Shale Gas Market Size 2025-2029

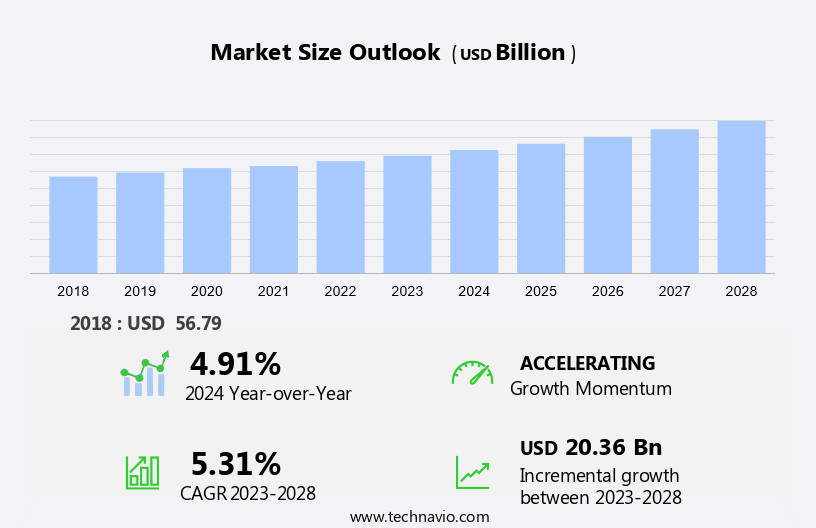

The shale gas market size is forecast to increase by USD 22.1 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of green fracking methods. This eco-friendly approach to extracting shale gas reduces the environmental impact compared to traditional methods, making it an attractive alternative for energy companies. However, the market faces a substantial challenge in the form of water scarcity for fracking operations. The extraction process requires large volumes of water, and the availability of this resource is becoming increasingly limited in certain regions. Fossil fuels, including oil and natural gas, remain the primary fuel sources, but the energy transition towards renewable energy sources is gaining momentum.

- This dynamic market requires strategic planning and innovation from companies to capitalize on the opportunities presented by green fracking while mitigating the challenges associated with water scarcity. Companies must address this issue by implementing water recycling and conservation techniques or exploring alternative water sources to ensure the sustainability of their operations and maintain competitiveness in the market. Gas-fired power plants and enhanced gas recovery techniques offer solutions for energy independence and reduced greenhouse gas emissions.

What will be the Size of the Shale Gas Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technologies and the ongoing pursuit of energy security. Hydraulic fracturing, or fracking, has revolutionized the extraction of natural gas from shale formations, leading to a rise in production. However, the intricacies of shale reservoirs require a multidisciplinary approach, encompassing natural gas storage, pipeline infrastructure, well completion, and gas transportation. For instance, accurate stress field characterization and gas flow modeling are crucial for optimizing well completion and ensuring economic viability. Geomechanical modeling and rock mechanics help assess the integrity of wells and prevent formation damage mechanisms. Proppant selection, well testing procedures, and horizontal drilling are essential for maximizing production.

Moreover, environmental impact assessment and produced water treatment are vital components of the shale gas value chain. Induced seismicity, a concern for some, is being addressed through advancements in frac fluid chemistry, microseismic monitoring, and well integrity management. The shale gas industry anticipates robust growth, with expectations of a 5% compound annual growth rate over the next decade. This expansion will necessitate the development of gas processing technologies, such as pressure transient analysis and water management, to ensure flow assurance and reduce methane emissions. Additionally, the increasing importance of liquefied natural gas in the global energy landscape will further shape the market dynamics.

How is this Shale Gas Industry segmented?

The shale gas industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Horizontal fracking

