Fiber Based Packaging Market Size 2024-2028

The fiber based packaging market size is forecast to increase by USD 49.8 billion, at a CAGR of 3% between 2023 and 2028.

- The market is driven by the increasing demand for sustainable packaging solutions and the efficiency of fiber-based equipment. Sustainability is a key trend in the packaging industry, with consumers and businesses alike seeking eco-friendly alternatives to traditional plastic packaging. Fiber-based packaging, made from renewable resources, offers a viable solution to this growing concern. However, market participants face challenges in the form of price fluctuations of recovered fiber materials. The availability and cost of recycled fiber significantly impact the profitability of fiber-based packaging production.

- Producers must navigate these price fluctuations to maintain competitiveness and ensure consistent product quality. Companies seeking to capitalize on market opportunities should focus on innovation, efficiency, and sustainability, while addressing the challenges of material cost volatility through strategic sourcing and supply chain optimization.

What will be the Size of the Fiber Based Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The fiber-based packaging market continues to evolve, driven by dynamic market trends and shifting consumer preferences. Kraft paper packaging, a long-standing favorite, remains in demand due to its durability and sustainability. However, the sourcing of packaging materials is a critical factor, with companies exploring various options, including recycled paperboard and plant-based sources like bagasse pulp. Fiber-based packaging design plays a pivotal role in meeting diverse industry needs. From structural integrity testing to water-resistant and oil-resistant solutions, designers employ various techniques, such as laminated fiber packaging and coating application methods, to enhance performance metrics. The packaging supply chain is another crucial aspect, with companies focusing on optimization and waste management.

Compostable packaging and moldable pulp packaging are gaining traction as eco-friendly alternatives. Yet, cost optimization remains a key concern, with printed fiber packaging and custom fiber packaging offering viable solutions. The packaging production process is undergoing significant changes, with advancements in packaging design software and material composition analysis. Rigid packaging and flexible packaging cater to different sectors, while sustainable packaging materials like biodegradable packaging and recycled paperboard gain popularity. The recycling infrastructure continues to evolve, influencing the market. Fiber density testing and paperboard strength analysis are essential to ensure effective waste reduction and packaging weight reduction.

Shelf life extension and barrier properties testing are crucial for maintaining product protection. Overall, the fiber-based packaging market is a dynamic landscape, with ongoing innovation and adaptation to meet evolving industry needs.

How is this Fiber Based Packaging Industry segmented?

The fiber based packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Chemical

- Food and beverage

- Consumer electronics

- Construction

- Others

- Geography

- North America

- US

- Europe

- France

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By End-user Insights

The chemical segment is estimated to witness significant growth during the forecast period.

The global fiber-based packaging market is experiencing significant growth due to the increasing demand for eco-friendly and sustainable packaging solutions. Structural integrity testing plays a crucial role in ensuring the durability and reliability of fiber-based packaging materials, such as kraft paper and recycled paperboard. In the packaging supply chain, fiber-based packaging design is a key focus area for companies seeking to optimize costs and reduce waste. Bagasse pulp molding and moldable pulp packaging offer biodegradable alternatives to traditional plastic packaging. Fiber-based packaging materials, including compostable packaging, are gaining popularity due to their environmental benefits. Water-resistant and oil-resistant packaging are essential for various industries, and fiber-based materials can meet these requirements through laminated fiber packaging and coating application methods.

Material composition analysis is essential to ensure the sustainability and recyclability of fiber-based packaging. Recycling infrastructure and recycling processes are critical components of the packaging supply chain. Packaging performance metrics, such as product protection analysis, fiber density testing, and paperboard strength, are essential to ensure the effectiveness of fiber-based packaging. Fiber type selection, shelf life extension, and barrier properties testing are also crucial considerations in the production process. Custom fiber packaging solutions, such as printed fiber packaging, are increasingly popular due to their ability to offer unique branding opportunities. Corrugated fiberboard is a widely used rigid packaging material, while flexible packaging offers convenience and versatility. Overall, the fiber-based packaging market is evolving to meet the demands of various industries for sustainable, cost-effective, and high-performing packaging solutions.

The Chemical segment was valued at USD 69.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

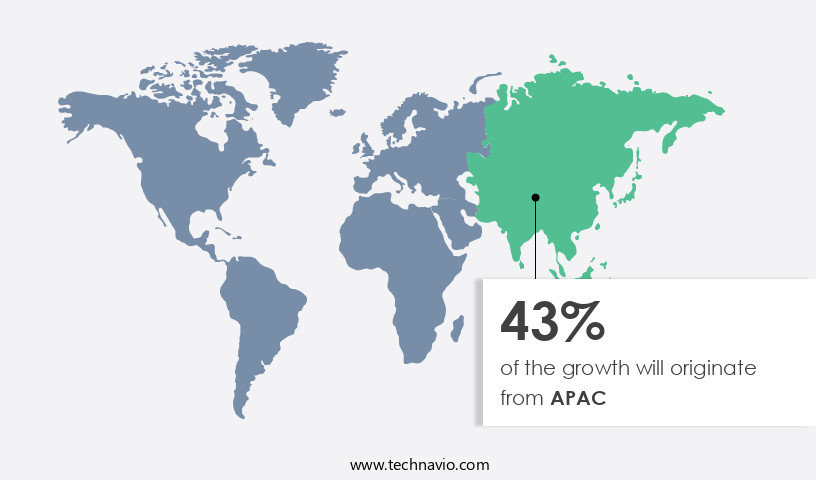

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The fiber-based packaging market in APAC is experiencing significant growth due to the expanding end-use industries, particularly in the chemical and food and beverage sectors. Fiber-based packaging is increasingly popular in the e-commerce sector for shipping various products, leading to custom-designed solutions from companies. With the rise of e-commerce, all types of fiber-based packaging, including printed, water-resistant, compostable, and laminated varieties, are in demand. Macro-economic factors and the presence of strong developing countries, such as India and China, are driving the growth of the e-commerce industry in APAC. Fiber-based packaging design and production processes involve various entities, including material sourcing, packaging supply chain, and recycling infrastructure.

Structural integrity testing, fiber type selection, and product protection analysis ensure the packaging's durability and functionality. Packaging cost optimization, fiber density testing, and paperboard strength are essential for manufacturers to maintain profitability. Sustainable packaging materials, such as biodegradable and recycled paperboard, are gaining popularity due to their environmental benefits. Barrier properties testing and coating application methods are crucial for enhancing the packaging's performance metrics, such as shelf life extension and oil resistance. Moldable pulp packaging and corrugated fiberboard are versatile options for various applications, while flexible packaging offers convenience and customization. Material composition analysis and recycling infrastructure are essential for minimizing packaging waste and reducing the environmental impact.

In conclusion, the fiber-based packaging market in APAC is witnessing a surge in demand due to the growing e-commerce sector and macro-economic developments. companies are focusing on providing customized solutions to cater to the diverse needs of industries and consumers. The market's growth is driven by various factors, including the adoption of sustainable packaging materials, cost optimization, and performance enhancement.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.In the realm of sustainable and eco-conscious solutions, the fiber packaging industry has emerged as a critical player in addressing the environmental impact of traditional paper and plastic packaging. With a focus on designing sustainable fiber packaging, the market is continually optimizing the supply chain to ensure cost-effective, biodegradable options that improve recyclability and reduce the environmental footprint. Strength properties of recycled fiberboard play a pivotal role in the development of advanced technologies in fiber packaging production. Innovative applications of molded pulp packaging, such as surgical site infection control ballistic protection, showcase the versatility and durability of these materials. Testing the durability of fiber-based containers through various methods, including life cycle assessment of paper-based products, is essential to understanding their potential in various industries. Key areas involve improving the barrier properties of paperboard and reducing the overall weight and material use in the cost analysis of different fiber packaging materials. Critical elements include sustainable sourcing of fiber for packaging and evaluating the structural integrity of fiber packaging, ensuring water resistance in coated paperboard packaging, and improving the recyclability of these products. New trends in fiber-based packaging design emphasize the importance of reducing the environmental footprint of fiber packaging. Manufacturing processes for sustainable fiber packaging are under constant scrutiny, with a focus on reducing energy consumption and minimizing waste. Studies highlight the importance of optimizing the fiber packaging supply chain, including the cost-effectiveness and efficiency of production methods. Evaluating the environmental impact of paper packaging is a crucial consideration in the fiber packaging market. By focusing on designing sustainable fiber packaging, the industry is not only addressing the needs of affluent US consumers seeking exclusivity and convenience but also contributing to a more sustainable future. Improving the overall sustainability of fiber packaging is a shared responsibility among all stakeholders, from manufacturers to consumers, and will continue to be a driving force in the evolution of this market.

What are the key market drivers leading to the rise in the adoption of Fiber Based Packaging Industry?

- The key driver of the market is the high efficiency of equipment, making it an essential factor for businesses in their decision-making process.

- Fiber-based packaging, specifically molded fibers, plays a significant role in the automotive industry for packaging heavy components and accessories. This type of packaging is known for its shock-absorbing properties, effectively safeguarding goods from damage during transit and storage. Molded fiber packaging is also anti-static, offering superior product protection compared to conventional polystyrene and extruded plastic alternatives. The material's lightweight nature reduces shipping costs, making it an attractive choice for the automotive sector. Furthermore, molded fiber's durability ensures the protection of delicate surfaces, making it a preferred option for various automotive products.

- Custom fiber packaging solutions, such as those based on fiber density testing and paperboard strength analysis, contribute to packaging waste reduction and weight reduction, further enhancing the appeal of fiber-based packaging in the industry.

What are the market trends shaping the Fiber Based Packaging Industry?

- The trend in the market is shifting towards the demand for sustainable products. The packaging industry is undergoing a significant transformation as companies prioritize eco-friendly and sustainable solutions in response to growing environmental and health concerns. Traditional plastic packaging, derived from non-renewable resources, has been identified as a major contributor to pollution and potential health hazards. In contrast, fiber-based packaging, such as kraft paper, offers a more sustainable alternative. This packaging material is biodegradable, renewable, and can be sourced from plant-based resources. To ensure the structural integrity and quality of fiber-based packaging, companies invest in rigorous testing and research. Innovative fiber-based packaging designs are being developed, including bagasse pulp molding and compostable packaging, which offer enhanced sustainability and waste management benefits.

- The packaging supply chain is also being optimized to minimize waste and resource use in manufacturing, improve transport efficiencies, and create efficient after-use disposal and recycling systems. Cost optimization is a crucial consideration in the packaging industry, and fiber-based packaging offers a competitive edge. Its renewable and recyclable nature reduces the overall cost of production and disposal, making it a cost-effective solution for businesses. As a result, fiber-based packaging is gaining popularity and is expected to become a preferred choice for companies seeking to minimize their environmental footprint while maintaining the highest standards of quality and performance.

What challenges does the Fiber Based Packaging Industry face during its growth?

- The price volatility of recovered fiber materials poses a significant challenge and significantly impacts the expansion of the industry.

- Fiber based packaging is a sustainable alternative to traditional plastic packaging, primarily composed of fibrous materials such as virgin pulpwood, recovered paper from post-industrial sources, and post-consumer waste. A significant portion of this packaging is made from paperboard, which relies heavily on wood pulp as a raw material. However, the escalating prices of wood pulp due to increased global demand, construction activities, industrial activities, and supply chain input costs have raised production costs for companies in the fiber based packaging industry. This trend poses a challenge for these companies to maintain profitability while meeting consumer demand for eco-friendly, cost-effective packaging solutions.

- Printed fiber packaging, including water-resistant and biodegradable varieties, is increasingly popular due to its sustainability benefits. Packaging design software and coating application methods are essential in creating visually appealing and functional fiber based packaging. Laminated fiber packaging, which involves bonding multiple layers of fiber-based materials together, offers enhanced durability and water resistance. Material composition analysis is crucial in ensuring the quality and consistency of fiber based packaging products. Despite the rising material costs, the market continues to grow due to its environmental advantages and versatility in various industries.

Exclusive Customer Landscape

The fiber based packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fiber based packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fiber based packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AR Packaging Group AB - The company specializes in producing fiber-based packaging solutions catering to the food and beverage, consumer and luxury, and medical industries. Their offerings encompass diverse types of packaging, enhancing product protection and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AR Packaging Group AB

- BillerudKorsnas AB

- Blue Lake Packaging Inc.

- Brodrene Hartmann AS

- BrUCkner Group Gmbh

- DS Smith Plc

- Evergreen Packaging LLC

- Huhtamaki Oyj

- International Paper Co.

- Koch Industries Inc.

- Mayr-Melnhof Karton AG

- McKinley Packaging

- Mondi Plc

- PulPac AB

- Rengo Co. Ltd.

- Smurfit Kappa Group

- Sonoco Products Co.

- Stora Enso Oyj

- UFP Technologies Inc.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fiber Based Packaging Market

- In January 2024, Amcor, a global packaging company, announced the launch of its new plant-based, fiber-based packaging solution, "PlanetBottle," in collaboration with Danimer Scientific. This eco-friendly, mono-material bottle is designed to reduce plastic waste and aligns with the growing consumer demand for sustainable packaging (Amcor, 2024).

- In March 2024, Smurfit Kappa, a leading European paper and packaging group, announced a strategic partnership with Sappi, a global pulp and paper company. This collaboration aimed to develop and commercialize innovative fiber-based packaging solutions using Sappi's renewable raw materials (Smurfit Kappa, 2024).

- In May 2024, Sonoco, a global consumer packaging solutions provider, completed the acquisition of Alpla's rigid plastic packaging business in Europe. This strategic move expanded Sonoco's reach in the European market and allowed it to offer a more comprehensive range of fiber-based and plastic packaging solutions (Sonoco, 2024).

- In February 2025, BillerudKorsnäs, a leading provider of packaging materials and solutions, received approval from the European Commission for its acquisition of the Dutch fiber-based packaging company, Verstraete IML. This acquisition strengthened BillerudKorsnäs' position in the European market and expanded its product portfolio (BillerudKorsnäs, 2025).

Research Analyst Overview

- In the dynamic fiber-based packaging market, trends revolve around enhancing sustainability and efficiency. Packaging labeling and traceability are crucial for ensuring transparency in the supply chain. Regulatory compliance, driven by material science and packaging regulations, plays a significant role in market growth. Innovations in packaging, such as fiber-based cushioning and insulation, reduce carbon footprints. Packaging disposal methods and life cycle assessments are key concerns for businesses, driving the need for recyclability and biodegradability. Aesthetics, durability, and printability are essential factors in packaging design, while automation and machinery optimize production. Quality control systems and certifications ensure consistency and safety.

- Surface treatment techniques and packaging assembly methods contribute to enhancing packaging durability and efficiency. Packaging logistics, transport, and storage solutions streamline the distribution process. Packaging graphics and decoration add value to brands, while standardization and certifications foster trust and credibility. The focus on reducing waste and improving sustainability continues to shape the fiber-based packaging industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fiber Based Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2024-2028 |

USD 49.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.9 |

|

Key countries |

China, US, UK, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fiber Based Packaging Market Research and Growth Report?

- CAGR of the Fiber Based Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fiber based packaging market growth of industry companies

We can help! Our analysts can customize this fiber based packaging market research report to meet your requirements.