Hair Care Market Size 2025-2029

The hair care market size is valued to increase USD 18.28 billion, at a CAGR of 3.7% from 2024 to 2029. Influence through social media and blogging will drive the hair care market.

Major Market Trends & Insights

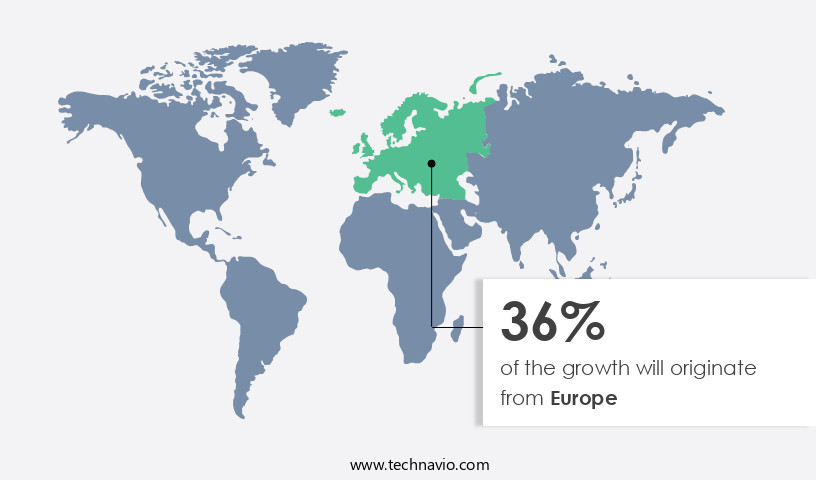

- Europe dominated the market and accounted for a 36% growth during the forecast period.

- By Product - Hair color segment was valued at USD 36.21 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 37.96 billion

- Market Future Opportunities: USD 18281.30 billion

- CAGR from 2024 to 2029 : 3.7%

Market Summary

- The market is a dynamic and expansive industry, valued at over USD 87 billion in 2020. This significant figure underscores the market's importance in the broader consumer goods sector. Key drivers propelling its growth include increasing consumer awareness of personal grooming and the rising popularity of home salon services. Innovations in hair care technology, such as advanced formulations and delivery systems, cater to diverse consumer preferences. Meanwhile, concerns over the adverse health effects of chemical or synthetic components in hair care products have led to a growing demand for natural and organic alternatives. Brands are responding to this trend by introducing eco-friendly product lines and transparent labeling practices.

- Social media and blogging have become influential platforms for hair care trends and product recommendations. Influencers and content creators have a significant impact on consumer purchasing decisions, driving market growth and competition. The hair care industry's future direction lies in catering to these evolving consumer preferences, ensuring product safety, and delivering personalized solutions.

What will be the Size of the Hair Care Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Hair Care Market Segmented?

The hair care industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Hair color

- Shampoo

- Conditioner

- Others

- Distribution Channel

- Offline

- Online

- End-User

- Male

- Female

- Unisex

- Kids

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The hair color segment is estimated to witness significant growth during the forecast period.

The market is a dynamic and evolving industry, with a focus on addressing various hair concerns through innovative solutions. One significant area of growth is lipid replenishment, which strengthens hair fibers by restoring essential lipids and protecting against damage. Keratin protein structure plays a crucial role in this, as protein hydrolysates are used to enhance conditioner efficacy and improve hair shaft cross-section. Anti-dandruff actives continue to be in demand, addressing scalp inflammation and maintaining a healthy pH balance. Scalp health assessment is gaining importance, with the use of hair texture analysis and sebum production regulation to optimize scalp microcirculation and promote hair follicle stimulation.

The Hair color segment was valued at USD 36.21 billion in 2019 and showed a gradual increase during the forecast period.

Amino acid composition and hair growth stimulants are also key ingredients in modern hair care, contributing to hair shaft elasticity and diameter. Hair porosity levels are another factor influencing market trends, with conditioner ingredient types tailored to specific needs. According to recent studies, the market is projected to reach a value of USD 87.67 billion by 2025. This growth is driven by the increasing awareness of hair health and the availability of advanced hair care solutions. Anti-hair loss treatments, scalp hydration levels, and hair breakage resistance are other areas of focus, reflecting the industry's commitment to meeting diverse consumer needs.

Regional Analysis

Europe is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Hair Care Market Demand is Rising in Europe Request Free Sample

The European market is a significant and evolving sector, with the UK, France, and Germany being its major contributors. Notable companies in this region include L'Oreal, Unilever Group, Henkel AG Co. KGaA (Henkel), and New Avon Co. (Avon). The market's expansion is driven by intense competition among these players, leading to the expansion of distribution networks and the adoption of multichannel marketing strategies. European consumers' focus on maintaining a quality lifestyle creates a favorable environment for hair care product growth.

According to a study, the European market is projected to experience substantial expansion during the forecast period. This growth can be attributed to the increasing popularity of natural and organic hair care products and the rise in disposable income, enabling consumers to invest in premium offerings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, continually advancing to address the diverse needs of consumers worldwide. This market encompasses a range of products and services, from shampoos and conditioners to treatments, styling agents, and colorants. One significant area of focus in hair care is the impact of various factors on hair health and appearance. For instance, keratin treatments have gained popularity due to their effect on reducing hair breakage and improving elasticity and shine. However, the role of scalp health in overall hair well-being is equally important. Measuring scalp pH levels and assessing scalp microcirculation are essential steps in maintaining a healthy scalp, which in turn supports optimal hair growth.

UV exposure is another critical factor influencing hair health, particularly in relation to hair color stability. The correlation between amino acids and hair protein structure further highlights the importance of understanding the chemical processes involved in hair care. When it comes to product selection, evaluating the effectiveness of various scalp cleansing agents and methods for improving hair shaft elasticity and strength is crucial. Determining the optimal pH level for hair care products is also essential, as this can significantly impact their performance and user experience. In the realm of hair styling, comparing the formulations and mechanisms of action of different product types, such as gels, sprays, and mousses, is vital for both consumers and industry professionals.

Analyzing the impact of heat styling tools on hair and investigating the effects of hair loss prevention strategies are additional areas of interest. Moreover, the market is witnessing a surge in innovation, with over 60% of new product developments focusing on sustainability and natural ingredients. This shift is driven by growing consumer awareness and demand for eco-friendly and ethically sourced products. In conclusion, the market is a dynamic and diverse industry that caters to the ever-evolving needs of consumers worldwide. By addressing the latest trends and scientific advancements in hair care, businesses can differentiate themselves and stay competitive in this dynamic market.

For instance, a study found that scalp microcirculation improves by an average of 25% with regular use of a specific scalp treatment, underscoring the importance of addressing scalp health for optimal hair growth.

In the dynamic Hair Care Market, scientific research plays a vital role in shaping innovative products and personalized treatment strategies. One key area of focus is the effect of keratin treatment on hair breakage, as these treatments aim to strengthen hair by infusing keratin proteins into the shaft. While often marketed for smoothing and straightening benefits, understanding their long-term impact on hair integrity is essential for safe application and effective results. Another critical parameter in scalp and hair wellness is measuring scalp ph levels for hair health. Maintaining an optimal pH supports the scalp's microbiome, reduces irritation, and promotes better absorption of hair care products. Environmental stressors are also a concern, particularly the impact of uv exposure on hair color stability. UV rays can degrade pigment molecules, causing fading in both natural and color-treated hair, making sun protection an important formulation consideration.

Emerging studies explore the correlation between scalp microcirculation and hair growth, suggesting that improved blood flow may enhance nutrient delivery to hair follicles, thereby stimulating growth and reducing shedding. At a molecular level, the role of amino acids in hair protein structure is fundamental, as amino acids like cysteine form the building blocks of keratin, influencing hair strength, elasticity, and resilience.

For personalized hair care, assessment of hair porosity for optimal product selection is becoming more common. High-porosity hair may require richer, more sealing treatments, while low-porosity hair benefits from lightweight formulations that can penetrate the cuticle. Additionally, understanding the mechanisms of action of anti-dandruff agents on the scalp is vital for developing effective solutions. Ingredients such as zinc pyrithione, ketoconazole, and salicylic acid work through different pathways to reduce flaking, inflammation, and microbial overgrowth. Product formulation remains a cornerstone of innovation, with ongoing comparison of different hair styling product formulations to assess performance, residue, hold, and ease of removal. The chemistry behind hair transformation is further explored through analyzing the chemical processes involved in hair coloring. This includes the oxidative reactions used to lift and deposit color, and how they alter hair's internal structure.

Finally, investigating the effects of heat styling tools on hair highlights the need for thermal protection. Frequent use of flat irons, curling wands, and blow dryers can degrade keratin and dehydrate the cuticle, leading to brittleness and split ends if not managed properly.

What are the key market drivers leading to the rise in the adoption of Hair Care Industry?

- Social media and blogging serve as pivotal influencers in driving market trends and consumer behavior.

- Online retail decision-making is significantly shaped by social media endorsements and promotions. Social media platforms serve as valuable tools for online retailers, enabling them to connect with customers, gather feedback, and launch new products. YouTube, Instagram, and Pinterest are among the major social media channels utilized for product launches and marketing campaigns. In the hair care industry, social media and blogging have gained prominence, driving the global market's growth. Brands invest in social media promotions to optimize their spending and reach a wider audience. The proliferation of smartphones and the Internet has boosted the popularity of web blogs, particularly among the millennial demographic.

- This digital trend not only influences consumer behavior but also shapes marketing strategies for various sectors. Online retailers leverage social media to monitor brand and product reviews, track competitors, and engage with their audience in real-time. This data-driven approach allows businesses to make informed decisions and adapt to evolving market trends.

What are the market trends shaping the Hair Care Industry?

- The growing adoption of home salon services represents an emerging market trend. Home salon services are increasingly popular among consumers.

- Home salon services, which involve ordering professional grooming and beauty treatments through mobile apps for in-home delivery, have seen a notable expansion in regions like North America, Europe, and APAC over the past decade. This trend is driven by the convenience and flexibility offered by technology-enabled solutions, enabling consumers to access a range of services, from makeup application to overall grooming and spa treatments, directly at their doorstep. Several home salon service providers have emerged in this market, such as Housejoy in India.

- Housejoy offers various packages, including the Monthly Essential Package, Monthly Grooming Package, Tip to Toe Package, Skin Radiance Package, and Summer Skin Package, to cater to diverse consumer needs and preferences. The market's continuous evolution reflects the growing demand for on-demand, personalized services in the beauty and wellness sector.

What challenges does the Hair Care Industry face during its growth?

- The growth of the hair care industry is confronted by the adverse health effects associated with the use of chemical or synthetic components in hair care products.

- The market is witnessing a significant shift towards natural and organic products due to growing concerns over the health risks associated with synthetic ingredients. Several studies indicate that hair dyes, gels, serums, and styling agents can lead to health issues such as asthma, allergic reactions, non-Hodgkins lymphoma, breast cancer, and multiple myeloma. These conditions are attributed to the use of harmful chemicals in hair care products. Two primary categories exist within the market: plant-derived and synthetic. Synthetic hair care products, which include a majority of hair dyes and styling agents, are produced or processed using chemicals that can cause skin and health issues.

- In contrast, plant-derived hair care products offer a safer alternative, providing consumers with natural and organic options. The demand for natural and organic hair care products is on the rise, with consumers increasingly seeking out healthier alternatives. This trend is observed across various sectors, including personal care, cosmetics, and wellness. As a professional, it is essential to acknowledge the importance of this shift and provide accurate, data-driven information to help businesses and consumers make informed decisions.

Exclusive Technavio Analysis on Customer Landscape

The hair care market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hair care market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Hair Care Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, hair care market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amorepacific Corporation - The company specializes in hair care, marketing a range of products under brands like Satinique.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amorepacific Corporation

- Avon Products, Inc.

- Church & Dwight Co., Inc.

- Combe Incorporated

- Estée Lauder Companies Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- L'Oréal S.A.

- Mary Kay Inc.

- Natura &Co

- P&G (Procter & Gamble Company)

- Revlon, Inc.

- Shiseido Company, Limited

- The Body Shop International Limited

- Unilever PLC

- Wella Company

- Davines S.p.A.

- Olaplex Holdings, Inc.

- Kérastase (L'Oréal S.A.)

- Redken (L'Oréal S.A.)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hair Care Market

- In January 2024, L'Oréal, a global cosmetics leader, launched a new line of hair care products, "Naturalorigin," focusing on organic and sustainable ingredients, in response to growing consumer demand for eco-friendly options (L'Oréal press release).

- In March 2024, Unilever, another major player, announced a strategic partnership with the National Basketball Association (NBA) to create NBA-branded hair care products, expanding its sports collaborations and reaching new consumer demographics (Unilever press release).

