Dual Chamber Dispensing Systems Market Size 2024-2028

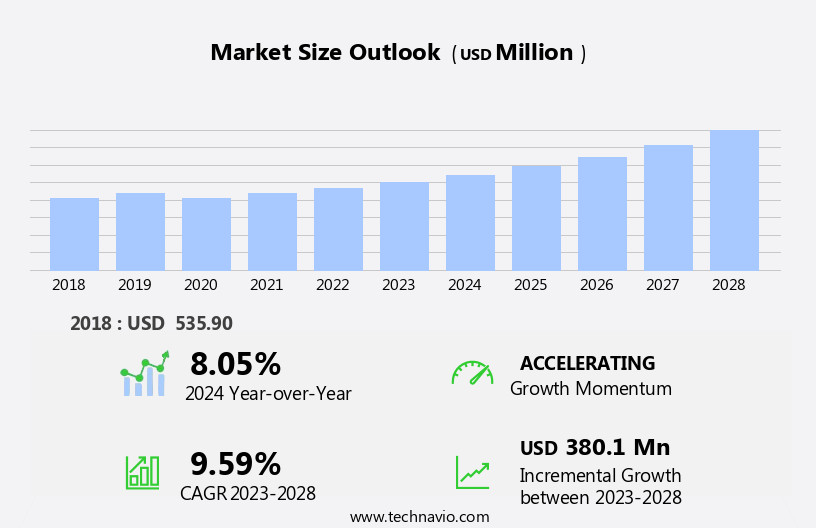

The dual chamber dispensing systems market size is forecast to increase by USD 380.1 million at a CAGR of 9.59% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for convenient packaging solutions in the cosmetics industry. This trend is fueled by consumers' preference for hygienic and easy-to-use packaging, which dual chamber systems offer through their separate compartments for different formulations. Additionally, there is a growing emphasis on sustainable packaging solutions, with dual chamber systems gaining popularity due to their ability to reduce product waste and prolong the shelf life of cosmetics. However, challenges remain in the disposal of these systems, as they contain multiple components that require separate disposal processes.

- Companies seeking to capitalize on this market opportunity should focus on developing innovative and eco-friendly solutions that address disposal concerns while maintaining the convenience and functionality of dual chamber systems. By doing so, they can effectively navigate the market landscape and meet the evolving needs of consumers and businesses alike.

What will be the Size of the Dual Chamber Dispensing Systems Market during the forecast period?

- The market in the US is experiencing significant growth due to the increasing demand for simultaneous dispensing of two distinct substances in various industries, particularly in cosmetics and chemicals. This market is driven by material science advancements, leading to the development of lightweight yet durable packaging solutions using materials like aluminum and high-density polyethylene (HDPE), as well as eco-friendly substitutes for traditional plastics like polystyrene. Regulations surrounding plastic waste have fueled innovation in this sector, with companies focusing on user-friendly packaging designs that minimize waste. Market dynamics are shaped by cost implications, with Ningbo Gidea Packaging and Hebei Xinfuda Plastic among the key players investing in design advances and strategic mergers to stay competitive.

- The use of metal components and pet materials like polyethylene terephthalate (PET) and low-density polyethylene (LDPE) in dual chamber systems adds to the market's size and direction. Overall, this market is poised for continued growth as consumer demand for convenient, sustainable, and aesthetically pleasing packaging solutions persists.

How is this Dual Chamber Dispensing Systems Industry segmented?

The dual chamber dispensing systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Personal care

- Homecare

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

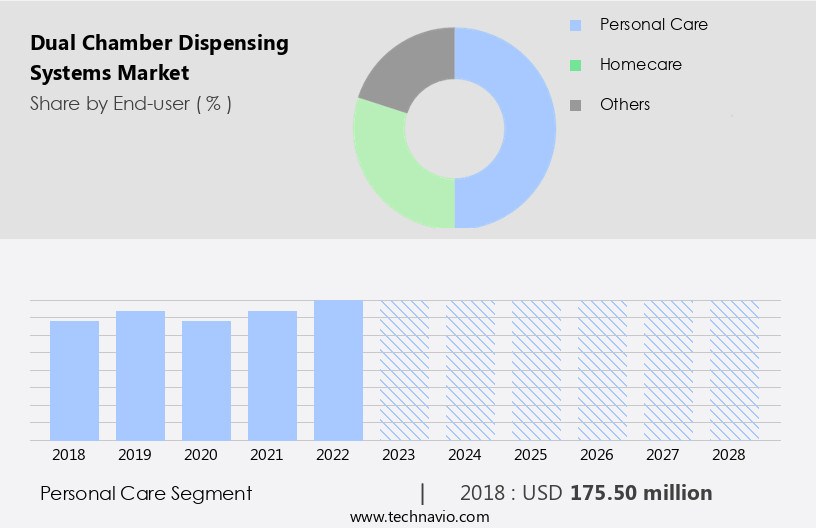

The personal care segment is estimated to witness significant growth during the forecast period.

