Hematology Analyzers and Reagents Market Size 2024-2028

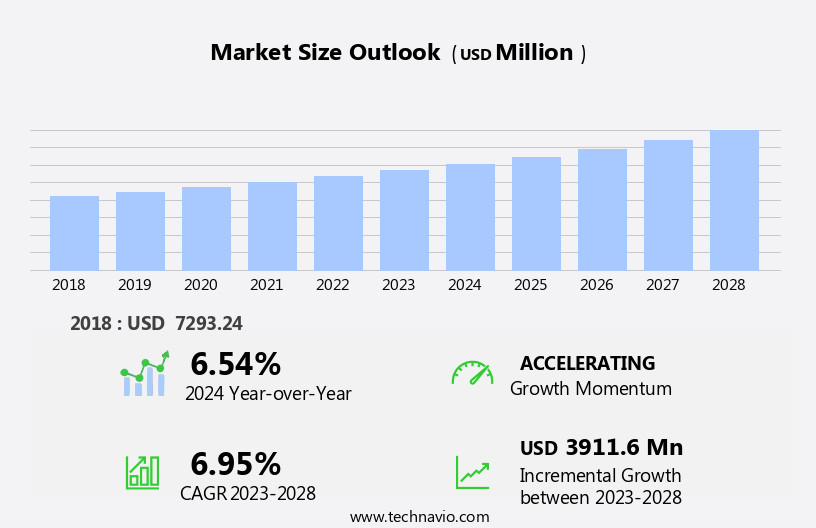

The hematology analyzers and reagents market size is forecast to increase by USD 3.91 billion, at a CAGR of 6.95% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing adoption of advanced hematology analyzer solutions in smaller and mid-sized laboratories. Automation in healthcare is a major trend, leading to the widespread use of hematology analyzers for accurate and efficient diagnosis. However, limited access to these technologies in rural areas presents a challenge. In the immunohematology market, the demand for cell surface markers is increasing due to their role in identifying blood types and detecting diseases such as leukemia and lymphoma. However, limited access to these solutions in rural areas poses a challenge for market expansion.

- Despite this obstacle, companies can capitalize on opportunities by focusing on developing cost-effective, portable, and easy-to-use hematology analyzers and reagents, catering to the needs of rural healthcare facilities and remote laboratories. By addressing this challenge, market players can broaden their customer base and strengthen their market position.

What will be the Size of the Hematology Analyzers and Reagents Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, driven by advancements in technology and regulatory requirements. CBC analyzers, for instance, are increasingly being integrated with automated systems, ensuring faster turnaround times and improved accuracy. IVD regulations, such as CLIA and CE marking, continue to shape the market, prioritizing regulatory compliance and quality assurance. Sample preparation and calibration fluids play a crucial role in maintaining the performance of these analyzers. Reagent management and inventory control are essential for ensuring a consistent supply of diagnostic reagents, while technical support and calibration services are vital for maintaining the accuracy and reliability of the systems.

Manual hematology systems and point-of-care testing are gaining popularity due to their ease of use and portability. Coagulation analyzers and immunohematology analyzers are also seeing significant growth, expanding the applications of hematology analyzers across various sectors. Platelet analyzers and differential analyzers are essential for diagnosing and monitoring blood disorders. Blood collection tubes and control materials are crucial components of the hematology analyzer system, ensuring accurate and reliable results. The market for hematology analyzers and reagents is dynamic, with ongoing developments in technology and regulatory requirements shaping its trajectory. The focus on improving turnaround time, ensuring regulatory compliance, and providing technical support and calibration services is driving innovation and growth in the market.

How is this Hematology Analyzers and Reagents Industry segmented?

The hematology analyzers and reagents industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Reagents and consumables

- Instruments

- End-user

- Hospitals

- Clinical laboratories

- Research institute

- Others

- Analyzer Type

- 3-Part Differential Analyzers

- 5-Part Differential Analyzers

- 6-Part Differential Analyzers

- Application

- Anemia

- Blood Cancer

- Hemorrhagic Conditions

- Infectious Diseases

- Immune System Disorders

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

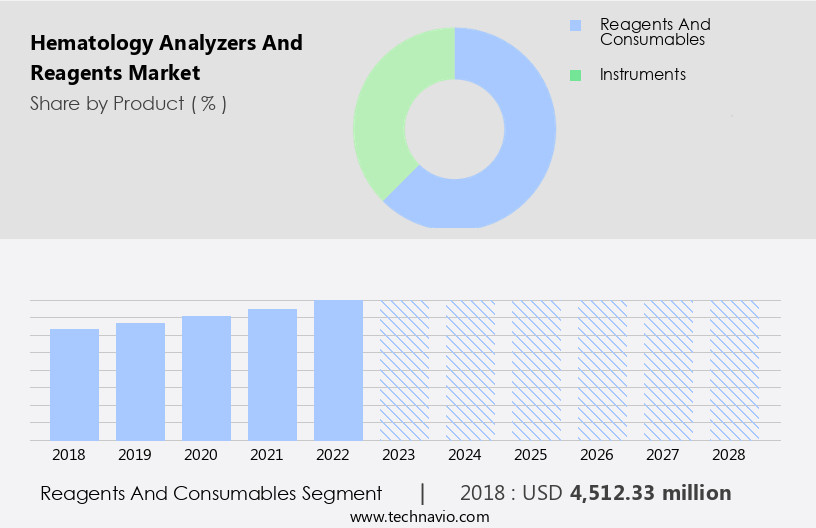

The reagents and consumables segment is estimated to witness significant growth during the forecast period.

