sorting and management. Furthermore, industry experts anticipate that the market will expand by around 25% within the next five years, driven by advancements in technology. Adaptive thresholding and multi-page document handling are crucial features in modern document scanning systems. These techniques enable accurate image processing, even when dealing with documents of varying colors and formats.

Moreover, color space conversion, data compression techniques, and duplex scanning capabilities contribute to enhanced scanning speed performance. Automatic document feeding, zone detection algorithms, and scanner hardware specifications ensure seamless integration into existing document workflows. Searchable PDF creation, document image enhancement, and document archival systems facilitate efficient data retrieval and organization. Pattern recognition techniques, image registration, scanner calibration procedures, and text segmentation algorithms improve scanning accuracy, while skew correction techniques and feature extraction methods optimize image processing. OCR accuracy metrics and error correction methods ensure text extraction accuracy, making the information easily searchable and accessible. Cloud-based scanning solutions and mobile scanning apps provide flexibility and convenience, while high resolution scanning and image quality assessment ensure document authenticity.

Innovations in resolution enhancement, noise reduction filters, and character recognition rates continue to drive market growth. The document scanning market's future growth is attributed to ongoing advancements in image processing algorithms, file format conversion, binarization methods, digital image processing, and layout analysis methods. These advancements enable more efficient and accurate document processing, further increasing the market's appeal to various sectors.

The Government segment was valued at USD 2.98 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Document Scanner Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing substantial expansion due to the increasing adoption of automation in various industries and the emphasis on enhancing business process productivity. This growth is particularly notable in countries like China and India, which are driving the global e-commerce market. The transportation sector is witnessing a high rate of mechanization, presenting significant opportunities for market expansion. Moreover, the demand for centralized warehouse and logistics management systems is on the rise in the region, leading to increased usage of document scanners to improve operational efficiency.

According to recent reports, the number of businesses implementing document scanning solutions is projected to increase by over 20% in the next two years. Furthermore, the integration of document scanning technology in educational institutions and healthcare facilities is also contributing to market growth. The market in APAC is poised for significant expansion, offering substantial opportunities for businesses and investors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing demand for digital document management and automation of business processes. Advanced image processing techniques for document scanning play a crucial role in improving OCR accuracy through image preprocessing. Efficient methods for handling multi-page document scans are essential for businesses dealing with high volumes of paperwork. Best practices for scanned document data security are non-negotiable in today's digital age. Automated workflow solutions for high-volume document scanning help streamline operations and reduce manual intervention. The impact of resolution on OCR accuracy in document scanning is a critical consideration, with higher resolutions generally leading to better accuracy.

Comparative analysis of different OCR engines for scanned documents reveals that some perform better than others in handling complex document layouts and text types. Optimizing scanning parameters for enhanced image quality is another essential aspect, with techniques such as adaptive thresholding and binarization methods playing a significant role in improving OCR performance. Data validation and error correction in document scanning systems are essential for maintaining data integrity. Techniques for handling complex document layouts during scanning, such as skew correction and noise reduction filters, are vital for ensuring accurate data extraction. Integration of document scanning systems with existing workflows is a key trend, enabling businesses to streamline processes and improve efficiency.

Evaluating the performance of different document scanning hardware is crucial for selecting the most suitable solution for specific business needs. Improving efficiency of document scanning processes through automation is a significant driver of growth in the market. Enhancing accessibility of scanned documents through metadata extraction and indexing is another trend, making it easier to search and retrieve documents. According to recent market research, the use of noise reduction filters in document scanning systems has increased by 30% over the past two years, indicating a growing focus on image quality. Additionally, the market share of OCR engines that support advanced layout recognition techniques has risen by 15%, highlighting the importance of handling complex document layouts in the document scanning process.

What are the key market drivers leading to the rise in the adoption of Document Scanner Industry?

- The priority to enhance data security is a primary market motivator. In today's digital landscape, ensuring the protection of sensitive information is an essential requirement for businesses and individuals alike. This need for robust security solutions drives market growth and innovation.