Dual chamber dispensing systems have gained significant traction in the personal care industry due to their ability to accommodate two distinct substances, such as creams and lotions, in a single packaging solution. This market trend is driven by rising consumer demand for product differentiation and innovation, particularly among fitness enthusiasts and those conscious of their health and appearance. Eco-friendly substitutes, like high-density polyethylene and post-consumer recycled resin, are increasingly being adopted to address environmental concerns. Smart gadgets, such as airless packaging and vacuum-insulated containers, are also gaining popularity for their precision mixing and user-friendly design.

Brands are investing in material science and design advances to create lightweight, aesthetic packaging that appeals to consumers. Strategic mergers and acquisitions between packaging solution providers and personal care product manufacturers are also shaping the market. The personal care industry, including cosmetics and hygiene care products, is expected to reach substantial growth due to increasing consumer spending and the emergence of new markets. Consumer preferences for eco-friendly and customizable packaging, as well as the adoption of smart technologies, are key factors contributing to this growth. However, cost implications and regulatory compliance, such as plastic waste regulations, may pose challenges for small clients.

Product innovations, such as biodegradable bottles and fixed-dose dispensing systems, are addressing these challenges by offering durable, recyclable, and sustainable packaging solutions. Chemicals, such as high-density polyethylene, low-density polyethylene, and polystyrene, are used in the production of these packaging solutions, while metal components, like steel and aluminium, are used for their durability and aesthetic appeal. In , the market is experiencing significant growth due to consumer demand for product differentiation, eco-friendly alternatives, and smart packaging solutions. Brands are focusing on innovation, sustainability, and design to meet the evolving needs and preferences of consumers in the personal care industry.

Get a glance at the market report of share of various segments Request Free Sample

The Personal care segment was valued at USD 175.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth, particularly in the Asia Pacific region. Factors contributing to this expansion include increasing urbanization, rising disposable incomes, and evolving consumer preferences. Personal care product manufacturers are expanding in APAC countries, leading to an increase in demand for innovative packaging solutions such as dual chamber dispensing systems. Emerging economies like India and Vietnam present high-growth opportunities for this market. Product differentiation is a key trend in the market, with companies focusing on eco-friendly substitutes, user-friendly packaging, and smart technologies. Hebei Xinfuda Plastic and Ningbo Gidea Packaging are among the companies investing in material science to develop lightweight and durable bottles made of High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE).

Consumer demand for customizable packaging and precision mixing is driving product innovations. Dual chamber dispensing systems are being used in various applications, including fitness enthusiasts' supplements, chemicals, cosmetics, and haircare. Smart gadgets, such as vacuum-insulated containers and airless packaging, are also gaining popularity due to environmental concerns and the beauty consciousness of consumers. Strategic mergers and acquisitions are shaping the competitive landscape, with companies like Berlin Packaging and Silgan Dispensing Systems expanding their product offerings. The use of post-consumer recycled resin, biodegradable bottles, and biodegradable materials is addressing capacity concerns and environmental challenges. The market dynamics are influenced by factors such as consumer preferences, capacity, and material science.

PET material, metal components, and aluminum bottles are commonly used in dual chamber dispensing systems due to their durability and aesthetic appeal. Fixed-dose dispensing and simultaneous dispensing are gaining traction due to their convenience and cost implications for small clients. In , the market is experiencing significant growth due to changing consumer lifestyles, increasing awareness about personal care products, and product innovations. companies are focusing on eco-friendly substitutes, user-friendly packaging, and smart technologies to cater to evolving consumer demands. The market is expected to continue growing, driven by factors such as capacity concerns, environmental challenges, and consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Dual Chamber Dispensing Systems Industry?

- Rising demand for convenient packaging from cosmetics industry is the key driver of the market.

- In the realm of personal care product manufacturing, an emerging trend is the adoption of innovative and convenient packaging designs to cater to diverse consumer segments. Convenience is a significant purchasing factor, with customers favoring packaging that facilitates easy product usage. Traditional bottles in the hair care industry are being replaced by airless dispensers to offer a more convenient experience.

- Airless dispensers eliminate the need for dispensing closures and screw caps, making the product usage process smoother. Cosmetic manufacturers are also exploring innovative packaging solutions to capture consumer attention. The shift from conventional pump packaging to airless dispensers signifies this trend, as it addresses the demand for more convenient and user-friendly packaging options.

What are the market trends shaping the Dual Chamber Dispensing Systems Industry?

- Increasing preference for sustainable packaging is the upcoming market trend.

- Global packaging manufacturers face growing demand from end-users, particularly in the personal care and homecare industries, for eco-friendly packaging solutions. Sustainability is a key concern for these industries as they seek to promote environmental responsibility and enhance their brand image. Unilever, for example, aims to use 100% recyclable plastic packaging by 2025, while P&G has set a goal of ensuring sustainable packaging for its leading 20 brands by 2030.

