Explosive Detection Equipment Market Size 2024-2028

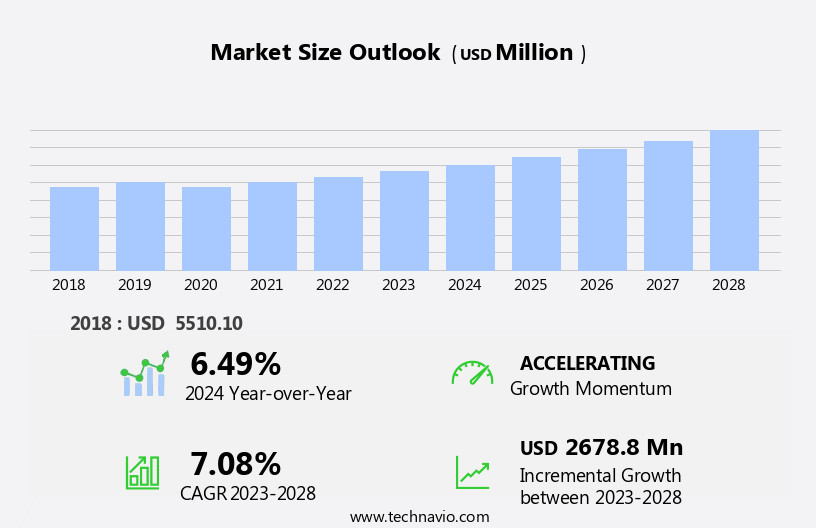

The explosive detection equipment market size is forecast to increase by USD 2.68 billion at a CAGR of 7.08% between 2023 and 2028.

- The Explosive Detection Equipment (EDE) market is experiencing significant growth due to the increasing passenger traffic in various transportation sectors, including aviation and public transportation. This trend is driving the demand for advanced and efficient EDE solutions to ensure safety and security. Another key driver is the emergence of laser spectroscopy detection technology, which offers high accuracy and sensitivity in detecting explosives, making it a preferred choice for security agencies and transportation companies. However, the market is not without challenges. The confidence breach due to the sale of counterfeit or substandard EDE products poses a significant threat to market growth.

- To mitigate this risk, manufacturers must focus on ensuring product quality and compliance with international safety standards. Companies seeking to capitalize on market opportunities and navigate challenges effectively should invest in research and development to innovate and differentiate their offerings, while also building strong partnerships and collaborations to expand their reach and enhance their capabilities. Additionally, adhering to regulatory requirements and maintaining transparency in business practices are essential to maintaining customer trust and loyalty.

What will be the Size of the Explosive Detection Equipment Market during the forecast period?

- The market encompasses various technologies and applications, including robotics, LED indicator lights, handheld detectors, LCD/LED screens, and thermal neutron activation. These solutions find extensive use in transportation, aviation, public spaces, and border control points to ensure safety against terrorism and the detection of flammable materials. Handheld detectors employ advanced technologies such as laser spectroscopy and spaser for quick and accurate identification of explosives. Robotics and vehicle-mounted devices enhance the capabilities of these systems, enabling real-time monitoring of large areas. Thermal neutron activation and x-rays are essential techniques for bulk detection at ports and airports, while LCD/LED screens and graphene-based sensors contribute to the development of portable and lightweight devices.

- The military sector also relies on fixed and advanced systems for securing bases and monitoring potential threats. The transportation sector's growing focus on safety and security, coupled with increasing terrorism threats, drives the demand for advanced explosive detection equipment. The market is expected to witness significant growth as technological advancements continue to improve the accuracy and efficiency of these systems. Innovations such as the integration of AI and machine learning algorithms into explosive detection equipment are expected to revolutionize the market, offering enhanced threat detection capabilities and improved operational efficiency. Additionally, the adoption of these technologies in various industries, including aviation, transportation, and military, is expected to further fuel market growth.

- The integration of LED indicator lights and LCD/LED screens into explosive detection equipment enhances the user experience, providing real-time alerts and visual cues for quick response to potential threats. These advancements, along with the development of portable and lightweight devices, enable rapid and efficient threat detection in various settings. The aviation industry's stringent security measures and the increasing number of passengers and cargo shipments drive the demand for advanced explosive detection equipment at airports. The market is expected to witness significant growth as technological advancements continue to improve the accuracy and efficiency of these systems.

- The growing trend of border control points and ports implementing advanced security measures to prevent the smuggling of explosives is expected to fuel the market's growth. The integration of AI and machine learning algorithms into these systems enables real-time threat detection and improves operational efficiency. The military sector's reliance on advanced explosive detection equipment for securing bases and monitoring potential threats is a significant market driver. The integration of robotics and vehicle-mounted devices enhances the capabilities of these systems, enabling real-time monitoring of large areas and improving overall security. The transportation sector's increasing focus on safety and security, coupled with the growing threat of terrorism, drives the demand for advanced explosive detection equipment.

