Energy Retrofit Systems Market Size 2024-2028

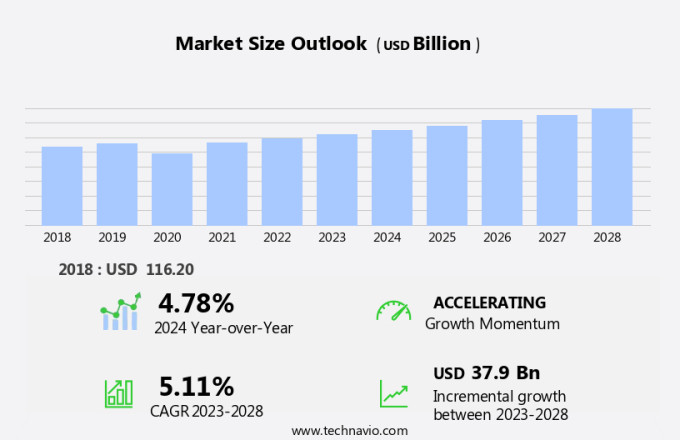

The energy retrofit systems market size is forecast to increase by USD 37.9 billion at a CAGR of 5.11% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for energy efficiency and the integration of building automation systems (BASs). Energy retrofitting refers to the process of upgrading existing buildings to make them more energy-efficient, reducing energy consumption, and lowering operational costs. Construction plays a pivotal role in driving the demand for energy retrofit systems, particularly in the realm of heating, ventilation, and air conditioning (HVAC) equipment. The adoption of BASs is a key trend In the market, as they enable the optimization of energy usage and improve overall building performance. However, the high installation cost is a major challenge for market growth. Despite this, the market is expected to continue expanding due to the growing awareness of energy conservation and the implementation of government regulations promoting energy efficiency.

What will be the Size of the Energy Retrofit Systems Market During the Forecast Period?

- The market encompasses the supply and installation of technologies that enhance the energy efficiency of existing buildings, reducing their greenhouse gas (GHG) emissions and carbon footprint. This market is driven by rising energy expenses and the increasing importance of sustainability in both the commercial and industrial sectors. HVAC appliances, envelope products, and building integration are key application segments. The medium buildings segment is expected to witness significant growth due to the substantial energy savings potential. The integration of renewable energy sources, such as solar and wind, is a significant trend, as is the adoption of smart technologies for thermal comfort and utility savings.

- The Department of Energy (DOE) and various industry players, including Johnson Controls, are actively promoting energy retrofits to reduce non-renewable energy consumption and GHG emissions. Moreover, the push towards smart buildings, motivated by environmental concerns, adds to the demand for energy-efficient systems. The market's shelf life is long, as retrofits often have a significant impact on the utility bills and infrastructure of buildings, from factories to residential properties.

How is this Energy Retrofit Systems Industry segmented and which is the largest segment?

The energy retrofit systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Non-residential

- Residential

- Product

- HVAC retrofit

- Envelope

- LED retrofit lighting

- Geography

- Europe

- Germany

- UK

- France

- APAC

- China

- North America

- US

- Middle East and Africa

- South America

- Europe

By Application Insights

- The non-residential segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the non-residential segment, which comprises commercial and industrial applications. This segment's dominance is attributed to the increasing need for energy efficiency in emerging economies, resulting In the implementation of retrofit systems in commercial buildings. Government regulations and heightened awareness regarding energy efficiency are also significant factors fueling market growth. Energy retrofit systems cater to the unique requirements of end-users by integrating various building operations. Customizable software enables users to modify installations according to building types and specific needs. The importance of reducing greenhouse gas (GHG) emissions and carbon footprint, as well as utility savings, has led to the adoption of energy retrofit systems using both non-renewable and renewable energy sources.

The Department of Energy (DOE) and various initiatives promote energy efficiency in buildings, further driving market expansion. In the commercial and industrial sectors, energy retrofitting is essential for enhancing system efficiency and reducing energy consumption and operational costs. Incentives for energy retrofitting also contribute to market growth. The socio-economic benefits of energy retrofitting, including environmental sustainability and economic development, are significant. The Biden Administration's focus on modernizing and upgrading infrastructure and funding for net-zero carbon emissions further highlights the importance of energy retrofit systems.

