Energy Management Software Market Size 2025-2029

The energy management software market size is forecast to increase by USD 17.42 billion, at a CAGR of 11.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing emphasis on cost reduction in various industries. Companies are recognizing the potential savings that can be achieved through the implementation of energy management software. Another key trend is the adoption of cloud-based solutions, which offer flexibility, scalability, and ease of use. Renewable energy integration, including wind power systems and solar power systems, necessitates advanced energy modeling and simulation software. Additionally, the rising number of open-source platforms for energy management software is expanding the market's competitive landscape, providing more options for businesses.

- To capitalize on market opportunities and navigate challenges effectively, companies should focus on addressing these obstacles through robust security measures and seamless integration capabilities. By doing so, they can reap the benefits of energy management software, including cost savings, improved operational efficiency, and enhanced sustainability efforts. However, the implementation of these systems can pose challenges, such as data security concerns and the need for extensive integration with existing systems.

What will be the Size of the Energy Management Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the increasing demand for efficient energy consumption and the integration of renewable energy sources. Microgrid management solutions enable the coordination of distributed energy resources, ensuring grid stability and resilience. Renewable energy integration software facilitates the seamless connection of solar, wind, and other renewable energy sources to the grid. Open protocols and cloud-based platforms promote interoperability and flexibility, allowing for hybrid deployments that combine on-premise and cloud solutions. Energy consumption monitoring and load forecasting tools provide real-time data, enabling proactive energy management and cost reduction. Integration services ensure seamless connectivity with various systems, including SCADA, IoT sensors, and APIs.

Simulation software and optimization algorithms facilitate the analysis of energy systems, allowing for the identification of inefficiencies and opportunities for improvement. Customer service and technical support ensure the effective implementation and utilization of energy management software. Battery management systems and sustainability initiatives promote the adoption of renewable energy sources and reduce carbon footprints. Software updates, reporting and analytics, and performance monitoring provide valuable insights into energy usage patterns and trends. Demand response optimization and energy benchmarking enable organizations to optimize energy consumption and reduce costs. Data security and wireless communication ensure the protection of sensitive energy data.

The market is characterized by continuous innovation, with new technologies and applications emerging regularly. The integration of AI algorithms, machine learning, and predictive analytics is driving the development of advanced energy management solutions. Energy efficiency audits and commissioning and retrofits ensure the effective implementation of energy management strategies. In this dynamic market, organizations must stay informed of the latest trends and developments to remain competitive and achieve their energy management goals. The ongoing unfolding of market activities and evolving patterns presents both opportunities and challenges, requiring a proactive and adaptive approach to energy management.

How is this Energy Management Software Industry segmented?

The energy management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Power industry

