EMEA Modular Cooking Systems Market Size 2026-2030

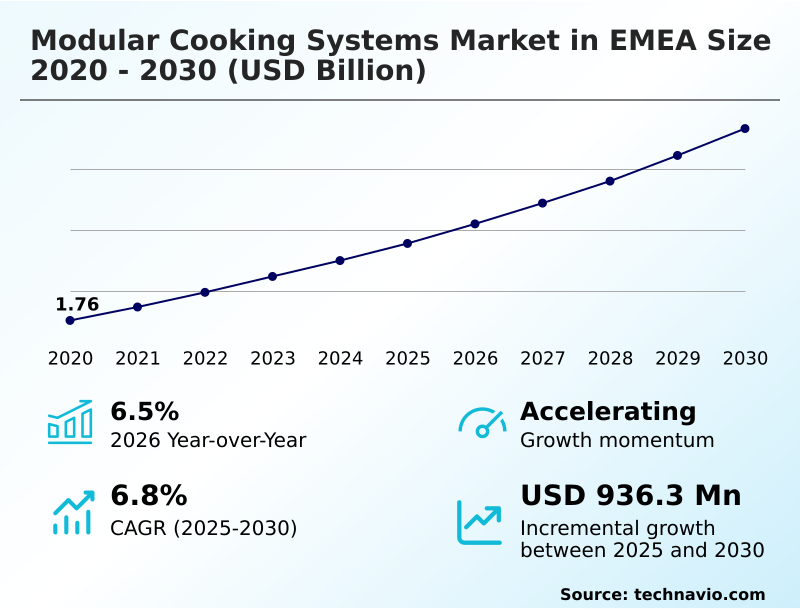

The emea modular cooking systems market size is valued to increase by USD 936.3 million, at a CAGR of 6.8% from 2025 to 2030. Strict sustainability mandates and energy efficiency regulations will drive the emea modular cooking systems market.

Major Market Trends & Insights

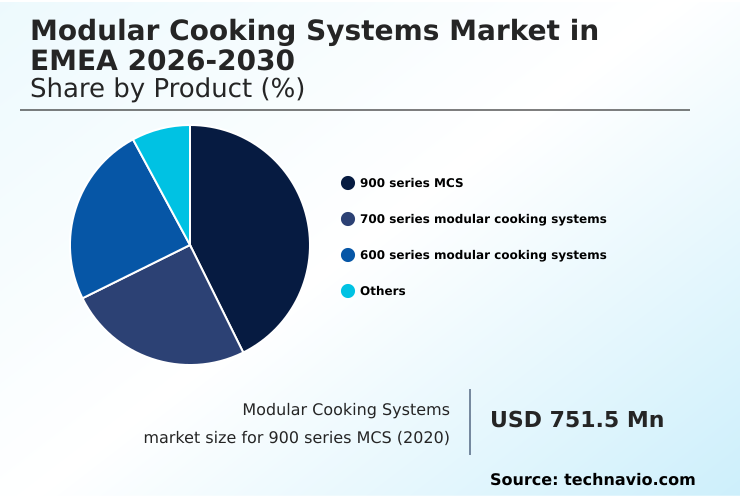

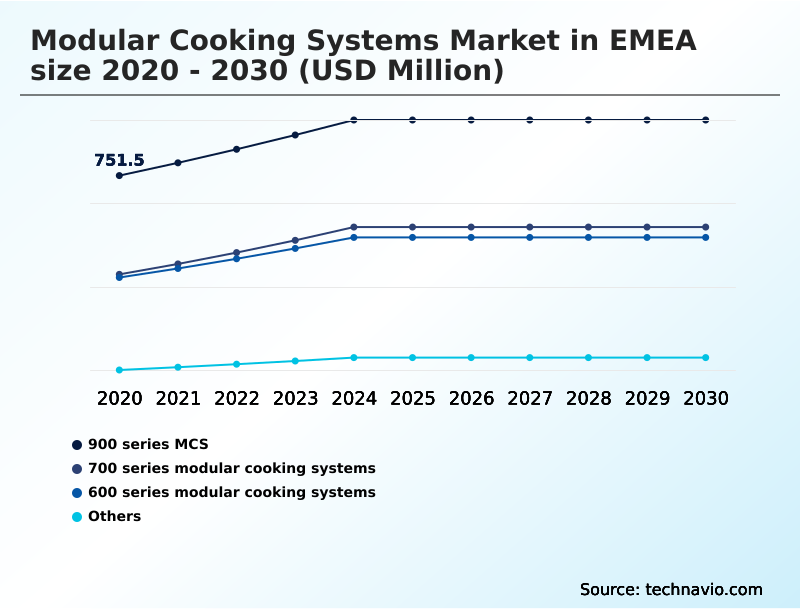

- By Product - 900 series MCS segment was valued at USD 926.7 million in 2024

- By End-user - Full service restaurants segment accounted for the largest market revenue share in 2024