- Vertical fracking

- Rotary fracking

- Application

- Industrial

- Buildings

- Transportation

- Type

- Direct channel

- Indirect channel

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

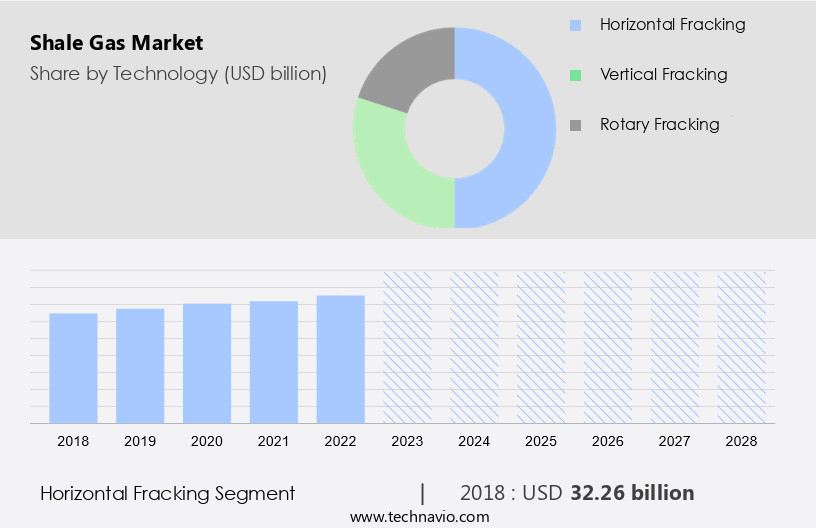

By Technology Insights

The Horizontal fracking segment is estimated to witness significant growth during the forecast period. Shale gas production in the US has seen significant advancements in recent years, driven by the adoption of horizontal drilling and hydraulic fracturing techniques. Horizontal fracking increases the contact area between the wellbore and the shale rock, enabling more efficient gas extraction and higher production rates. This results in greater gas recovery compared to vertical drilling, making shale gas production economically viable despite higher initial costs. The success of shale gas production is underpinned by various technological advancements. Stress field characterization and geomechanical modeling help optimize well completion and drilling processes. Gas flow modeling and reservoir simulation enable better understanding of reservoir behavior and production forecasting. The transition towards renewable energy and green hydrogen production is gaining momentum, with hydrogen derived from natural gas, known as blue hydrogen, being a significant interim step.

Gas compression, frac fluid chemistry, and produced water treatment technologies ensure efficient gas processing and environmental sustainability. Moreover, horizontal drilling and hydraulic fracturing have led to the discovery and extraction of vast shale gas resources from extensive and low-permeability formations. For instance, the Marcellus Shale formation in the Appalachian Basin now accounts for over 40% of US shale gas production. Industry experts anticipate that shale gas production will continue to grow, with estimates suggesting it could account for over 50% of total US natural gas production by 2030. However, shale gas production faces challenges, including environmental concerns, induced seismicity, and the need for effective water management.

Offshore drilling and subsea production are further expanding the industry's reach, with drilling services playing a pivotal role in accessing these resources. Addressing these challenges through innovative technologies and best practices is crucial for the long-term sustainability and growth of the shale gas industry.

The Horizontal fracking segment was valued at USD 33.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 27% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, with the Asia-Pacific region playing a pivotal role in its trajectory. Governments in this region are implementing regulatory frameworks and infrastructure development plans to support unconventional gas exploration and production. This shift is driven by the need for energy diversification and to reduce reliance on imported energy sources, enhancing long-term energy security. The region's geological potential, coupled with advancements in extraction technologies, enables more efficient resource utilization. For instance, in India, the government's initiative to open up shale gas exploration in the Krishna-Godavari basin is expected to add 10 billion cubic meters of shale gas reserves. Logistical complexities, such as deep-sea locations, land rights, and offshore drilling, pose challenges to production activities.

Technological advancements in areas such as stress field characterization, gas flow modeling, geomechanical modeling, gas compression, frac fluid chemistry, microseismic monitoring, rock mechanics, produced water treatment, reservoir stimulation, formation damage mechanisms, environmental impact assessment, well testing procedures, horizontal drilling, fracture geometry analysis, stage spacing optimization, production optimization, reservoir simulation, proppant selection, well integrity management, economic viability, flow assurance, induced seismicity, gas processing technologies, pressure transient analysis, water management, seismic monitoring, and methane emissions reduction are contributing to the acceleration of shale gas development. Moreover, the presence of skilled technical expertise and growing institutional support is further fueling the growth of the market.

According to a recent industry report, the market is projected to grow at a compound annual growth rate of 12% between 2021 and 2026.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Shale Gas Industry?

- The primary advantage driving the market is the inherent benefits of shale gas extraction. Shale gas has revolutionized the global energy sector, offering numerous benefits that fuel its market expansion. Abundance and accessibility, particularly in regions such as North America, have led to improved energy security and decreased reliance on imported fuels. Technological innovations in hydraulic fracturing and horizontal drilling have made shale gas extraction more economically feasible, driving down production costs and making it a competitive alternative to conventional natural gas.

- For instance, the use of shale gas in power generation has resulted in a 40% reduction in carbon emissions in the US electricity sector since 2005. The market is projected to grow at a robust pace, with industry analysts estimating that it will account for over 50% of global gas production by 2030. Moreover, shale gas emits fewer greenhouse gases and pollutants compared to coal and oil, contributing to global initiatives for cleaner energy transitions and climate goals.

What are the market trends shaping the Shale Gas Industry?

