Microgrid Market Size 2025-2029

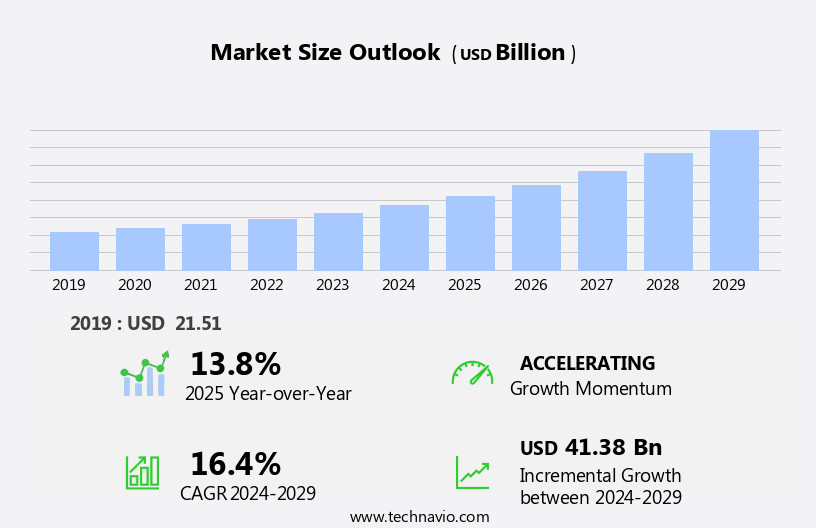

The microgrid market size is forecast to increase by USD 41.38 billion at a CAGR of 16.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for reliable and resilient power infrastructure, particularly in regions prone to power outages and grid instability. Microgrids offer an attractive solution, enabling local energy generation and consumption, and ensuring uninterrupted power supply during grid failures. This trend is further fueled by rapid technological advancements, including energy storage solutions and smart grid technologies, which enhance microgrid efficiency and capabilities. However, the market growth is not without challenges. High implementation costs, primarily driven by the expensive nature of energy storage systems and advanced grid technologies, remain a significant barrier to entry.

- Moreover, regulatory frameworks and policy inconsistencies across various regions can hinder market expansion. Companies seeking to capitalize on the market opportunities must navigate these challenges effectively by collaborating with stakeholders, optimizing costs, and leveraging innovative business models. By doing so, they can position themselves as key players in the evolving microgrid landscape, contributing to the market's continued growth and innovation.

What will be the Size of the Microgrid Market during the forecast period?

- The market is experiencing significant growth as businesses seek more efficient and sustainable energy solutions. Solar generators and energy storage systems are key components, with microgrid topologies enabling the integration of these resources into electrical networks. Fuel cells and hydrogen are also gaining traction as alternative power generation sources. Smart microgrids allow for the effective management of linked loads and peak loads, ensuring a reliable electricity supply. Microturbines and wind energy are additional micro-sources contributing to the evolution of the electric system. Hybrid microgrid networks enable the integration of renewable resources and dispersed energy resources into the main power grid.

- Electric grids are becoming more complex as they adapt to these advances, with solar energy and wind energy becoming increasingly important. Battery storage systems play a crucial role in energy storage and grid stability. Off-grid applications are also driving the market's growth, as businesses look to reduce their reliance on the main power grid. Overall, the market is dynamic and evolving, with a focus on optimizing energy production and consumption.

How is this Microgrid Industry segmented?