Market Size & Forecast

- Market Opportunities: USD 1.57 billion

- Market Future Opportunities: USD 936.3 million

- CAGR from 2025 to 2030 : 6.8%

Market Summary

- The modular cooking systems market in EMEA is characterized by a fundamental shift toward integrated, intelligent, and efficient kitchen environments. Beyond simply assembling interchangeable culinary components, the market is now driven by the need to create a cohesive culinary station that optimizes workflow, energy, and labor.

- The adoption of high-efficiency electric systems and modular induction technology is accelerating due to stringent sustainability regulations and a focus on reducing operational costs.

- For instance, a large hospitality chain can implement a network of IoT-enabled modular equipment to achieve remote quality control and holistic data visibility across dozens of properties, ensuring menu consistency and enabling predictive maintenance algorithms to reduce equipment downtime.

- This connectivity, governed by an emerging standardized communication protocol, transforms the kitchen from a collection of standalone appliances into a responsive, data-driven ecosystem. This evolution is crucial for sectors ranging from high-volume QSRs using automated frying stations to luxury hotels designing customized aesthetic modular blocks for open-kitchen concept dining.

What will be the Size of the EMEA Modular Cooking Systems Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the EMEA Modular Cooking Systems Market Segmented?

The emea modular cooking systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2026-2030, as well as historical data from 2020-2024 for the following segments.

- Product

- 900 series MCS

- 700 series modular cooking systems

- 600 series modular cooking systems

- Others

- End-user

- Full service restaurants

- Quick service restaurants

- Institutional and caterer

- Hotel

- Type

- Burner

- Fryer

- Induction

- Fry top and griddle

- Others

- Geography

- EMEA

By Product Insights

The 900 series mcs segment is estimated to witness significant growth during the forecast period.

The heavy-duty 900 series segment caters to high-volume operations like institutional catering and central production units, where durability is paramount.

This segment is defined by its robust culinary station configuration, often in an island kitchen arrangement built on a unified base plinth.

Innovation is moving toward industrial-scale automation and efficiency, incorporating technologies like high-capacity modular braising and advanced energy optimization system controls.

The integration of universal power couplings and standardized connection points simplifies the installation of these massive systems, while features like projected digital interfaces contribute to a sleek, monolithic equipment appearance.

Unlike the compact 600 series or drop-in cooking solutions, this segment prioritizes throughput, with suites engineered to operate 24/7, providing holistic data visibility and reducing energy waste in institutional kitchens by up to 20%.

The 900 series MCS segment was valued at USD 926.7 million in 2024 and showed a gradual increase during the forecast period.

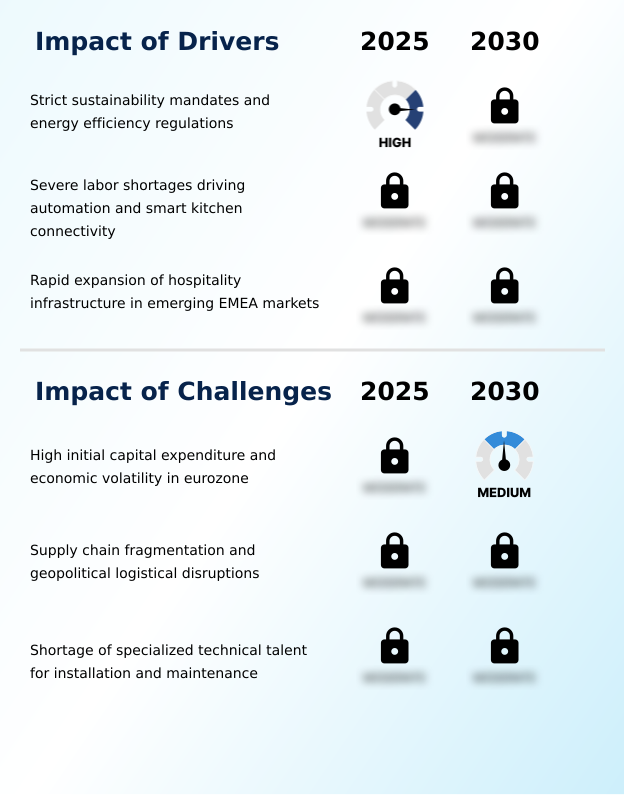

Market Dynamics

Our researchers analyzed the data with 2025 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

- Strategic decisions in the modular cooking systems market in EMEA 2026-2030 are increasingly influenced by total cost of ownership rather than initial price. Understanding the impact of modularity on kitchen workflow is critical, as well-designed systems can significantly reduce staff movement and cross-contamination.

- The sustainability benefits of electric modular cooking are compelling, with the benefits of induction in commercial kitchens including superior energy efficiency and a cooler working environment. This is especially true for modular cooking systems for small spaces, where heat management is crucial. AI integration in modular kitchen appliances is enabling predictive maintenance, addressing the maintenance challenges for smart modular kitchens.

- For operators, calculating the ROI of upgrading to modular cooking systems must factor in these long-term gains. Ventless modular cooking for urban restaurants and plug-and-play modular systems for food trucks open new revenue streams in previously inaccessible locations. Different segments have unique needs, from heavy-duty modular systems for institutional catering to specialized modular cooking solutions for ghost kitchens.

- The ergonomic advantages of modern modular designs also play a role in staff retention, a factor more significant than the direct cost savings which can be upwards of 15% on energy alone. When comparing 700 series vs 900 series mcs, the decision hinges on volume versus versatility.

- Ultimately, the focus is on customizing modular suites for fine dining, ensuring hygiene standards in seamless modular kitchens, and following connectivity standards for professional kitchen equipment to future-proof the investment. The aesthetic design trends in modular cooking further underscore the shift toward experience-driven hospitality.

What are the key market drivers leading to the rise in the adoption of EMEA Modular Cooking Systems Industry?

- The market is primarily driven by strict sustainability mandates and regulations focused on energy efficiency.

- Market drivers are increasingly centered on operational efficiency and compliance.

- The adoption of high-efficiency electric systems and energy management software is critical for peak power load limitation and achieving green building certifications, leading to a documented 20% reduction in energy waste.

- Labor shortages are accelerating the deployment of smart kitchen technologies, including automated frying stations and automated grilling stations that rely on automated recipe algorithms to de-skill kitchen tasks. This automation can reduce staffing needs by one person per shift.

- Furthermore, hospitality expansion demands versatile solutions like heavy-duty modular banquet systems and customized aesthetic modular blocks. The use of IoT-enabled modular equipment enables effective remote quality control and contributes to better ergonomic kitchen design.

What are the market trends shaping the EMEA Modular Cooking Systems Industry?

- A prominent market trend is the hyper-specialization of equipment designed for off-premise dining models. This includes ghost kitchens and dark kitchens.

- Market trends are pushing the boundaries of commercial kitchen equipment, focusing on the theater of food concept and bespoke modular appearance in open-kitchen concept designs. This includes display-ready modular suites and even invisible induction technology for a seamless look.

- Simultaneously, the rise of off-premise dining models fuels demand for ghost kitchen equipment and dark kitchen specialization, utilizing vertical integration systems and plug-and-play infrastructure for maximum efficiency in small spaces. Operators are achieving a 15% increase in production capacity within the same footprint using these specialized systems.

- The shift toward interoperable kitchen ecosystems provides holistic data visibility, with cognitive modular cooking suites and compact modular cooking islands now standard. This integration reduces menu development time by up to 25%.

What challenges does the EMEA Modular Cooking Systems Industry face during its growth?

- High initial capital expenditure, compounded by economic volatility in the Eurozone, presents a key challenge to industry growth.

- Key challenges temper market expansion, particularly the complexity of modern systems. While a standardized communication protocol and embedded telemetry sensors are enabling predictive maintenance algorithms and automated HACCP data logging, the lack of trained technicians hinders the streamlined installation process. Building a cohesive culinary station with interchangeable culinary components requires expertise in professional chef appliance assembly and cantilever system integration.

- High initial costs remain a barrier, even with designs that promise maximized floor space and simplified culinary station configuration. The inability to service advanced systems can lead to downtime that negates the benefits of automated cleaning cycles, and failure to properly configure systems can result in non-compliance with tiered energy tariff compliance, increasing operational costs by over 10%.

