Foam-Based Beauty And Personal Care Products Market Size 2025-2029

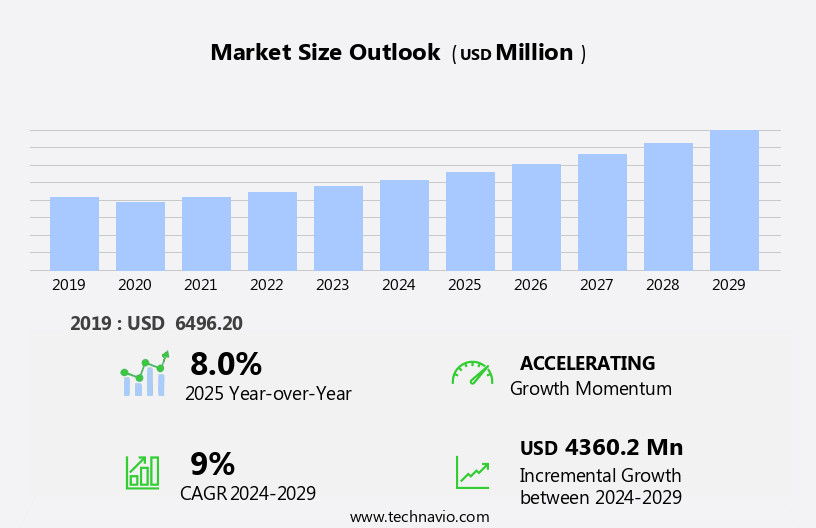

The foam-based beauty and personal care products market size is forecast to increase by USD 4.36 billion, at a CAGR of 9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of anti-pollution foam-based skincare products. This trend is a response to the rising environmental concerns and the desire for effective, innovative solutions to combat the effects of pollution on the skin. Another key driver is the growing preference for organic products, as consumers become more health-conscious and seek alternatives to products containing synthetic ingredients.

- However, the market faces challenges related to the potential adverse health effects of certain chemicals used in foam-based personal care products. Companies must navigate this issue by investing in research and development to create safer, more natural alternatives. To capitalize on market opportunities and navigate challenges effectively, businesses should focus on innovation, sustainability, and transparency, meeting the evolving demands of consumers for effective, eco-friendly, and ethically-sourced products. Skincare technology, such as AI-powered skincare and skincare devices, will help in enhancing the consumer experience in the coming years.

What will be the Size of the Foam-Based Beauty And Personal Care Products Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The foam-based beauty and personal care market encompasses a wide range of products, from anti-dandruff shampoos and volume-boosting conditioners to hair styling tools and skincare regimens. One notable trend is the increasing popularity of foam-based cleansers, such as cleansing balms and micellar water, which offer gentle yet effective cleansing for various skin types. In addition, gel nail polish and makeup sponges have gained traction due to their ease of use and long-lasting results. Hair care continues to dominate the market, with anti-frizz products, hair serums, leave-in conditioners, and hair masks being key players. Makeup enthusiasts are drawn to acrylic nails, color-safe hair dyes, and a diverse range of makeup brushes. Social media marketing is also playing a crucial role in driving market growth, as influencers and celebrities promote various men's grooming products to their followers.

- Body care products, including body scrubs, foot cream, hand cream, and body butters, cater to the growing demand for self-care and wellness. Skincare advice and tips are increasingly sought after, with an emphasis on anti-aging products, such as eye creams, neck creams, and facial oils. Hair growth products, hair straighteners, hair curlers, and hair dryers are essential tools for maintaining healthy and stylish hair. Lip gloss is another product that's in major demand. Nail care essentials, such as nail clippers, nail files, and nail buffers, complete the comprehensive foam-based beauty and personal care market landscape.

How is this Foam-Based Beauty And Personal Care Products Industry segmented?

The foam-based beauty and personal care products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Skincare