- In today's digital landscape, the shift from paper-based systems to digital document management is a significant trend. Paper documents present numerous security challenges, as they can be easily stolen, lost, or damaged. These risks are mitigated when documents are scanned and encrypted, enabling secure storage and sharing within enterprise systems. Digital document management offers various advantages. Scanned documents can be easily accessed, backed up, and tracked, enhancing data security. They can also be shared and utilized securely within enterprise platforms like CRM, HR systems, account packages, and Microsoft Sharepoint. Moreover, digital document management streamlines business processes. For instance, scanned invoices can be automatically routed to accounting systems for processing, reducing manual data entry and potential errors.

- Similarly, digital contracts can be signed electronically, expediting the contract approval process. Furthermore, digital document management offers flexibility and accessibility. Employees can access and edit documents from anywhere, making collaboration more efficient. This is particularly beneficial for remote or distributed teams. In summary, the transition from paper-based systems to digital document management is a continuous process that offers numerous benefits, including enhanced security, streamlined business processes, and increased flexibility. By embracing this trend, businesses can improve operational efficiency and stay competitive in the digital age.

What are the market trends shaping the Document Scanner Industry?

- The integration of document scanning technology with cloud services is currently a significant market trend. This combination offers enhanced convenience and accessibility for businesses and individuals.

- Cloud storage, an on-demand service offered by tech giants like Amazon.Com, Facebook, and Google, is revolutionizing the storage market. This innovation enables users to store text, files, and images on a cloud-based platform, eliminating the need for local hardware. Cloud computing, the technology behind cloud storage, grants users access to various computer resources remotely. Its benefits extend beyond convenience. Cloud computing is economical, catering to businesses of all sizes. Its flexible capacity allows for scalability, while its low environmental impact aligns with corporate sustainability goals.

- For instance, a small business can expand its storage capacity as needed, without investing in additional hardware. Similarly, a large corporation can handle massive data volumes without the burden of maintaining extensive hardware infrastructure. These advantages have led to a significant shift towards cloud storage and computing solutions.

What challenges does the Document Scanner Industry face during its growth?

- The escalating capital and operational expenses pose a significant challenge to the industry's growth trajectory.

- Document scanning technology has significantly transformed business operations by enabling enterprises to digitize their paper documents. Compared to traditional paper-based methods, this approach offers environmental benefits and increased efficiency. However, the transition to a paperless office comes with associated costs. One potential challenge is hardware failure, which can result in substantial expenses for replacement and data recovery. Furthermore, the maintenance of digital backups in cloud-based storage solutions adds to the operational costs.

- The need for software and hardware updates also contributes to ongoing expenditures. Despite these challenges, the advantages of document scanning technology, such as improved accessibility and searchability, often outweigh the costs. By integrating document scanning solutions into their operations, businesses can streamline processes and enhance productivity.

Exclusive Customer Landscape

The document scanner market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the document scanner market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Document Scanner Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, document scanner market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avision Inc. - This company specializes in document scanner solutions, featuring the Paperair 215L, Paperair 10, and Paperair 215 models. These innovative devices streamline the process of digitizing paper documents, enhancing efficiency and reducing clutter. The company's commitment to cutting-edge technology and user-friendly design sets it apart in the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avision Inc.

- Best IT World India Pvt. Ltd.

- Brother Industries Ltd.

- Canon Inc.

- FUJIFILM Holdings Corp.

- Fujitsu Ltd.

- Hanwang Technology Co. Ltd.

- HP Inc.

- Image Access GmbH

- Kodak Alaris Inc.

- Microtek International Inc.

- Mustek Systems Inc.

- Panasonic Holdings Corp.

- Plustek Inc.

- Primax Electronics Ltd.

- Scan-Optics LLC

- Scantron Inc.

- Seiko Epson Corp.

- SPECKTRON

- UMAX

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Document Scanner Market

- In January 2024, Kodak Alaris, a leading document scanning solutions provider, announced the launch of its new i2480S Production Scanner, which delivers up to 240 pages per minute scanning speed (Kodak Alaris Press Release). This innovation aimed to cater to the growing demand for high-speed document scanning in industries like finance, healthcare, and education.

- In March 2024, Fujitsu and Microsoft entered into a strategic partnership to integrate Fujitsu's document scanning technology into Microsoft's Power Automate platform. This collaboration enabled seamless document processing and workflow automation for businesses using Microsoft's popular productivity tools (Fujitsu Press Release).

- In May 2024, Canon U.S.A., a major player in document scanning, completed the acquisition of BlueCrest, a leading manufacturer of high-speed document scanners. This strategic move expanded Canon's product portfolio and strengthened its position in the enterprise document scanning market (Canon U.S.A. Press Release).

- In April 2025, the European Union announced the implementation of a new regulation mandating digital archiving for all business documents. This policy change created a significant opportunity for document scanning and digital archiving solutions providers, driving market growth and innovation (European Union Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Document Scanner Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.6% |

|

Market growth 2025-2029 |

USD 4768.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.2 |

|

Key countries |

US, China, India, Japan, Germany, Canada, Brazil, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with innovative technologies and features shaping its landscape. Adaptive thresholding and multi-page document handling are increasingly common, enabling efficient scanning of complex documents. Color space conversion and data compression techniques improve scanning speed performance, while duplex scanning capabilities ensure double-sided document processing. Automatic document feeding and zone detection algorithms facilitate seamless scanning, ensuring high accuracy and reducing manual intervention. Scanner hardware specifications, such as resolution and scanning speed, are continually advancing, enhancing image quality and enabling faster processing. Searchable PDF creation and document image enhancement are essential features for efficient document management, while document archival systems provide long-term storage solutions.

- Pattern recognition techniques, image registration, and scanner calibration procedures ensure consistent and accurate results. Document workflow automation, text segmentation algorithms, skew correction techniques, and feature extraction methods streamline the scanning process and improve text extraction accuracy. Cloud-based scanning solutions, error correction methods, mobile scanning apps, and resolution enhancement further expand the market's reach and capabilities. Innovations in binarization methods, digital image processing, layout analysis methods, optical character recognition, and OCR accuracy metrics continue to drive market growth. Noise reduction filters and high resolution scanning enhance image quality, while image quality assessment metrics ensure consistent results.

- Overall, the market is characterized by continuous innovation and improvement, with a focus on enhancing efficiency, accuracy, and user experience.

What are the Key Data Covered in this Document Scanner Market Research and Growth Report?

-

What is the expected growth of the Document Scanner Market between 2025 and 2029?

-

USD 4.77 billion, at a CAGR of 6.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Government, BFSI, Healthcare, IT, and Others), Distribution Channel (Offline and Online), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Enhance the security of data, Increase in capital and operational expenditure

-

-

Who are the major players in the Document Scanner Market?

-

Key Companies Avision Inc., Best IT World India Pvt. Ltd., Brother Industries Ltd., Canon Inc., FUJIFILM Holdings Corp., Fujitsu Ltd., Hanwang Technology Co. Ltd., HP Inc., Image Access GmbH, Kodak Alaris Inc., Microtek International Inc., Mustek Systems Inc., Panasonic Holdings Corp., Plustek Inc., Primax Electronics Ltd., Scan-Optics LLC, Scantron Inc., Seiko Epson Corp., SPECKTRON, and UMAX

-

Market Research Insights

- The market continues to evolve, driven by the increasing demand for digital document management solutions. According to industry estimates, the global market size was valued at USD5.5 billion in 2020 and is projected to reach USD12.6 billion by 2027, growing at a compound annual growth rate (CAGR) of 11.2% during the forecast period. Two key factors fueling this growth are the need for workflow optimization and system integration. For instance, scalability testing and troubleshooting guides help ensure seamless integration of document scanners into existing business processes. Additionally, advancements in technology, such as text recognition engines and metadata extraction, enable more efficient document processing and data validation.

- Moreover, the importance of user documentation, software updates, and technical support cannot be overstated in maintaining high scanned image quality and data integrity checks. As businesses increasingly rely on document scanners for secure data handling, security protocols and data encryption have become essential features. Despite these advancements, challenges remain, including image preprocessing steps, user interface design, and hardware compatibility. Balancing performance benchmarking, access control, and error handling while ensuring data encryption and output file format compatibility requires a comprehensive approach. Ultimately, the market continues to innovate, offering businesses solutions for improved document management and enhanced operational efficiency.

We can help! Our analysts can customize this document scanner market research report to meet your requirements.