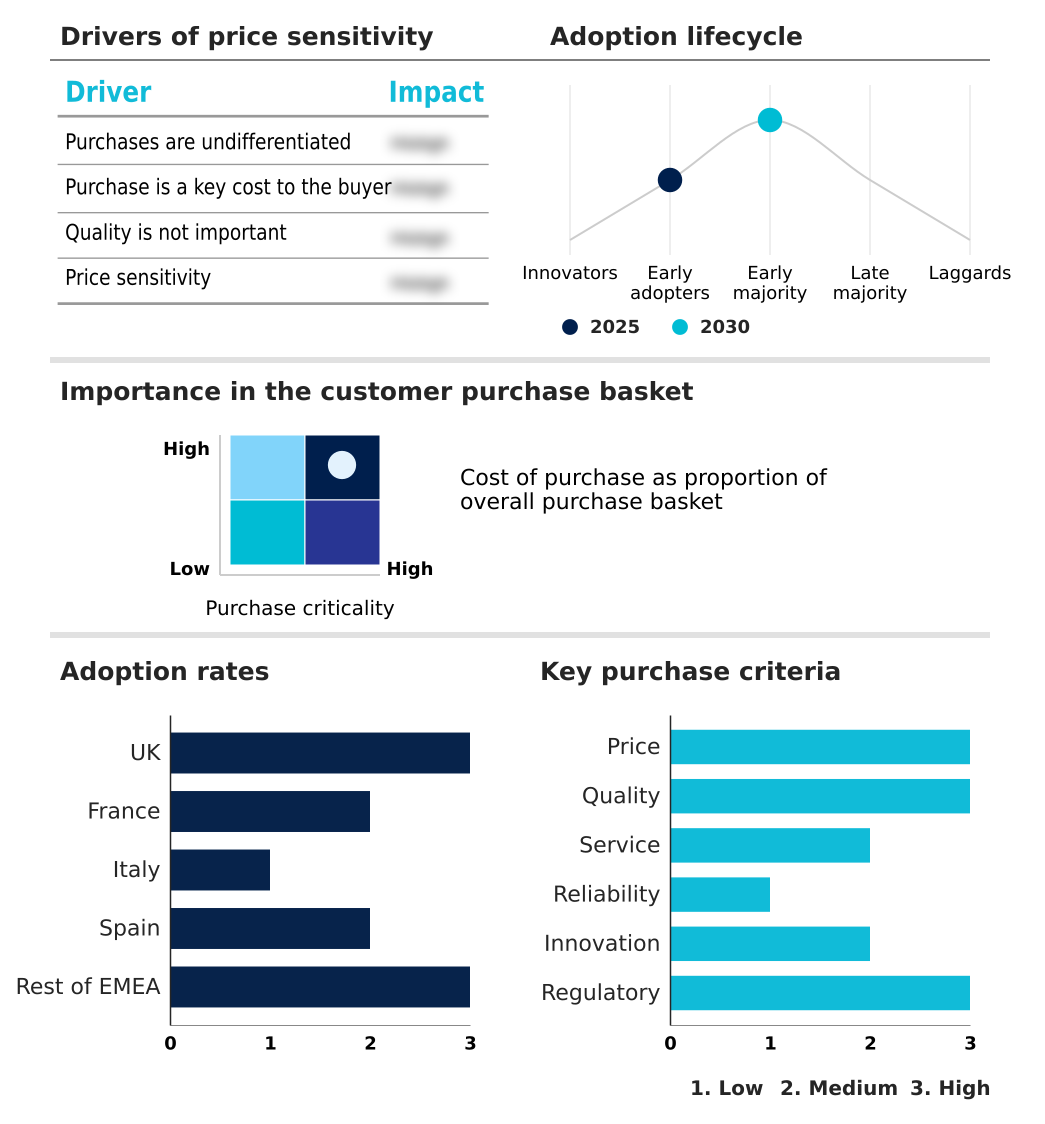

Exclusive Technavio Analysis on Customer Landscape

The emea modular cooking systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the emea modular cooking systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of EMEA Modular Cooking Systems Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, emea modular cooking systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ali Group Srl - Offerings center on bespoke modular suites and customizable kitchen configurations, enabling highly efficient and integrated professional culinary environments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ali Group Srl

- Angelo Po Grandi

- ATA Srl

- BARON ALI GROUP S.R.L

- BERTOS SPA

- BSH Hausgerate GmbH

- Charvet

- DC Norris and Co. Ltd.

- Duke Manufacturing

- Electrolux Professional AB

- Fagor Industrial S. Coop

- FNF Metal and Karelli

- Henny Penny Corp.

