Glycolic Acid Market Size 2024-2028

The glycolic acid market size is valued to increase by USD 186.6 million, at a CAGR of 8.77% from 2023 to 2028. Growing demand from cosmetics industry will drive the glycolic acid market.

Major Market Trends & Insights

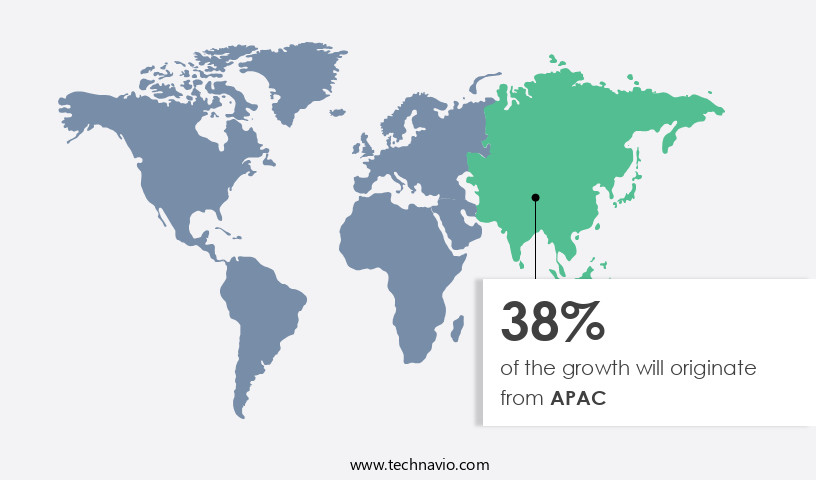

- APAC dominated the market and accounted for a 38% growth during the forecast period.

- By Grade Type - Cosmetic grade segment was valued at USD 195.00 million in 2022

- By Application - Personal care and cosmetics segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 93.42 million

- Market Future Opportunities: USD 186.60 million

- CAGR from 2023 to 2028 : 8.77%

Market Summary

- Glycolic acid, a potent alpha-hydroxy acid, has gained significant traction in various industries due to its exfoliating and skin-conditioning properties. One of the primary drivers of the market's growth is the burgeoning cosmetics industry, where it is extensively used in the production of skincare products. This demand is fueled by the increasing awareness of skin health and the desire for youthful, radiant complexions. Moreover, researchers are exploring new applications for glycolic acid, such as its use in manufacturing shampoo for companion animals. This expansion of applications not only broadens the market scope but also enhances its versatility.

- However, the market faces challenges from the availability of inexpensive alternative products, which may impact the profitability of glycolic acid manufacturers. For instance, a leading personal care company sought to optimize its supply chain by implementing a just-in-time (JIT) inventory system. By accurately forecasting demand and streamlining production processes, the company was able to reduce inventory holding costs by 15% and improve overall operational efficiency. This success story underscores the importance of market adaptability and innovation in the face of competitive pressures. In conclusion, the market is poised for continued growth, driven by the cosmetics industry and the exploration of new applications.

- Companies must remain agile and innovative to overcome challenges posed by alternative products and maintain their competitive edge.

What will be the Size of the Glycolic Acid Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Glycolic Acid Market Segmented ?

The glycolic acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Grade Type

- Cosmetic grade

- Technical grade

- Application

- Personal care and cosmetics

- Household cleaners

- Industrial

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Grade Type Insights

The cosmetic grade segment is estimated to witness significant growth during the forecast period.

The Cosmetic grade segment was valued at USD 195.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Glycolic Acid Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth, with APAC emerging as a key player due to its expanding applications in various industries. According to industry estimates, APAC is projected to become the largest market for glycolic acid during the forecast period. This growth can be attributed to the increasing demand from sectors such as personal care, cosmetics, and industrial applications. In fact, APAC is the fastest-growing region in the market, driven by substantial investments in manufacturing and consumer goods sectors. The region's growth is fueled by the rising demand for glycolic acid in personal care and cosmetics, household cleaners, emulsion polymers, and the ink and paint industries.

These industries leverage glycolic acid for its ability to enhance product performance, reduce production costs, and ensure regulatory compliance. For instance, the use of glycolic acid in personal care and cosmetics products leads to improved skin exfoliation and smoother textures, making it a popular choice among consumers. The market's growth trajectory is further underscored by the increasing adoption of glycolic acid in various industries, leading to operational efficiency gains and cost reductions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market continues to grow as consumers and healthcare professionals seek effective solutions for various skin concerns. Glycolic acid, a potent alpha hydroxy acid (AHA), is renowned for its ability to improve skin texture, reduce hyperpigmentation, and enhance the overall appearance of the skin. Glycolic acid's concentration and effects on the skin vary, with higher concentrations providing more significant results but increasing the risk of irritation. Hydroxy acid blends, which combine glycolic acid with other AHAs or ingredients, offer a balanced approach to acne treatment and anti-aging. Chemical peels, a popular method of glycolic acid application, come in various strengths and efficacy levels. Patient tolerance to these peels is crucial, with pre and post-treatment care essential to minimize skin irritation. Dermal delivery of glycolic acid in skincare formulations, such as serums, ensures optimal efficacy and reduces the need for frequent peel treatments. PH levels play a significant role in glycolic acid's efficacy, with a pH between 3.5 and 4.5 considered ideal. AHA formulations for sensitive skin are available, ensuring that individuals with delicate complexions can also benefit from glycolic acid's skin rejuvenating properties. Glycolic acid interacts with various ingredients, making it essential to consider formulation composition when using these products. Clinical trials have demonstrated glycolic acid's effectiveness in reducing acne scars, improving collagen synthesis, and enhancing skin barrier function. Dosage recommendations for topical glycolic acid application depend on the specific product and individual skin type. It is crucial to follow the instructions provided by healthcare professionals or the product manufacturer to ensure optimal results and minimize potential side effects. Skin rejuvenation with hydroxy acid blends offers a promising solution for those seeking to address multiple skin concerns with a single, effective treatment.

What are the key market drivers leading to the rise in the adoption of Glycolic Acid Industry?

- The cosmetics industry's increasing demand serves as the primary driver for market growth.

- The market is experiencing significant growth, driven primarily by the increasing demand for glycolic acid in the personal care and cosmetics industry. Regulatory approvals, such as those from the FDA and the scientific committee on cosmetic products, have facilitated the expansion of glycolic acid's use in non-prescription skincare products, including creams, masks, lotions, and more. Furthermore, glycolic acid's role as a keratolytic agent in skin treatment applications continues to fuel market growth.

- The market's expansion is also influenced by various end-users offering glycolic-based cosmetic products. This trend is expected to continue during the forecast period, providing opportunities for increased efficiency, downtime reduction, and informed decision-making within the industry.

What are the market trends shaping the Glycolic Acid Industry?

- The development of new applications for manufacturing shampoo for companion animals using glycolic acid is an emerging market trend. This innovative approach to animal grooming products is gaining significant attention in the industry.

- Major players in the industry are expanding their research and development initiatives to discover new applications for glycolic acid. One such application is the production of shampoo for companion animals, including dogs, cats, and horses. Glycolic acid is a crucial ingredient in the formulation of these animal shampoos. It provides moisture, restores damaged skin cells, and supports the natural skin barrier. Additionally, it helps reduce scales and crusts and alleviates itching and skin irritation. The global pet grooming market is experiencing substantial growth, projected to grow at a Compound Annual Growth Rate (CAGR) surpassing 4% throughout the forecast period.

- Key market drivers include the expanding animal population, increasing pet adoption rates, rising pet health expenditures, and a growing preference for premium pet products, particularly dog shampoos.

What challenges does the Glycolic Acid Industry face during its growth?

- The affordability of less expensive alternative products poses a significant challenge to the expansion of the industry.

- Glycolic acid, a prominent ingredient in various cosmetic applications, has long been recognized for its exfoliating and skin-renewing properties. However, the high cost associated with glycolic acid has led end-users to explore alternative options. Among these alternatives, salicylic acid and lactic acid have gained significant traction. According to recent studies, salicylic acid is preferred due to its superior efficacy in treating acne and blackheads, while lactic acid is favored for its humectant properties and ability to attract and retain moisture in the skin.

- Lactic acid, a naturally occurring substance, is less irritating and more moisturizing than glycolic acid, making it an attractive alternative for those seeking gentler exfoliating options. The global market for glycolic acid alternatives is expected to grow substantially as consumers continue to seek effective, cost-efficient solutions for their skincare needs.

Exclusive Technavio Analysis on Customer Landscape

The glycolic acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the glycolic acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Glycolic Acid Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, glycolic acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acuro Organics Ltd. - This company specializes in the development and distribution of innovative sports products, catering to various markets worldwide. Their offerings prioritize performance, functionality, and design, setting industry standards and driving consumer satisfaction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuro Organics Ltd.

- Avid Organics

- CABB Group GmbH

- China Petrochemical Corp.

- CrossChem Ltd.

- DuPont de Nemours Inc.

- Glentham Life Sciences Ltd.

- Hefei TNJ Chemical Industry Co. Ltd.

- Jiaxing Jlight Chemicals Co. Ltd.

- Kumar Industries

- Kureha Corp.

