Skincare Devices Market Size 2025-2029

The skincare devices market size is forecast to increase by USD 12.42 billion, at a CAGR of 12.7% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The rising prevalence of skin disorders, such as acne, aging, and hyperpigmentation, is driving the demand for effective skincare solutions. Moreover, the introduction of new, advanced devices, including LED light therapy and micro-needling tools, is attracting a large consumer base. However, the high cost of these advanced devices may limit the market growth for some consumers. Despite this challenge, the market is expected to continue its upward trajectory, providing ample opportunities for manufacturers and suppliers.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a wide range of treatments and products designed to enhance and improve the overall health and appearance of the skin. Two prominent areas of focus within this market are skin rejuvenation and the removal of various lesions. Skin rejuvenation treatments, such as wrinkle reduction and skin texture improvement, aim to restore a more youthful and radiant complexion. These treatments often include dermatological procedures, like laser skin resurfacing and non-surgical facelifts, which can provide significant results. Another area of demand in the skincare market is the removal of vascular lesions and moles. These conditions can cause cosmetic concerns and, in some cases, may indicate underlying health issues. Dermatologists play a crucial role in addressing these concerns, offering expert advice and various treatment options. Skin health is a primary concern for many individuals, leading to the growth of a diverse skincare industry. This industry caters to various segments, including affordable dermatology, cosmetic dermatology, and luxury skincare.

- Skincare routines have become increasingly popular, with a focus on skin hydration, barrier repair, and sun damage repair. Skincare trends continue to evolve, with an emphasis on natural and organic ingredients, as well as advanced skincare technology. Anti-aging treatments remain a significant category, with a growing interest in anti-aging skincare science and the development of effective ingredients and delivery systems. The market also addresses various skin disorders, offering solutions for skin allergies, irritation, sensitivity, and cancer screening. The best skincare products cater to the unique needs of different skin types and concerns, ensuring optimal results. As the skincare industry continues to grow, it is essential to prioritize skin health and consult with professionals, such as dermatologists, for personalized advice and treatment options. Skincare tips and trends can provide valuable insights, while online stores offer convenient access to a wide range of skincare solutions.

How is this market segmented and which is the largest segment?

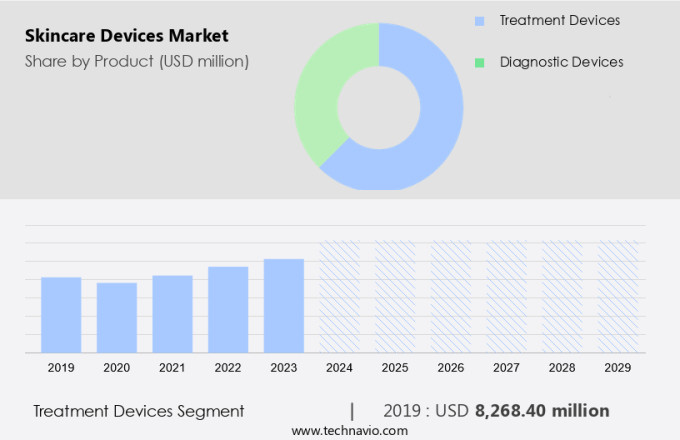

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Treatment devices

- Diagnostic devices

- End-user

- Dermatological clinics

- Hospitals

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- South America

- Brazil

- Middle East and Africa

- North America

By Product Insights

- The treatment devices segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of treatment solutions, primarily focusing on devices used for therapeutic applications. These devices cater to diverse skin conditions and aesthetic concerns. Notable categories include light therapy devices, laser devices, microdermabrasion tools, cryotherapy devices, and ultrasound devices. Light therapy devices, in particular, have gained popularity due to their therapeutic benefits in treating conditions such as acne, eczema, and signs of ageing. Utilizing specific wavelengths of light, these devices penetrate the skin and stimulate cellular processes, enhancing skin health and appearance.

Get a glance at the market report of share of various segments Request Free Sample

The Treatment devices segment was valued at USD 8.27 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