- These initiatives reflect a broader trend towards sustainable packaging in various industries. The adoption of sustainable packaging not only addresses environmental concerns but also reduces carbon footprint, making it an attractive option for manufacturers and consumers alike.

What challenges does the Dual Chamber Dispensing Systems Industry face during its growth?

- Challenges faced in disposal of packaging is a key challenge affecting the industry growth.

- Dual chamber dispensing systems, commonly fabricated from rigid plastics like HDPE and PET, are subject to environmental concerns due to their disposal process. These materials, being non-biodegradable, release methane during decomposition and emit poisonous gases when disposed of in landfills. The physical properties of dual chamber dispensing systems can also vary depending on the resin used, with HDPE systems posing a fire hazard due to their high flammability.

- The environmental impact and associated costs of disposing of these systems necessitate the exploration of eco-friendly alternatives, such as biodegradable plastics or reusable systems, to mitigate the environmental consequences.

Exclusive Customer Landscape

The dual chamber dispensing systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the dual chamber dispensing systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, dual chamber dispensing systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Berlin Packaging UK Ltd - Airless bottle technology, specifically DUAL PP variant, enhances cosmetic product stability and prolongs shelf life. This innovation, featuring dual layers and advanced air exclusion, ensures product integrity and effectiveness. By minimizing exposure to air and external contaminants, these bottles maintain the quality and freshness of formulations, ultimately benefiting consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Berlin Packaging UK Ltd

- Bettix Ltd

- Cospack America Corp.

- Hangzhou Luzern Packaging Trading Co. Ltd

- Matsa Group Ltd.

- Ningbo Gidea Packaging Co. Ltd

- O.Berk Co. LLC

- Quadpack Industries SA

- Shanghai Hopeck Packaging Co. Ltd.

- Shijiazhuang Xinfuda Medical Packaging Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Dual chamber dispensing systems have gained significant traction in various industries due to their unique ability to contain and dispense two distinct substances simultaneously. These systems offer numerous benefits, including product differentiation and user-friendly packaging solutions for a wide range of applications. One of the key drivers for the growth of dual chamber dispensing systems is the increasing health awareness among consumers. Fitness enthusiasts and those with specific dietary requirements often rely on supplements and nutritional products that come in dual chamber packaging. These systems enable precise mixing of two substances, ensuring optimal dosage and consistent results. Moreover, eco-friendly substitutes for traditional packaging materials have gained popularity in recent times.

High-density polyethylene (HDPE) and low-density polyethylene (LDPE) are commonly used in the production of dual chamber dispensing systems. These materials offer durability and are recyclable, making them an attractive alternative to non-reusable packaging. The use of smart technologies in dual chamber dispensing systems has also gained momentum. Smart gadgets and connected devices are increasingly being integrated into packaging solutions to enhance user experience and convenience. These systems offer features such as vacuum-insulated containers, precision mixing, and fixed-dose dispensing, among others. Design advances have also played a crucial role in the growth of the market. Aesthetic packaging and lightweight products have become essential for brands looking to stand out in a crowded market.

Berlin Packaging and Ningbo Gidea Packaging are some of the leading players in this space, offering innovative solutions to meet the evolving needs of consumers. The market for dual chamber dispensing systems is not limited to developed economies. Emerging markets, particularly in Asia and Africa, are expected to drive growth in the coming years. Strategic mergers and acquisitions have also been a common trend in the industry, with larger players looking to expand their product offerings and reach new customer segments. Cost implications are a critical consideration for small clients in the market. Customizable packaging solutions and the use of post-consumer recycled resin have emerged as viable options for cost-effective production.

Environmental concerns have become a significant factor influencing the market dynamics of dual chamber dispensing systems. Regulations on plastic waste and the growing demand for biodegradable bottles have led to the development of new materials such as biodegradable polymers and aluminum. In the cosmetics and skincare industries, dual chamber dispensing systems have gained popularity due to their ability to maintain the separation of two substances until the moment of use. This feature is particularly important for products that require precise mixing, such as foundation and sunscreen. The use of chemicals in dual chamber dispensing systems has raised concerns regarding safety and environmental impact.

Companies are investing in material science to develop safer alternatives and reduce the carbon footprint of their products. In , the market is driven by various factors, including health awareness, eco-friendly packaging, design advances, and emerging markets. The use of smart technologies and cost-effective solutions have also gained significance in recent times. Companies that can innovate and adapt to the evolving needs of consumers are expected to thrive in this dynamic market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.59% |

|

Market growth 2024-2028 |

USD 380.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.05 |

|

Key countries |

China, US, UK, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Dual Chamber Dispensing Systems Market Research and Growth Report?

- CAGR of the Dual Chamber Dispensing Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the dual chamber dispensing systems market growth of industry companies

We can help! Our analysts can customize this dual chamber dispensing systems market research report to meet your requirements.