Public Transportation Market Size 2025-2029

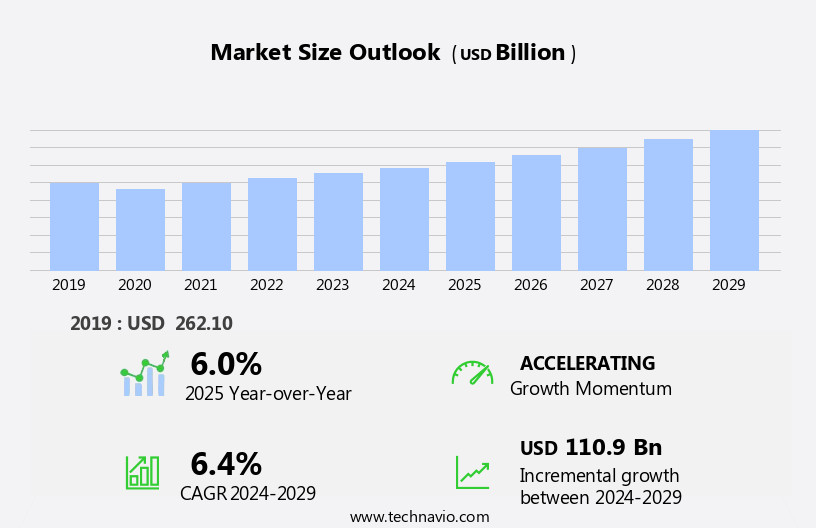

The public transportation market size is forecast to increase by USD 110.9 billion at a CAGR of 6.4% between 2024 and 2029.

- Increasing domestic trips for public transportation is the key driver of the public transportation market, as more people rely on efficient and affordable transport options for their daily commutes. The upcoming trend is the development of hyperloop transportation systems. With the potential to revolutionize travel, these high-speed, energy-efficient systems promise to significantly reduce travel times, offering a futuristic solution to meet growing transportation demands and contribute to sustainable urban mobility.

- The market is witnessing significant growth due to several key factors. One major trend is the increasing demand for domestic trips, which is driving the need for efficient and affordable public transportation solutions. Another trend is the development of advanced transportation systems, such as hyperloop, that offer faster and more sustainable options for travel. Additionally, the availability of alternatives, such as ride-hailing services and car sharing, is pushing public transportation providers to adapt and innovate to remain competitive.

What will be the Size of the Public Transportation Market During the Forecast Period?

To learn more about the market report, Request Free Sample

- The market is experiencing significant growth due to urbanization and increasing population density. Mass transportation systems, including public buses, subways, taxis, auto rickshaws, and rail transportation, are essential in mitigating traffic congestion and reducing greenhouse gas emissions. Environmental concerns and air quality issues have led to the adoption of green technologies such as electric buses, hybrid vehicles, and high-speed trains.

- Moreover, the rise of smart cities and digitization has transformed the industry, with mobility apps, third-party platforms, and ride-sharing services becoming increasingly popular. The road transportation system continues to face challenges in terms of traffic congestion and environmental impact, making public transportation an attractive alternative for commuters. The market is expected to continue growing as the need for sustainable and efficient mobility solutions becomes more pressing.

How is this Public Transportation Industry segmented and which is the largest segment?

The public transportation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Bus

- Metro

- Suburban rail

- Light rail transit

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- APAC

By Type Insights

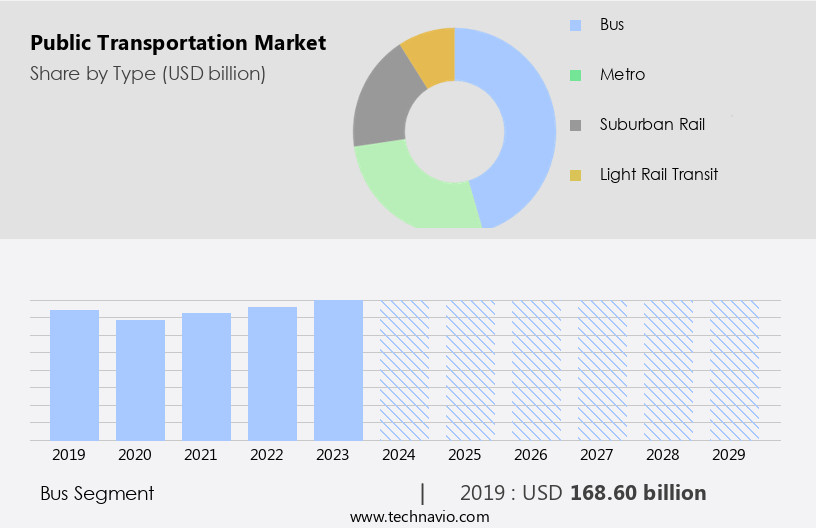

The bus segment is estimated to witness significant growth during the forecast period. Public transportation, specifically bus systems, plays a crucial role in urban areas by providing an efficient, cost-effective, and flexible solution for moving people and goods. Bus transportation systems encompass various designs, services, and integration levels with other modes of transportation. The demand for fast and convenient transportation in cities, with their high volume of educational institutions and businesses, necessitates the use of high-capacity solutions like buses. Effective bus transportation is essential to the functioning of urban areas.

Get a glance at share of various segments. Request Free Sample

The bus segment was valued at USD 168.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

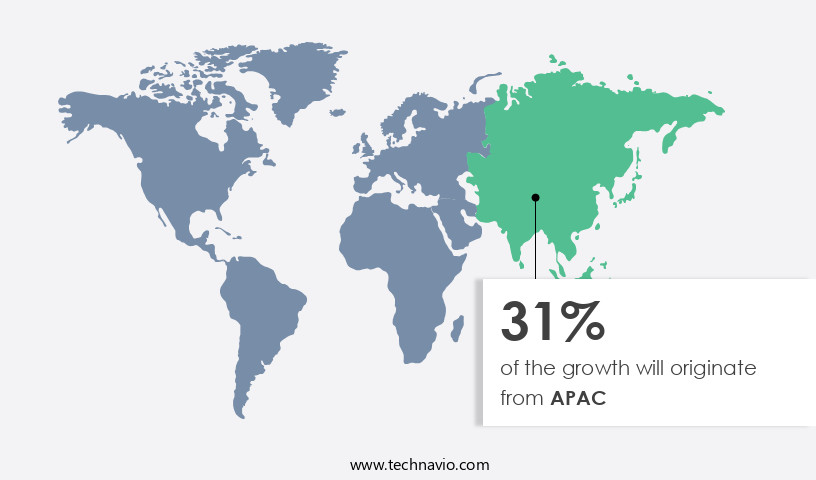

APAC is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is projected to lead the global industry due to increasing urbanization, population growth, and the need for efficient transportation systems to reduce traffic and emissions from private vehicles. This region's market expansion is driven by significant investments in public transport infrastructure, rising disposable income, and the growing number of tourists. Furthermore, environmental concerns have led countries such as Japan, China, South Korea, India, and others to adopt electric buses for their public transportation systems. The increasing use of smartphones and internet connectivity also contribute to the market's growth in APAC.

Public Transportation Market Dynamics

Our public transportation market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Public Transportation Industry?

Increasing domestic trips for public transportation is the key driver of the market.

- The market is experiencing significant growth due to the increasing preference for mass transportation in urban areas. With population growth and urbanization on the rise, efficient public transportation systems have become essential for mobility in densely populated regions. Factors such as traffic congestion, environmental concerns, and the need for cost-effective travel options are driving individuals towards public transit for their daily commuting needs and leisure activities. Government initiatives aimed at improving public transportation infrastructure and services, as well as investments in modernization and expansion projects, are further fueling market growth. These initiatives include the construction of subways, metro systems, and high-speed trains, as well as the integration of smart technologies such as intelligent transportation systems and smart ticketing.

- Moreover, the adoption of green technologies, including electric buses and hybrid vehicles, is a key trend In the market. These technologies help reduce greenhouse gas emissions and improve air quality in urban areas, making public transportation a more environmentally-friendly alternative to private vehicles. The digitization of public transportation services, including the use of mobility apps, websites, and third-party platforms, is also transforming the industry. These technologies offer greater convenience and flexibility for passengers, allowing them to easily plan their trips and purchase tickets or passes online. In summary, the market is experiencing strong growth due to the increasing demand for efficient, cost-effective, and environmentally-friendly transportation solutions in urban areas. Government initiatives, technological advancements, and the adoption of green technologies are key drivers of market growth.

What are the market trends shaping the Public Transportation Industry?

Development of hyperloop transportation systems is the upcoming market trend.

- The mass transportation market is experiencing significant growth due to urbanization and population growth in urban areas. This trend is driving the demand for efficient and eco-friendly public transportation systems. Mass transportation modes such as public buses, subways, taxis, auto rickshaws, and trams are increasingly popular choices for commuters in urban areas. Environmental concerns, including traffic congestion and greenhouse gas emissions, are also influencing the shift towards public transportation. As a result, there is a growing interest in green technologies such as electric buses, hybrid technologies, and smart cities. Intelligent transportation systems, including smart ticketing systems and real-time traffic updates, are also becoming essential components of modern public transportation systems.

- Moreover, rail transportation, including metro construction and high-speed trains, is another area of growth In the market. Digitalization and mobility apps are also transforming the way people travel, with ride-sharing services and digitization of tickets and passes becoming increasingly popular. The focus on reducing carbon emissions and minimizing environmental impact is driving innovation In the public transportation sector, with a shift towards sustainable and eco-friendly transportation solutions.

What challenges does Public Transportation Industry face during the growth?

Availability of alternatives is a key challenge affecting the industry growth.

- Public transportation plays a significant role in addressing urbanization challenges, particularly in managing population growth and reducing traffic congestion in urban areas. Mass transportation systems, including public buses, subways, taxis, auto rickshaws, and rail transportation, are essential components of an effective urban mobility solution. In recent years, environmental concerns have gained prominence, leading to the adoption of green technologies such as electric buses, hybrid vehicles, and smart cities. The increasing construction of metro systems and high-speed trains reflects the growing demand for efficient and eco-friendly transportation options. The digitization of public transportation systems, including smart ticketing systems, mobility apps, and third-party platforms, enhances user experience and convenience.

- Intelligent transportation systems and congestion pricing are other initiatives aimed at reducing carbon emissions and improving air quality. The shift towards green technologies and digitalization is driving market growth in public transportation. The cost reduction of batteries, primarily due to the relocation of manufacturing bases to countries like China, has made electric vehicles more affordable. This trend is expected to continue, further encouraging the adoption of eco-friendly transportation alternatives. Despite the advantages, challenges persist, such as the availability of alternatives like e-bikes, which may hamper market growth due to their lower cost and environmental benefits. Nevertheless, public transportation remains a crucial element in addressing the mobility needs of urban populations while minimizing the environmental impact.

Customer Landscape

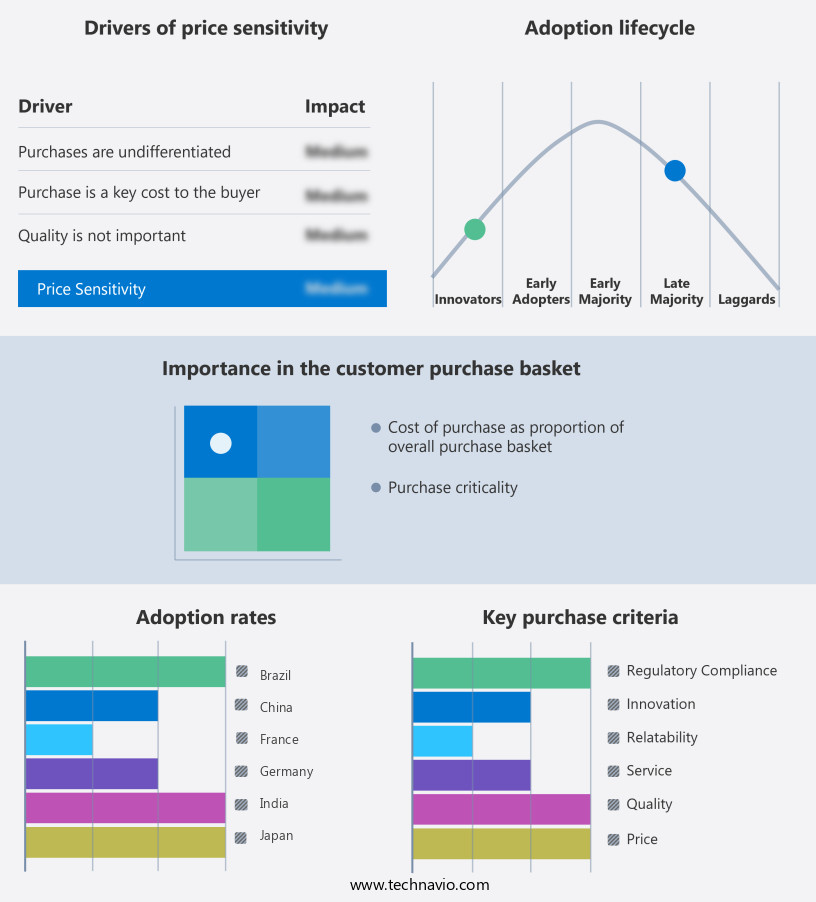

The public transportation market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the public transportation market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, public transportation market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Bay Area Rapid Transit - The company offers public transportation such as heavy rail public transit system that connects the San Francisco Peninsula with communities in the East Bay and South Bay.

The public transportation industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BC Transit Corporation

- berliner verkehrsbetriebe

- Chicago Transit Authority

- Deutsche Bahn AG

- East Japan Railway Company

- FirstGroup plc

- Massachusetts Bay Transportation Authority

- Metro de Madrid SA

- Metropolitan Transportation Authority

- MTR Corp. Ltd.

- San Diego Metropolitan Transit System

- Seoul Tourism Organization

- Sin U Lian Group

- SNCF Group

- Southern California Regional Rail Authority

- STIB

- Transdev Group SA

- Transport For London

- Washington Metropolitan Area Transit Authority

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In December 2024, Siemens Mobility unveiled a new range of electric buses designed to reduce emissions and improve energy efficiency in urban public transportation systems. The new electric buses, which feature advanced battery technology, aim to help cities meet sustainability goals while providing a reliable, clean transportation option.

-

In November 2024, Alstom launched an advanced smart ticketing system for public transportation networks, integrating contactless payments, real-time tracking, and mobile app capabilities. This system aims to enhance the convenience and efficiency of urban travel while improving the overall passenger experience.

-

In October 2024, BYD announced a partnership with several European cities to expand the use of electric trams and buses. The initiative focuses on reducing traffic congestion and lowering carbon emissions in urban areas, aligning with broader efforts to improve public transportation infrastructure and sustainability.

-

In September 2024, the New York Metropolitan Transportation Authority (MTA) introduced a new AI-powered route optimization software designed to enhance the efficiency of bus and subway services. The system uses real-time data to adjust routes and schedules, improving service delivery and reducing wait times for passengers.

Research Analyst Overview

The market has gained significant importance In the context of urbanization and growing environmental concerns. With an increasing population in urban areas, the demand for efficient and eco-friendly mobility solutions has become a pressing issue. In this context, this content aims to provide an insightful analysis of the public transportation system and its various components. Urbanization, with its population boom, has led to a increase In the number of commuters relying on public transportation systems. Mass transportation modes such as buses, subways, taxis, auto rickshaws, and rail transportation have become integral parts of daily life in urban areas.

Moreover, these systems offer several advantages, including reduced travel time, cost-effectiveness, and the ability to transport large numbers of people at once. Environmental concerns have emerged as a significant factor influencing the market. Traffic congestion and greenhouse gas emissions are major issues in urban areas, with road transportation systems contributing significantly to these problems. In response, there has been a growing trend towards the adoption of green technologies, such as electric buses, hybrid technologies, and intelligent transportation systems. These solutions aim to reduce carbon emissions and improve air quality in urban areas. The public transportation system's digitalization is another critical trend shaping the market.

In addition, smart ticketing systems, mobile apps, and third-party platforms have transformed the way commuters access and use public transportation services. High-speed trains and ride-sharing services have also gained popularity, offering travelers greater convenience and comfort. Metro construction is another area of growth In the market. Metro systems offer several advantages, including faster travel times, reduced congestion, and improved connectivity within urban areas. The construction of metro systems requires significant investment and planning, making it a complex and intricate process. The market faces several challenges, including traffic congestion, funding, and the need for continuous improvement to meet evolving consumer demands.

Furthermore, intelligent transportation systems and smart cities are emerging as potential solutions to these challenges, offering more efficient and eco-friendly mobility solutions. The market's continued growth and development will depend on its ability to address these challenges and offer innovative solutions that meet the changing needs of urban commuters. The public transportation system's role in reducing traffic congestion and greenhouse gas emissions cannot be overstated. As urban populations continue to grow, the importance of efficient and eco-friendly mobility solutions will only become more significant.

|

Public Transportation Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 110.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.0 |

|

Key countries |

China, India, US, Japan, Germany, Russia, South Korea, Brazil, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Public Transportation Market Research and Growth Report?

- CAGR of the Public Transportation industry during the forecast period

- Detailed information on factors that will drive the Public Transportation growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and public transportation market trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the public transportation market growth of industry companies

We can help! Our analysts can customize this public transportation market research report to meet your requirements.