Dual Fuel Engine Market 2024-2028

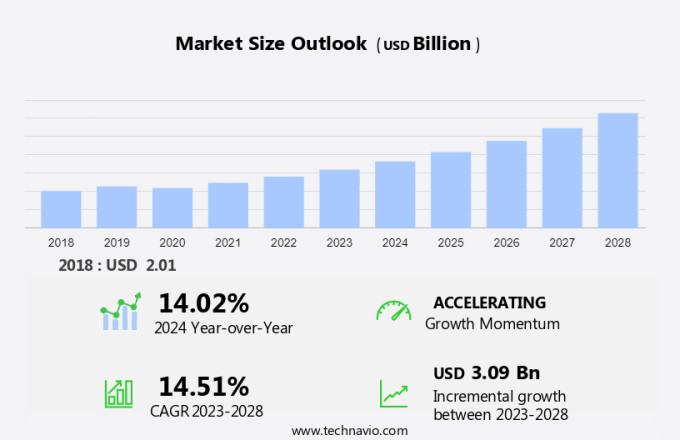

The dual fuel engine market size is forecast to increase by USD 3.09 billion, at a CAGR of 14.51% between 2023 and 2028. The growth rate of the market depends on several factors such as an increase in the adoption of cleaner technologies, an increase in demand for dual-fuel engines in the generation of electricity and gradual conversion of conventional engines to dual-fuel engines. Our market report examines historical data from 2018-2022, besides analyzing the current and forecasted market scenario.

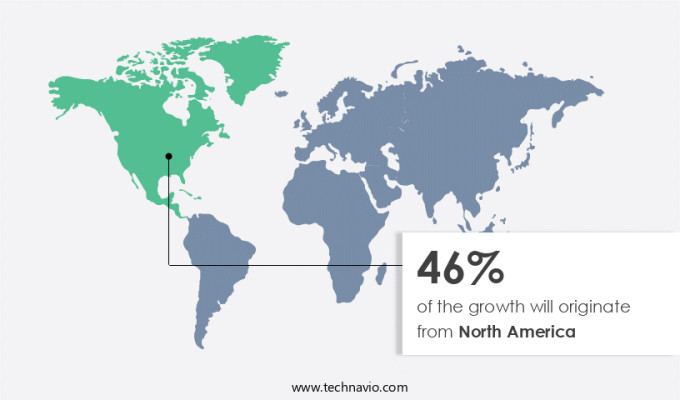

The demand for dual-fuel engines as well as gas engines in North America, propelled by stringent emission laws and the imperative for efficient power generation, particularly in the US and Canada, is met by key offerings from companies like Anglo Belgian Corp, featuring the BeHydro dual-fuel engine with an energy capacity ranging from 1 MW to 10 MW. Similarly, Cummins Inc. contributes to this demand with its offerings, including the 3512E Tier 4 Final Dynamic Gas Blending Engine and the 3512C Dynamic Gas Blending Engine.

Market Forecasting and Size

Market Forecast 2024-2028

To learn more about this report, Request Free Sample

Market Dynamic

Our researchers studied the market research and growth data for years, with 2023 as the base year and 2024 as the estimated year, and presented the key drivers, trends, and challenges for the market.

Driver - Increase in demand for dual-fuel engines in the generation of electricity

Electricity is the most common form of energy use. One of the major uses of gas engines is electricity generation. With changes in globalization and urbanization, lifestyles and work culture across sectors have changed. The use of electricity has risen. Households have increased their consumption of electrical appliances. Manufacturing and production processes have been mechanized and less labour-intensive. With the rising demand for electricity, the need for gas engines that generate electricity is also increasing. The consumption of electricity has risen, particularly in non-OECD nations. They contributed to around 50% of the global electricity consumption before 2010 and are expected to account for more than 60% by 2025. OECD nations have stable growth because markets here are well established, and consumption patterns have reached a mature stage. Many nations are making attempts to reduce greenhouse emissions.