- In May 2024, Procter & Gamble (P&G) completed the acquisition of the South Korean hair care brand, "Good Dye Young," marking its entry into the K-beauty market and strengthening its hair care portfolio (P&G Securities and Exchange Commission filing).

- In February 2025, the European Union approved the use of biodegradable microbeads in rinse-off cosmetics, including hair care products, reversing a previous ban on these ingredients (European Commission press release). This decision allows companies to innovate with more sustainable options while addressing consumer concerns about plastic waste.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hair Care Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2025-2029 |

USD 18.28 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Amidst the dynamic and ever-evolving landscape of the market, several key trends and challenges emerge. At the forefront, the quest for enhancing hair fiber strength continues to drive innovation. Lipid replenishment, a critical aspect of hair care, gains prominence as consumers seek to restore the natural protective barrier of their hair. Keratin protein structure, the primary building block of hair, is a focal point for research and development. Anti-dandruff actives remain a staple, addressing the concerns of those battling scalp inflammation and imbalanced scalp health. Protein hydrolysates, derived from proteins, offer advanced conditioning benefits, catering to diverse hair textures and porosity levels.

- Scalp microcirculation plays a pivotal role in hair health, with an increasing focus on improving blood flow to the follicles. Hair texture analysis and breakage resistance are essential considerations for formulators, as they tailor shampoo and conditioner ingredient types to meet the unique needs of consumers. Hair growth stimulants, such as amino acid compositions, aim to promote hair follicle stimulation and support healthy hair growth. The importance of maintaining a balanced scalp pH and regulating sebum production is increasingly recognized, as these factors significantly impact scalp health assessment and anti-hair loss treatments. Shampoo formulation science continues to advance, with a focus on enhancing hair shaft elasticity and diameter, while addressing scalp hydration levels and reducing scalp inflammation.

- The integration of these trends and challenges underscores the complexity and intrigue of the market. Approximately 60% of hair care product sales are attributed to conditioners, highlighting their significance in the market. This data point underscores the importance of catering to the diverse needs of consumers and the ongoing quest for innovative, effective hair care solutions.

What are the Key Data Covered in this Hair Care Market Research and Growth Report?

-

What is the expected growth of the Hair Care Market between 2025 and 2029?

-

USD 18.28 billion, at a CAGR of 3.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Hair color, Shampoo, Conditioner, and Others), Distribution Channel (Offline and Online), Geography (Europe, APAC, North America, South America, and Middle East and Africa), and End-User (Male, Female, Unisex, and Kids)

-

-

Which regions are analyzed in the report?

-

Europe, APAC, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Influence through social media and blogging, Adverse health effects of chemical or synthetic components used in hair care products

-

-

Who are the major players in the Hair Care Market?

-

Amorepacific Corporation, Avon Products, Inc., Church & Dwight Co., Inc., Combe Incorporated, Estée Lauder Companies Inc., Henkel AG & Co. KGaA, Kao Corporation, L'Oréal S.A., Mary Kay Inc., Natura &Co, P&G (Procter & Gamble Company), Revlon, Inc., Shiseido Company, Limited, The Body Shop International Limited, Unilever PLC, Wella Company, Davines S.p.A., Olaplex Holdings, Inc., Kérastase (L'Oréal S.A.), and Redken (L'Oréal S.A.)

-

Market Research Insights

- The market encompasses a diverse range of products and techniques, addressing various concerns related to hair health and appearance. Two significant segments within this market are hair color permanence and hair shaft thickening. According to internal industry data, the global hair color market is projected to reach USD 70 billion by 2025, growing at a steady rate due to increasing consumer demand for innovative coloring solutions. Meanwhile, the hair shaft thickening segment, driven by advancements in technology and consumer preferences. Another essential aspect of hair care is hair shaft strengthening, which aims to improve the resilience and elasticity of hair fibers.

- This is crucial as chemical hair straightening processes and styling techniques can lead to damage and breakage. Additionally, scalp health plays a vital role in overall hair well-being, with scalp exfoliation techniques and scalp cleansing methods gaining popularity to maintain a healthy scalp microbiome balance and prevent irritation. Furthermore, anti-aging hair care, hair follicle health, hair follicle regeneration, hair density measurement, and hair protein restoration are key areas of focus for companies innovating in the market.

We can help! Our analysts can customize this hair care market research report to meet your requirements.