Get a glance at the Energy Retrofit Systems Industry report of share of various segments Request Free Sample

The Non-residential segment was valued at USD 83.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

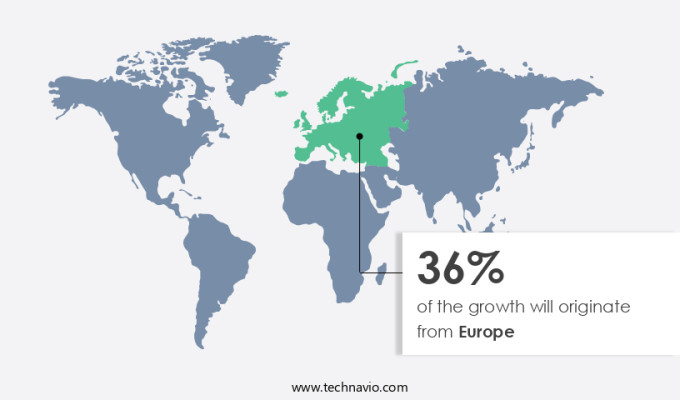

- Europe is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Europe is projected to lead the global market due to a strong focus on reducing greenhouse gas (GHG) emissions and improving energy efficiency. In 2023, Europe accounted for a significant market share, driven by initiatives like the European Commission's Renovation Wave, which aims to renovate 35 million buildings by 2030. This initiative targets three main areas: improving the performance of poorly performing buildings, decarbonizing heating and cooling systems, and upgrading public buildings and social infrastructure. The European Union's commitment to net-zero carbon emissions by 2050 further highlights the importance of energy retrofitting In the region. Energy retrofitting involves upgrading existing buildings with energy-efficient technologies, such as insulation, energy-efficient HVAC appliances, and renewable energy systems.

These upgrades not only help in reducing energy consumption and operational costs but also contribute to socio-economic benefits and environmental sustainability. The focus on energy efficiency and the implementation of stringent building codes and energy performance standards further boost the market growth.

Market Dynamics

Our energy retrofit systems market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Energy Retrofit Systems Industry?

Demand for energy efficiency is the key driver of the market.

- Energy retrofitting is a crucial initiative for both commercial and residential buildings in reducing energy consumption and associated utility bills. With the increasing focus on energy efficiency and the reduction of greenhouse gas (GHG) emissions, the demand for energy retrofit systems is on the rise. HVAC appliances, insulation, windows and doors, ventilation systems, and lighting fixtures are among the key components of energy retrofit systems. These solutions enable building occupants to regulate thermal comfort and energy usage, leading to significant operational cost savings. In the commercial and industrial sectors, energy retrofitting is essential for medium-sized buildings to modernize and upgrade energy systems.

- The DOE's Building Integration program highlights the importance of energy efficiency in commercial buildings, aiming to reduce energy intensity by 2.2% per year. Johnson Controls and other energy systems providers offer envelope products, HVAC systems, and other energy-efficient solutions to help commercial end-users achieve their energy savings goals. Residential buildings are also adopting energy retrofit systems to improve comfort and reduce energy consumption. These solutions provide residents with control over their living spaces, allowing them to manage room temperature and lighting systems within their homes. Energy retrofitting initiatives offer numerous socio-economic benefits, including reducing GHG emissions, utility savings, and contributing to economic development and sustainability.

What are the market trends shaping the Energy Retrofit Systems Industry?

The rise in the incorporation of building automation systems (BASs) is the upcoming market trend.

- Building Automation Systems (BASs) have gained significant traction In the market due to their ability to optimize energy usage in commercial and industrial buildings. These systems, which control and monitor HVAC, lighting, and other electronic equipment, are integrated with advanced computing and digital communication tools. The rising number of construction projects and building retrofits has led to an increase In the installation of integrated BASs. The evolution of BAS technology is driven by advancements in sensor technology, the availability of cheaper and faster communication systems, and improved user interfaces.

- Manufacturers are implementing open protocols, including the Internet protocol, to offer enhanced control solutions. BASs have become a standard technology for improving the interaction and operability among HVAC, lighting, fire, and security control units in buildings. The market: Market Dynamics The market is driven by the need to reduce greenhouse gas (GHG) emissions and carbon footprint. The market is also influenced by the desire to lower energy expenses associated with non-renewable energy sources and the increasing adoption of renewable energy. The US Department of Energy (DOE) and various state and local governments are offering incentives for energy retrofitting and upgrading existing buildings to improve energy performance.

What challenges does the Energy Retrofit Systems Industry face during its growth?

High installation cost is a key challenge affecting the industry growth.

- Energy retrofit systems, which include HVAC appliances, insulation, lighting fixtures, ventilation systems, windows and doors, and envelope products, play a crucial role in reducing greenhouse gas (GHG) emissions and carbon footprint in various sectors. In the commercial and industrial sectors, energy retrofitting can lead to utility savings and improved system efficiency, reducing energy consumption and operational costs. However, the high cost and long payback period are major barriers to adoption, especially for large buildings. companies such as Johnson Controls and Honeywell offer solutions based on per square foot, which can increase the overall expense. The DOE's Building Integration and Energy Efficiency programs aim to incentivize energy retrofitting initiatives, providing stimulus investment for medium and large buildings.

- The socio-economic benefits of reducing energy use and promoting sustainability are significant, especially during global health emergencies and economic crises. The construction sector can modernize and upgrade existing buildings, including historical structures, to meet energy performance codes and net-zero carbon emissions. The Biden Administration's funding for energy-efficient building practices and international energy policies further highlights the importance of energy retrofit systems in reducing energy consumption and CO2 emissions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the energy retrofit systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, energy retrofit systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AECOM

- Ameresco Inc.

- Chevron Corp.

- Daikin Industries Ltd.

- Danfoss AS

- Dow Chemical Co.

- ENGIE SA

- General Electric Co.

- Johnson Controls International Plc.

- Koninklijke Philips N.V.

- National LED Inc.

- Ocean Insight

- Orion Energy Systems Inc.

- Redaptive Inc.

- Renew Energy Partners LLC

- ROI Energy Solutions Inc.

- Schneider Electric SE

- Siemens AG

- Signify NV

- Trane Technologies Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the design, installation, and implementation of technologies and practices that enhance the energy efficiency of existing structures in various sectors. This market is driven by the growing awareness of reducing energy use, energy conservation, and sustainability, as well as the need to mitigate greenhouse gas emissions and improve thermal comfort. Energy retrofitting involves upgrading existing buildings, including residential, commercial, industrial, factories, and infrastructure, to improve their energy performance. The application segments for energy retrofit systems include medium buildings, commercial, industrial sectors, and residential. The demand for energy retrofit systems is influenced by several factors. The global health emergency and economic crisis have led to an increased focus on energy efficiency and cost savings for both commercial end users and governments.

Moreover, the aviation and air transport industries, which contribute significantly to carbon emissions, are also exploring retrofit initiatives to reduce their energy intensity and carbon footprint. Energy retrofitting offers numerous socio-economic benefits, including environmental sustainability, economic development, and productivity improvements. The need to improve energy efficiency in emerging economies is expected to encourage many commercial buildings as well as smart workplaces in the region to implement energy retrofit systems. The energy retrofit market comprises various systems, including HVAC systems, lighting fixtures, ventilation systems, windows and doors, insulation, and building envelope products. These systems help reduce energy consumption and improve system efficiency, leading to operational cost savings and utility bill reductions.

Furthermore, the construction sector plays a crucial role In the energy retrofit market, as it is responsible for implementing energy-efficient building practices and adhering to international energy codes and building performance standards. HVAC, general lighting systems, and other energy-efficient systems need to be installed in these buildings to improve infrastructure and reinforce energy efficiency, therefore requiring the installation of energy retrofit systems to achieve operational efficiency. Historical buildings and existing structures also present opportunities for retrofitting, as upgrading these structures can lead to significant energy savings and carbon emissions reductions. Energy retrofit initiatives are also influenced by various incentives, such as government funding and subsidies, tax incentives, and regulatory requirements. These incentives encourage building owners and operators to invest in energy retrofit projects and adopt energy-efficient technologies and practices. The energy retrofit market is expected to continue growing as governments and businesses prioritize energy efficiency, sustainability, and cost savings.

|

Energy Retrofit Systems Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.11% |

|

Market Growth 2024-2028 |

USD 37.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.78 |

|

Key countries |

China, US, Germany, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Energy Retrofit Systems Market Research and Growth Report?

- CAGR of the Energy Retrofit Systems industry during the forecast period

- Detailed information on factors that will drive the Energy Retrofit Systems growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the energy retrofit systems market growth of industry companies

We can help! Our analysts can customize this energy retrofit systems market research report to meet your requirements.