Gastroparesis Drugs Market Size 2025-2029

The gastroparesis drugs market size is forecast to increase by USD 1.34 billion at a CAGR of 3.5% between 2024 and 2029.

- The market is witnessing significant growth due to the rising global burden of diabetes, a primary cause of gastroparesis. Diabetes affects the nerves that control the muscles of the stomach, leading to delayed gastric emptying. According to the International Diabetes Federation, the global prevalence of diabetes reached 463 million in 2019, and this number is projected to increase to 700 million by 2045. This trend presents a substantial growth opportunity for the market. Moreover, emerging markets, particularly in Asia Pacific, are expected to offer lucrative growth opportunities due to increasing awareness and diagnosis rates. However, the market faces challenges from stringent regulatory guidelines.

- For instance, the US Food and Drug Administration (FDA) requires rigorous clinical trials and post-marketing surveillance for gastroparesis drugs. These factors necessitate strategic planning and investment in research and development for market players to capitalize on growth opportunities and navigate regulatory challenges effectively. Companies seeking to enter or expand in the market must focus on developing innovative solutions that address unmet medical needs while complying with regulatory requirements.

What will be the Size of the Gastroparesis Drugs Market during the forecast period?

- The gastroparesis drug market in the US is experiencing significant activity due to the rising prevalence of gastroparesis, a digestive disorder characterized by delayed emptying of the stomach. Factors driving market growth include the increasing incidence of diabetes, a known risk factor for gastroparesis, and lifestyle factors such as tobacco and alcohol consumption. The market is also witnessing an influx of innovative drugs, including metopimazine, erythromycin, metoclopramide, tradipitant, and deudomperidone, which offer improved symptom management for patients. Clinical trials for new antiemetics are underway to address unmet needs in gastroparesis treatment, such as addressing the underlying cause of the condition rather than just managing symptoms.

- However, concerns regarding the safety of certain gastroparesis drugs, including metoclopramide and Reglan, due to side effects like liver injury and neuroleptic malignant syndrome, may hinder market growth. Additionally, digestive disruptions caused by acute cholecystitis and pancreatitis can lead to gastroparesis, further expanding the market scope.

How is this Gastroparesis Drugs Industry segmented?

The gastroparesis drugs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Drug Class

- Prokinetic agents

- Antiemetics

- Botulinum toxin injection

- Disease Type

- Idiopathic gastroparesis

- Diabetic gastroparesis

- Post-surgical gastroparesis

- Drug

- Aminosalicylates

- Digestive enzymes

- Proton Pump Inhibitors

- Laxatives

- Anti-Emetics

- Aminosalicylates

- Digestive enzymes

- Proton Pump Inhibitors

- Laxatives

- Anti-Emetics

- Route of Administration

- Oral

- Injectable

- Others

- Oral

- Injectable

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

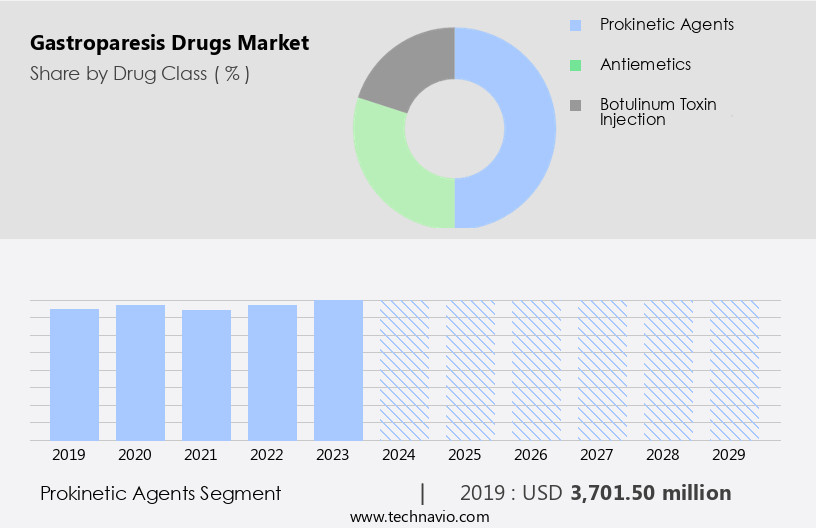

By Drug Class Insights

The prokinetic agents segment is estimated to witness significant growth during the forecast period.

Prokinetic drugs play a crucial role in managing gastroparesis symptoms by addressing the underlying issue of delayed stomach emptying. These medications, such as metoclopramide and domperidone, are popular due to their ability to improve stomach motility. However, not all prokinetic agents guarantee a corresponding improvement in stomach emptying. A few have been withdrawn from the market. Some prokinetic medications, including metoclopramide, also exhibit antiemetic properties. explores innovative drugs like ghrelin, motilin, 5-HT4 receptor agonists, and dopamine receptors for their potential in gastroparesis treatment. These drugs offer fewer side effects and proven efficacy. Tobacco consumption and alcohol intake can hinder the effectiveness of these medications and contribute to gastroparesis symptoms.

Additionally, complications from surgical procedures, diabetes, and blood sugar regulation, as well as autonomic neuropathy in diabetic cases, can exacerbate gastroparesis symptoms. Enteral nutrition, specialized care, and surgical interventions may be necessary for severe cases. Gastroparesis can also be associated with conditions like acute pancreatitis and acute cholecystitis. Symptoms such as vomiting, nausea, abdominal discomfort, and nutrient absorption complications require careful management. Clinical trials and FDA clearance are essential for bringing new treatments to market.

Get a glance at the market report of share of various segments Request Free Sample

The Prokinetic agents segment was valued at USD 3.7 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing growth due to the rising prevalence of diabetes, a major risk factor for the condition. According to the Centers for Disease Control and Prevention (CDC), over 130 million adults in the US had diabetes in 2022. Obesity, caused by unhealthy diets and sedentary lifestyles, is a significant contributor to the increasing diabetes prevalence. Type 2 diabetes, which accounts for 90%-95% of all diabetes cases in the US, is particularly prevalent. Gastroparesis, a condition characterized by hindered digestion and resulting symptoms such as vomiting, abdominal discomfort, and nutrient absorption complications, affects individuals with diabetes more frequently.

Factors such as tobacco consumption and alcohol use can also contribute to gastroparesis. In the medical community, various treatments are employed for gastroparesis management, including metoclopramide, prokinetic agents like domperidone, and antiemetics like metopimazine. In some cases, surgical procedures, enteral nutrition, and specialized care may be necessary. has led to the development of innovative drugs like tradipitant for symptom management and erythromycin for motility enhancement. Clinical trials and FDA clearance are ongoing for these and other potential treatments. Gastroparesis can complicate acute conditions like acute pancreatitis and acute cholecystitis, necessitating prompt and effective treatment. The market for gastroparesis drugs is expected to continue growing as researchers and pharmaceutical companies work to improve treatment options for this debilitating condition.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Gastroparesis Drugs Industry?

- Rising global burden of diabetes is the key driver of the market.

- Diabetes, a chronic condition affecting over 537 million adults worldwide, impairs the body's ability to use insulin effectively or produce sufficient insulin, leading to hyperglycemia and potential damage to vital organs. By 2030, this number is projected to rise to 643 million, and further increase to 783 million by 2045. The prevalence of both Type 1 and Type 2 diabetes significantly increases the risk of developing gastroparesis. This condition, characterized by delayed gastric emptying, can result in severe discomfort and complications, making timely intervention crucial.

- The market is driven by the rising prevalence of diabetes, increasing awareness, and advancements in treatment options. The market is expected to grow steadily due to the unmet medical needs and the significant burden of diabetes on the global population.

What are the market trends shaping the Gastroparesis Drugs Industry?

- Increasing growth opportunities in emerging markets is the upcoming market trend.

- The gastrointestinal disorders market is witnessing significant growth due to the increasing number of undiagnosed and untreated cases, particularly in emerging economies. According to , the incidence and prevalence of chronic gastrointestinal disorders, such as gastroparesis, have been increasing in Asia, including China and India. To capitalize on this trend, companies are expanding their businesses in these regions to generate substantial revenue and increase their market presence. Additionally, these companies are investing in expanding their research and development teams and manufacturing facilities to improve their product portfolios and launch new offerings, thereby creating new growth opportunities.

- For instance, Abbott, a leading market player, has been continuously expanding its research and development capabilities in emerging markets like Brazil, India, and China. This strategic move will enable the company to cater to the growing demand for gastrointestinal disorder treatments and strengthen its market position.

What challenges does the Gastroparesis Drugs Industry face during its growth?