The microgrid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Remote

- Institutions and campus

- Military

- Others

- Connectivity

- Grid connected

- Off-grid connected

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

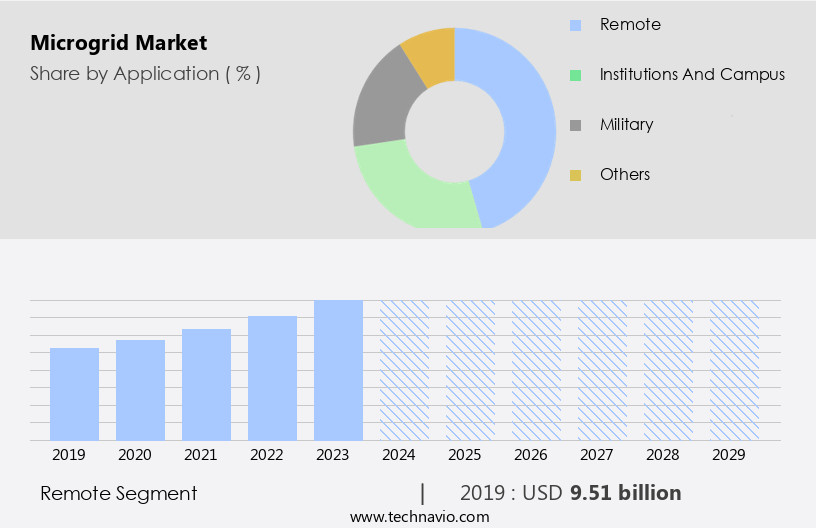

The remote segment is estimated to witness significant growth during the forecast period.

Microgrids, comprised of solar generators, wind turbine generators, solar panels, sophisticated controllers, and energy storage devices, have gained significance in remote installations where traditional electricity supply is unreliable or inaccessible. These microgrids, including hybrid microgrids and solar-powered water pumping systems, are being adopted in villages and rural areas, particularly in countries like India, Indonesia, Bangladesh, and several African and Southeast Asian nations. Diesel generators continue to serve as a backup power source in such microgrids, but the declining cost of solar panels and advancements in energy storage technology are enabling the deployment of clean energy microgrids in regions where investments in conventional grid infrastructure are not feasible.

Energy storage systems are integrated into these microgrids to reduce fuel consumption, meet peak loads, and enhance the efficiency of diesel generators. The hybrid segment of microgrids, which combines renewable energy sources and traditional power sources, is expected to witness substantial growth due to its ability to provide energy security and grid resiliency. Microgrids are also being implemented in defense bases, healthcare facilities, and data centers to ensure uninterrupted power supply and reduce carbon footprint. Grid instability and transmission losses are major challenges in the implementation of microgrids, necessitating the development of advanced monitoring systems and energy-efficient technologies. Microgrid topologies, including distributed energy resources and linked loads, are being explored to optimize energy production and consumption.

CHP systems, fuel cells, and waste-to-energy technologies are also being integrated into microgrids to improve overall efficiency and reduce reliance on fossil fuels and traditional power sources. Microgrids are evolving to become an integral component of smart electrical networks, with the potential to provide grid-connected connectivity, grid resiliency, and grid-connected assets for power producers and distribution networks. System engineers are playing a crucial role in the design and implementation of these complex systems, ensuring optimal performance and reliability.

Get a glance at the market report of share of various segments Request Free Sample

The Remote segment was valued at USD 9.51 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

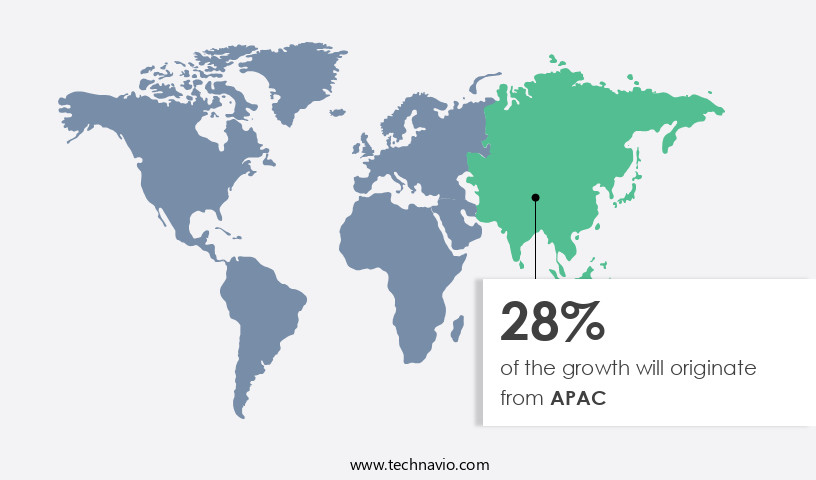

APAC is estimated to contribute 28% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The US market for additive manufacturing in the energy sector is witnessing significant growth due to increasing government initiatives for energy efficiency and grid resiliency. The US government is funding technologies that enhance power system resilience, leading to the adoption of advanced energy solutions such as microgrids. Microgrids, which can operate independently or in parallel with the main power grid, are becoming increasingly popular in the region. While fossil fuels dominate the microgrid power landscape, the use of renewable energy sources is anticipated to surge as utilities comply with state-specific mandates under the Renewable Portfolio Standards (RPS).

Remote installations, including military bases and rural areas, are significant contributors to the market in the US. These installations often face challenges in accessing reliable electricity supply, making microgrids an attractive solution. Renewable energy sources, such as solar, wind, and hydro, are being integrated into microgrids to reduce the carbon footprint and improve energy security. Solar-powered water pumps, solar generators, and wind turbine generators are integral components of these systems. Microgrids also offer benefits in managing peak loads and grid instability. Advanced controllers and sophisticated energy storage devices, such as batteries, help in optimizing energy consumption and ensuring power quality.

The integration of dispersed energy resources, such as fuel cells and CHP systems, further enhances the efficiency of these systems. The US market for microgrids is expected to remain the leading contributor to the global market during the forecast period. The growth of this market is driven by the increasing adoption of energy-efficient technologies, infrastructure development projects, and the integration of renewable energy resources into the electric grid. The market also presents opportunities for system engineers and power producers to design resilient networks and provide backup power solutions. The US market for additive manufacturing in the energy sector is witnessing significant growth due to increasing government initiatives for energy efficiency and grid resiliency.

Microgrids, which offer benefits in managing peak loads and integrating renewable energy sources, are becoming increasingly popular in the region. The market presents opportunities for system engineers, power producers, and energy storage device manufacturers to design and implement advanced energy solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Microgrid Industry?

- Growing demand for microgrids to tackle power infrastructure issues is the key driver of the market.

- The power industry faces significant challenges, including aging infrastructure, climate change, rising energy costs, and mass electrification. These issues are prevalent worldwide, with developed countries grappling with grid reliability due to infrastructure decay, and developing regions dealing with low electrification rates. Traditional power grids adhere to a hierarchical structure, with power generated at central locations and distributed through transmission and distribution lines to end-users. However, any disruption in one part of the system can cause a ripple effect, impacting the overall grid performance.

- These challenges necessitate innovative solutions to ensure power reliability and sustainability. Microgrids, as decentralized power systems, offer a promising solution by generating and distributing power locally, reducing dependence on traditional power grids and enhancing energy security. Microgrids can operate independently during grid outages, ensuring uninterrupted power supply and improving overall grid resilience.

What are the market trends shaping the Microgrid Industry?

- Rapid advances in technology is the upcoming market trend.

- The electricity utility industry is undergoing significant transformations as microgrids emerge as a game-changer in the electricity sector. Advancements in technology have led to the development of compact energy storage systems, sophisticated control mechanisms, and efficient renewable power sources. These innovations enable the creation of energy resources near consumers without compromising energy quality. The decreasing cost of power generation is fueling the adoption of decentralized power systems like microgrids. This trend is anticipated to boost the appeal of microgrid technologies among consumers.

- Another technological development, blockchain, is gaining traction due to the popularity of bitcoins, and is being integrated into microgrid systems to facilitate peer-to-peer network transactions. The integration of blockchain technology in microgrids offers potential benefits such as increased security, transparency, and efficiency. This technological fusion is expected to further enhance the appeal and functionality of microgrids.

What challenges does the Microgrid Industry face during its growth?

- High implementation costs is a key challenge affecting the industry growth.

- Microgrids represent a complex and costly power generation solution, encompassing advanced technologies for power generation resources, distribution infrastructure, and control systems. These components, including infrastructure, generation, and controls, must be connected and monitored using sophisticated control and communication technologies. Microgrids cater to diverse load types and can operate under varying grid conditions. Most microgrids are built using existing infrastructure, with custom equipment installed to meet specific customer requirements, resulting in varying costs.

- The generation of power through microgrids involves intricate processes and components, necessitating a deep understanding of the market dynamics.

Exclusive Customer Landscape

The microgrid market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the microgrid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, microgrid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd - The company provides advanced microgrid solutions, including the MGS100 system. This modular and integrated microgrid combines solar power and battery energy storage, catering to the needs of remote communities and small commercial facilities. The MGS100's design ensures reliability and scalability, making it an ideal choice for energy independence and resilience. By integrating renewable energy sources with energy storage, this solution enhances overall efficiency and sustainability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd

- Anbaric Development Partners LLC

- Canopy Power

- Eaton Corp.

- Emerson Electric Co.

- Exelon Corp.

- General Electric Co.

- General MicroGrids

- Gram Power (India) Pvt. Ltd.

- Honeywell International Inc.

- Pareto Energy

- Power Analytics Global Corp.

- Powerhive Inc.

- S and C Electric Co.

- Schneider Electric SE

- Siemens AG

- Spirae LLC

- Tesla Inc.

- TotalEnergies SE

- UL Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth as the demand for reliable and sustainable power sources continues to increase. Solar generators and wind turbines are becoming increasingly popular power sources for microgrids due to their renewable nature and ability to reduce carbon footprint. These power sources are often integrated with smart control solutions to optimize energy production and consumption. Hybrid microgrid networks, which combine multiple power sources, are gaining traction as they offer improved resilience and flexibility. Solar-powered water pumps are one application of microgrids that has seen significant growth, particularly in remote installations. Grid infrastructure continues to evolve, with diesel gensets being supplemented by renewable energy sources and energy storage devices.

Grid instability is a challenge that microgrid systems are designed to address. By providing backup power and managing peak loads, microgrids can help mitigate congestion and improve power quality. Microgrid project implementation is a complex process that requires careful planning and coordination between power sources, distribution networks, and grid-connected assets. Smart microgrids, which use sophisticated controllers and monitoring systems, are becoming more common in various sectors, including defense, data centers, and healthcare facilities. These systems enable efficient energy management and improve grid resiliency. Distributed energy resources, such as solar PV, microturbines, and fuel cells, are also being integrated into microgrids to enhance their capabilities.

The hybrid segment of the market is expected to grow significantly due to its ability to provide a more stable and reliable power supply. Microgrids are also being used for remote electrification, particularly in areas with limited access to traditional electrical networks. Grid infrastructure development projects are increasingly incorporating microgrids to improve energy security and reduce dependence on fossil fuels. Renewable resources, such as wind and solar, are becoming more cost-effective and are being integrated into microgrids through various financing schemes. Microgrids are also being used for traffic signal control and local energy communities. In the defense sector, microgrids are being used to provide backup power and improve grid resiliency.

Energy storage systems, such as batteries, are being used to store excess energy generated by renewable sources and provide backup power during grid outages. The integration of microgrids into electrical networks is a complex process that requires careful planning and coordination between various stakeholders. Microgrid topologies vary depending on the specific application and power sources involved. Micro-sources, such as solar panels and wind turbine generators, are being integrated into electrical networks to improve power generation efficiency and reduce transmission losses. The use of microgrids is not limited to the power sector. They are also being used in the healthcare sector to ensure uninterrupted power supply and in the defense sector to improve grid resiliency.

Microgrids are being used to power urban infrastructure, such as streetlights and lighting, and to provide backup power to electronic goods during power outages. The market is witnessing significant growth due to the increasing demand for reliable and sustainable power sources. Solar and wind power, smart control solutions, and energy storage devices are key components of microgrid systems. Microgrids are being used in various sectors, including defense, data centers, healthcare facilities, and urban infrastructure, to improve power generation efficiency, reduce dependence on traditional fuel sources, and enhance grid resiliency. The integration of microgrids into electrical networks is a complex process that requires careful planning and coordination between various stakeholders.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.4% |

|

Market growth 2025-2029 |

USD 41.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.8 |

|

Key countries |

US, China, Canada, India, Japan, Brazil, Germany, UK, Argentina, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Microgrid Market Research and Growth Report?

- CAGR of the Microgrid industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the microgrid market growth of industry companies

We can help! Our analysts can customize this microgrid market research report to meet your requirements.