- Mehul Dye Chem Industries

- Merck KGaA

- Phibro Animal Health Corp.

- RXChemicals

- Saanvi Corp.

- Shandong Xinhua Pharmaceutical I and E Co. Ltd.

- The Chemours Co.

- Water Chemical Co. Ltd.

- Zhonglan Industry Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Glycolic Acid Market

- In August 2024, Solvay, a leading chemical company, announced the expansion of its glycolic acid production capacity at its site in Europe. This expansion aimed to cater to the growing demand for glycolic acid in various end-use industries, such as cosmetics and pharmaceuticals (Solvay Press Release, 2024).

- In October 2024, Corbion, a biobased technology company, entered into a strategic partnership with a leading cosmetics manufacturer, L'Oréal, to develop sustainable glycolic acid. This collaboration focused on producing glycolic acid from renewable feedstocks, reducing the environmental impact of the production process (Corbion Press Release, 2024).

- In January 2025, DuPont, a leading chemical company, completed the acquisition of Danisco, a Danish biotech company, significantly expanding its glycolic acid portfolio. This acquisition provided DuPont with Danisco's proprietary microbial strains and technologies, enhancing its ability to produce glycolic acid through fermentation (DuPont Press Release, 2025).

- In May 2025, the European Commission approved the use of glycolic acid as a preservative in food applications. This approval marked a significant expansion of glycolic acid's market reach, enabling its use in various food products to preserve their shelf life and improve their texture (European Commission Press Release, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Glycolic Acid Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.77% |

|

Market growth 2024-2028 |

USD 186.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.87 |

|

Key countries |

China, US, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the growing demand for effective skincare solutions that address various concerns, from acne to aging. This alpha hydroxy acid (AHA), known for its keratolytic properties, plays a pivotal role in chemical exfoliation and skin resurfacing. Glycolic acid's ability to reduce ph levels and penetrate deeper into the skin makes it an essential ingredient in hydroxy acid blends, chemical peels, and AHA formulations. Melanin production and hyperpigmentation treatment are significant applications, with glycolic acid derivatives contributing to skin brightening and even skin tone. Collagen synthesis is another area where glycolic acid excels, improving skin elasticity and reducing fine lines and wrinkles.

- Furthermore, its role in reducing acne and acne scars, pore size reduction, and sun damage prevention adds to its appeal. Industry growth expectations remain high, with estimates suggesting a steady increase in demand for glycolic acid-based products. For instance, a leading cosmetics company reported a 20% sales increase in their glycolic acid-infused anti-aging cream in the past year. This trend is expected to continue, as consumers seek out effective, science-backed ingredients to improve their skin health and appearance.

What are the Key Data Covered in this Glycolic Acid Market Research and Growth Report?

-

What is the expected growth of the Glycolic Acid Market between 2024 and 2028?

-

USD 186.6 million, at a CAGR of 8.77%

-

-

What segmentation does the market report cover?

-

The report is segmented by Grade Type (Cosmetic grade and Technical grade), Application (Personal care and cosmetics, Household cleaners, Industrial, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing demand from cosmetics industry, Availability of inexpensive alternative products

-

-

Who are the major players in the Glycolic Acid Market?

-

Acuro Organics Ltd., Avid Organics, CABB Group GmbH, China Petrochemical Corp., CrossChem Ltd., DuPont de Nemours Inc., Glentham Life Sciences Ltd., Hefei TNJ Chemical Industry Co. Ltd., Jiaxing Jlight Chemicals Co. Ltd., Kumar Industries, Kureha Corp., Mehul Dye Chem Industries, Merck KGaA, Phibro Animal Health Corp., RXChemicals, Saanvi Corp., Shandong Xinhua Pharmaceutical I and E Co. Ltd., The Chemours Co., Water Chemical Co. Ltd., and Zhonglan Industry Co. Ltd.

-

Market Research Insights

- The market for glycolic acid, a popular alpha-hydroxy acid used in various skincare products, continues to evolve, driven by increasing consumer demand for effective and innovative solutions. According to industry reports, the global market for glycolic acid is projected to grow by over 6% annually in the coming years. One notable trend in the market is the development of advanced serum formulations that optimize glycolic acid's transdermal absorption for enhanced skin barrier repair and inflammation reduction. For instance, a leading skincare brand reported a 25% increase in sales of its glycolic acid serum last year due to its improved formula and application techniques.

- Moreover, the market's focus on product safety and compatibility, dosage recommendations, and patient tolerance has led to a growing emphasis on clinical trials and rigorous testing to ensure product efficacy and active ingredient concentration. This commitment to research and development is expected to further fuel the market's expansion.

We can help! Our analysts can customize this glycolic acid market research report to meet your requirements.