As a result of initiatives to reduce carbon emissions and promote renewable energy sources, the use of coal for energy generation has significantly decreased. The US's adoption of the Clean Power Plan underscores a shift towards renewable energy, aligning with global efforts to mitigate climate change. Similarly, India has set ambitious targets to scale up renewable energy production capacity from megawatts to gigawatts, further driving the transition away from fossil fuels. In this evolving energy landscape, there is a growing demand for dual-fuel engines, including diesel power engines, for electricity generation. These engines offer flexibility in fuel options, combining diesel with natural gas or renewable fuels, thereby enhancing efficiency and reducing emissions. This trend is expected to propel market growth significantly during the forecast period, as industries and utilities worldwide seek cleaner and more sustainable energy solutions.

Trends - Increasing use of advanced dual fuel compression-ignition engines

The increasing use of advanced dual-fuel compression ignition engines boosts the growth of the market. The medium- and heavy-duty markets are dominated by diesel or compression-ignition engines because of their higher efficiency and capacity to produce large amounts of torque. A more reactive fuel that will ignite on its own at high pressures and temperatures is needed for these engines. This restricts the fuels that compression engines (CI) engines can use. Because dual-fuel engines can use a second, more reactive fuel to produce ignition, they offer a way to use fewer reactive fuels. Additionally, research has been done on dual fuel concepts as a means of lowering engine emissions.

Moreover, the adoption of advanced dual fuel compression-ignition engines is notably prevalent in sectors like marine transportation, where adherence to stringent emission standards is imperative. These engines offer a compelling solution by integrating the efficiency of compression ignition with the environmental benefits of dual fuel technology. This approach aligns with industries' increasing focus on sustainability and their pursuit of cleaner alternatives. In particular, marine propulsion engines benefit from dual fuel capabilities, allowing them to operate on a combination of diesel and natural gas or other renewable fuels. This versatility not only enhances operational efficiency but also reduces emissions significantly, addressing regulatory requirements and environmental concerns in maritime operations. As demand grows for greener marine propulsion solutions, the market for advanced dual fuel compression-ignition engines is poised to expand during the forecast period, driven by the need for sustainable transportation solutions across global shipping fleets.

Challenge - High initial cost of installing dual-fuel engines

The high initial cost of installing dual-fuel engines represents a significant challenge for the market. While dual-fuel engines offer long-term benefits in terms of efficiency and reduced emissions, the upfront investment required for their adoption can be a substantial barrier for businesses and industries. The cost challenge encompasses several factors, including the expense of purchasing and installing dual-fuel engines, along with the associated infrastructure modifications. Transitioning from conventional engines to dual-fuel technology often necessitates retrofitting existing equipment or acquiring new vehicles and machinery, both of which involve considerable capital expenditure.

Additionally, the need for specialized training programs for personnel to operate and maintain dual fuel systems contributes to the overall initial cost. Despite the potential for long-term savings in fuel consumption and compliance with environmental regulations, businesses may be hesitant to make such significant investments without clear assurances of rapid returns. Thus, these factors will hamper the growth of the market during the forecast period.

Market Segmentation by End-user, Type and Geography

End-user Segment Analysis:

The market share growth by the marine industry segment will be significant during the forecast period. The growth of the modern maritime industry is driven by the increasing globalization of world trade. This connects the emerging markets with the developed markets. Technological developments in marine engine design, such as hybrid engines, have resulted in a decline in the consumption of fossil fuels by the shipping industry. This is because hybrid engines operate on alternative fuels and offer high energy efficiency with minimal emissions.

Customised Report as per your requirements!

The marine industry segment was the largest and was valued at USD 1.46 billion in 2018. Dual-fuel engines are preferred in vessels, especially crude oil carriers and other large carriers because they reduce extra fuel storage requirements. This, in turn, cuts down not only the operating cost, including the storage maintenance cost but also the overall weight of the ship. Reducing the weight of the ship will improve the efficiency of the vessel. However, dual-fuel engines are yet to be adopted in commercial marine vessels. Despite the dominance of diesel engines, the marine sector will be a potential market for dual-fuel engines. Therefore, the increase in advantages and the growing demand for dual-fuel engines in the marine industry segment will boost the growth of the market during the forecast period.

Type Segment Analysis:

Based on the type, the market has been segmented into two-stroke and four-stroke. The two-stroke segment will account for the largest share of this segment.?The dual-fuel two-stroke engine operates on the high-pressure natural gas and heavy fuel oil (HFO) or marine diesel oil (MDO) combustion principle, where the fuel is injected and burned directly instead of premixed or Otto-cycled. Additionally, two or three conventional fuel oil injectors simultaneously inject a small amount of pilot oil to guarantee an optimally controlled combustion. Further, two-stroke dual-fuel engines have gained recognition for their potential to meet societal requirements as a viable option for attaining environmental performance, future energy transformation, and the dependability required by marine engines, which boosts the demand for two-stroke dual-fuel engines. Hence, the market will witness positive growth during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download Sample PDF now!

North America is estimated to contribute 46% to the growth by 2028. Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the forecast period. The demand for dual-fuel engines in North America is driven by stringent emission laws and the need for efficient power generation in countries such as the US and Canada. For instance, the US Environmental Protection Agency passed a law in 2014, which aims to reduce carbon emissions from coal power plants by 30% by 2030 when compared with the 2005 levels. Rather than shutting down the existing coal power plants and building new ones, utilities are focusing on enabling existing coal power plants to use dual-fuel turbines, accompanied by technologies such as heat recovery steam generators. This move will improve efficiency and reduce fuel costs.

In addition, the US has more than 110 operational LNG facilities, some of which export natural gas, while others provide natural gas to the interstate pipeline system and local distribution companies. Some LNG facilities store the fuel to service peak demand. Moreover, certain facilities produce LNG for industrial use. Thus, the demand for clean energy production and the development of gas pipelines across the country have boosted the demand for dual-fuel engines. Thus, the regional market is expected to grow during the forecast period.

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Heinzmann GmbH and Co - The company offers duel fuel engine such as NY12V280CZ, NY12V280CD, NY6200LCZ, NY16V240CZ and others.

We also have detailed analyses of the market’s competitive landscape and offer information on 20 market companies, including Anglo Belgian Corp., Cummins Inc., Heinzmann GmbH and Co. KG, Kubota Corp., Volkswagen AG, Wartsila Corp., Woodward Inc., Yanmar Holdings Co. Ltd., Winterthur Gas and Diesel Ltd., Hyundai Motor Co., China Yuchai International Ltd., Daihatsu Diesel Mfg. Co. Ltd., Kawasaki Heavy Industries Ltd., Westport Fuel Systems Inc., and Caterpillar Inc.

Technavio market forecast the an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. Companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Market Analyst Overview

The market is experiencing notable growth, especially in the automotive industry, driven by the imperative to enhance internal combustion engine efficiency and reduce environmental impact. The market embraces alternative fuels like liquefied petroleum gas (LPG), offering a more sustainable and cost-effective solution compared to conventional fossil fuels such as gasoline. Dual fuel engines stand out for their ability to provide lower emissions and fuel flexibility, contributing to the realization of environmentally friendly transportation options. This aligns with the global push towards more sustainable transportation options to combat issues like air pollution and reduce greenhouse gas emissions.

Moreover, the application of dual fuel engines extends beyond the automotive sector, making an impact in various domains, including shipping vessels and automobiles, with manufacturers investing significantly in research and development to enhance engine efficiency. The incorporation of smart technologies for control and monitoring further exemplifies the market's commitment to advancing dual fuel engine technology for a more sustainable and environmentally conscious future.

Segment Overview

The market analysis and report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2017 to 2027.

- End-user Outlook

- Marine industry

- Power generation industry

- Type Outlook)

- Two-stroke

- Four-stroke

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

|

Dual Fuel Engine Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.51% |

|

Market Growth 2024-2028 |

USD 3.09 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

14.02 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 46% |

|

Key countries |

US, China, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anglo Belgian Corp., Cummins Inc., Heinzmann GmbH and Co. KG, Kubota Corp., Volkswagen AG, Wartsila Corp., Woodward Inc., Yanmar Holdings Co. Ltd., Winterthur Gas and Diesel Ltd., Hyundai Motor Co., China Yuchai International Ltd., Daihatsu Diesel Mfg. Co. Ltd., Kawasaki Heavy Industries Ltd., Westport Fuel Systems Inc., and Caterpillar Inc. |

|

Market dynamics |

Parent market growth analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Dual Fuel Engine Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the dual fuel engine market between 2024 and 2028

- Precise estimation of the market growth and trends and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Market growth and forecasting across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough market analysis and report of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch