Gas Compressors Market Size 2025-2029

The gas compressors market size is forecast to increase by USD 2.88 billion at a CAGR of 5.2% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing demand for energy-efficient compressor systems. The global energy landscape is shifting towards cleaner and more sustainable energy sources, leading companies to invest in advanced compressor technologies that offer improved efficiency and reduced emissions. Furthermore, strategic alliances and collaborations among key players are shaping the market's competitive landscape, with companies seeking to expand their product offerings and geographical reach. The construction sector also relies heavily on compressors for various applications, further expanding the market's reach.

- However, resistance to new technology adoption poses a challenge for market growth. Older compressor systems continue to operate in various industries, particularly in developing economies, due to their lower upfront costs. To capitalize on market opportunities and navigate challenges effectively, companies must focus on developing innovative compressor technologies that offer superior efficiency and environmental performance while also addressing cost concerns. Additionally, targeted marketing efforts and educational initiatives can help overcome resistance to new technology adoption and expand the market's customer base. Overall, the market presents significant growth potential for companies that can successfully address the market's key drivers, trends, and challenges.

What will be the Size of the Gas Compressors Market during the forecast period?

- The global gas compressor market is experiencing robust growth due to increasing gas demand and the expansion of gas infrastructure. Compressor units play a crucial role in the production, storage, and transportation of various gases, including hydrocarbons and cleaner energy sources. The market encompasses a diverse range of compressor types, including reciprocating, centrifugal, and screw compressors, catering to various industrial processes and applications. Carbon emissions remain a significant concern, driving the adoption of more efficient compressor technologies and improved materials. Advanced control systems enable better energy management and reduced emissions. After-sales services have become essential for maintaining customer relationships and ensuring optimal compressor performance.

- Gas production and storage projects continue to proliferate, creating new opportunities for compressor deployment. The transition towards cleaner energy sources is expected to fuel additional demand for gas compressors in the coming years. Despite these positive trends, the market faces challenges related to regulatory compliance and the need for continuous innovation to meet evolving customer needs.

How is this Gas Compressors Industry segmented?

The gas compressors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- PD compressors

- Roller crushers

- End-user

- Oil and gas

- Power generation

- Chemicals and petrochemicals

- Mining

- Others

- Technology

- Reciprocating

- Rotary screw

- Centrifugal

- Axial

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South America

- APAC

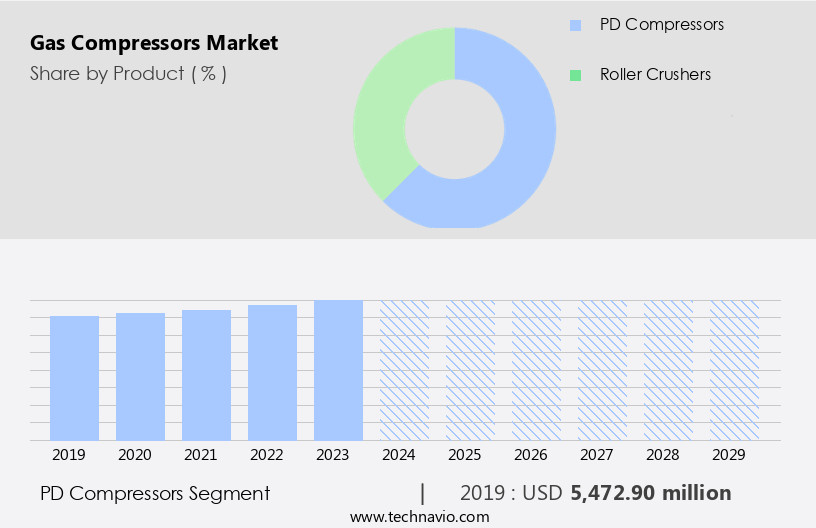

By Product Insights

The PD compressors segment is estimated to witness significant growth during the forecast period. The market is driven by expanding industrial activities and rising infrastructure investments, particularly in the midstream sector. Positive displacement (PD) compressors, including reciprocating piston, rotary screw, and rotary vane compressors, dominate the market due to their efficiency in compressing gases. PD compressors function by capturing a certain volume of gas in a chamber and then reducing the chamber size to compress the gas. Operational efficiency, product quality, and customer relationships are key focus areas for market players. After-sales services, such as maintenance, repair, and spare parts supply, are essential for enhancing customer base and ensuring long-term customer relationships.

Technological advancements, including improved materials, IoT integration, and dynamic compressors with variable speed drives, are crucial for increasing compressor efficiency and reducing carbon emissions. Environmental awareness and stringent regulatory standards necessitate the deployment of cleaner energy sources and net-zero emissions solutions. The market is further influenced by pipeline network expansion, LNG projects, and storage capacity investments.

Get a glance at the market report of share of various segments Request Free Sample

The PD compressors segment was valued at USD 5.47 billion in 2019 and showed a gradual increase during the forecast period.

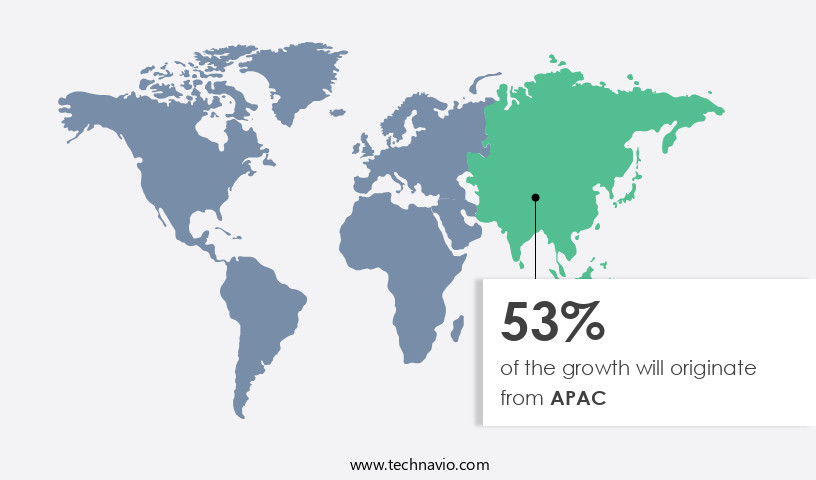

Regional Analysis

APAC is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is projected to dominate the global landscape due to significant investments in natural gas infrastructure, particularly in China. With over 31 tcm of technically recoverable shale gas resources, China is a major contributor to the market's revenue growth. The country's commitment to invest around USD160 billion in shale oil development and USD 33 billion in future projects presents lucrative opportunities for both domestic and foreign investors. The expanding industrial activities and exploration efforts in the region are driving the demand for compressor units, compressor trains, and dynamic compressors in various industrial processes and power generation.

Compressor designs continue to evolve with improved materials, enhanced sealing mechanisms, and technological advancements to ensure operational efficiency, energy efficiency, and reduced carbon emissions. The midstream sector's pipeline network expansion and replacement projects, LNG projects, and polypropylene plant construction are significant contributors to the market's growth. Strategic partnerships, IoT integration, and regulatory standards are key factors shaping the market dynamics. The market's focus on sustainability and net-zero emissions is driving the demand for cleaner energy sources and carbon capture, utilization, and storage units.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gas Compressors Industry?

- An increasing need for energy-efficient gas compressor systems is the key driver of the market. The oil and gas industry is prioritizing energy efficiency and emissions reduction, driving the demand for advanced compressor technologies. Regulatory bodies in Europe and North America are implementing regulations to ensure industrial equipment, including compressors, adhere to regional standards. The high electricity consumption of compressors, which accounts for approximately 70% of their total lifetime costs, is a significant factor influencing their adoption.

- With nearly eight horsepower of electricity required to produce one horsepower of compressed gas, energy efficiency is a crucial consideration in the compressor market. This trend underscores the importance of implementing energy-efficient compressors to minimize electricity consumption and reduce overall costs.

What are the market trends shaping the Gas Compressors Industry?

- An increasing strategic alliances among companies is the upcoming market trend. In the dynamic compressor market, companies recognize the significance of strategic mergers and acquisitions to expand their offerings and enter new markets. This approach enables manufacturers to provide their customers with comprehensive, dependable, and technologically advanced products and services. However, the compressor industry confronts increasing technological and strategic demands, as well as the need for effective after-sales services. To maintain market growth and enhance competitive advantages, consolidation becomes essential.

- For instance, Hitachi's acquisition of Northern California Distributor General Air Compressors in November 2023 is a strategic move to differentiate products and boost profit margins. Mergers and acquisitions play a crucial role in helping market players adapt to evolving market conditions and stay competitive.

What challenges does the Gas Compressors Industry face during its growth?

- The resistance to new technology adoption is a key challenge affecting the industry growth. Gas compressors play a vital role in the oil and gas industry, providing essential pressure increases for various applications. The total cost of owning and operating a gas compressor over a 10-year period is approximately composed of three main components: electricity consumption (74%), equipment cost (12%), and maintenance expenses (14%).

- The escalating raw material prices and labor costs have significantly influenced the manufacturing cost of these compressors, leading to an increase in their overall lifecycle cost. This trend underscores the importance of energy efficiency and cost-effective maintenance strategies for gas compressor users in the oil and gas sector.

Exclusive Customer Landscape

The gas compressors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gas compressors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gas compressors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accudyne Systems Inc.: The company offers gas compressors system which has high efficiency that deliver consistently high performance in the critical industries and serve environments with flow control systems for oil and gas industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accudyne Systems Inc.

- Aerzener Maschinenfabrik GmbH

- Atlas Copco AB

- BAUER COMPRESSORS INC

- BOGE

- Burckhardt Compression

- Ebara Corp.

- Elgi Equipments Ltd

- Gardner Denver

- General Electric Co.

- Hitachi Ltd.

- IDEX Corp.

- Ingersoll Rand Inc.

- J.P Sauer and Sohn Maschinenbau GmbH

- KAESER KOMPRESSOREN SE

- Kobe Steel Ltd.

- Mitsubishi Heavy Industries Ltd.

- Siemens AG

- Sulzer Ltd.

- The Procter and Gamble Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The global compressor market encompasses a wide range of mechanical devices employed in various industries to compress gases for diverse applications. Compressors play a crucial role in enhancing operational efficiency, reducing energy consumption, and addressing environmental concerns in numerous sectors. As industrial activities expand and cleaner energy sources gain prominence, the demand for compressors is on the rise. This trend is particularly noticeable in the midstream sector, where compressor trains are essential for gas transportation and storage. The increasing focus on net-zero emissions and stringent environmental regulations is driving the adoption of more efficient compressor designs and enhanced sealing mechanisms.

The gas compressor market is witnessing significant technological advancements, with dynamic compressors and variable speed drives gaining popularity due to their energy efficiency and flexibility. These compressors enable better control over pressure and flow rates, contributing to overall system efficiency and reducing pressure losses. The expanding industrial activities in various sectors, including manufacturing, power generation, and oil and gas, are leading to increased demand for compressors. In the oil and gas industry, compressors are used for gas production, exploration efforts, and natural gas transportation. Offshore gas fields and LNG projects require specialized compressor units, such as nitrogen gas compressors, to ensure the safe and efficient production and transportation of natural gas.

The midstream sector is undergoing significant infrastructure investments to expand pipeline networks and replace aging infrastructure. These projects necessitate the deployment of compressor trains to maintain the required pressure and transport capacity. In addition, the increasing demand for cleaner energy sources and the energy transition plan is driving the development of renewable energy projects, which in turn is leading to the deployment of compressors for liquefaction capacity and power generation. The customer base for compressors is diverse, ranging from general manufacturing industries to specific applications such as polypropylene plants. Customer relationships are crucial in this market, as the reliability and performance of compressors can significantly impact the productivity and profitability of industrial processes.

The compressor market is also witnessing product diversification, with manufacturers focusing on sustainable products and improved materials to cater to the growing environmental awareness. Strategic partnerships and collaborations are becoming increasingly common to facilitate research and development and to address the evolving market dynamics. The market for compressors is influenced by various factors, including natural gas prices, regulatory standards, and technological innovation. The increasing focus on energy efficiency and transport efficiency is driving the adoption of advanced control systems and IoT integration to optimize compressor performance and reduce energy consumption. In summary, the compressor market is a dynamic and evolving landscape, driven by the expanding industrial activities, the energy transition plan, and the growing focus on environmental sustainability. The market is witnessing significant technological advancements, with compressor designs becoming more efficient and sustainable to meet the evolving needs of various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 2.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

US, China, Japan, India, UK, South Korea, Germany, Canada, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gas Compressors Market Research and Growth Report?

- CAGR of the Gas Compressors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gas compressors market growth of industry companies

We can help! Our analysts can customize this gas compressors market research report to meet your requirements.