Grid Connected PV Systems Market Size 2024-2028

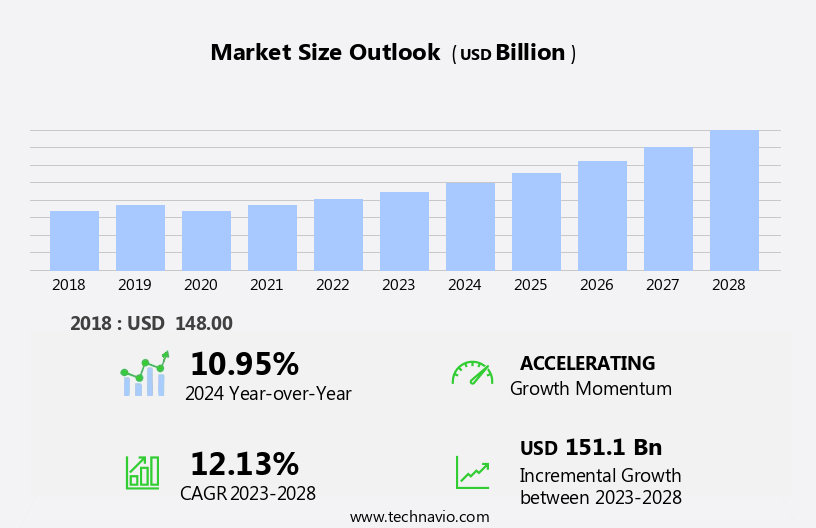

The grid connected PV systems market size is forecast to increase by USD 151.1 billion at a CAGR of 12.13% between 2023 and 2028.

- The market is witnessing significant growth due to several key factors. One of the primary drivers is the advantages associated with grid-connected PV systems, which include cost savings through net metering, reliable power supply, and reduced carbon footprint. Another trend influencing the market is the increasing adoption of microgrids, which enable the integration of renewable energy sources into the power grid and ensure uninterrupted power supply during grid outages. However, the intermittency in solar power generation remains a challenge, as solar energy is dependent on weather conditions. To mitigate this issue, energy storage solutions such as batteries are being integrated into grid-connected PV systems to ensure a consistent power supply. Overall, the market is expected to grow steadily due to these factors and the increasing focus on renewable energy sources.

What will be the Size of the Grid Connected Pv Systems Market During the Forecast Period?

- The market encompasses the deployment of solar panels to generate electricity, which is fed into the public grid. This market comprises various applications, including commercial rooftop systems and small residential units. Technological improvements in power conditioning units, inverters, and integrated power solutions have led to cost-effective and environmentally friendly grid-connected PV systems. The utility section plays a crucial role in managing the integration of renewable energy sources, such as solar PV systems, into the grid structures.

- Additionally, island networks are increasingly turning to renewable sources for electricity generation, further boosting market growth. Electricity storage devices, such as batteries, are also gaining popularity to ensure a consistent power supply and optimize the usage of renewable energy.

How is this Grid Connected PV Systems Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Non-residential

