Cloud Computing Market Size 2025-2029

The cloud computing market size is valued to increase by USD 600.5 billion, at a CAGR of 18.5% from 2024 to 2029. Increased inclination toward cloud computing for cost-cutting will drive the cloud computing market.

Market Insights

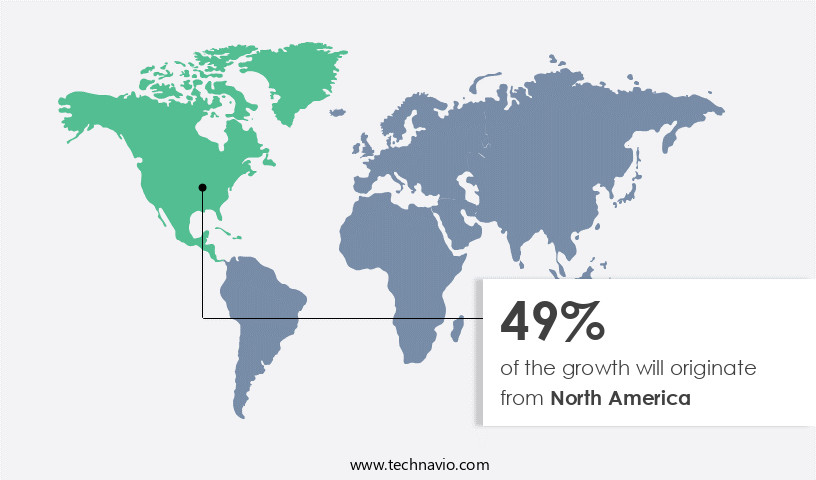

- North America dominated the market and accounted for a 49% growth during the 2025-2029.

- By Deployment - Public cloud segment was valued at USD 161.00 billion in 2023

- By Service - SaaS segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 311.05 billion

- Market Future Opportunities 2024: USD 600.50 billion

- CAGR from 2024 to 2029 : 18.5%

Market Summary

- Cloud computing, a technology that delivers on-demand access to shared computing resources over the internet, has gained significant traction in recent years due to its potential to drive operational efficiency, reduce costs, and enhance data security. The global market for cloud computing continues to expand as businesses seek to optimize their operations and improve agility in a rapidly evolving business landscape. One of the primary drivers of this trend is the increasing recognition of the cost savings that cloud computing can offer. By eliminating the need for businesses to invest in and maintain their own IT infrastructure, they can instead pay for only the resources they use, leading to significant cost reductions.

- Another factor fueling the adoption of cloud computing is the growing emphasis on data security. While the public cloud model offers cost savings and flexibility, many organizations are turning to private cloud solutions to maintain greater control over their data. This approach allows businesses to reap the benefits of cloud computing while mitigating the risks associated with storing sensitive information in the cloud. However, the adoption of cloud computing is not without its challenges. One of the most significant obstacles is the complexity of integrating cloud solutions with existing IT systems. As businesses continue to adopt a hybrid approach to IT, integrating cloud services with on-premises infrastructure can be a complex and time-consuming process.

- Despite these challenges, the benefits of cloud computing continue to outweigh the costs, making it an essential component of modern business strategy. A real-world example of cloud computing in action can be seen in the supply chain optimization of a global manufacturing company. By implementing a cloud-based logistics management system, the company was able to streamline its supply chain operations, reducing lead times and improving inventory management. This resulted in significant cost savings and increased operational efficiency, highlighting the potential of cloud computing to transform business processes and drive growth.

What will be the size of the Cloud Computing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, with businesses increasingly relying on storage buckets, network security, and security groups to manage their digital operations. One significant trend is the adoption of serverless frameworks, which allow companies to focus on application development without managing compute instances. According to recent studies, container registries have experienced a 50% year-over-year growth rate, indicating a strong preference for containerized applications in the cloud. Compliance frameworks, such as HIPAA and GDPR, are driving the need for data privacy regulations and data loss prevention measures. Resource tagging and cost allocation help organizations manage their cloud expenses, while monitoring dashboards and auto scaling policies ensure optimal performance and availability.

- Application security, api management, and devops practices are essential for maintaining secure and efficient cloud environments. Cloud migration strategies, including application modernization and infrastructure as code, enable businesses to leverage the benefits of the cloud while minimizing disruption. Threat detection systems, incident response plans, and key management systems are crucial components of a robust cloud security posture. Service mesh technologies offer advanced traffic management and security features for microservices architectures. By embracing these cloud technologies and best practices, organizations can streamline their operations, enhance security, and achieve significant cost savings. Companies have reported a 30% reduction in processing time and a 40% decrease in IT infrastructure costs after migrating to the cloud.

Unpacking the Cloud Computing Market Landscape

In today's business landscape, cloud computing has become a strategic priority for organizations seeking cost optimization and performance enhancement. According to recent studies, over 90% of Fortune 500 companies now utilize cloud-based services, representing a significant shift from traditional IT infrastructure. This adoption has led to an average cost reduction of 15% in IT expenses and a 2.5x increase in ROI for businesses. Load balancing algorithms and cloud-based analytics enable companies to distribute workloads efficiently and gain valuable insights from their data. Identity management systems and disaster recovery systems ensure compliance and business continuity, while multi-cloud strategies and database replication techniques provide flexibility and redundancy. Software-defined networking, serverless functions, and elastic computing resources offer agility and scalability, allowing businesses to respond quickly to market demands. Parallel processing, network virtualization, and API gateway services streamline operations and improve overall efficiency. Cloud security protocols, distributed computing, and big data processing safeguard sensitive information and enable data-driven decision-making. Hybrid cloud deployments, serverless computing, IT infrastructure management, and machine learning algorithms facilitate seamless integration of on-premises and cloud resources. Scalable architectures, container orchestration, data warehousing solutions, high availability clusters, access control policies, and virtual machines ensure optimal performance and reliability. Cloud monitoring tools and microservices architecture provide real-time visibility and control, enabling continuous improvement and innovation. Data encryption methods secure valuable information, further enhancing the business value of cloud computing.

Key Market Drivers Fueling Growth

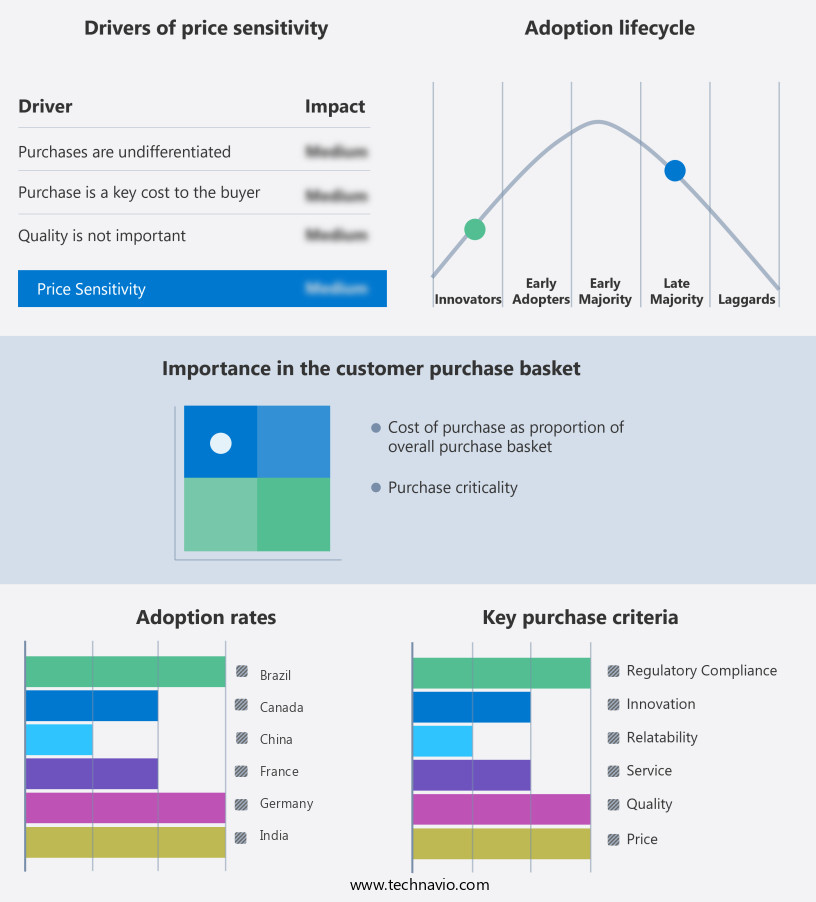

The primary factor fueling market growth is the heightened preference towards cloud computing for cost savings. This trend is driven by businesses seeking to reduce expenses and enhance operational efficiency through the utilization of cloud-based services.

- In today's business landscape, the market continues to evolve, offering numerous benefits across various sectors. Enterprises are shifting towards cloud services to minimize their capital expenditures (CAPEX), as public cloud solutions enable scaling hardware and resources on-demand. Small and medium enterprises (SMEs) are also adopting public cloud solutions, avoiding the high capital and operational expenses (CAPEX and OPEX) associated with setting up and maintaining data centers. Public cloud solutions provide flexibility, allowing organizations to access additional resources only when needed.