- Maschinenfabrik GmbH Co. KG

- Pimak Kitchen Co. Ltd.

- Spangenberg International BV

- The Middleby Corp.

- The Nice Kitchen

- Vital Kitchen

- WELBILT Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Emea modular cooking systems market

- In February, 2025, The Middleby Corp. announced the definitive separation of its Food Processing division to concentrate resources on its Commercial Foodservice and Residential groups.

- In March, 2025, Electrolux Professional AB released its annual sustainability report, detailing a new initiative to transition its manufacturing facility in Vallenoncello, Italy, to fully carbon-neutral operations.

- In April, 2025, a leading QSR chain with operations in France and Germany announced the rollout of fully automated modular frying and grilling stations across 500 locations.

- In May, 2025, the United Arab Emirates updated its Green Building Regulations, mandating that all new hotel developments in Dubai and Abu Dhabi incorporate smart kitchen technologies.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled EMEA Modular Cooking Systems Market insights. See full methodology.

| Market Scope | |

|---|---|

| Page number | 224 |

| Base year | 2025 |

| Historic period | 2020-2024 |

| Forecast period | 2026-2030 |

| Growth momentum & CAGR | Accelerate at a CAGR of 6.8% |

| Market growth 2026-2030 | USD 936.3 million |

| Market structure | Fragmented |

| YoY growth 2025-2026(%) | 6.5% |

| Key countries | UK, France, Italy, Spain and Rest of EMEA |

| Competitive landscape | Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The modular cooking systems market in EMEA is evolving from a focus on hardware to integrated digital ecosystems. The core value proposition is no longer just the flexibility of interchangeable culinary components but the intelligence embedded within them. A cohesive culinary station now incorporates IoT-enabled modular equipment for automated HACCP data logging and operational analysis.

- Technologies like cognitive modular cooking suites and automated frying stations are addressing critical labor shortages. For boardroom decisions, the key metric is ROI through efficiency; implementing high-efficiency electric systems with advanced energy management software has enabled some operators to achieve a 20% reduction in utility costs.

- The market is bifurcating between heavy-duty 900 series for industrial scale and versatile medium-duty 700 series and compact 600 series units for commercial and urban environments, all increasingly featuring multi-functional modular pans and ventless cooking stations. The future lies in interoperable kitchen ecosystems where a standardized communication protocol unites all appliances.

What are the Key Data Covered in this EMEA Modular Cooking Systems Market Research and Growth Report?

-

What is the expected growth of the EMEA Modular Cooking Systems Market between 2026 and 2030?

-

USD 936.3 million, at a CAGR of 6.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (900 series MCS, 700 series modular cooking systems, 600 series modular cooking systems, and Others), End-user (Full service restaurants, Quick service restaurants, Institutional and caterer, and Hotels), Type (Burner, Fryer, Induction, Fry top and griddle, and Others) and Geography (EMEA)

-

-

Which regions are analyzed in the report?

-

EMEA

-

-

What are the key growth drivers and market challenges?

-

Strict sustainability mandates and energy efficiency regulations, High initial capital expenditure and economic volatility in eurozone

-

-

Who are the major players in the EMEA Modular Cooking Systems Market?

-

Ali Group Srl, Angelo Po Grandi, ATA Srl, BARON ALI GROUP S.R.L, BERTOS SPA, BSH Hausgerate GmbH, Charvet, DC Norris and Co. Ltd., Duke Manufacturing, Electrolux Professional AB, Fagor Industrial S. Coop, FNF Metal and Karelli, Henny Penny Corp., Maschinenfabrik GmbH Co. KG, Pimak Kitchen Co. Ltd., Spangenberg International BV, The Middleby Corp., The Nice Kitchen, Vital Kitchen and WELBILT Inc.

-

Market Research Insights

- Market dynamics are shaped by the dual pressures of operational efficiency and experiential dining. The adoption of smart kitchen technologies is no longer optional, with operators reporting up to a 15% reduction in energy consumption through peak power load limitation and energy optimization system controls. This shift is essential for tiered energy tariff compliance.

- The theater of food concept is driving investment in customized aesthetic modular blocks for open-kitchen concept designs. This focus on aesthetics for front-of-house cooking contrasts with the utilitarian demands of off-premise dining models, which prioritize dark kitchen specialization. The ability to achieve remote quality control across multiple sites has improved brand consistency by over 90% for multi-unit operators.

We can help! Our analysts can customize this emea modular cooking systems market research report to meet your requirements.