- Residential

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

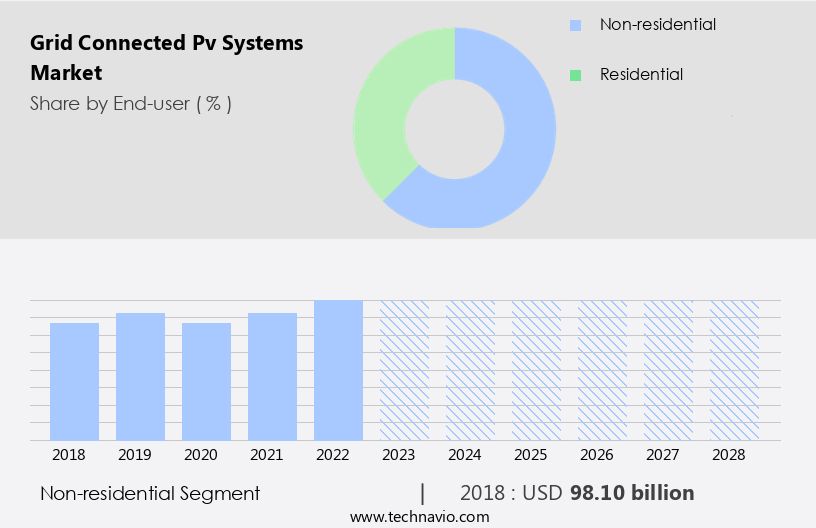

By End-user Insights

- The non-residential segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the increasing adoption of solar power in the non-residential sector. Utility-scale solar installations, which account for a significant portion of the non-residential segment, are expected to grow due to the rising demand for renewable energy sources in electricity generation. These large-scale solar power plants, with capacities exceeding 5 MW, generate electricity and feed it into the main power grid. Utility solar producers enter into long-term power purchase agreements (PPAs) with power distributors, ensuring a steady revenue stream. Technological advancements, such as integrated power solutions and energy storage systems, are enhancing the efficiency and reliability of grid-connected PV systems.

In addition, the integration of distributed energy resources (DERs) and the expansion of microgrids are enabling greater grid resilience and reducing the reliance on fossil fuels. The market for grid-connected PV systems is expected to continue growing due to the cost-effectiveness and environmental benefits of solar energy.

Get a glance at the Grid Connected PV Systems Industry report of share of various segments Request Free Sample

The Non-residential segment was valued at USD 98.10 billion in 2018 and showed a gradual increase during the forecast period.

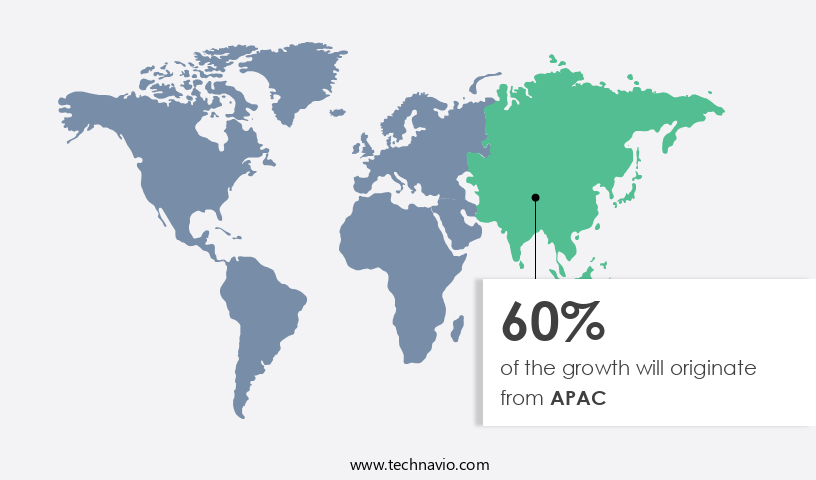

Regional Analysis

- APAC is estimated to contribute 60% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is poised for substantial expansion in the coming years. In 2020, China, Japan, India, Australia, and South Korea were the leading countries in the region, collectively accounting for over 80% of APAC's total solar PV capacity. China, with its significant solar PV capacity, surpassed 200 GW in 2020, representing over two-thirds of the global total. Japan, India, and South Korea also made considerable progress, contributing over 40 GW collectively. Financial incentives, such as feed-in-tariffs (FiTs), have been instrumental in driving growth in countries like China, Japan, Thailand, and Vietnam.

Moreover, the increasing focus on reducing greenhouse gas (GHG) emissions in China and India, the two most populous countries in the world, has accelerated the adoption of renewable energy sources, including solar and wind energy, for power generation. The utility scale solar PV industry, including commercial rooftop systems and small residential units, is expected to benefit significantly from these trends. Technological improvements in solar panels, power conditioning units, inverters, and integrated photovoltaic systems have made solar energy increasingly cost-effective and environmentally friendly. Energy storage solutions, such as batteries, have also gained popularity to address peak call demand and ensure grid stability.

Furthermore, the integration of distributed energy resources (DERs) into the power grid is a key development in the solar PV industry. Microgrids, island networks, and energy storage systems are increasingly being adopted to mitigate power outages caused by natural disasters and grid failures. The utility sector is also investing in renewable energy sources and grid structures to reduce reliance on fossil fuels and power plants.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Grid Connected PV Systems Industry?

Advantages associated with grid-connected PV systems is the key driver of the market.

- Grid-connected photovoltaic (PV) systems are a popular choice for both commercial rooftop installations and small residential units. These systems enable the solar panels to generate and feed electricity directly into the public grid, eliminating the need for costly energy storage devices and other standalone equipment. The utility section benefits from the integration of solar PV systems as renewable energy sources, reducing the reliance on fossil fuels and power plants. Technological improvements in power conditioning units and inverters have made grid-connected PV systems more cost-effective and environmentally friendly. Commercial establishments and utilities often install larger solar PV systems with greater capacity than residential units.

- However, the installation and maintenance costs for these centralized systems are significantly higher than decentralized residential systems. Integrated power solutions, such as integrated photovoltaic systems and energy storage technologies, are increasingly being adopted to address the challenges of system dynamics and peak call demand in the utility scale industry. Island networks, which operate independently from the main grid, are also gaining popularity due to their ability to provide power during grid outages and natural disasters. Energy storage technologies, such as batteries, are essential for these networks to ensure a consistent power supply. The PVESS residential industry is expected to grow as more homeowners seek cost savings and environmental benefits from solar PV systems.

What are the market trends shaping the Grid Connected PV Systems Industry?

Increasing adoption of microgrids is the upcoming market trend.

- Grid-connected photovoltaic (PV) systems, which include solar panels, inverters, and power conditioning units, are a significant part of the renewable energy sources market In the US. These systems enable the integration of solar PV into the public grid, providing cost-effective and environmentally friendly energy alternatives to fossil fuels from power plants. Technological improvements in integrated photovoltaic systems, energy storage, and charge management have led to the growth of the PVESS residential industry and commercial rooftop systems. In the utility scale industry, grid parity has been achieved in many regions, making solar PV a viable solution for utility subsidiaries. Microgrids, which can operate in both grid-connected and island modes, are essential in areas with unstable power grids, preventing power outages during natural disasters or utility section failures.

- Solar PV modules, such as thin film and crystalline silicon, are key components of these systems. Energy benchmarks, such as Levelized Energy Cost (LCOE), Distributed Energy Resources (DERs), and system dynamics models, are used to evaluate the efficiency and cost-effectiveness of these systems. The integration of solar PV and energy storage devices, including batteries and flywheels, enhances the stability and reliability of the power grid.

What challenges does the Grid Connected PV Systems Industry face during its growth?

Intermittency in solar power generation is a key challenge affecting the industry growth.

- Solar photovoltaic (PV) systems connected to the public grid have gained significant traction due to the declining costs of solar technology. This trend has led to an increase in the installation of solar panels, both in small residential units and commercial rooftop systems. However, the intermittent nature of solar energy poses a challenge to the power system. Solar PV output is dependent on various factors such as panel efficiency, degree of shade, and solar irradiation, which can fluctuate throughout the day and under overcast conditions. To address this challenge, technological improvements have been made in power conditioning units, inverters, and energy storage solutions.

- Integrated power solutions, such as integrated photovoltaic systems and storage technologies, are gaining popularity in the utility scale industry. These systems can charge during peak sunlight hours and discharge during peak demand periods, ensuring a consistent power supply. Moreover, renewable energy sources, including solar PV, are becoming increasingly cost-effective and environmentally friendly alternatives to fossil fuel-based power plants. Governments are investing in microgrid projects to improve grid structures and enhance the integration of renewable energies into the power grid. These microgrids can operate independently during power outages or natural disasters, ensuring uninterrupted power supply.

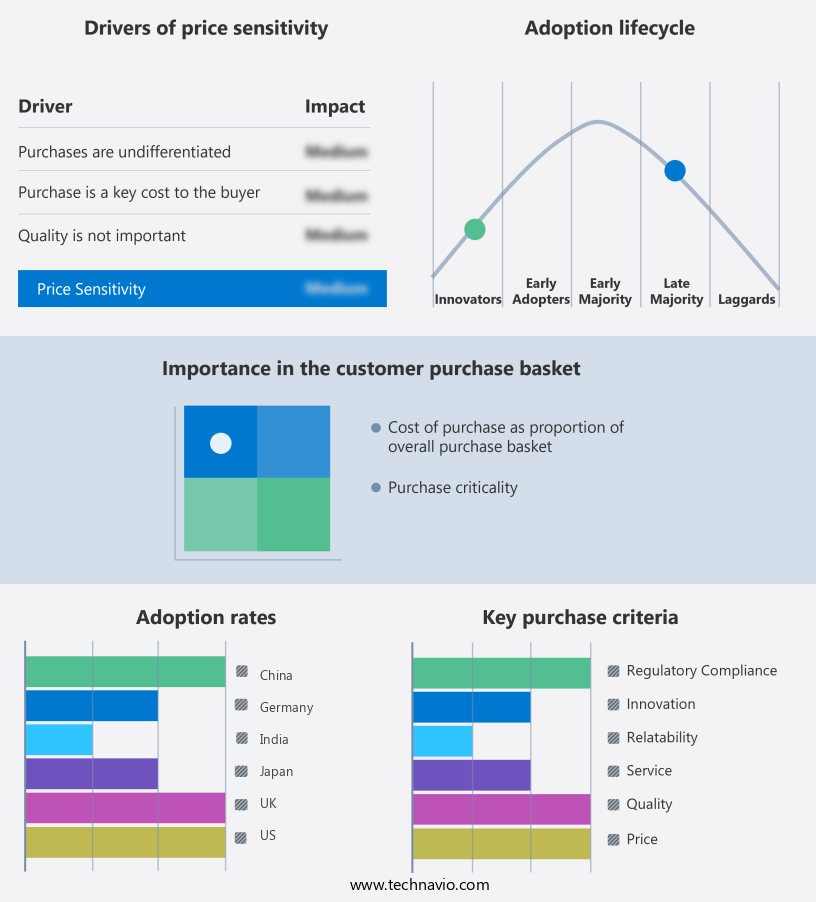

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB

- Canadian Solar Inc.

- Delta Electronics Inc.

- Emeren Group Ltd.

- First Solar Inc.

- Flin Technologies Pvt. Ltd.

- Hanwha Corp.

- Huawei Technologies Co. Ltd.

- JA Solar Technology Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- KACO new energy

- Kyocera Corp.

- LG Electronics Inc.

- Luminous Power Technologies Pvt. Ltd.

- Lumos Global BV

- Panasonic Holdings Corp.

- Shenzhen Kstar Science and Technology Co. Ltd.

- SMA Solar Technology AG

- SolarEdge Technologies Inc.

- Trina Solar Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Grid-connected photovoltaic (PV) systems have emerged as a significant contributor to the global energy landscape, offering cost-effective and environmentally friendly solutions to meet the growing demand for renewable energy sources. These systems, which convert solar energy into electricity for use In the public grid, have gained popularity due to their ability to reduce reliance on fossil fuels and decrease electricity bills for consumers. The PV industry has witnessed technological improvements, leading to the development of integrated power solutions, energy storage, and charge management systems. These advancements have enabled the expansion of the PV market beyond small residential units to commercial rooftop systems and utility-scale projects.

Moreover, grid parity, the point at which the cost of electricity from renewable sources equals or falls below that of traditional power plants, has been a driving force behind the growth of the PV market. As system dynamics models show, the levelized cost of energy (LCOE) for PV systems continues to decrease, making them increasingly competitive with conventional power sources. The integration of PV systems into the power grid has brought about changes in grid structures. Utilities have had to adapt to accommodate the intermittent nature of solar energy and ensure grid stability. Distributed Energy Resources (DERs), such as PV systems and energy storage devices, have played a crucial role in this transition.

Furthermore, microgrids, which operate independently or in parallel with the main grid, have gained attention due to their ability to provide power during grid outages and natural disasters. The utility sector has seen a rise in microgrid projects, with estimates suggesting the potential for over 10,000 renewable microgrids worldwide. Grid connection equipment, including inverters and power conditioning units, have become essential components of PV systems. Inverters convert the direct current (DC) electricity generated by solar panels into alternating current (AC) for use in the grid. Thin film and crystalline silicon are the two primary types of solar PV modules used in grid-connected systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.13% |

|

Market growth 2024-2028 |

USD 151.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.95 |

|

Key countries |

China, Japan, India, US, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Grid Connected PV Systems Market Research and Growth Report?

- CAGR of the Grid Connected PV Systems industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the grid connected pv systems market growth of industry companies

We can help! Our analysts can customize this grid connected pv systems market research report to meet your requirements.