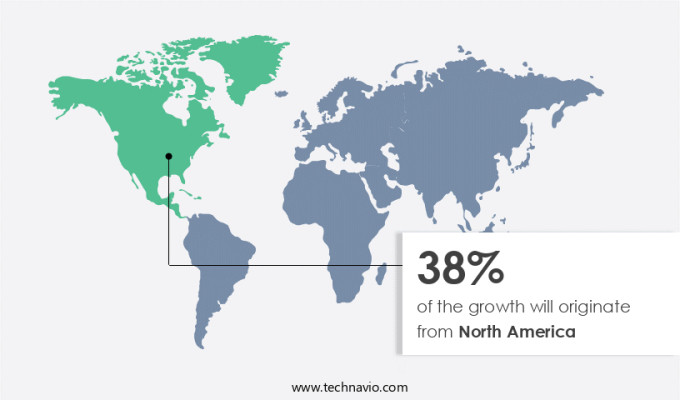

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is significantly driven by the high prevalence of acne and an aging population. In the United States, acne affects approximately 50 million individuals annually, making it the most common skin condition. In Canada, the figure stands at around 5.5 million people. This substantial demand for effective skincare treatments and devices is a key growth factor. Additionally, the aging population in the US is projected to increase by 47% to around 80 million by 2050. This demographic shift presents a significant opportunity for skincare devices that address aging concerns. The market's growth is further fueled by advancements in technology, enabling devices for early diagnosis of skin conditions such as melanoma, and non-invasive fat removal treatments.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the market?

The rising prevalence of skin disorders is the key driver of the market.

- The market is experiencing significant growth due to the increasing prevalence of various cosmetic skin conditions and skin diseases. According to the National Psoriasis Foundation, psoriasis, a chronic autoimmune condition, affects over 8 million individuals in the US. This condition necessitates effective diagnostic and treatment devices, driving demand for advanced skincare solutions. Furthermore, atopic dermatitis, a common form of eczema, impacts approximately 18 million people in the US, with about one-third of these individuals suffering from moderate-to-severe forms. This highlights the need for advanced skincare devices to manage symptoms and improve quality of life. In addition, the market is witnessing increasing demand for non-invasive fat reduction, body contouring, and skin rejuvenation devices.

- These devices offer aesthetic appeal and address concerns related to aging and weight management. Moreover, the rise in skin cancer cases, particularly melanoma, has led to a growing demand for diagnostic devices for early detection and treatment. The market for skincare devices also includes treatments for vascular lesions, pigmented lesions, acne, and hair removal. Technologies such as LED therapy, radiofrequency devices, and ultrasound devices are increasingly popular for skin health and rejuvenation. Furthermore, the aging population and increasing awareness of skin health are expected to fuel market growth. At-home skincare devices are also gaining popularity, offering convenience and affordability for consumers.

- These devices include facial cleansing devices, microdermabrasion devices, and LED therapy devices. Non-invasive cosmetic procedures, such as cellulite reduction and tattoo removal, are also driving market growth. Overall, the market is expected to continue growing due to the increasing prevalence of skin disorders, the rising demand for non-invasive cosmetic procedures, and the growing awareness of skin health. Diagnostic devices, treatment devices, and hair removal devices are expected to remain key areas of focus in the market.

What are the market trends shaping the market?

The introduction of new products is the upcoming trend in the market.

- The market is experiencing notable growth due to the increasing demand for non-invasive cosmetic procedures. Dermatologists and consumers alike are turning to advanced technology-driven devices for the treatment of various skin concerns, including acne, pigmented lesions, vascular disorders, and body contouring. These devices offer solutions for early diagnosis and treatment of skin diseases, such as melanoma, and address cosmetic skin conditions like cellulite reduction and hair removal. Lumenis Be Ltd., a leading energy-based medical device company, recently introduced OptiPLUS, a dual-frequency radiofrequency device. FDA-cleared, this innovative device combines RF technology with the existing OptiLIGHT technology for dry eye treatment, offering enhanced peri-orbital rejuvenation.

- OptiPLUS delivers heat at varying tissue depths, promoting collagen formation, improving meibomian gland function, and rejuvenating the skin around the eyes. Additionally, it caters to skin health concerns, such as skin aging, eczema, and skin cancer, through skin rejuvenation treatments, photo rejuvenation, and medical diagnostics devices. The market for skincare devices is further fueled by the development of at-home devices, enabling consumers to access professional-grade treatments in the comfort of their homes. These devices include facial cleansing devices, LED therapy for skin acne and rejuvenation, and microdermabrasion and ultrasound devices for skin tightening. Furthermore, the growing aging population and increasing awareness of skin health are expected to contribute significantly to the market's growth.

What challenges does the market face during the growth?

The high cost of advanced devices is a key challenge affecting the market growth.

- The market encompasses a range of technologies designed to enhance aesthetic appeal and address various cosmetic skin conditions, including fat removal, vascular lesions, acne, pigmented lesions, and skin rejuvenation. Dermatologists utilize advanced treatment devices for early diagnosis and treatment of skin diseases, such as melanoma and eczema. Non-invasive fat reduction techniques, like radiofrequency devices and ultrasound devices, are increasingly popular for body contouring and cellulite reduction. Moreover, skincare devices offer solutions for skin health concerns related to aging, such as skin tightening and photo rejuvenation. Technological advancements, including LED therapy and Skintel technology, contribute to the market's growth. Hair removal devices and diagnostic devices, like those used for tattoo removal and vascular lesion detection, further expand the market's scope.

- Artificial intelligence integration in skincare devices is a recent trend, offering personalized treatment plans and improved diagnostic accuracy. At-home skincare devices cater to consumers seeking convenient, cost-effective alternatives to professional treatments. However, the high cost of professional-grade devices remains a significant challenge, limiting access for smaller clinics and individual practitioners. In summary, the market presents opportunities for growth, driven by the increasing demand for non-invasive cosmetic procedures and advanced technologies. Despite the high investment required for professional-grade devices, the market continues to evolve, addressing various skin health concerns and enhancing overall aesthetic appeal.

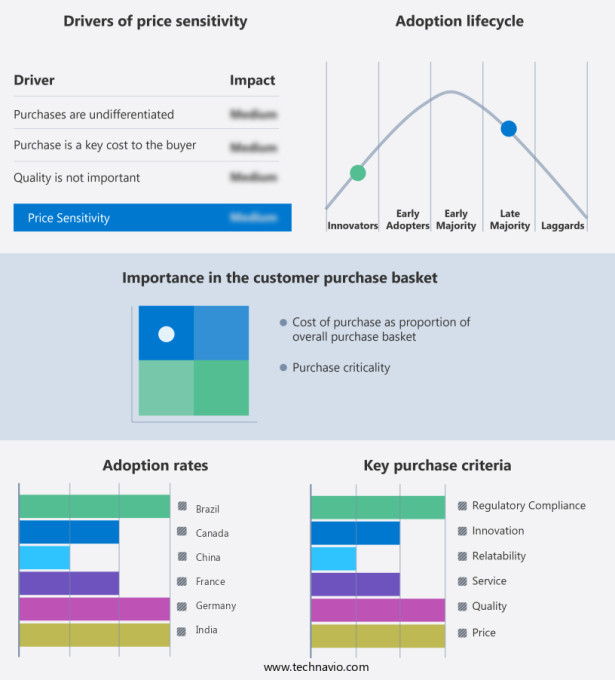

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Beurer GmbH - The company offers skincare devices such as facial brushes, microdermabrasion tools, and facial saunas.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bioderma Laboratories

- bluemercury

- Candela Corp.

- Carol Cole Co. Inc.

- Cynosure LLC

- Dermaroller GmbH

- FOREO AB

- Koninklijke Philips NV

- Laboratoire HRA Pharma SAS

- LightStim

- LOreal SA

- Lumenis Be Ltd.

- mesoestetic

- Obagi Cosmeceuticals LLC

- Panasonic Holdings Corp.

- Shiseido Co. Ltd.

- The Beauty Tech Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of technological innovations designed to address various cosmetic concerns, from skin rejuvenation and acne treatment to body contouring and hair removal. This market caters to both professional dermatology settings and at-home use, catering to the growing demand for non-invasive cosmetic procedures. Aesthetic appeal is a significant factor driving the market. Consumers seek to enhance their appearance, and these devices offer accessible, convenient, and often more affordable alternatives to traditional surgical procedures. Skincare devices can improve the overall health and appearance of the skin, addressing concerns such as vascular lesions, pigmented lesions, and skin diseases. Non-invasive fat reduction and body contouring devices have gained significant traction in recent years. These devices utilize various technologies, including radiofrequency and ultrasound, to target and eliminate fat cells, resulting in a more sculpted appearance. This trend is particularly popular among individuals who are health-conscious but not ready for surgical procedures like liposuction.

Skin rejuvenation and anti-aging treatments are another major segment of the market. As the global population ages, the demand for products and treatments that can help maintain a youthful appearance continues to grow. Devices that utilize LED therapy, microdermabrasion, and other advanced technologies can effectively address signs of aging, such as fine lines, wrinkles, and uneven skin tone. Skin health diagnostics and early disease detection are also important applications for skincare devices. With the increasing prevalence of skin cancer, particularly melanoma, there is a growing need for tools that can help identify potential issues early on. Dermatologists and other healthcare professionals rely on diagnostic devices to assess the severity of various skin conditions and develop appropriate treatment plans. Artificial intelligence (AI) is increasingly being integrated into skincare devices to enhance their functionality and accuracy.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.7% |

|

Market Growth 2025-2029 |

USD 12.42 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.4 |

|

Key countries |

US, China, Germany, Japan, France, UK, Canada, India, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch