Document Scanner Market Size 2026-2030

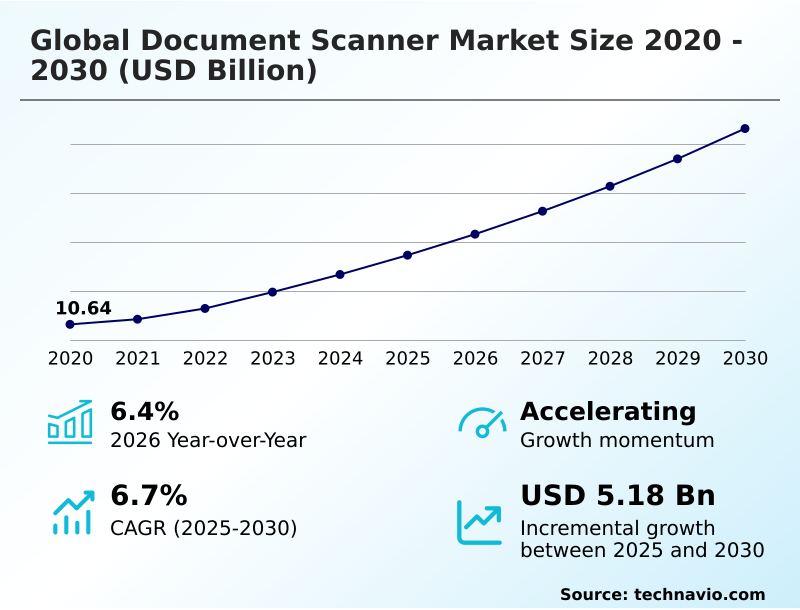

The document scanner market size is valued to increase by USD 5.18 billion, at a CAGR of 6.7% from 2025 to 2030. Proliferation of digital transformation initiatives and business process automation will drive the document scanner market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 46% growth during the forecast period.

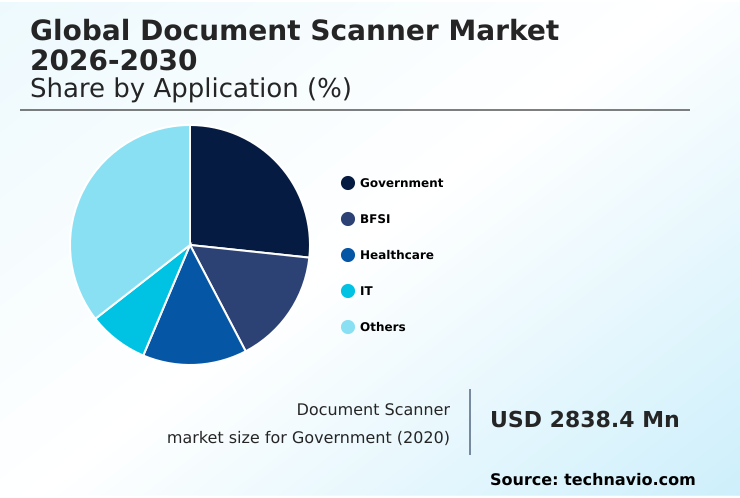

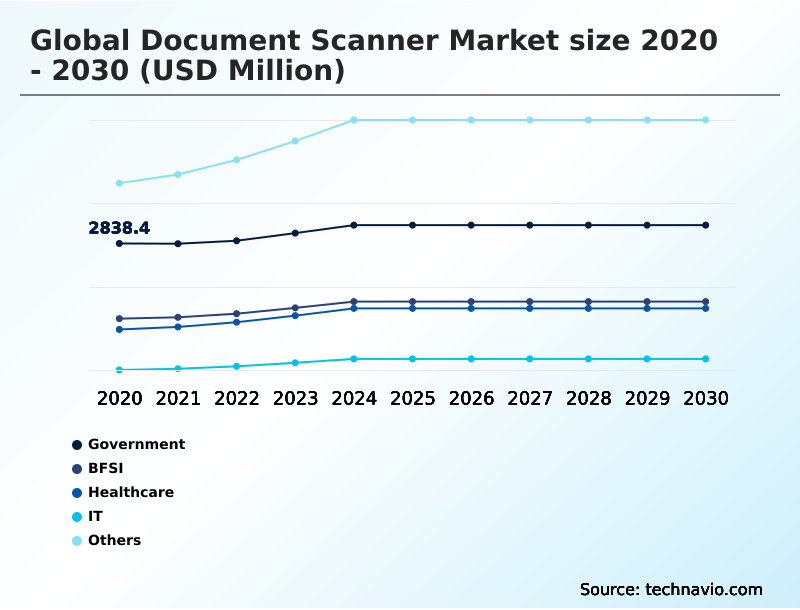

- By Application - Government segment was valued at USD 3.12 billion in 2024

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 8.01 billion

- Market Future Opportunities: USD 5.18 billion

- CAGR from 2025 to 2030 : 6.7%

Market Summary

- The document scanner market is sustained by the persistent need for businesses to bridge the gap between physical and digital information ecosystems. Widespread digital transformation initiatives and stringent regulatory compliance mandates compel organizations to convert paper records into secure, manageable data.

- This transition is not merely about achieving a paperless office; it is about enabling business process automation (BPA) and unlocking the value within documents. For example, in logistics, digitizing bills of lading at the point of receipt using a device with advanced image processing technology can accelerate invoice cycles by days, directly improving cash flow.

- However, the market faces challenges from the growing volume of born-digital workflows that bypass the need for scanning altogether. Concurrently, the sophistication of intelligent process automation (IPA) and artificial intelligence within capture software is a key trend, shifting the value proposition from hardware speed to the intelligence of the overall data capture solution.

- This evolution ensures the scanner's role as a critical on-ramp for data-driven operations.

What will be the Size of the Document Scanner Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Document Scanner Market Segmented?

The document scanner industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Application

- Government

- BFSI

- Healthcare

- IT

- Others

- Distribution channel

- Offline

- Online

- Type

- High-speed

- Portable

- Flatbed

- Geography

- APAC

- China

- Japan

- India

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of World (ROW)

- APAC

By Application Insights

The government segment is estimated to witness significant growth during the forecast period.

Government agencies are foundational clients, driven by e-governance mandates to convert immense paper archives into manageable digital assets. This information asset conversion is critical for automating administrative functions through a data-centric workflow.

Demand is for durable hardware featuring a high-capacity automatic document feeder (ADF) and robust image processing technology. Solutions must offer precise optical character recognition (OCR) and intelligent character recognition (ICR) for creating searchable records from diverse documents.

Features like ultrasonic double-feed detection and automatic skew correction are standard requirements to handle varied media types without interruption, while duplex scanning capabilities enhance throughput.

Effective enterprise workflow integration via a robust application programming interface (API) is essential, with SOHO setups also growing, contributing to overall supply chain resilience in public sector procurement.

The Government segment was valued at USD 3.12 billion in 2024 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Document Scanner Market Demand is Rising in APAC Request Free Sample

The market's geographic dynamics are led by the APAC region, which is projected to expand at a 7.9% rate, contributing to 46% of the industry's incremental growth.

This expansion is fueled by government-led digital transformation initiatives and the adoption of the electronic health record (EHR) systems.

In established markets like North America, the focus is on sophisticated enterprise workflow integration, including digital mailroom outsourcing and extensive backfile conversion projects. The distributed workforce model in Europe has increased demand for network-attached scanners with scan-to-cloud functionality.

Technology adoption varies, with high-end devices using charge-coupled device (CCD) sensors for superior archival image quality, while contact image sensor (CIS) technology enables more compact designs.

This diverse global landscape ensures a continued demand for a wide range of document capture solutions, from day-forward scanning strategies in emerging economies to creating a fully paperless office environment in mature regions.

Market Dynamics

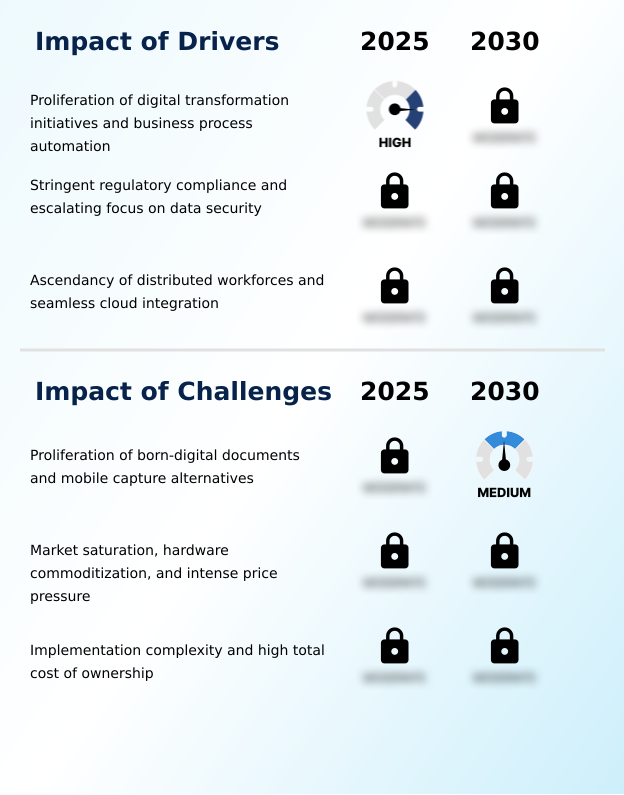

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- The global document scanner market 2026-2030 is diversifying to meet highly specific operational demands across industries. For example, the need for a high-speed scanner for financial services is driven by transaction velocity and compliance, where digitizing loan applications can be 70% faster than manual processing.

- In contrast, the demand for a portable scanner for remote workforces is about empowering mobile employees to integrate field documents into central systems instantly. A flatbed scanner for delicate archival documents remains critical for cultural institutions, while a network scanner with enterprise workflow integration serves as a shared resource in corporate settings.

- Increasingly, a document scanner with integrated OCR software is standard, providing a baseline ocr solution for converting scans to searchable pdfs. The compact scanner for small business accounting helps manage cash flow, and secure document scanning for healthcare compliance is non-negotiable for digitizing patient records with ehr-integrated scanner.

- Large-scale operations utilize a production scanner for mailroom automation and a duplex scanner for legal document management. Meanwhile, a wireless document scanner for cloud storage supports modern IT infrastructure. Niche applications, such as a large format scanner for technical drawings and a high-resolution scanner for graphic arts, address specialized professional needs.

- The overarching goal, from a scanner for logistics and proof of delivery to an e-invoicing compliance scanning solution, is to support the broader document management for paperless office transition by efficiently digitizing invoices and receipts with a scanner featuring a robust automatic document feeder for batch jobs.

What are the key market drivers leading to the rise in the adoption of Document Scanner Industry?

- The proliferation of digital transformation initiatives and the enterprise-wide drive for business process automation are primary drivers fueling market expansion.

- The market's primary impetus stems from the enterprise-wide adoption of digital transformation initiatives, with document scanners serving as the crucial bridge for paper-to-digital workflows.

- These efforts are fundamentally tied to business process automation (bpa), where digitizing at the source can accelerate the customer onboarding process by up to 50%.

- A strong driver is the need to adhere to regulatory compliance mandates, which necessitates a robust information governance strategy supported by secure document lifecycle management. For industries like finance, know your customer (kyc) compliance is streamlined through rapid digitization.

- In the public sector, e-governance platform rollouts depend on converting legacy paper into manageable digital assets.

- A comprehensive disaster recovery plan is made more viable through digital archives, with a clear return on investment (roi) analysis showing reduced physical storage costs of over 60%.

- The integration with enterprise content management (ecm) systems via secure network protocols and user authentication controls solidifies the scanner's role.

What are the market trends shaping the Document Scanner Industry?

- The infusion of artificial intelligence and intelligent process automation is a transformative trend, redefining document capture from simple digitization to an integral part of automated, data-driven workflows.

- Market evolution is driven by the fusion of hardware with cognitive technologies, transforming scanners into intelligent endpoints for intelligent process automation (ipa). This trend is shifting focus from mechanical specifications to the sophistication of the embedded document capture solution.

- The integration of handwritten text recognition and advanced document classification software enables automated workflows, such as accounts payable automation, which can improve processing accuracy by over 35%. Modern data extraction tools, leveraging robotic process automation (rpa) beyond traditional zonal ocr, convert unstructured documents into structured data, enhancing archival image quality for downstream analytics.

- This emphasis on software-driven value is compelling vendors and value-added resellers (vars) to offer advanced capabilities through as-a-service subscription models. These platforms often include robust software development kits (sdks) to facilitate custom integrations for complex tasks like claims processing optimization, ensuring devices are deeply embedded in enterprise ecosystems.

What challenges does the Document Scanner Industry face during its growth?

- The increasing prevalence of born-digital documents and the rise of viable mobile capture alternatives present a significant challenge to the growth of the dedicated hardware market.

- A primary market challenge is the rise of the born-digital workflow, which reduces the total volume of paper requiring digitization. This trend is compounded by the proliferation of capable mobile capture applications, which serve as a 'good enough' substitute for low-volume needs, challenging the market for personal and workgroup scanners.

- The hardware commoditization trend in mature markets intensifies price pressures, compelling vendors to focus on value-added software and managed capture services. However, the high total cost of ownership (tco) for professional-grade systems, including software and maintenance, can be a barrier for smaller businesses.

- Furthermore, ensuring supply chain resilience for key components like application-specific integrated circuits requires significant strategic effort and procurement cost efficiency, often managed through systems integrator partnerships. These factors are forcing a strategic pivot from reliance on centralized scanning operations and high-volume production-level scanners toward decentralized capture technology and service-based models.

Exclusive Technavio Analysis on Customer Landscape

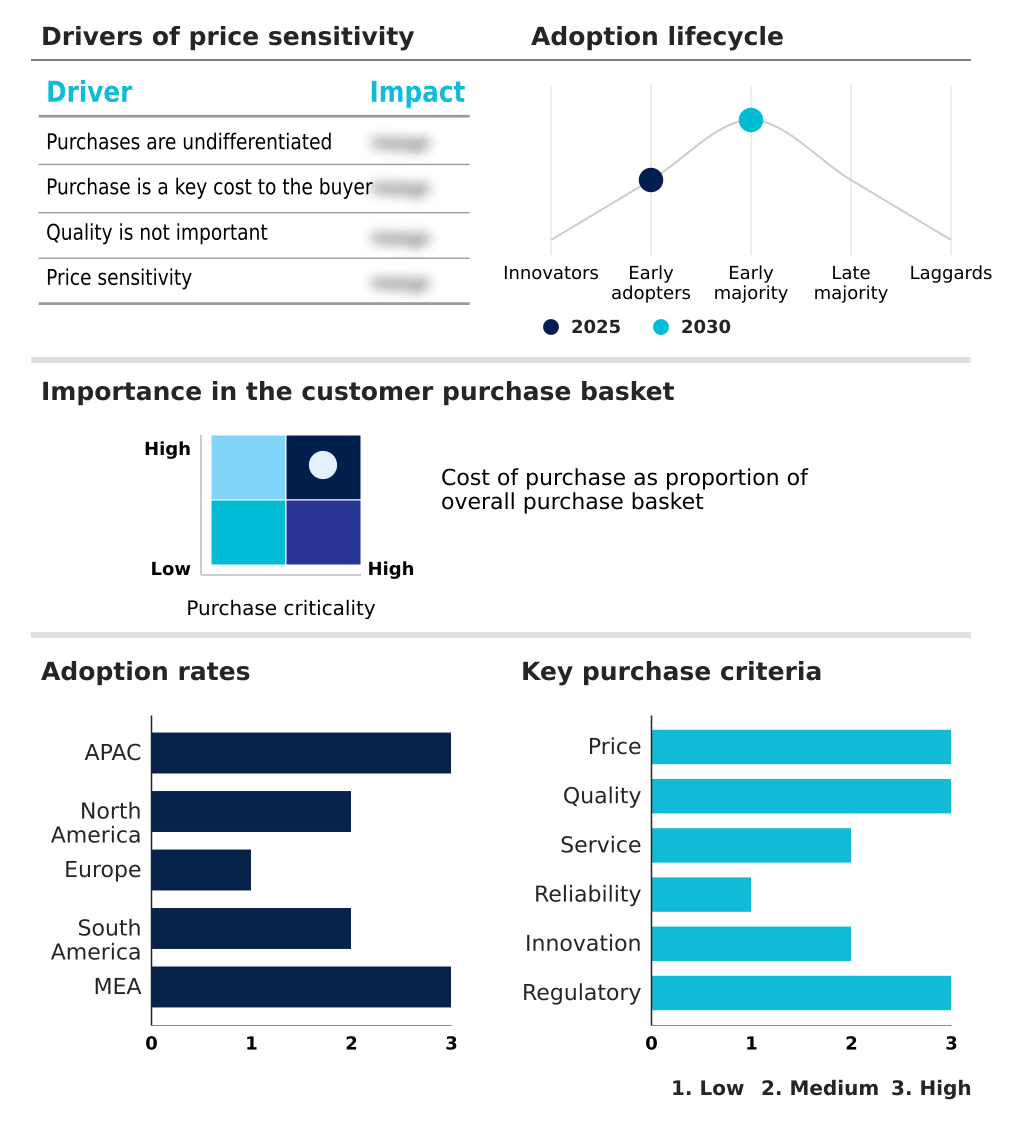

The document scanner market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the document scanner market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Document Scanner Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, document scanner market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ambir Technology Inc. - Offerings include advanced document scanners, ID card scanners, and digital signature pads, creating comprehensive solutions for professional environments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambir Technology Inc.

- Avision Inc.

- Brother Industries Ltd.

- Canon Inc.

- Contex A S

- Fujitsu Ltd.

- Hanwang Technology Co. Ltd.

- HP Inc.

- I.R.I.S. Group

- Image Access GmbH

- Kodak Alaris Inc.

- Microtek International Inc.

- Panasonic Holdings Corp.

- Plustek Inc.

- Ricoh Co. Ltd.

- Scan-Optics LLC

- Seiko Epson Corp.

- Visioneer Inc.

- Xerox Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Document scanner market

- In August 2025, Ricoh enhanced its ScanSnap software, introducing improved cloud integration with automatic uploads to shared Google drives and removing page limits for generating searchable PDFs via its cloud service.

- In May 2025, the South African government formally launched its national 'Roadmap for the Digital Transformation of Government,' a multi-phase strategy to digitize public services and establish a digital identity system.

- In January 2025, FUJIFILM Business Innovation and Konica Minolta established a joint venture, Global Procurement Partners Corp., to centralize the procurement of raw materials and components for their imaging equipment businesses.

- In January 2025, Ricoh announced that its PaperStream Capture Pro software would integrate artificial intelligence-powered optical character recognition (OCR) for handwritten documents, enhancing data extraction capabilities.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Document Scanner Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 312 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 6.7% |

| Market growth 2026-2030 | USD 5177.6 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 6.4% |

| Key countries | China, Japan, India, South Korea, Australia, Indonesia, US, Canada, Mexico, Germany, UK, France, Italy, Spain, The Netherlands, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa, Egypt and Nigeria |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The document scanner market's evolution is increasingly defined by software intelligence rather than hardware speeds alone, a critical consideration for boardroom-level strategic investment. The integration of intelligent process automation (ipa) and sophisticated image processing technology is creating new value streams.

- Devices now function as critical endpoints for business process automation (bpa), featuring user authentication controls and secure network protocols to support stringent information governance strategy. An effective document lifecycle management and disaster recovery plan relies on the archival image quality provided by technologies like charge-coupled device (ccd) and contact image sensor (cis).

- The inclusion of handwritten text recognition has enabled organizations in the finance and healthcare sectors to reduce manual data entry errors by over 25%. This shift toward intelligent document capture, incorporating features from duplex scanning and skew correction to advanced data extraction tools and ocr, anchors the technology's relevance in enterprise content management (ecm) ecosystems.

- As a result, the market is moving toward managed capture services and solutions offering advanced document classification software, zonal ocr, and seamless scan-to-cloud functionality.

What are the Key Data Covered in this Document Scanner Market Research and Growth Report?

-

What is the expected growth of the Document Scanner Market between 2026 and 2030?

-

USD 5.18 billion, at a CAGR of 6.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Government, BFSI, Healthcare, IT, and Others), Distribution Channel (Offline, and Online), Type (High-speed, Portable, and Flatbed) and Geography (APAC, North America, Europe, South America, Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Proliferation of digital transformation initiatives and business process automation, Proliferation of born-digital documents and mobile capture alternatives

-

-

Who are the major players in the Document Scanner Market?

-

Ambir Technology Inc., Avision Inc., Brother Industries Ltd., Canon Inc., Contex A S, Fujitsu Ltd., Hanwang Technology Co. Ltd., HP Inc., I.R.I.S. Group, Image Access GmbH, Kodak Alaris Inc., Microtek International Inc., Panasonic Holdings Corp., Plustek Inc., Ricoh Co. Ltd., Scan-Optics LLC, Seiko Epson Corp., Visioneer Inc. and Xerox Holdings Corp.

-

Market Research Insights

- The market is shaped by a definitive shift toward intelligent enterprise workflow integration. A core focus is on delivering a clear return on investment (ROI) analysis, as solutions that automate the customer onboarding process can reduce document handling times by over 30%. The demand for comprehensive regulatory compliance mandates is met with systems that improve audit trail accuracy by 99%.

- As part of a broader digital transformation initiative, businesses are adopting flexible as-a-service subscription models, which can lower the total cost of ownership (TCO) compared to traditional capital expenditures. This transition emphasizes value-added services, including know your customer (KYC) compliance modules and specialized e-governance platform integrations, which are becoming key differentiators.

We can help! Our analysts can customize this document scanner market research report to meet your requirements.