- Construction

- Others

- Application

- Commercial

- Residential

- Component

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

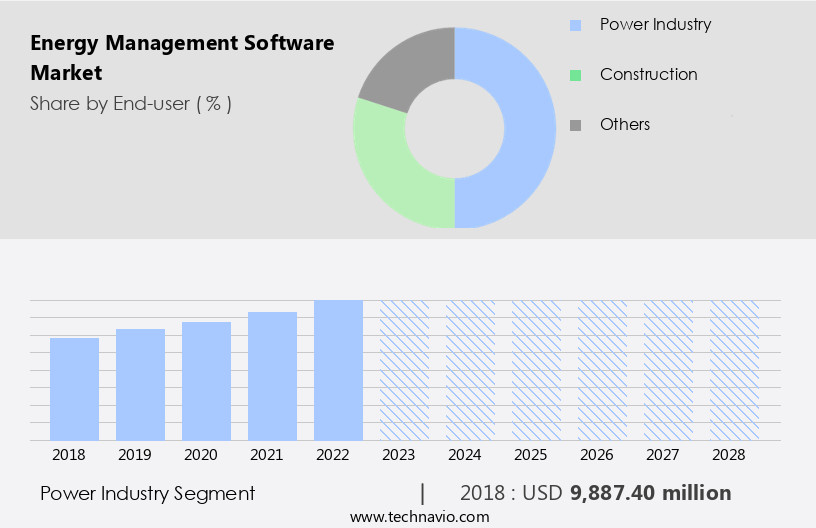

By End-user Insights

The power industry segment is estimated to witness significant growth during the forecast period. In the power industry, the market is experiencing significant growth due to the increasing demand for resource management, security, and efficient operational processes. The need for digitization in this sector is a major driving factor, as it enables real-time tracking, operational efficiencies, cost reduction, and compliance with regulations. One of the primary applications of energy management software in the power industry is the automation of energy generation and management workflows. This technology empowers users to effectively collaborate with internal and external teams, enhancing control and productivity. Data analytics plays a crucial role in this context, as it facilitates the collection, processing, and interpretation of data from various sources, including HVAC control systems, lighting control, solar panel integration, and occupancy sensing.

Integration services, API integrations, and simulation software ensure seamless integration with various systems and tools. Battery management systems, microgrid management, and renewable energy integration are essential features that cater to the growing demand for sustainable energy solutions. Data visualization dashboards, user access management, and role-based access control facilitate effective monitoring and reporting of energy consumption and cost data. Demand response optimization, energy benchmarking, and carbon footprint reduction are essential features that help organizations meet their sustainability initiatives and regulatory compliance requirements. Real-time data acquisition, power quality monitoring, and wireless communication are essential features that ensure reliable and efficient energy management.

The Power industry segment was valued at USD 10.71 billion in 2019 and showed a gradual increase during the forecast period.

The Energy Management Software Market is advancing rapidly as organizations seek smarter, more resilient energy strategies. A growing emphasis on data center optimization is driving adoption, with software helping reduce power consumption and improve uptime. In the education and corporate sectors, campus management tools are enabling centralized energy monitoring across sprawling facilities. Businesses are turning to lifecycle cost analysis to evaluate long-term savings and guide sustainable investment decisions. Security is a key priority, prompting the integration of penetration testing features to identify vulnerabilities in energy systems. Additionally, robust disaster recovery planning capabilities are being built into platforms to ensure operational continuity during outages. Big data and wireless communication are transforming EMS, enabling real-time data acquisition, process optimization, and machine learning.

Network infrastructure, SCADA systems, and IoT sensors are essential components that enable seamless data transfer and communication between different systems. Professional services, consulting, and commissioning ensure the successful implementation and optimization of energy management software. Machine learning, optimization algorithms, and predictive analytics further enhance the capabilities of energy management software by providing insights into energy consumption patterns, forecasting energy demand, and optimizing energy usage. Training and education, energy efficiency audits, and performance monitoring are essential services that help organizations maximize the benefits of their energy management software investments. The cloud-based platform and hybrid deployment models offer flexibility and scalability, making it easier for organizations to adopt energy management software.

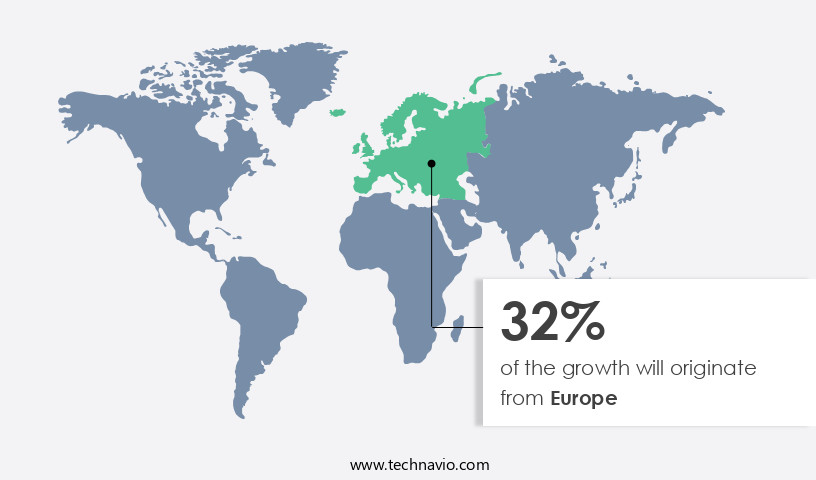

Regional Analysis

Europe is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American industrial sector's technological maturity fuels the adoption of energy management software solutions, driving market growth in the region. Energy prices and the focus on conventional and non-conventional energy sources are significant factors contributing to the market's expansion. The United States leads the regional market due to the increasing demand for smart grid technologies, real-time energy analytics, and stringent security compliance standards. In contrast, Canada and Mexico exhibit accelerated growth, driven by substantial investments in industrial infrastructure and more rigorous environmental regulations.

