Floating Storage Regasification Unit Market Size 2025-2029

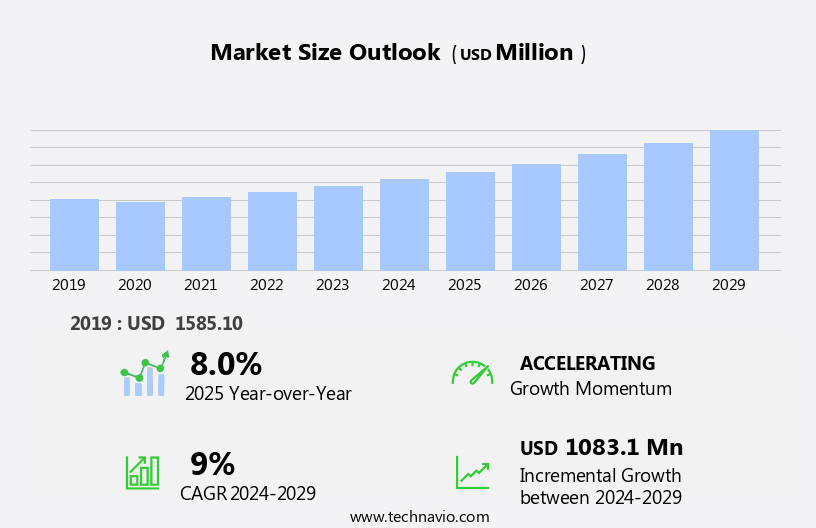

The floating storage regasification unit (FSRU) market size is forecast to increase by USD 1.08 billion at a CAGR of 9% between 2024 and 2029.

- The Floating Storage and Regasification Unit (FSRU) market is experiencing significant growth, driven by several key factors. One of the primary drivers is the cost competitiveness of FSRUs, which offers an economical solution for importing liquefied natural gas (LNG) compared to traditional pipelines. Another trend influencing the market is the stabilization of crude oil prices, making LNG a more attractive alternative for energy consumption. Furthermore, the increasing number of alternatives to traditional LNG import terminals, such as FSRUs, is contributing to the market growth. These trends are shaping the future of the global energy landscape and positioning FSRUs as a viable and flexible solution for meeting the growing energy demands.

What will be the Size of the Floating Storage Regasification Unit (FSRU) Market During the Forecast Period?

- The market has experienced significant growth due to the increasing demand for Liquefied Natural Gas (LNG) in various energy sectors, particularly in power plants and the automotive industry. The shale gas revolution in numerous regions has led to an abundance of natural gas production, driving the need for LNG as a fuel and for export. FSRUs, which convert LNG back into its gaseous state for distribution, play a crucial role in this global LNG trade. These units are typically located in seas and oceans and operate in a semi-cooled state, with temperature control essential for efficient vaporization. FSRUs are either converted LNG carriers or new-build vessels, offering flexible storage capacity solutions for markets with intermittent LNG import demand.

- Moreover, capital for installing new FSRUs and expanding existing ones continues to flow, reflecting the market's direction and the ongoing importance of LNG as a fuel source In the energy mix. The oceanic ecosystem remains a critical consideration in FSRU design and construction, ensuring minimal environmental impact.

How is this Floating Storage Regasification Unit (FSRU) Industry segmented and which is the largest segment?

The floating storage regasification unit industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Power generation

- Industrial

- Others

- Type

- Newly built

- Converted

- Capacity

- Medium (1-5 MTPA)

- Large (above 5 MTPA)

- Small (less than 1 MTPA)

- Geography

- Middle East and Africa

- Egypt

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

By End-user Insights

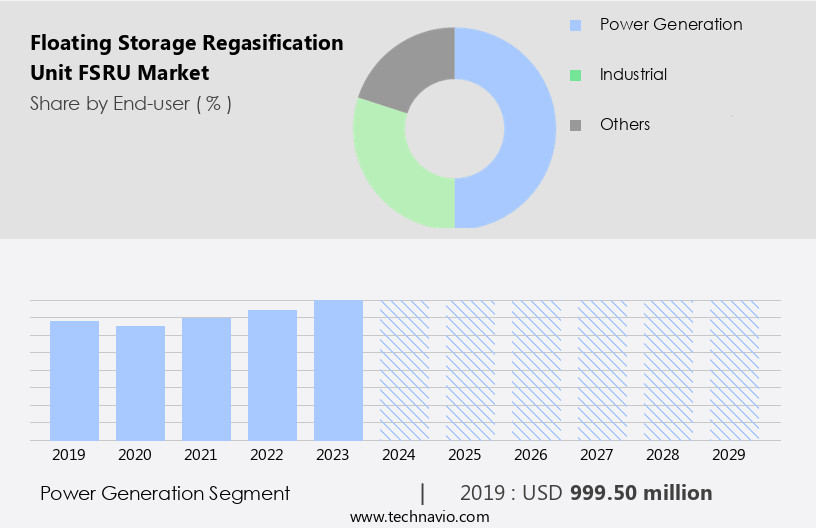

- The power generation segment is estimated to witness significant growth during the forecast period.

The Floating Storage and Regasification Unit (FSRU) market is experiencing growth due to the increasing demand for LNG imports, driven by natural gas production and the shale gas revolution. FSRUs convert liquefied natural gas (LNG) back into its gaseous state for use in power plants, the automotive sector, and industries. These units are particularly useful in locations without access to traditional pipeline networks or where pipeline infrastructure is insufficient. FSRUs operate in a semi-cooled state, using intermediate fluid vaporization and open circuit systems, which reduce environmental pollution and enable low carbon emissions. FSRUs are also used for defense purposes and In the transportation sector for fuel and energy consumption.

Get a glance at the Floating Storage Regasification Unit (FSRU) Industry report of share of various segments Request Free Sample

The power generation segment was valued at USD 999.50 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing notable growth due to strategic initiatives aimed at enhancing energy security and establishing the region as a significant energy hub. Notably, the UAE launched the first large-scale FSRU project at the Port of Fujairah in June 2024, with a regasification capacity of 2.5 million tons per annum (MTPA). This project is a pivotal step in addressing the UAE's domestic energy needs and contributing to the broader Middle Eastern market. Natural gas production, particularly from shale formations, and the shale gas revolution, have led to increased LNG imports. The power plant sector, automotive industry, and energy consumption In the transportation sector are major consumers of natural gas.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Floating Storage Regasification Unit (FSRU) Industry?

Cost competitiveness of FSRU is the key driver of the market.

- The Floating Storage and Regasification Unit (FSRU) market involves the use of specialized vessels for transporting Liquefied Natural Gas (LNG) from its production source to various regions worldwide. These vessels, which function as both a storage unit and a regasification facility, address fuel shortages and support power demands across diverse sectors. FSRUs are either docked at a port or anchored at sea, where the LNG undergoes regasification, enters the transmission network, and ultimately reaches the end user. Natural gas production, particularly from the shale gas revolution, has fueled the demand for LNG imports. Power plants and the automotive sector are significant end-users of LNG, as they seek to reduce their carbon footprint.

- In addition, FSRUs enable the conversion of LNG from its liquefied state to a gaseous form, making it easier for transportation and utilization. The maritime sector, including transportation vessels, also benefits from FSRUs as they offer quicker LNG transportation compared to traditional pipelines. However, environmental concerns related to intermediate fluid vaporization and potential hydrocarbon emissions must be addressed. FSRUs' technological flexibility, mobility, feasibility, and availability make them attractive to LNG importers In the energy, transportation, and power sectors. Despite the capital-intensive nature of FSRU installations, the global LNG trade and increasing import demand drive market growth. However, storage capacity constraints, port congestion, and geo-technical analysis are challenges that must be addressed for the continued expansion of the FSRU market.

What are the market trends shaping the Floating Storage Regasification Unit (FSRU) Industry?

Stabilization of crude oil prices is the upcoming market trend.

- The global FSRU market is experiencing growth due to the stabilization of crude oil prices in 2023. This stability has instilled confidence in governments and investors, enabling the planning and commitment to long-term LNG projects, including FSRU infrastructure. The attractive nature of LNG as a fuel source, particularly in regions where energy diversification is essential, is further boosting market growth. Europe, for instance, has seen increased investments in FSRUs to meet the rising demand for natural gas. The temperature of natural gas In the semi-cooled state during transportation in FSRUs allows for greater flexibility in energy sectors, including power plants and the automotive industry.

- Moreover, the FSRU market's growth is also driven by the availability of LNG imports, the feasibility of FSRUs for small-scale LNG imports, and the technological flexibility of FSRUs for various applications. However, challenges such as storage capacity constraints, port congestion, and geo-technical analysis remain. Despite these challenges, the market's growth is expected to continue due to the increasing demand for LNG as a low-carbon emission fuel and its role in transportation and energy sectors. The construction of new FSRU vessels and the conversion of LNG carriers into FSRUs are also contributing to the market's expansion.

What challenges does the Floating Storage Regasification Unit (FSRU) Industry face during its growth?

Growth in number of alternatives is a key challenge affecting the industry growth.

- The Floating Storage and Regasification Unit (FSRU) market is a significant component of the global LNG trade, facilitating the import and regasification of liquefied natural gas (LNG) in various sectors. FSRUs are specialized vessels that store and regasify LNG at sea, enabling the transfer of LNG to oil and gas pipeline networks, power plants, and the automotive sector. These units operate in a semi-cooled state, requiring temperature management to maintain the LNG in its liquid form. The shale gas revolution In the energy sector and increasing LNG import demand from power plant sectors and the automotive industry have led to a growing need for FSRUs.

- Furthermore, FSRUs offer several advantages, including mobility, feasibility, availability, and technological flexibility. They can be deployed near shore or offshore, using mooring systems such as special buoy systems or port-based FSRUs. FSRUs play a crucial role in addressing potential storage capacity constraints and port congestion, especially in regions with high LNG import demand. They also contribute to reducing greenhouse gas emissions by enabling the conversion of LNG carriers into floating storage units, thereby reducing the need for new FSRU vessels. However, challenges such as geo-technical analysis, environmental pollution, and production cost remain critical factors influencing the market dynamics. The FSRU market caters to the energy, transportation, and maritime sectors, providing an essential link In the global LNG value chain.

Exclusive Customer Landscape

The floating storage regasification unit market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the floating storage regasification unit market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, floating storage regasification unit (FSRU)market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

BUMI ARMADA BERHAD: The company offers floating storage regasification unit (FSRU) such as Armada TGT 1 and Armada sterling.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BW Group

- Dynagas Ltd.

- Eni SpA

- Excelerate Energy Inc.

- Exmar NV

- Flex LNG Ltd.

- Golar LNG Ltd.

- H Energy Group of Companies

- Hoegh LNG Holdings Ltd.

- Jaya Samudra Karunia Group

- Karadeniz Holding A.S.

- LNG Hrvatska d.o.o

- Mitsui and Co. Ltd.

- OLT Offshore LNG Toscana Spa

- RWE AG

- SENER GRUPO DE INGENIERIA SA

- Swan Energy Ltd.

- Teekay Corp.

- Trafigura Group Pte. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The floating storage and regasification unit (FSRU) market has experienced significant growth in recent years, driven by the increasing demand for liquefied natural gas (LNG) in various sectors. The shift towards cleaner fuel sources and the shale gas revolution have led to an increase in LNG imports, particularly In the power plant sectors and the automotive industry. FSRUs are essential infrastructure for converting LNG from its liquefied state back into a gaseous form for transportation and use. These facilities operate by vaporizing the LNG in an open circuit, which allows the gas to be transported through pipelines or used as fuel directly.

Moreover, the temperature of the gas is maintained in a semi-cooled state during the regasification process. The FSRU market dynamics are influenced by several factors. One of the primary drivers is the growing demand for gas-to-energy projects, which require a reliable and flexible source of natural gas. Intermediate fluid vaporization is an essential aspect of FSRU operations, and technological flexibility is crucial for meeting the varying demands of different industries. Environmental concerns have also played a role In the growth of the FSRU market. As the world moves towards reducing carbon emissions, LNG is seen as a cleaner alternative to traditional fossil fuels.

However, the construction and operation of FSRUs and LNG carriers can have environmental implications, particularly regarding hydrocarbon emissions and potential pollution of the oceanic ecosystem. The availability and feasibility of FSRUs are crucial factors In their adoption. LNG importers require reliable and accessible FSRUs to ensure the uninterrupted supply of natural gas. The energy, transportation, and maritime sectors have all shown an interest in FSRUs, with the potential for new FSRU vessels and converted LNG carriers to increase storage capacity and address capacity constraints. FSRUs can be located in various locations, including inshore terminals, near-shore, and offshore terminals.

In addition, mooring systems and special buoy systems are essential components of FSRU operations, ensuring the stability and safety of the facilities. Port congestion can also impact the availability and feasibility of FSRUs, making geo-technical analysis and careful planning essential. The FSRU market is influenced by several factors, including the global LNG trade and import demand, particularly In the power plant sector and automotive sector as well as offshore transportation. The cost of production and the availability of capital for installations are also crucial factors. In some cases, FSRUs may be used for defense purposes or to address artificial LNG shortages. Therefore, the FSRU market is a dynamic and evolving sector, driven by the increasing demand for natural gas in various industries. FSRUs provide a flexible and reliable solution for converting LNG from its liquefied state back into a gaseous form for transportation and use. The availability, feasibility, and environmental considerations of FSRUs are essential factors In their adoption and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 1.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

Iran, UK, Qatar, Japan, UAE, US, Egypt, Germany, South Korea, and China |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Floating Storage Regasification Unit (FSRU) Market Research and Growth Report?

- CAGR of the Floating Storage Regasification Unit (FSRU) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, APAC, Europe, North America, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the floating storage regasification unit (FSRU) market growth of industry companies

We can help! Our analysts can customize this floating storage regasification unit (FSRU) market research report to meet your requirements.