- Haircare

- Male grooming

- Others

- Price

- Mass

- Premium

- Luxury

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

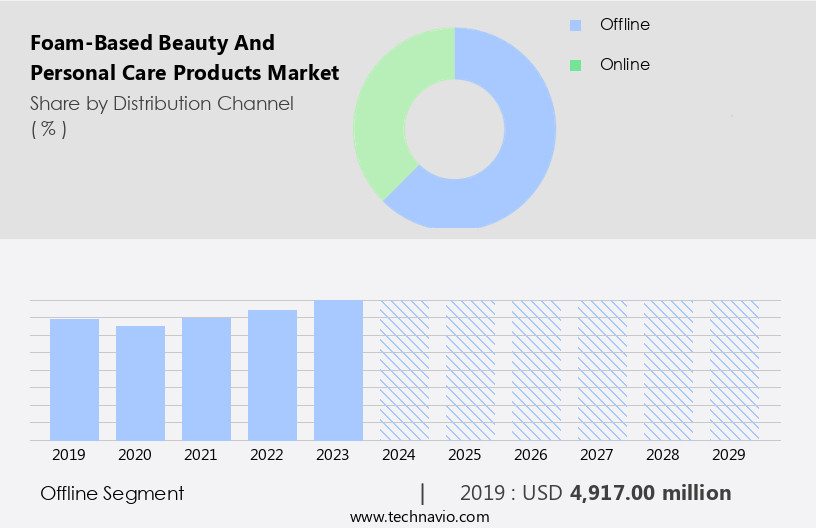

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. In the realm of foam-based beauty and personal care products, offline distribution channels have seen a gradual decline in revenue due to the increasing trend towards online shopping. Manufacturers sell their products through various retail formats, including specialty stores, hypermarkets, supermarkets, and others. However, to counteract this decline, companies are expanding their presence in local and regional markets. Skincare regimens, which encompass facial cleansers, exfoliating scrubs, and skincare ingredients like hyaluronic acid and glycolic acid, continue to dominate the market. Consumer preferences lean towards vegan and cruelty-free products, as well as those containing natural ingredients such as essential oils and plant extracts.

Quality control is paramount, with clinical testing and customer feedback playing crucial roles in ensuring product effectiveness and customer satisfaction. Beauty influencers and bloggers, as well as influencer marketing, have significantly impacted consumer behavior, driving trends in skincare apps, LED light therapy, and personalized skincare. Beauty magazines, retail distribution, and digital advertising further fuel market growth. Hair care products, including hair oils and styling products, and body washes round out the market landscape. The beauty industry events, supply chain management, and market research provide valuable insights into emerging trends and consumer preferences. Direct-to-consumer brands and subscription boxes cater to niche markets, while e-commerce sales and product reviews contribute to the convenience and accessibility of these foam-based offerings.

The Offline segment was valued at USD 4.92 billion in 2019 and showed a gradual increase during the forecast period.

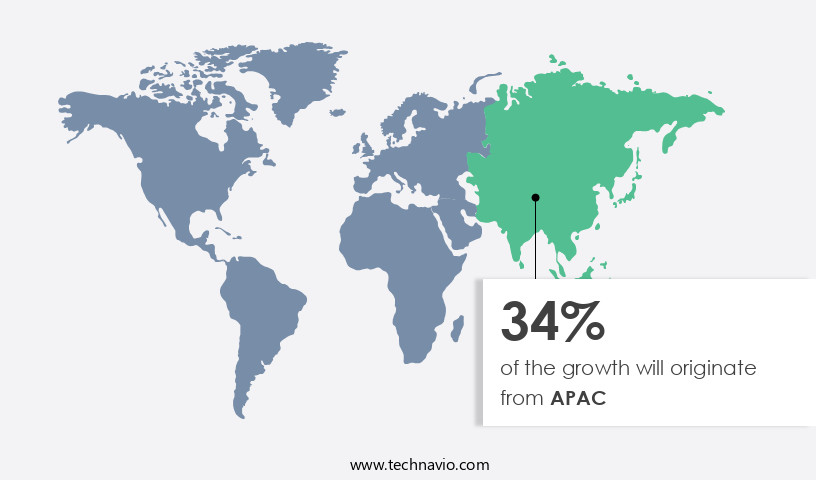

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth, driven by the introduction of innovative foam-based products, increasing consumer preference for online shopping platforms, and a rising trend towards organic options. Brand loyalty remains strong in this market, with consumers turning to beauty magazines and influencer marketing for product recommendations. Vitamin C, essential oils, and LED light therapy are popular skincare trends, while vegan and cruelty-free products continue to gain traction. Skincare apps and subscription boxes cater to personalized skincare routines, and e-commerce sales are on the rise. Skincare concerns such as oily skin, sensitive skin, and acne-prone skin are addressed through a range of foam-based cleansers, exfoliating scrubs, and hyaluronic acid-infused formulas. The e-commerce sector has played a pivotal role in the market's expansion, offering convenient access to these products.

Hair care products, including shampoos, conditioners, and hair oils, also contribute to the market's growth. The market is further fueled by advances in skincare technology, such as AI-powered skincare and skincare devices. Sustainable packaging, including recyclable and biodegradable options, is a key consideration for both consumers and brands. Despite economic challenges, the market is expected to continue growing due to the increasing demand for high-quality, effective foam-based beauty and personal care products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Foam-Based Beauty And Personal Care Products market drivers leading to the rise in the adoption of Industry?

- The increasing demand for foam-based skincare products with anti-pollution properties is the primary market trend, driven by growing consumer awareness and concerns regarding environmental pollution. The beauty industry has witnessed a notable trend towards foam-based skincare and personal care products due to their ability to address the negative effects of air pollution on the skin. With increasing concerns over indoor and outdoor air quality, consumers are seeking effective solutions to protect their skin from harmful pollutants. Skincare regimens have become a priority for individuals with various skin types, leading to brand loyalty and a growing market for these products. Beauty magazines, influencer marketing, and social media have played a significant role in promoting foam-based skincare products. Influencer marketing and skincare apps have become essential tools for consumers to discover new products and learn about the latest trends in the beauty industry.

- Quality control and consumer insights are crucial factors driving the growth of the foam-based skincare market. Brands are focusing on offering vegan products, vitamin C, essential oils, and other natural ingredients to cater to the evolving needs of consumers. Moreover, the beauty industry is embracing technology, with LED light therapy and other advanced skincare treatments gaining popularity. Effective supply chain management and innovation are also key factors contributing to the growth of the market. Brands that prioritize quality, innovation, and consumer insights will thrive in this market.

What are the Foam-Based Beauty And Personal Care Products market trends shaping the Industry?

- The increasing preference for organic products represents a significant market trend. This trend reflects consumers' growing awareness and demand for healthier, more sustainable food options. The market for foam-based beauty and personal care products, specifically those focused on hair care, is experiencing a shift towards natural and organic alternatives. Consumers are increasingly aware of the potential health concerns associated with synthetic foam-based products, including skin irritations, allergies, and long-term health effects. In response, the demand for foam-based products made with natural ingredients, such as plant extracts and essential oils, is on the rise. Organic foam-based hair care products contain natural and organic ingredients, including aloe vera, sea salt, charcoal, coconut oil, shea butter, mango seed butter, cocoa seed butter, lanolin, jojoba seed oil, apricot kernel oil, beeswax, almond oil, coconut oil, and avocado oil.

- These ingredients offer numerous benefits, such as nourishing and moisturizing the hair and scalp, without the harmful side effects of synthetic chemicals. Facial cleansers, hair oils, exfoliating scrubs, and other foam-based personal care products are also seeing a trend towards natural and organic formulations. Retail distribution channels, including online beauty retailers, are responding to this trend by increasing their offerings of natural and organic foam-based products. Digital advertising and social media are also playing a significant role in promoting these products to consumers. Cruelty-free and eco-friendly production methods are also important considerations for consumers in the foam-based beauty and personal care market. Clinical testing and the use of natural ingredients, such as hyaluronic acid and facial massagers, are also popular trends in this market. Subscription boxes and customized product offerings are also gaining popularity, allowing consumers to try a variety of natural and organic foam-based products tailored to their skin tone and specific concerns, such as oily skin or combination skin.

How does Foam-Based Beauty and Personal Care Products market face challenges during its growth?

- Adverse health effects from chemical or synthetic ingredients in foam-based beauty and personal care products poses a significant challenge to the industry's growth trajectory. It is crucial for companies to address this concern by investing in research and development of alternative, safer ingredients to maintain consumer trust and ensure long-term success in the market. The market is experiencing significant growth due to increasing consumer awareness regarding the potential health risks associated with synthetic ingredients. Harmful chemicals, such as ammonia, peroxides, p-phenylenediamine, diaminobenzene, toluene-2,5-diamine, and resorcinol, are commonly found in these products and can cause various skin and hair issues. These chemicals may lead to skin irritation, allergies, hair dryness, hair fall, immunotoxicity, chemical burns, blisters, hair breakage, and even cancer. For instance, ammonia, which is commonly used in shaving foam, can cause dry, brittle, and unhealthy skin, as well as respiratory and eye irritations.

- To cater to the growing demand for safer alternatives, the market is witnessing a shift towards natural ingredients, such as glycolic acid, which is derived from sugarcane. This trend is particularly strong among consumers with sensitive skin and those who are acne-prone. Furthermore, customer feedback and customer service are crucial factors influencing market growth, with e-commerce sales and product reviews playing a significant role in shaping consumer preferences. Beauty blogs and social media marketing are also driving demand for foam-based beauty and personal care products, as they provide a platform for consumers to share their experiences and connect with brands.

Exclusive Customer Landscape

The foam-based beauty and personal care products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the foam-based beauty and personal care products market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, foam-based beauty and personal care products market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AMOREPACIFIC Group Inc. - This company specializes in the production and distribution of high-quality foam-based beauty and personal care solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMOREPACIFIC Group Inc.

- Amway Corp.

- Beiersdorf AG

- Chanel Ltd.

- Chatters GP Inc.

- Colgate Palmolive Co.

- Coty Inc.

- Dr. Babor GmbH and Co. KG

- Essity AB

- Groupe Clarins

- Henkel AG and Co. KGaA

- Johnson and Johnson Services Inc.

- Kao Corp.

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- Oriflame Cosmetics S.A.

- The Avon Co.

- The Estee Lauder Co. Inc.

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Foam-Based Beauty And Personal Care Products Market

- In February 2023, L'Oréal, the global cosmetics leader, announced the launch of a new shaving foam product, Foam Shower Cream, under its men's grooming brand, Grooming Club (L'Oréal press release, 2023). This innovative foam-based offering combines the benefits of a shaving cream and a shower gel, catering to the evolving consumer preference for multifunctional personal care products.

- In March 2024, Unilever, a leading consumer goods company, entered into a strategic partnership with Clariant, a specialty chemical company, to develop sustainable, bio-based foams for their beauty and personal care products (Unilever press release, 2024). This collaboration aligns with the increasing demand for eco-friendly and sustainable products, positioning both companies at the forefront of the industry's green transformation.

- In May 2024, Kao Corporation, a Japanese personal care company, completed the acquisition of P&G's beauty business, including its prestige and mass beauty brands, for approximately USD10.5 billion (Reuters, 2024). This deal significantly expanded Kao's global market presence and product portfolio, making it a major player in the market.

- In January 2025, Procter & Gamble (P&G) received approval from the U.S. Food and Drug Administration (FDA) for its new foam-based hand sanitizer, Sanicare Foam Sanitizer (P&G press release, 2025). This approval came in response to the heightened demand for effective and convenient hand sanitizers during the COVID-19 pandemic, making P&G's foam-based offering a significant addition to the market.

Research Analyst Overview

The market continues to evolve, with dynamic market trends shaping its growth across various sectors. Ingredient sourcing is a critical factor, with consumers demanding natural, vegan, and cruelty-free options. Brand loyalty is influenced by skincare regimens tailored to individual skin types, such as sensitive, oily, or combination skin. Beauty magazines and influencers play a significant role in shaping consumer preferences, promoting the latest trends and ingredients like glycolic acid, vitamin C, and salicylic acid. Customer feedback and service are essential for maintaining brand reputation, with e-commerce sales and product reviews driving market growth.

Cosmetics manufacturing adheres to clinical testing and quality control standards to meet consumer demands for effective and safe products. Innovations in skincare technology include AI-powered skincare, led light therapy, and personalized skincare solutions. Beauty blogs and social media marketing are essential channels for reaching consumers, with influencer marketing and content marketing strategies driving engagement. The body care segment includes shower gels, bath bombs, and hair care products, with an increasing focus on natural ingredients, recyclable and biodegradable packaging, and sustainable supply chain management. Consumer insights continue to shape market trends, with a growing emphasis on skincare concerns, such as acne-prone skin and aging skin.

The Foam-Based Beauty And Personal Care Products Market is expanding with innovative formulations tailored to diverse skin types and skin concerns. Products designed for mature skin enhance hydration and elasticity, integrating well into a personalized skincare regimen and skincare routine. Trending beauty trends focus on sustainable solutions like recyclable packaging and aesthetic packaging design. Essential items such as cleansing balm, eye cream, and neck cream boost skincare effectiveness, alongside volume-boosting products for hair care. Color-safe products ensure longevity for treated hair, complemented by advanced hair straightening irons and hair curling irons. Foam-based makeup remover enhances ease of application, aligning with expert skincare tips.

Market research plays a crucial role in understanding evolving consumer preferences and market dynamics, with a focus on sustainability, innovation, and customer experience. The beauty industry events provide a platform for showcasing new products and technologies, fostering collaboration and knowledge sharing among industry players.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Foam-Based Beauty and Personal Care Products Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 4.36 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Germany, UK, India, France, Japan, Canada, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Foam-Based Beauty And Personal Care Products Market Research and Growth Report?

- CAGR of the Foam-Based Beauty And Personal Care Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the foam-based beauty and personal care products market growth of industry companies

We can help! Our analysts can customize this foam-based beauty and personal care products market research report to meet your requirements.