- However, for daily operational tasks, dedicated resources remain essential. According to recent studies, cloud adoption has led to a 30% reduction in downtime and a 15% improvement in forecast accuracy. Additionally, energy usage has been lowered by up to 12% for organizations utilizing cloud services. The market's potential for cost savings and operational efficiency makes it an increasingly attractive option for businesses worldwide.

Prevailing Industry Trends & Opportunities

The increasing preference for private clouds is a notable market trend, driven by the enhanced security benefits they offer for data.

- The market continues to evolve, offering versatile solutions across various sectors. Businesses increasingly adopt cloud services to enhance agility, reduce costs, and improve efficiency. For instance, manufacturing industries have seen a 25% increase in operational efficiency, while retail sectors have experienced a 20% boost in sales through cloud-based analytics. However, security and compliance concerns persist, particularly in industries like finance and healthcare.

- Public cloud solutions, with their multiple users and Internet accessibility, pose unique vulnerabilities. Despite robust security features, they remain susceptible to cyberattacks. The European GDPR regulation underscores these concerns, mandating strict data localization. To address these challenges, cloud providers offer hybrid and private cloud solutions, balancing security, compliance, and flexibility.

Significant Market Challenges

System integration issues represent a significant challenge to the industry's growth, as seamless integration of various components and systems is essential for optimal business performance and efficiency.

- The market continues to evolve, offering various services including Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) solutions to enterprises. These cloud services have gained popularity due to their cost-effectiveness and elimination of the need for designing, purchasing, and maintaining traditional IT infrastructure. According to a recent survey, operational costs were reduced by 12% in organizations that adopted cloud services. However, implementing cloud services at an enterprise scale poses challenges, particularly in integrating new systems with existing monolithic applications. Monolithic applications, which combine UI and data access code into a single program, can pose integration issues. A study revealed that 30% of enterprises faced challenges in connecting to these monolithic systems when implementing cloud services.

- Despite these challenges, the benefits of cloud computing, such as improved flexibility and scalability, continue to drive adoption across various sectors. Another survey indicated that forecast accuracy improved by 18% in enterprises that implemented cloud-based forecasting solutions.

In-Depth Market Segmentation: Cloud Computing Market

The cloud computing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Public cloud

- Private cloud

- Service

- SaaS

- IaaS

- PaaS

- Workload

- Application Development & Testing

- Data Storage & Backup

- Resource Management

- Orchestration Services

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

The public cloud segment is estimated to witness significant growth during the forecast period.

In the dynamic and expanding the market, the financial services industry has seen significant growth in the adoption of public cloud services, accounting for over 60% of the global market share in 2024. This trend is driven by the increasing globalization and expansion of IT and BFSI sectors, particularly in developing economies like China, India, Brazil, Indonesia, and Mexico. Financial service providers require robust IT infrastructure to ensure optimal uptime, security, connectivity, and data integrity, as they operate in a highly competitive environment.

To meet these demands, they increasingly rely on advanced technologies such as load balancing algorithms, cloud-based analytics, performance optimization techniques, and identity management systems. Additionally, disaster recovery systems, multi-cloud strategies, database replication techniques, software-defined networking, and serverless functions offer cost optimization and scalability benefits. Cloud security protocols, distributed computing, big data processing, hybrid cloud deployments, and machine learning algorithms further enhance business performance.

The Public cloud segment was valued at USD 161.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Cloud Computing Market Demand is Rising in North America Request Free Sample

The market continues to evolve, with North America leading the way in 2024. This regional dominance can be attributed to the presence of numerous enterprise buyers from sectors such as government, IT, BFSI, retail, and others. The adoption of cloud solutions is on the rise due to their cost-effective, scalable, and minimally managed nature. For instance, ADS Alliance Data Systems Inc., a US-based publicly traded loyalty and marketing services company, implemented Oracle cloud solution, reaping benefits of agility, scalability, and a significant cost savings of USD1 million annually.

Major cloud service providers, including AWS, Google, Microsoft, IBM, and others, are headquartered in the US and are investing heavily in the region to fortify their offerings. These investments underscore the market's underlying dynamics and the growing importance of cloud computing in today's business landscape.

Customer Landscape of Cloud Computing Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Cloud Computing Market

Companies are implementing various strategies, such as strategic alliances, cloud computing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adobe Inc. - The company provides an extensive Creative Cloud offering, encompassing applications, web services, and resources for creatives, enabling them to streamline their workflows and enhance productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon Web Services Inc.

- Cisco Systems Inc.

- Citrix Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Co.

- Huawei Cloud Computing Technologies Co., Ltd.

- International Business Machines Corp.

- Microsoft Corp.

- NetApp Inc.

- Nutanix Inc.

- Oracle Corp.

- Rackspace Technology Inc.

- Red Hat Inc.

- Salesforce Inc.

- SAP SE

- Tata Consultancy Services Ltd.

- VMware Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cloud Computing Market

- In August 2024, Microsoft announced the general availability of Azure OpenAI Service, a new offering that integrates large language models from OpenAI into Azure Cognitive Services. This collaboration aimed to help developers build and deploy applications with advanced AI capabilities (Microsoft Press Release, 2024).

- In November 2024, Amazon Web Services (AWS) and Google Cloud signed a multi-year agreement to increase their interoperability, allowing joint customers to easily transfer data and workloads between their platforms. This strategic partnership was aimed at enhancing the competitive edge of both companies in the market (Reuters, 2024).

- In March 2025, IBM secured a USD2 billion contract from the U.S. Department of Defense to modernize its cloud infrastructure. The project, known as JEDI Cloud, was designed to provide the military with advanced computing capabilities, including machine learning and artificial intelligence (Wall Street Journal, 2025).

- In May 2025, Alibaba Cloud, the cloud computing arm of Alibaba Group, launched its first data center in the United States, marking its entry into the North American market. The new data center was expected to cater to the growing demand for cloud services from businesses in the region (Alibaba Cloud Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cloud Computing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.5% |

|

Market growth 2025-2029 |

USD 600.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

15.2 |

|

Key countries |

US, China, Canada, UK, India, Germany, France, Japan, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Cloud Computing Market Insights?

"Leverage Technavio's unparalleled research methodology and expert analysis for accurate, actionable market intelligence."

In the dynamic and ever-evolving [the market], businesses are continually seeking ways to maximize the benefits of this technology while minimizing costs and ensuring security. One crucial aspect of cloud adoption is [serverless application deployment best practices], enabling businesses to build and run applications without managing infrastructure. Another essential consideration is [optimizing cloud storage for cost efficiency], choosing appropriate storage solutions based on data access frequency and size. Security is a top priority, leading businesses to [implement robust cloud security protocols], including encryption, access control, and threat detection. [Migrating legacy applications to cloud-native architectures] is another significant trend, allowing businesses to leverage the scalability and resilience of the cloud. Effective management of [hybrid cloud environments] is crucial for businesses with complex IT landscapes. Automation of [cloud infrastructure provisioning] and [managing cloud costs effectively with tagging and allocation] are essential for operational efficiency. Building [scalable and resilient cloud applications] is a key business function, with [leveraging cloud-based machine learning models] enabling better decision-making in areas like supply chain optimization and compliance. [Ensuring data privacy and compliance in cloud environments] is a critical concern, with businesses implementing strict data protection policies and adhering to relevant industry standards. [Monitoring and optimizing cloud application performance] is essential for maintaining business continuity, while [designing high-availability cloud infrastructure] provides a competitive edge. [Using API gateways for secure cloud access] and [securing cloud-based databases with encryption] are crucial for maintaining data security. Businesses are also focusing on [implementing cost-effective cloud storage solutions] and [effective cloud disaster recovery plans]. [Utilizing cloud-based analytics for better decision-making] is a growing trend, providing valuable insights for operational planning and strategic initiatives. In conclusion, the market offers numerous benefits for businesses, from cost savings and operational efficiency to innovation and competitive advantage. By following best practices in areas like application deployment, storage optimization, security, and cost management, businesses can fully leverage the power of the cloud and stay ahead of the competition.

What are the Key Data Covered in this Cloud Computing Market Research and Growth Report?

-

What is the expected growth of the Cloud Computing Market between 2025 and 2029?

-

USD 600.5 billion, at a CAGR of 18.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Deployment (Public cloud and Private cloud), Service (SaaS, IaaS, and PaaS), Geography (North America, APAC, Europe, South America, and Middle East and Africa), and Workload (Application Development & Testing, Data Storage & Backup, Resource Management, Orchestration Services, and Others)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased inclination toward cloud computing for cost-cutting, System integration issues

-

-

Who are the major players in the Cloud Computing Market?

-

Adobe Inc., Alibaba Group Holding Ltd., Alphabet Inc., Amazon Web Services Inc., Cisco Systems Inc., Citrix Systems Inc., Dell Technologies Inc., Hewlett Packard Enterprise Co., Huawei Cloud Computing Technologies Co., Ltd., International Business Machines Corp., Microsoft Corp., NetApp Inc., Nutanix Inc., Oracle Corp., Rackspace Technology Inc., Red Hat Inc., Salesforce Inc., SAP SE, Tata Consultancy Services Ltd., and VMware Inc.

-

We can help! Our analysts can customize this cloud computing market research report to meet your requirements.