- Stringent regulatory guidelines is a key challenge affecting the industry growth.

- In The market, regulatory authorities such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a crucial role in ensuring the safety and efficacy of drugs. These agencies rigorously examine various factors, including pharmacological data, pharmacodynamic effects, and drug interactions, before approving a drug. Failure to meet these criteria can result in a complete response letter (CRL) or rejection.

- In response to a CRL, the drug applicant must provide additional data to address the regulatory concerns. The stringent regulatory approval process is essential to maintaining the highest standards of drug quality and safety.

Exclusive Customer Landscape

The gastroparesis drugs market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gastroparesis drugs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gastroparesis drugs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in providing innovative solutions for gastroparesis, including FDA-approved medications such as Ganaton OD and Ganaton. These drugs aim to improve gastric emptying and alleviate symptoms associated with this condition. With a focus on advancing medical research and development, the company's offerings cater to a global market, delivering effective treatments for individuals suffering from gastroparesis.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- Aclipse Therapeutics

- ANI Pharmaceuticals Inc.

- Bausch Health Companies Inc.

- Cadila Pharmaceuticals Ltd.

- Eisai Co. Ltd.

- Evoke Pharma Inc.

- GlaxoSmithKline Plc

- Ipca Laboratories

- Johnson and Johnson Inc.

- Medtronic Plc

- Neurogastrx Inc.

- Otsuka Pharmaceutical Co. Ltd.

- Pfizer Inc.

- Processa Pharmaceuticals Inc.

- Rhythm Pharmaceuticals Inc.

- Takeda Pharmaceutical Co. Ltd.

- Theravance Biopharma Inc.

- Vanda Pharmaceuticals Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The gastroparesis market encompasses a range of pharmaceutical solutions designed to manage the symptoms of this debilitating condition. Gastroparesis, a motility disorder characterized by delayed emptying of the stomach, can be caused by various factors including diabetes, tobacco consumption, and certain medications. The symptoms of gastroparesis can significantly impact patients' quality of life, leading to vomiting, abdominal discomfort, and hindering the digestion and absorption of nutrients. The condition can also complicate blood sugar regulation in diabetic cases. Several classes of drugs are employed in the treatment of gastroparesis, including prokinetic agents, antiemetics, and enteral nutrition supplements.

Prokinetic agents, such as metoclopramide and domperidone, stimulate gastrointestinal motility, helping to move food through the stomach more efficiently. Antiemetics, like metopimazine and tradipitant, alleviate nausea and vomiting. Enteral nutrition supplements provide essential nutrients to patients experiencing feeding intolerance. The development of innovative drugs continues to expand the gastroparesis treatment landscape. For instance, Neurogastrx's proprietary technology, which utilizes electrical stimulation to improve gastric emptying, holds promise for patients with refractory gastroparesis. Gastroparesis can also arise as a complication following surgical procedures or in cases of autonomic neuropathy. In such instances, specialized care and interventions, including surgical procedures and lifestyle modifications, may be necessary for effective management.

The gastroparesis market is influenced by several factors, including the prevalence of risk factors, such as diabetes and tobacco consumption, and the availability of effective treatment options. The regulatory landscape, including FDA clearance and clinical trials, also plays a significant role in shaping market dynamics. The condition can be exacerbated by various factors, including alcohol consumption and acute conditions like cholecystitis and pancreatitis. These complications can further hinder nutrient absorption and worsen symptoms. Pharmaceutical companies, including Ani Pharmaceuticals and Evoke Pharma, are actively involved in the development of new treatments for gastroparesis. Their efforts aim to address unmet medical needs and improve patient outcomes.

In summary, the gastroparesis market comprises a diverse range of treatment options designed to manage the symptoms of this complex condition. The market is influenced by various factors, including patient demographics, regulatory landscape, and the availability of innovative treatments. Effective management of gastroparesis requires a multifaceted approach, incorporating pharmacological interventions, lifestyle modifications, and, in some cases, surgical procedures.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2025-2029 |

USD 1338.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.4 |

|

Key countries |

US, China, Germany, UK, Canada, India, Japan, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gastroparesis Drugs Market Research and Growth Report?

- CAGR of the Gastroparesis Drugs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gastroparesis drugs market growth of industry companies

We can help! Our analysts can customize this gastroparesis drugs market research report to meet your requirements.