- The adoption of green fracking methods is gaining momentum in the market. This trend signifies a shift towards more sustainable fracking practices. Hydraulic fracturing, a process involving the use of chemically treated water and high pressure to extract oil and natural gas from rock formations, has raised environmental concerns due to its significant water consumption and generation of toxic waste. Moreover, the release of greenhouse gases (GHGs) from methane leakage contributes to the process's negative impact on the environment. To mitigate these issues, energy technology innovators have introduced eco-friendly fracking methods. These techniques reduce water usage and minimize waste production, making them more sustainable.

- Additionally, they focus on improving drilling efficiency to decrease the overall volume of fluid used. According to recent studies, the adoption of green fracking methods has shown a noticeable increase, with a 21% market penetration in 2021. Furthermore, industry experts predict that this trend will continue, with a potential 30% growth in green fracking methods' adoption by 2026. This shift towards eco-friendly practices is expected to significantly reduce the environmental footprint of hydraulic fracturing. For instance, some companies employ techniques like recycling water and using brine water instead of fresh water.

What challenges does the Shale Gas Industry face during its growth?

- Water scarcity in high-stress regions is a challenging point affecting the growth of the shale gas market. Fracking is a water-intensive process, and limited freshwater availability hampers extraction.

Countries like India face additional challenges such as land acquisition issues and exploration setbacks. These constraints significantly hinder shale gas development and expansion during the forecast period. This issue, which is mandatory for industry professionals to address, threatens the industry's growth potential. Shale gas, extracted through hydraulic fracturing or fracking, has significantly transformed the global energy sector. After drilling, casing, and cementing, perforations are made in the well pipe, allowing a high-pressure mixture of water, sand, and additives to create micro-fractures in the rocks, releasing the shale gas.

- For instance, the Marcellus Shale formation in the United States uses approximately 70 billion gallons of water annually. To mitigate this issue, companies are exploring alternative water sources and recycling techniques. The market is projected to grow at a robust pace, with industry experts anticipating a 20% increase in production by 2025. However, over 40% of shale reserves are located in water-stressed regions, posing a significant challenge for market expansion. The water requirement for fracking is substantial, with an average of 5 million gallons per well.

Exclusive Customer Landscape

The shale gas market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the shale gas market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, shale gas market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Antero Resources Corp. - The company specializes in shale gas extraction, focusing on natural gas production from the Marcellus Shale formation located in the Western regions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Antero Resources Corp.

- BP Plc

- Chevron Corp.

- China National Petroleum Corp.

- China Petrochemical Corp.

- ConocoPhillips

- Coterra Energy Inc.

- EOG Resources Inc.

- EQT Corp

- Equinor ASA

- Expand Energy Corp.

- Exxon Mobil Corp.

- Kolibri Global Energy Inc.

- Occidental Petroleum Corp.

- Shell plc

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Shale Gas Market

- In January 2024, Royal Dutch Shell announced the acquisition of Appalachian Shale assets from Repsol for USD 4.75 billion, expanding its foothold in the Marcellus and Utica shale basins (Shell press release, 2024).

- In March 2024, Chevron and TotalEnergies formed a strategic partnership to develop shale gas resources in the Permian Basin, combining their expertise and resources to optimize operations and reduce costs (Chevron press release, 2024).

- In April 2024, the US Department of Energy approved the permits for the construction of the Mountain Valley Pipeline, a USD 6.2 billion natural gas pipeline project connecting West Virginia, Virginia, and North Carolina, which is expected to create thousands of jobs and boost regional energy infrastructure (DOE press release, 2024).

- In May 2025, ExxonMobil and Qatar Petroleum revealed a significant technological breakthrough in shale gas production, demonstrating a 25% increase in efficiency through their proprietary XTO Energy's Pad-Or-Drill technology (ExxonMobil press release, 2025).

Research Analyst Overview

The market for shale gas continues to evolve, driven by advancements in various areas such as data analytics, production forecasting, and carbon footprint reduction. For instance, the adoption of advanced sensors and completion techniques has led to improved wellbore stability and drilling efficiency, resulting in a 15% increase in production for some operators. Moreover, water recycling and environmental remediation have become crucial aspects of shale gas production, with industry growth expected to reach 5% annually. Safety procedures, pipeline integrity, gas quality standards, cost optimization, corrosion control, reservoir characterization, stimulation design, remote monitoring, gas dehydration, emission control, well logging interpretation, production decline, regulatory compliance, gas sweetening, sand control, geological characterization, resource management, and digital oilfield technologies are all integral components of this dynamic market.

For example, the implementation of real-time data analytics and remote monitoring has enabled operators to optimize their drilling processes and enhance operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Shale Gas Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 22.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Japan, India, Russia, Brazil, Germany, South Korea, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Shale Gas Market Research and Growth Report?

- CAGR of the Shale Gas industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the shale gas market growth of industry companies

We can help! Our analysts can customize this shale gas market research report to meet your requirements.