- The integration of AI and machine learning algorithms into these systems offers enhanced threat detection capabilities and improved operational efficiency, making them an essential component of modern transportation infrastructure. The adoption of advanced technologies such as laser spectroscopy, spaser, and graphene in explosive detection equipment is expected to revolutionize the market, offering improved accuracy and efficiency. These innovations, along with the growing trend of integrating AI and machine learning algorithms, are expected to fuel the market's growth and transform the way explosive threats are detected and addressed. The integration of LED indicator lights and LCD/LED screens into explosive detection equipment enhances the user experience, providing real-time alerts and visual cues for quick response to potential threats.

- The development of portable and lightweight devices, along with the integration of advanced technologies, enables rapid and efficient threat detection in various settings, making these systems an essential component of modern security infrastructure. In summary, the market is driven by the growing need for advanced security solutions in various industries, including transportation, aviation, and military. The integration of AI and machine learning algorithms, along with the adoption of advanced technologies such as laser spectroscopy, spaser, and graphene, is expected to revolutionize the market and offer improved accuracy and efficiency. The use of LED indicator lights and LCD/LED screens enhances the user experience, while the development of portable and lightweight devices enables rapid and efficient threat detection in various settings.

How is this Explosive Detection Equipment Industry segmented?

The explosive detection equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Hand-held detectors

- Ground-mounted screeners

- Vehicle-mounted mobile detectors

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- France

- UK

- Middle East and Africa

- South America

- North America

By Type Insights

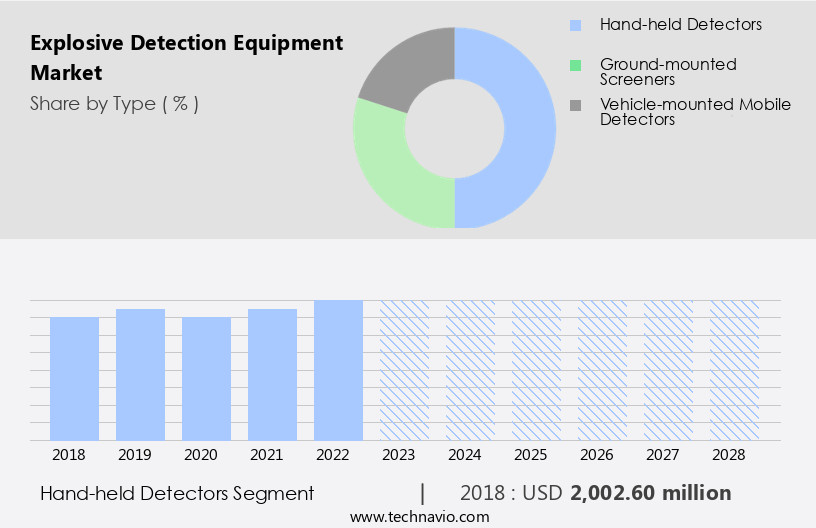

The hand-held detectors segment is estimated to witness significant growth during the forecast period.

The escalating number of terrorist activities and inncies worldwide has fueled the demand for advanced security solutions, particularly in the detection of improvised explosive devices (IEDs). Handheld explosive detectors have emerged as a critical tool for security personnel, enabling them to swiftly identify and neutralize potential threats in public spaces, airports, ports, and other high-risk areas. These devices are instrumental in detecting various explosive materials, including TNT, nitrates, peroxides, nitramines, and chlorates. The market for handheld explosive detectors is witnessing significant growth due to the increasing defense spending and the need for enhanced security measures. In recent years, technological advancements have led to the integration of artificial intelligence, thermal neutron activation, and laser spectroscopy in these devices, enhancing their accuracy and efficiency.

For instance, OSI Systems' ZBV-EPT handheld explosive trace detector uses advanced spectroscopic technology to identify explosives and narcotics. Moreover, the integration of graphene and other advanced materials in handheld explosive detectors has led to the development of portable, lightweight, and durable devices. For example, the EVD3500 Handheld Explosive Trace Detector by Westminster Group Plc is a portable device that uses a combination of chemical and spectroscopic sensors to detect explosives. Law enforcement agencies and military forces are increasingly adopting handheld explosive detectors to secure borders, public places, and transportation systems. The devices are also being integrated into robotics and ground penetration radar systems to enhance their capabilities.

For instance, the U.S. Department of Defense is investing in research and development of Spaser technology, which uses sound waves to detect explosives, reducing the need for physical contact with suspicious materials. In the aviation industry, handheld explosive detectors are being used extensively to secure airports and aircraft. For example, the Transportation Security Administration (TSA) in the United States uses a variety of explosive detection systems, including X-ray machines and trace detection equipment, to secure airports and airplanes. In summary, the market for handheld explosive detectors is witnessing significant growth due to the increasing threat of terrorism and the need for advanced security solutions.

The integration of advanced technologies and materials is driving innovation in the market, leading to the development of portable, efficient, and accurate devices. The market is expected to continue growing in the coming years, driven by the increasing demand for security solutions in various industries and applications.

Get a glance at the market report of share of various segments Request Free Sample

The Hand-held detectors segment was valued at USD 2 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

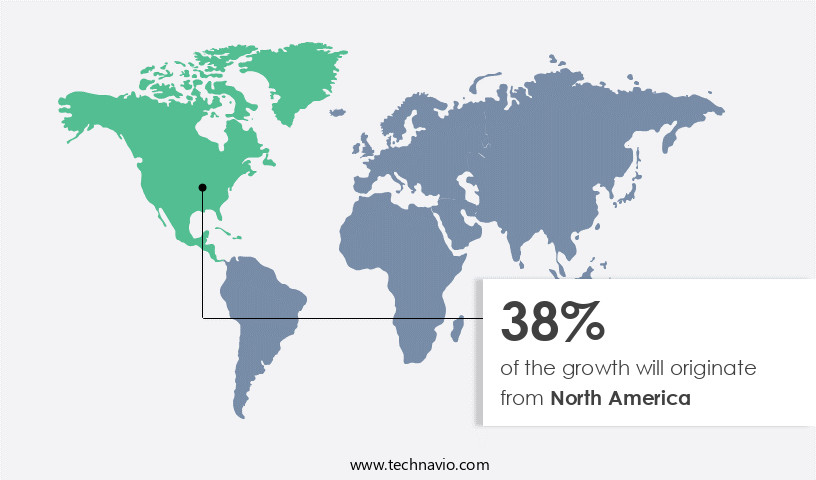

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America, with the US as its leading contributor, is experiencing significant growth due to heightened security concerns and the need for advanced screening technologies. IEDs, a major threat identified by the Department of Homeland Security (DHS) since the early 2000s, have necessitated collaborative efforts between federal agencies, public and private entities, and partners to counteract their impact. The US, as both a consumer and exporter of such equipment, is investing in upgrading its existing detection capabilities to ensure national security and efficient public services. Inorganic Nitrates, Chlorates, and Peroxides are integral components of IEDs, making the detection of these chemicals crucial in preventing potential terrorist activities.

Ground penetration radar, laser spectroscopy, and X-rays are among the technologies employed in explosive detection equipment to identify these substances. Military and law enforcement agencies utilize these tools to secure borders, airports, ports, public spaces, and transportation systems. Graphene, a revolutionary material, is being explored for its potential in developing more sensitive and efficient explosive detection systems. Similarly, the integration of Artificial Intelligence and Robotics in explosive detection equipment is enhancing their capabilities and accuracy. Thermal neutron activation, a detection technique, is used to identify Nitramines and other radiological components, providing an additional layer of security.

The global market for explosive detection equipment is driven by the increasing threat of terrorism, territorial disputes, and war. The need for advanced, portable, and cost-effective solutions has led to continuous innovation and development in this field. Companies such as OSI Systems, with their advanced ZBV-E100 explosive detection portal, are at the forefront of this technological advancement. In summary, the market is witnessing significant growth due to the evolving threat landscape and the need for advanced, efficient, and cost-effective solutions. The integration of advanced technologies like Artificial Intelligence, Robotics, and Graphene is driving innovation and enhancing the capabilities of these systems.

The US, as a key player in this market, is investing in upgrading its existing detection capabilities and collaborating with partners to counter the rising threat of IEDs and other explosive devices.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Explosive Detection Equipment Industry?

- Increase in passenger traffic is the key driver of the market.

- The market has experienced significant growth due to the increasing number of air passengers and heightened security measures at airport terminals. With the in air travel, airports face the challenge of managing increased traffic while maintaining stringent security protocols. Advanced machinery is being incorporated to quickly scan personnel and baggage for explosives and other threats, including chemical weapons. These technologies, both handheld and ground-mounted, are essential for accommodating cyclic fluctuations in passenger inflow during peak seasons. The need for efficient and accurate explosive detection is paramount to ensure the safety and security of travelers.

- The market is driven by various factors, including growing concerns over terror threats, increasing government investments in security infrastructure, and the adoption of advanced technologies for threat detection. The market is expected to continue its growth trajectory in the coming years.

What are the market trends shaping the Explosive Detection Equipment Industry?

- Emergence of laser spectroscopy detection technology is the upcoming market trend.

- Laser spectroscopy detection technology, developed by Laser Detect Systems (LDS), is a pioneering solution for explosive and substance detection. This Israeli innovation combines standoff and trace detection capabilities, eliminating the need for sampling. It functions by integrating multiple spectral analysis and data fusion tools into real-time data collected through a laser beam aimed at the target. The technology's versatility allows for the detection of various substances, including explosives, narcotics, chemicals, biological agents, and minerals, by correlating their spectral signatures with a known substance database.

- The portable technology can be integrated into static, mobile, and handheld detectors, extending its applicability beyond security checks. Furthermore, it can identify and characterize individually manufactured materials, leading to the potential tracking of their production sources, enhancing threat prevention efforts.

What challenges does the Explosive Detection Equipment Industry face during its growth?

- Confidence breach due to the sale of counterfeit products is a key challenge affecting the industry growth.

- The market has faced scrutiny due to past incidents of fraudulent sales. In some instances, defense agencies in the Middle East and Asia Pacific regions were sold counterfeit explosive detection equipment, resulting in devastating consequences. Notably, the deployment of non-functional fake bomb detectors, such as the ADE 651 produced by ATSC in the UK, led to the tragic loss of innocent lives and extensive property damage.

- These incidents underscore the importance of ensuring the authenticity and functionality of explosive detection equipment to prevent potential harm and maintain security. The market for explosive detection equipment continues to evolve, driven by technological advancements and the growing need for enhanced security measures.

Exclusive Customer Landscape

The explosive detection equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the explosive detection equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, explosive detection equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company specializes in advanced explosive detection solutions for aviation security, featuring the innovative LEDS System with Cobalt Insight200 and Handheld SORS Technology. These systems provide swift, accurate identification of liquid explosives, enhancing safety and security protocols. The LEDS System integrates advanced spectroscopic techniques, while the Handheld SORS Technology offers portable, on-the-go screening capabilities. Both systems contribute to the company's commitment to delivering cutting-edge, reliable detection solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Analogic Corp.

- Autoclear LLC

- BAE Systems Plc

- Chemring Group Plc

- DetectaChem Inc.

- iSENTECH

- Kromek Group Plc

- L3Harris Technologies Inc.

- LASER DETECT SYSTEM LLC

- Leidos Holdings Inc.

- Morphix Technologies

- Novatest Srl

- OSI Systems Inc.

- Security Electronic Equipment Co. Ltd.

- Smiths Detection Group Ltd.

- Suzhou Aoteng Electron Technology Co. Ltd.

- Teledyne FLIR LLC

- Westminster Group Plc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of technologies designed to identify and neutralize potentially harmful chemical components used in various forms of explosives. The market's growth is driven by the persistent threat of anti-social activities, including the use of TNT, large-vehicle borne IEDs, and homemade bombs, in both military conflicts and terrorist attacks. Military applications continue to dominate the market due to the significant role explosives play in warfare. However, the need for enhanced security measures in public spaces, transportation, and critical infrastructure sectors, such as airports and ports, has led to an increasing demand for portable and advanced explosive detection systems.

Ground penetration radar, thermal neutron activation analysis, and laser spectroscopy are some of the technologies employed in the market to detect a variety of explosive components, including inorganic nitrates, nitroaromatics, peroxides, nitramines, and chlorates. These technologies have shown promising results in the detection of both organic and inorganic explosives. Recent advancements in robotics, artificial intelligence, and sensor technologies have led to the development of more sophisticated and efficient explosive detection systems. For instance, OSIsystems' SPASER technology uses a high-powered laser to generate shockwaves that can detect the presence of explosives. Similarly, the integration of LED indicator lights and LCD/LED screens in portable devices enhances their usability and ease of deployment.

Defense spending, territorial disputes, and the threat of terrorism continue to fuel the demand for advanced explosive detection equipment. The market is expected to grow significantly in the coming years as governments and law enforcement agencies invest in new technologies to enhance their security capabilities. The transportation sector, particularly aviation, has been a major focus area for explosive detection technology development. The use of X-rays, thermal imaging, and other advanced technologies has become standard practice in airport security procedures. However, the threat of aerial bombs and the increasing use of flammable materials in terrorist attacks have led to the development of more advanced aerial bomb detection systems.

The market for explosive detection equipment is highly competitive, with numerous players offering a range of solutions. Companies are investing in research and development to create more efficient, portable, and cost-effective solutions. For example, the use of graphene in explosive detection sensors has shown promising results in improving sensitivity and reducing false positives. In , the market is a dynamic and evolving industry driven by the persistent threat of anti-social activities and the need for enhanced security measures in various sectors. The market is expected to grow significantly in the coming years as governments and organizations invest in advanced technologies to detect and neutralize explosives.

The integration of artificial intelligence, robotics, and sensor technologies is expected to drive innovation and efficiency in the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 2678.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, China, India, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Explosive Detection Equipment Market Research and Growth Report?

- CAGR of the Explosive Detection Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the explosive detection equipment market growth of industry companies

We can help! Our analysts can customize this explosive detection equipment market research report to meet your requirements.