Rigid Packaging Market Size 2024-2028

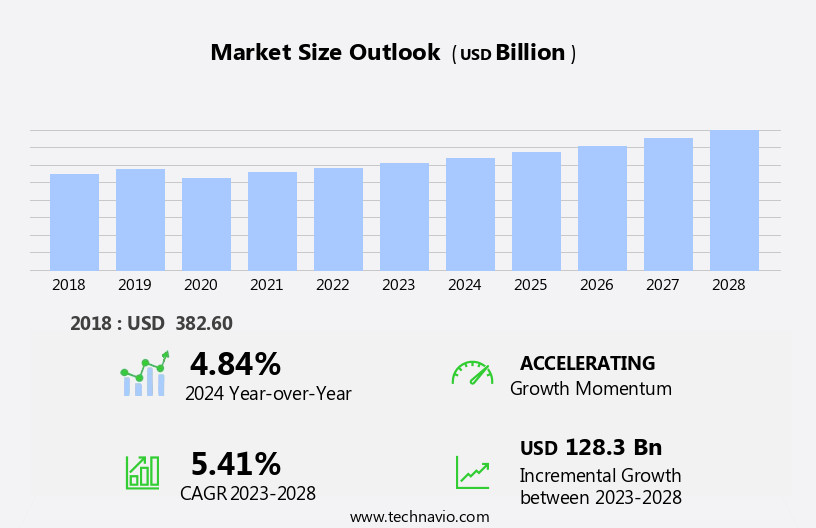

The rigid packaging market size is forecast to increase by USD 128.3 billion, at a CAGR of 5.41% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for glass packaging in various end-use industries, including food and beverages, cosmetics, and pharmaceuticals. This trend is driven by the desirable qualities of glass, such as its ability to preserve product quality, ensure product safety, and provide an attractive appearance. Additionally, the emergence of new markets, particularly in Asia Pacific and Latin America, is contributing to the market's expansion. However, the market faces challenges as well. One major obstacle is the rise of flexible packaging, which offers advantages such as lighter weight, easier transportation, and lower production costs.

- This trend is particularly prominent in the food and beverage sector, where convenience and portability are key consumer preferences. Another challenge is the increasing focus on sustainable packaging solutions, which has led to the development of biodegradable and recyclable alternatives to traditional rigid packaging materials. Companies must adapt to these trends to remain competitive and capitalize on the opportunities presented by the evolving market landscape.

What will be the Size of the Rigid Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Plastic extrusion processes and high-barrier films are increasingly popular, as they offer improved material handling systems and packaging automation. These innovations contribute to packaging waste reduction and enhanced product protection. Environmental impact assessments and impact resistance testing are essential components of the market, with food safety regulations and lamination processes ensuring the safety and quality of packaged goods. The industry anticipates a growth of 3% annually, as companies invest in sustainable packaging materials and packaging design software. For instance, a leading food manufacturer increased sales by 15% by implementing a new rigid container manufacturing process, which improved transport vibration resistance and product protection methods.

Additionally, distribution network optimization and structural integrity analysis are crucial for ensuring product safety and shelf life extension. Sustainability remains a top priority, with companies focusing on compression testing methods, supply chain management, and recycling infrastructure impact. Packaging line efficiency and flexible packaging integration are also key areas of investment, as businesses strive to minimize product damage and optimize costs. Consumer safety standards continue to evolve, driving the adoption of automated packaging machinery and container design principles that prioritize transport vibration resistance, stacking strength testing, and barrier properties testing. Thermoforming techniques and the use of sustainable packaging materials further enhance the market's continuous dynamism.

How is this Rigid Packaging Industry segmented?

The rigid packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Plastic

- Metal

- Glass

- Application

- Food and beverages

- Pharmaceuticals

- Personal care

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

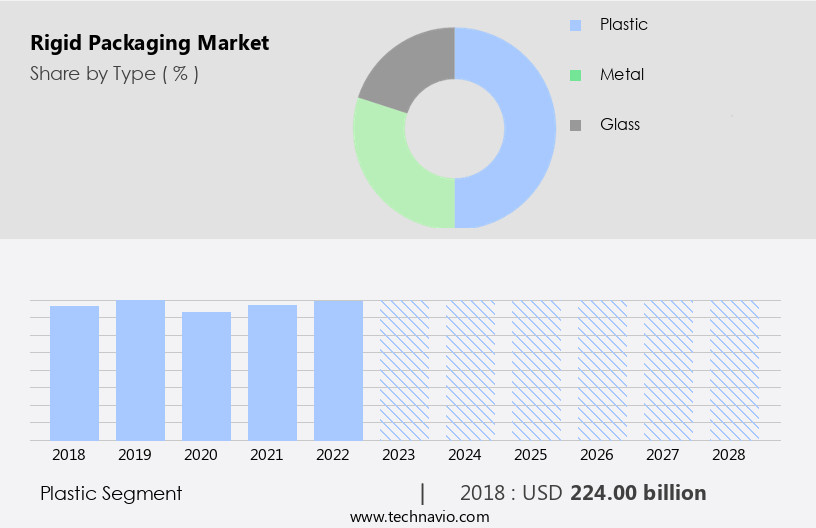

The plastic segment is estimated to witness significant growth during the forecast period.

Rigid plastic packaging, manufactured from raw materials such as PP, PE, PET, PS, PVC, and bioplastics, is experiencing significant growth due to its numerous advantages over metal and glass alternatives. The plastic packaging industry is expected to expand by 3% annually, with processes like injection molding, extrusion molding, and blow molding driving production. Rigid plastic's shatter-resistant, non-brittle, and easy-to-transport nature increases its demand. Additionally, its graphic capabilities and improved resins and technology offer convenience and product protection. Manufacturers prioritize material handling systems and automation to enhance efficiency and reduce waste. High-barrier films and lamination processes ensure product freshness and safety, while structural integrity analysis and impact resistance testing maintain container durability.

Food safety regulations are strictly adhered to, with rigorous quality control procedures in place. Transport vibration resistance is crucial for product protection during distribution. Container design principles, including thermoforming techniques, focus on optimizing pallet load and stacking strength. Sustainable packaging materials and design software are integrated to minimize environmental impact. Consumer safety standards and packaging cost optimization are essential considerations. Automated packaging machinery streamlines production lines, increasing efficiency and reducing product damage. Shelf life extension is a significant benefit, ensuring freshness and maintaining product quality. Flexible packaging integration offers versatility and cost savings. Overall, the rigid plastic packaging market's evolution is characterized by innovation, efficiency, and a commitment to sustainability.

For instance, a leading food manufacturer reported a 20% increase in sales by switching to rigid plastic packaging.

The Plastic segment was valued at USD 224.00 billion in 2018 and showed a gradual increase during the forecast period.

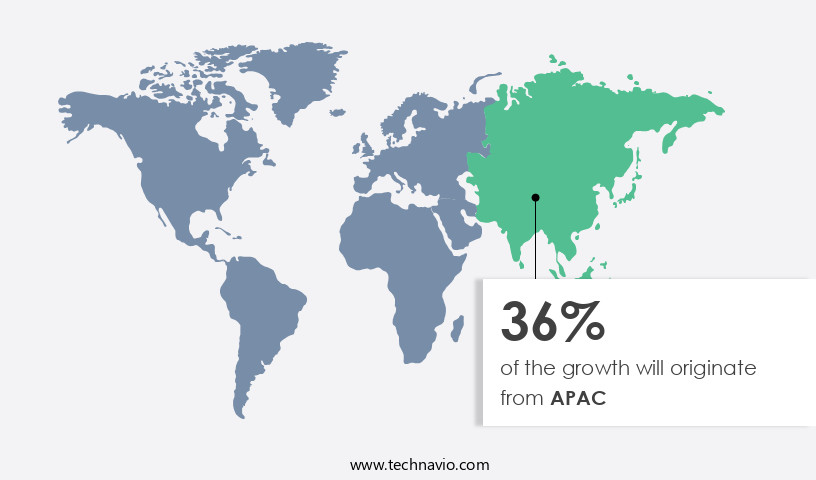

Regional Analysis

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, driven by the increasing demand for F and B and pharmaceutical products in Asian countries, particularly China and India. With rising per capita income and improving living standards, the region's population is anticipated to experience substantial growth in the next two decades. In 2018, China and India's combined GDP was USD 21.4 trillion, and this figure is projected to increase as consumer spending on packaged goods rises. To cater to this demand, global companies are expanding their presence in the region. The packaging industry is responding by innovating to meet the needs of this market.

For instance, there is a focus on packaging waste reduction through the use of high-barrier films and sustainable packaging materials. Material handling systems and packaging automation systems are also being implemented to streamline production and improve efficiency. Environmental impact assessments and impact resistance testing are crucial in the development of packaging solutions. Food safety regulations require strict adherence to quality control procedures and lamination processes. Container design principles, such as transport vibration resistance and structural integrity analysis, are essential to ensure product protection during transportation. Barrier properties testing and container design software are being used to optimize packaging material selection and container design.

Compression testing methods and supply chain management systems are being employed to prevent product damage and optimize pallet load and stacking strength. Flexible packaging integration and packaging line efficiency are also key trends in the market. The market is expected to grow at a rate of 5% annually, as companies invest in automated packaging machinery to meet the increasing demand for high-quality, efficient, and sustainable packaging solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for high-quality, protective packaging solutions across various industries. To meet this demand, innovations in manufacturing technologies are playing a crucial role. For instance, high-speed thermoforming machine setups are being adopted to improve production efficiency and reduce cycle times. Similarly, advancements in injection molding technology are enabling manufacturers to optimize cycle times and enhance product consistency. In the realm of blow molding, process parameters are being meticulously fine-tuned to ensure optimal production and product quality. The impact of packaging design on shelf life and product protection is another critical consideration. Material selection plays a pivotal role in this regard, with sustainable rigid packaging materials gaining popularity due to their eco-friendly nature and ability to reduce waste in the supply chain. Moreover, improving pallet load stability and efficiency is a key focus area for rigid packaging manufacturers. This is achieved through designing for recyclable rigid packaging and evaluating packaging line efficiency metrics. Assessing the structural integrity of rigid containers is also essential to ensure product safety and reduce the risk of damage during transportation and storage. In conclusion, the market is driven by the need for innovative, protective, and sustainable packaging solutions. Manufacturers are continuously exploring ways to enhance production efficiency, optimize processes, and reduce waste, while ensuring the highest level of product protection and shelf life. By focusing on these areas, the rigid packaging industry is well-positioned to meet the evolving needs of businesses and consumers alike.

What are the key market drivers leading to the rise in the adoption of Rigid Packaging Industry?

- The increasing demand for glass packaging is the primary factor fueling market growth. With consumers increasingly preferring glass packaging due to its eco-friendliness, transparency, and preservation qualities, the market for glass packaging is experiencing significant expansion.

- Glass packaging, renowned for its durability, malleability, and non-permeability, is a preferred choice in the market. With benefits including reusability, sterility, chemical stability, and hygiene, glass is utilized extensively in various industries such as beverages, food products, pharmaceuticals, cosmetics, and more. Glass's eco-friendliness is another significant advantage, as it is infinitely recyclable. Within a month, recycled glass can be transformed into a new bottle, saving natural resources and reducing CO2 emissions.

- For instance, recycling five tons of glass results in substantial CO2 emission reductions. The market is projected to experience robust growth, with industry analysts estimating a 5% annual expansion in the coming years.

What are the market trends shaping the Rigid Packaging Industry?

- The trend in market dynamics is characterized by an increasing number of emerging markets. Emerging markets are gaining prominence in the global economic landscape.

- The market in South America is experiencing a significant surge due to the increasing demand in the food industry. This region's acceptance of the importance of rigid packaging has led manufacturers to expand their operations. The food and beverage sector is the primary driver of the market's growth. Other industries, such as personal care and home care, as well as pet food, are also contributing to the market's expansion. The consumption of packaged food and beverages is on the rise worldwide, primarily due to the expanding urban population base.

- Rapid urbanization has led to significant lifestyle changes, resulting in a burgeoning demand for convenient and hygienic packaging solutions. The market is expected to grow robustly in the coming years, reflecting the increasing importance of sustainable and efficient packaging solutions in various industries.

What challenges does the Rigid Packaging Industry face during its growth?

- The escalating demand for flexible packaging poses a significant challenge to the industry's growth trajectory.

- The market is experiencing significant growth due to shifting consumer preferences towards convenience and extended shelf life. This trend is leading to the replacement of traditional packaging formats, such as metal cans and glass jars, with more modern, flexible alternatives. Flexible packaging offers several advantages over rigid packaging, including lighter weight, improved cost economics, freight cost savings, and extended product shelf life. End-users, particularly in the packaged foods and pharmaceutical industries, are increasingly adopting multilayer flexible pack solutions with metalized films. High-barrier films, used in case-ready and modified packaging for PET-based transparent deposition films, are a key driver of market development.

- According to industry reports, the market is projected to grow by over 4% annually in the coming years, reflecting the increasing demand for these advanced packaging solutions. For instance, the use of high-barrier films in the food industry has resulted in a significant increase in the shelf life of snack foods, leading to increased sales and customer satisfaction. This trend is expected to continue, as consumers increasingly demand convenient, long-lasting packaging solutions for their food and pharmaceutical products.

Exclusive Customer Landscape

The rigid packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the rigid packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, rigid packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALPLA Werke Alwin Lehner - This company specializes in the development and distribution of innovative sports products, catering to various markets and consumer needs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALPLA Werke Alwin Lehner

- Amcor Plc

- Ardagh Group SA

- Ball Corp.

- Berry Global Inc.

- Borealis AG

- Can Corp. of America Inc.

- Crown Holdings Inc.

- Delkor Systems Inc.

- DS Smith Plc

- Gerresheimer AG

- Graham Packaging Co. LP

- KP Holding GmbH and Co. KG

- Plastipak Holdings Inc.

- Printpack Inc.

- Silgan Holdings Inc.

- Sonoco Products Co.

- TotalEnergies SE

- Vetropack

- Vidrala SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Rigid Packaging Market

- In January 2024, Amcor, a global packaging company, announced the launch of its new mono-material, recyclable PET bottle for carbonated soft drinks, marking a significant stride in sustainable rigid packaging solutions (Amcor Press Release, 2024).

- In March 2024, Ball Corporation entered into a strategic partnership with Novolex, a leading producer of plastic packaging, to expand its offerings in the flexible packaging market (Ball Corporation Press Release, 2024).

- In April 2024, Berry Global Group, a leading rigid packaging solutions provider, completed the acquisition of AEP Industries, a significant player in flexible packaging, enhancing Berry's product portfolio and expanding its market reach (Berry Global Press Release, 2024).

- In May 2025, the European Union's Single Use Plastics Directive came into full effect, mandating the use of recyclable or reusable packaging for certain products, driving increased demand for rigid packaging solutions with superior sustainability credentials (European Parliament Press Release, 2021).

Research Analyst Overview

- The market continues to evolve, with ongoing activities shaping its landscape. Waste diversion strategies, such as package design validation and material compatibility assessment, are increasingly prioritized to minimize environmental impact. Package security measures, including active packaging technologies and anti-counterfeiting technologies, are essential in various sectors to ensure product integrity and consumer trust. Transit damage reduction is another key focus, with innovations in bio-based packaging materials and polymer properties analysis. Industry growth is expected to reach 4% annually, driven by the adoption of sustainable material sourcing, consumer experience design, and product tamper evidence. For instance, a leading food company reported a 25% increase in sales by implementing recyclable packaging design and transit damage reduction strategies.

- Packaging ergonomics, supply chain traceability, and e-commerce packaging solutions are also crucial, as consumer preferences and market dynamics continue to shift. Additionally, the market is exploring intelligent packaging systems, end-of-life management, and lightweighting strategies to enhance product-packaging interaction and reduce environmental footprint. Modified atmosphere packaging and compostable packaging options are further contributing to the market's evolution, addressing the need for packaging durability testing and seal integrity verification.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Rigid Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.41% |

|

Market growth 2024-2028 |

USD 128.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.84 |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Rigid Packaging Market Research and Growth Report?

- CAGR of the Rigid Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the rigid packaging market growth of industry companies

We can help! Our analysts can customize this rigid packaging market research report to meet your requirements.