Rigid Plastic Packaging Market Size 2025-2029

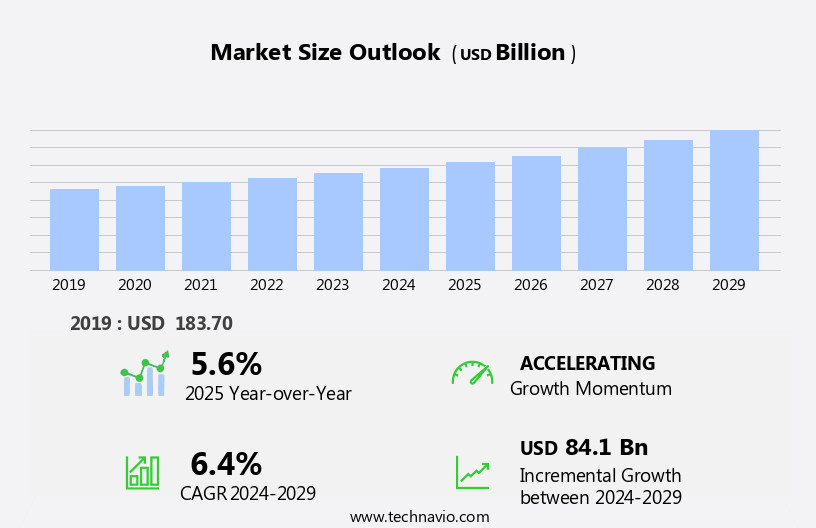

The rigid plastic packaging market size is forecast to increase by USD 84.1 billion at a CAGR of 6.4% between 2024 and 2029.

- The market is witnessing significant growth, driven primarily by the increasing demand from the food and beverage industry. This sector's shift towards lightweight, durable, and cost-effective packaging solutions is fueling market expansion. However, the use of fiber-based materials for packaging poses a challenge, as these alternatives offer similar benefits and are gaining popularity due to their eco-friendliness. Another significant obstacle is the high cost of recycling rigid plastic products, which can hinder market growth. Despite these challenges, opportunities exist for companies to innovate and offer cost-effective recycling solutions or differentiate themselves through the use of advanced technologies, such as biodegradable plastics or improved production processes.

- By addressing these challenges and capitalizing on the market's growth potential, businesses can effectively position themselves for success in the market. In the food and beverage sector, the demand for rigid plastic packaging is on the rise, driven by the increasing consumption of products such as hair care, soft drinks, detergent, pasta, meat, oral care, packaging for cookies, alcoholic beverages, juices, and pickles. Expanded polystyrene and polyethylene are commonly used materials for food packaging, while polyethylene terephthalate is preferred for beverage containers.

What will be the Size of the Rigid Plastic Packaging Market during the forecast period?

- In the dynamic US packaging market, material science advances continue to shape the landscape, with a focus on reducing packaging waste and integrating packaging lines. Sustainable packaging trends, such as carbon footprint reduction and modified atmosphere packaging, are driving innovation in labeling materials, closure systems, and packaging equipment. Smart packaging, including inkjet printing and RFID tagging, enhances food safety and consumer engagement. Brand loyalty is paramount, and sustainability initiatives, such as recycled plastic content and biodegradable packaging, are key differentiators. Packaging automation and efficiency are essential for e-commerce and food industries, with vacuum packaging, protective films, and packaging foams optimizing product preservation.

- Food contact compliance, moisture absorbers, and anti-static packaging ensure product quality and safety. Digital printing and plant-based polymers offer design flexibility and environmental benefits. Life cycle analysis and environmental impact assessments guide packaging material sourcing and production process efficiency. Circular economy principles, including reusable packaging and packaging recycling, are increasingly important for reducing waste and minimizing environmental impact. Aseptic packaging and packaging line optimization further streamline operations and enhance product protection. Overall, the US packaging market is continuously evolving, with a focus on innovation, efficiency, and sustainability.

How is this Rigid Plastic Packaging Industry segmented?

The rigid plastic packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Bottles

- Containers

- Caps and closures

- Others

- End-user

- Food

- Healthcare

- Cosmetic and toiletries

- Beverages

- Industrial

- Material

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

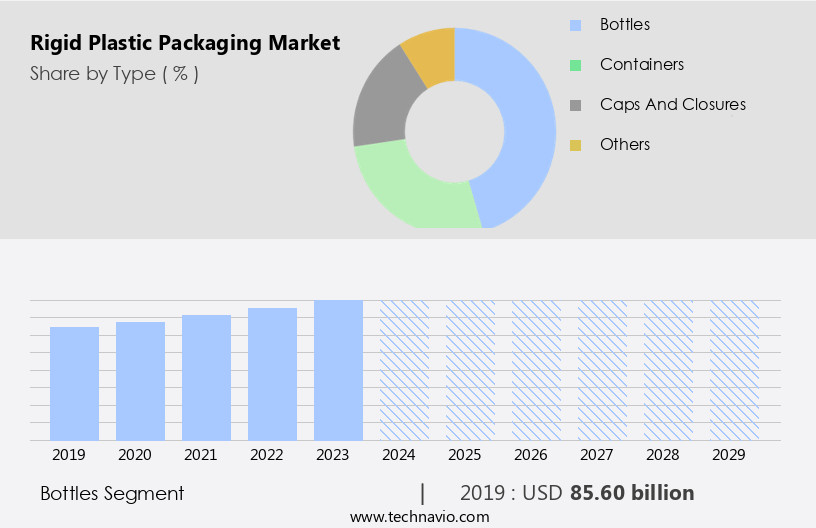

The bottles segment is estimated to witness significant growth during the forecast period. Rigid plastic packaging, primarily made from materials such as polyethylene terephthalate (PET), polypropylene plastic (PP), and high-density polyethylene (HDPE), continues to dominate various industries due to its versatility and durability. This packaging type is utilized extensively for a wide range of products, including water, juices, pharmaceuticals, food items, cosmetics, carbonated soft drinks, and personal care products. The retail sector's expansion and the increasing preference for convenient and sustainable packaging solutions have fueled market growth. For instance, Coca-Cola India introduced 100% recycled PET (rPET) bottles in the carbonated beverage category in October 2023. Consumer preferences for child-resistant, tamper-evident, and oxygen barrier packaging have led to the development of advanced packaging technologies.

Material science innovations have enabled the creation of lightweight, moisture-barrier, and UV-protection packaging, enhancing product protection and shelf life. Packaging automation and efficiency have become essential for businesses to optimize their supply chains and reduce costs. Sustainability initiatives, such as the circular economy and the use of biodegradable and compostable packaging, are gaining traction, driven by growing environmental concerns and brand loyalty. Packaging regulations play a crucial role in ensuring food safety and quality control. Packaging machinery manufacturers continue to invest in research and development to create innovative and efficient solutions. The e-commerce sector's growth has led to the demand for protective and reusable packaging solutions.

The use of PVC packaging is under scrutiny due to environmental concerns, and there is a growing emphasis on recyclable and sustainable packaging alternatives. Packaging standards continue to evolve to meet the changing needs of various industries and consumer preferences.

The Bottles segment was valued at USD 85.60 billion in 2019 and showed a gradual increase during the forecast period.

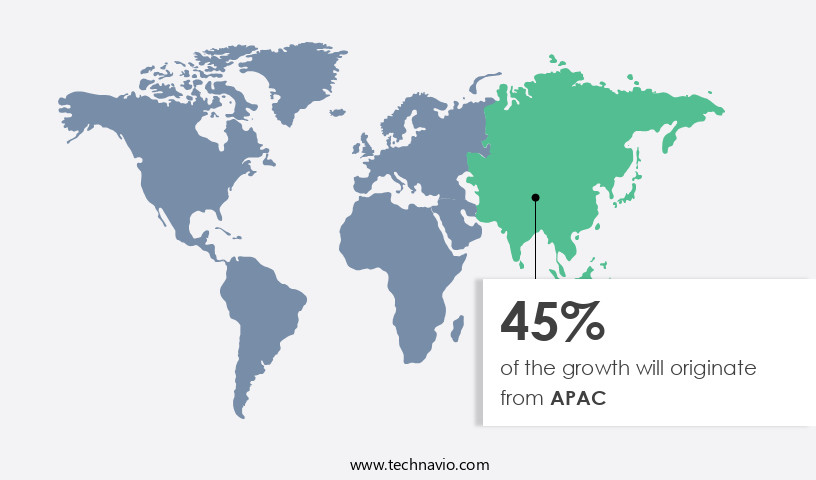

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing notable growth due to several significant factors. One of the primary drivers is the increasing demand for household care products and food and beverages. Consumer preferences are evolving towards convenience and sustainability, leading retailers in the food and beverage industry to transition from single-use plastic bags to rigid plastic packaging solutions. For instance, New World, Countdown, and Pak'n Save in New Zealand have adopted rigid plastic for their food packaging. New World uses plastic trays for its store-brand lamington squares, while Countdown's bakery and produce sections utilize rigid plastic tubs for its store-brand cheesecake.

Moreover, the adoption of rigid plastic packaging is essential for supply chain optimization and product protection. Packaging lines are integrating advanced technologies such as material science, packaging software, and packaging machinery to enhance the production process and ensure product traceability. PS and PP packaging are popular choices due to their barrier properties, which extend the shelf life of food products and protect them from moisture, UV radiation, and oxygen. Packaging regulations are also driving the market's growth, with a focus on child-resistant packaging, tamper-evident packaging, and sustainable packaging. Consumer goods companies are investing in e-commerce packaging, biodegradable packaging, and reusable packaging to cater to the changing consumer landscape.

The circular economy is gaining momentum, with a focus on recyclable packaging, compostable packaging, and sustainable packaging initiatives. In the industrial sector, HDPE containers and PVC packaging are widely used for their durability and cost-effectiveness. Packaging automation and packaging efficiency are crucial for companies to remain competitive. Industrial packaging, retail packaging, and beverage packaging are significant segments of the market, with a focus on product protection, quality control, and design. Overall, the market in the APAC region is witnessing a dynamic shift, driven by consumer preferences, packaging regulations, and technological advancements. Companies are investing in sustainable packaging solutions, automation, and material science to meet the evolving needs of consumers and retailers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Rigid Plastic Packaging market drivers leading to the rise in the adoption of Industry?

- The food and beverage industry's increasing demand for rigid plastic packaging serves as the primary market driver. The food industry faces a significant challenge in reducing food loss and waste, with approximately 32% of the food produced globally being lost or wasted between harvest and consumption. The United Nations has emphasized the importance of addressing this issue, as food contamination during storage can negatively impact its nutritional value. Rigid plastic packaging plays a crucial role in mitigating this problem by preserving the food's freshness and extending its shelf life. Consumer preferences for convenient, protective, and child-resistant packaging have led to the increased use of PS and PP packaging in various applications, including food packaging. The rigidity and barrier properties of these materials ensure effective protection against temperature, moisture, and other environmental factors.

- Moreover, supply chain optimization is a key consideration for businesses, and rigid plastic packaging's ability to streamline the packaging process by reducing the need for manual labor and minimizing packaging waste makes it an attractive option. Additionally, regulatory compliance is essential, and rigid plastic packaging adheres to various food packaging regulations, ensuring food safety and consumer protection. In conclusion, the adoption of rigid plastic packaging is driven by the need to reduce food loss and waste, consumer preferences, and supply chain optimization. Its ability to provide effective barrier properties, protection, and regulatory compliance makes it a preferred choice for various food packaging applications.

What are the Rigid Plastic Packaging market trends shaping the Industry?

- The use of fiber-based materials is gaining popularity in the packaging industry, representing an emerging market trend. Fiber-based packaging offers numerous benefits, including sustainability, biodegradability, and reduced environmental impact. In the packaging industry, enterprises are prioritizing sustainability as a key factor in response to growing consumer awareness and environmental concerns. The shift towards recyclable and eco-friendly materials, such as fiber-based packaging, is gaining momentum. Fiber-based materials, which include paper, cardboard, and other plant-derived substances, offer several advantages. They are reusable, renewable, and biodegradable, making them an ideal choice for various industries, including food and beverage, chemical, and construction. This trend is not limited to traditional markets but is also influencing e-commerce packaging. Packaging software and automation are facilitating the production and implementation of sustainable packaging solutions. These technologies enable increased packaging efficiency and reduce waste, further enhancing the appeal of sustainable packaging.

- Moreover, brand loyalty is increasingly tied to a company's commitment to sustainability initiatives. Biodegradable packaging, another sustainable alternative, is gaining traction in specific markets, particularly for perishable goods. Food safety remains a critical concern, and fiber-based materials offer excellent barrier properties to ensure product preservation. In conclusion, the packaging industry is undergoing a transformation as enterprises embrace sustainable practices and materials. Fiber-based packaging, with its versatility, renewability, and eco-friendliness, is at the forefront of this shift. Packaging software, automation, and other technological advancements are enabling more efficient and cost-effective production and implementation of sustainable packaging solutions. The circular economy, which emphasizes the elimination of waste and the continual use of resources, is driving this trend, as companies strive to reduce their environmental footprint and meet evolving consumer demands.

How does Rigid Plastic Packaging market faces challenges face during its growth?

- The escalating costs associated with recycling rigid plastic products pose a significant challenge and hinder the growth of the industry. Rigid plastic packaging, including PVC and HDPE containers, plays a significant role in the retail and consumer goods industries. However, the recycling process for these materials involves substantial costs, including procurement, energy consumption, and labor. Recyclable packaging, such as compostable and tamper-evident options, is gaining popularity due to sustainability concerns. Quality control is crucial in maintaining the integrity of these packaging solutions, especially for beverage and oxygen barrier applications.

- Despite the challenges, the shift towards sustainable packaging continues, driven by consumer preferences and packaging standards. The manufacturing of new rigid plastic containers is often more economical than recycling due to the energy and water requirements of cleaning and processing used plastic.

Exclusive Customer Landscape

The rigid plastic packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rigid plastic packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rigid plastic packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albea Services SAS - The company offers rigid plastic packaging products such as lipstick shells, mascara bottles and brushes and skincare jars and bottles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albea Services SAS

- ALPLA Werke Alwin Lehner

- Altium Packaging

- Amcor Plc

- Berry Global Inc.

- CKS Packaging Inc.

- Crown Holdings Inc.

- DS Smith Plc

- Graham Packaging Co. LP

- Hitech Corp. Ltd.

- Jabil Inc.

- KP Holding GmbH and Co. KG

- Lacerta Group LLC

- Nampak Ltd.

- Pactiv Evergreen Inc.

- Plastipak Holdings Inc.

- Sealed Air Corp.

- Silgan Holdings Inc.

- Sonoco Products Co.

- Tetra Laval SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rigid Plastic Packaging Market

- In February 2024, Amcor, a global packaging company, announced the launch of its new lightweight PET bottle for water and carbonated soft drinks, which offers a 30% reduction in material use and a 25% reduction in carbon emissions compared to traditional PET bottles (Amcor Press Release, 2024). This innovation aligns with the growing trend towards sustainable packaging solutions in the market.

- In July 2025, Berry Global, a leading producer of rigid plastic packaging, entered into a strategic partnership with Danone, a leading food company, to develop and commercialize reusable and returnable packaging solutions for the food and beverage industry (Berry Global Press Release, 2025). This collaboration is expected to reduce single-use plastics and promote a circular economy within the industry.

- In September 2024, LyondellBasell, a leading plastics and chemical company, completed the acquisition of A. Schulman, a global supplier of plastic compounds and resins, for approximately USD2.2 billion (LyondellBasell Press Release, 2024). This acquisition is expected to expand LyondellBasell's portfolio in the market and strengthen its position as a global leader in the industry.

- In March 2025, the European Union passed a regulation banning single-use plastic plates, cutlery, and straws from 2021, with other member states encouraged to implement similar measures (European Commission Press Release, 2025). This regulatory initiative is expected to drive demand for sustainable rigid plastic packaging alternatives, such as reusable containers and biodegradable packaging, in the European market.

Research Analyst Overview

Rigid plastic packaging continues to be a dynamic and evolving market, shaped by various factors including consumer preferences, technological advancements, and regulatory requirements. This sector encompasses a wide range of applications, from PET bottles and food packaging to industrial and retail applications. Consumer preferences play a significant role in driving the market's direction. For instance, there is a growing demand for packaging that offers better product traceability, ensuring the origin and journey of products from the manufacturer to the consumer. Additionally, there is a trend towards sustainable and eco-friendly packaging solutions, such as biodegradable, compostable, and recyclable options.

Manufacturers are responding to these trends by investing in packaging lines that can produce various types of rigid plastic packaging, including PS (polystyrene) and PP (polypropylene) packaging. Material science advancements have led to the development of packaging with superior barrier properties, protecting products from moisture, oxygen, and UV light. Packaging regulations also influence the market's dynamics. For example, child-resistant packaging is mandatory for certain products, such as pharmaceuticals and household chemicals, to ensure safety. Food packaging regulations focus on ensuring food safety and extending shelf life. Supply chain optimization is another critical factor in the market. Packaging software and automation have streamlined processes, reducing costs and increasing efficiency.

Lightweight packaging is also gaining popularity as a means of reducing transportation costs and minimizing the environmental impact. Sustainability initiatives are a significant trend in the market. Brands are recognizing the importance of sustainable packaging in building consumer loyalty and reducing their carbon footprint. Reusable packaging and circular economy principles are becoming increasingly popular. Packaging machinery plays a crucial role in the production of rigid plastic packaging. Technological advancements have led to the development of more sophisticated machinery, such as extrusion blow molding and injection molding, which can produce high-quality, consistent packaging with excellent product protection. In conclusion, the market is a dynamic and evolving industry, shaped by various factors, including consumer preferences, technological advancements, and regulatory requirements.

The market encompasses a wide range of applications, from food and beverage packaging to industrial and retail applications. The focus on sustainability and eco-friendly solutions is a significant trend, with a growing demand for packaging that offers better product traceability, extended shelf life, and reduced environmental impact. Packaging machinery and automation are essential for producing high-quality, consistent packaging efficiently and cost-effectively.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rigid Plastic Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 84.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Germany, India, Japan, UK, South Korea, France, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rigid Plastic Packaging Market Research and Growth Report?

- CAGR of the Rigid Plastic Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rigid plastic packaging market growth and forecasting

We can help! Our analysts can customize this rigid plastic packaging market research report to meet your requirements.