The market's evolution includes advancements in HVAC control systems, enabling real-time energy monitoring and optimization. Data analytics and visualization dashboards provide actionable insights, while training and education ensure effective implementation and utilization. Lighting control systems and professional services cater to energy cost reduction and regulatory compliance. Solar panel integration, automated control systems, and AI algorithms optimize energy consumption and generate renewable energy. SCADA systems, IoT sensors, power quality monitoring, and occupancy sensing facilitate efficient energy management. Energy Management Systems (EMS) have evolved significantly due to technological advancements, particularly the Internet of Things (IoT) and Artificial Intelligence (AI).

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Energy Management Software Industry?

- The primary factor driving the market is the cost reduction advantage it offers. Energy management software is a crucial investment for organizations seeking to optimize energy usage and reduce operating costs. With the growing emphasis on resource efficiency and productive outputs, energy management software has become an essential tool. This software automates processes to ensure optimal energy usage, enabling organizations to manage resources effectively. The benefits of energy management software are manifold. It facilitates process management by increasing connectivity and enabling organizations to handle project-related inquiries efficiently. Automation also decreases response time and enhances productivity, leading to streamlined processes.

- On-premise deployment further enhances security and control. By employing energy management software, organizations can gain valuable insights into their energy usage patterns and identify areas for improvement. The software's advanced analytics capabilities enable predictive maintenance, helping to prevent equipment failures and reduce downtime. Moreover, it facilitates compliance with energy regulations and reporting requirements, ensuring that organizations remain compliant and avoid potential penalties. Overall, energy management software is a smart investment for organizations looking to optimize energy usage, reduce costs, and enhance operational efficiency.

What are the market trends shaping the Energy Management Software Industry?

- Cloud-based energy management software adoption is a mandated market trend in the professional energy sector. This technological shift enables organizations to effectively monitor and manage their energy consumption in a efficient and cost-effective manner. The market is witnessing significant growth due to the increasing integration of renewable energy sources and microgrids. Open protocols enable seamless communication between various energy systems, enhancing the efficiency of energy management.

- Hybrid deployment models allow businesses to leverage the benefits of both on-premises and cloud-based solutions. The focus is on providing a comprehensive, user-friendly solution for managing energy consumption and optimizing energy production. A cloud-based platform facilitates easy access to energy consumption monitoring, load forecasting, and integration services from anywhere, using any device. Simulation software assists in optimizing energy usage and evaluating the impact of sustainability initiatives. Customer service and battery management systems are crucial components of energy management software, ensuring smooth operation and maintenance. Software updates and reporting and analytics tools provide valuable insights into energy usage patterns and trends.

What challenges does the Energy Management Software Industry face during its growth?

- The proliferation of open-source energy management software platforms poses a significant challenge to the industry's growth, as companies must contend with increasing competition and the need to differentiate their offerings. In today's business environment, the need for energy management software is increasingly important as companies strive to reduce energy consumption, improve performance, and enhance operational efficiency. Open-source energy management software platforms have gained popularity due to their affordability and extensive features. These platforms employ advanced technologies such as demand response optimization, performance monitoring, technical support, energy benchmarking, predictive analytics, role-based access control, and real-time data acquisition.

- Wireless communication and energy modeling further enhance the functionality of these software solutions. The use of predictive analytics helps businesses anticipate energy usage patterns and optimize energy consumption accordingly. Role-based access control ensures secure access to sensitive data. The payback period for energy management software is typically short, making it a sound investment for businesses looking to streamline their energy management processes and reduce their carbon footprint. Technologies like the Common Information Model (CIM) and web-based enterprise management (WBEM) enable seamless integration of energy management systems and IT resources, leading to cost savings. Additionally, these platforms offer energy modeling, energy auditing tools, smart meter integration, carbon footprint reduction, and data security.

Exclusive Customer Landscape

The energy management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the energy management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, energy management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in Energy Management Software and offers cloud-based solutions designed to optimize energy consumption and enhance overall asset performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Accruent

- Autodesk Inc.

- Benchmark Digital Partners LLC

- Broadcom Inc.

- C3.ai Inc.

- Eaton Corp. plc

- Emerson Electric Co.

- EnergyCAP LLC

- ENGIE SA

- Envizi

- General Electric Co.

- Honeywell International Inc.

- International Business Machines Corp.

- Itron Inc.

- MRI Software LLC

- SAP SE

- Schneider Electric SE

- Siemens AG

- Wolters Kluwer NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Energy Management Software Market

- In January 2024, Schneider Electric, a leading energy management company, announced the launch of its new EcoStruxure IT Expert software, expanding its EcoStruxure platform with advanced analytics and AI capabilities to optimize data center energy management (Schneider Electric Press Release, 2024).

- In March 2024, Siemens and Microsoft entered into a strategic partnership to integrate Microsoft Azure IoT and Siemens' MindSphere industrial IoT operating system, enhancing their energy management offerings and enabling better data analysis for industrial customers (Microsoft News Center, 2024).

- In May 2024, Honeywell International completed the acquisition of Elster, a leading provider of gas and water metering technologies, strengthening Honeywell's position in energy management and utility solutions (Honeywell Press Release, 2024).

- In February 2025, the European Union passed the new Energy Performance of Buildings Directive, mandating the installation of energy management systems in all new and existing commercial buildings by 2030, creating a significant market opportunity for energy management software providers (European Parliament Press Release, 2025).

Research Analyst Overview

The market is witnessing significant growth, driven by the increasing demand for workflow automation and facility management solutions. Implementation services play a crucial role in ensuring seamless integration of these systems, particularly in the context of grid modernization and energy trading. Project management and change management are essential components of successful implementations, requiring data integrity and capacity planning. Geospatial data analysis, industrial automation, and security audits are key trends in the market, enabling energy efficiency standards and system upgrades. Data governance and data migration are critical aspects of energy accounting and portfolio management, while user experience (UX) and energy efficiency standards enhance user interface (UI) and system integration.

Risk management, smart grid technologies, and green building certification are essential for ensuring business continuity planning and disaster recovery. Process automation and preventative maintenance are vital for optimizing data center operations and reducing lifecycle costs. Contract negotiation, data archiving, and energy procurement are crucial elements of effective portfolio management. Cloud security, vulnerability assessments, and system upgrades are essential for ensuring data security and system reliability. Mobile applications and data archiving facilitate access to critical energy data from anywhere, while energy efficiency standards and system integration promote energy savings and operational efficiency.

The Energy Management Software Market is evolving as organizations embrace digital sustainability solutions to cut costs and reduce carbon footprints. Tools supporting compliance reporting ensure businesses meet environmental regulations and energy mandates with ease. Solutions for plug load management are gaining traction, allowing granular control over office and industrial device consumption. Innovations in natural light optimization help maximize daylight usage, lowering dependence on artificial lighting while enhancing occupant comfort. Integrating renewable sources, especially wind turbine integration, is becoming increasingly common within commercial energy strategies. In parallel, demand for expert consulting services is rising as companies seek tailored roadmaps for implementing software platforms and optimizing system performance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Energy Management Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.4% |

|

Market growth 2025-2029 |

USD 17.42 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, China, Germany, UK, France, Canada, Japan, Italy, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Energy Management Software Market Research and Growth Report?

- CAGR of the Energy Management Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the energy management software market growth of industry companies

We can help! Our analysts can customize this energy management software market research report to meet your requirements.