The market encompasses various product segments, each playing a crucial role in ensuring accurate and efficient blood analysis. Reagents, specifically, are integral to the hematology system as they facilitate chemical reactions for identifying and measuring blood components. Hematology reagents, which include calibration fluids, control materials, and diagnostic reagents, are dedicated substances used in automated cell counters. Sample preparation is a critical process in hematology analysis, and the use of specialized reagents facilitates optimal sample handling. Compliance with regulations such as CLIA and IVD is essential, and reagents must undergo rigorous testing to meet quality assurance standards. Automated hematology systems, which include CBC analyzers, platelet analyzers, coagulation analyzers, and immunohematology analyzers, require regular maintenance and calibration services.

Reagent management systems ensure inventory control and timely replacement of consumables. Point-of-care testing has gained popularity due to its ease of use and quick turnaround time, necessitating the availability of diagnostic reagents and calibration services. Ease of use and CE marking are essential considerations for both manual and automated systems. Sample storage and transportation require specialized reagents and materials, such as blood collection tubes and control materials, to maintain sample integrity and prevent contamination. Regulatory compliance and quality control are paramount in the production and use of these reagents. Assay kits and inventory management systems facilitate efficient reagent utilization and reduce waste.

Technical support and calibration services ensure the continued performance of hematology analyzers and maintain the accuracy of results.

The Reagents and consumables segment was valued at USD 4.51 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

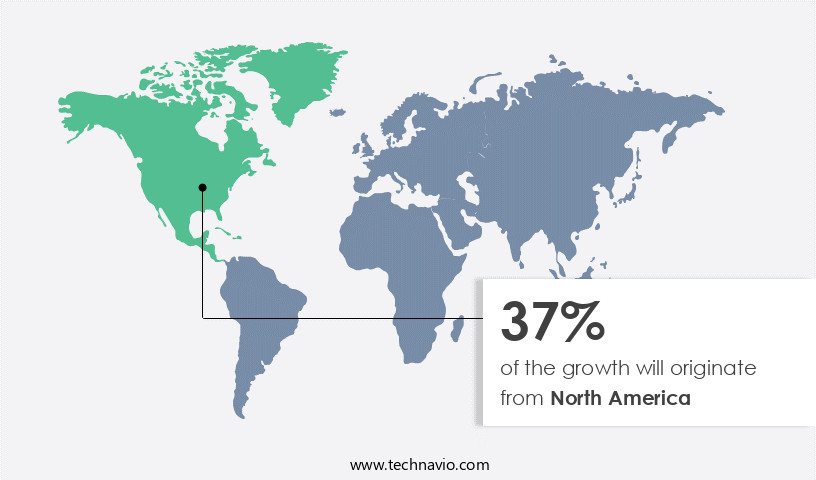

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing steady growth due to substantial investments in healthcare research and testing in the US. In 2020, the Centers for Medicare and Medicaid Services (CMS) reported a 2.7% increase in US national health expenditure spending, reaching USD4.3 trillion, or USD12,914 per person, contributing 18.3% to the country's gross domestic product. The well-established distribution network in countries like the US and Canada, along with manufacturers' focus on offering comprehensive hematology solutions, such as automated analyzers, to hospitals and diagnostic centers, is driving market expansion. Data management software plays a crucial role in ensuring regulatory compliance, including CLIA regulations, in the hematology analyzers market.

Reagent management, calibration fluids, and control materials are essential components of these systems, ensuring accurate and reliable results. Hematology analyzers, including CBC analyzers, platelet analyzers, hemoglobin analyzers, and coagulation analyzers, are integral to diagnosing various blood disorders. Automated hematology systems, with their ease of use and quick turnaround times, are increasingly popular. Point-of-care testing and manual hematology systems also have their place in the market, catering to specific needs. IVD regulations and quality assurance are critical factors influencing market trends. Inventory management and technical support are essential services provided by manufacturers to ensure seamless operations. Calibration services and assay kits are essential for maintaining the accuracy and reliability of hematology analyzers.

CE marking and quality control are crucial for regulatory compliance and ensuring the highest standards in the industry. Blood collection tubes and sample storage are vital components of the overall hematology solutions portfolio. The market is evolving, with a focus on providing integrated solutions that cater to various needs, from manual systems to automated, and from routine testing to specialized applications. Manufacturers are continually innovating to meet the demands of healthcare providers and diagnostic centers, ensuring the market remains dynamic and responsive to the needs of the industry.

Market Dynamics

The global hematology analyzers and reagents market is undergoing substantial growth, driven by the increasing need for accurate blood disorder diagnosis, including prevalent conditions like anemia diagnosis and severe illnesses such as blood cancer diagnosis. The expanding hematology analyzers and reagents market size and dynamic hematology analyzers and reagents market trends are fueled by strong hematology analyzers and reagents market growth drivers. Hematology analyzers, especially point-of-care (POC) hematology analyzers, are crucial for performing a complete blood count (CBC). The effectiveness of these devices relies heavily on specialized hematology reagents. Innovations like automated hematology analysis leveraging AI in hematology analysis and machine learning (ML) in hematology are transforming diagnostics. Furthermore, advancements in flow cytometry technology are vital. These tools are indispensable for infectious disease diagnosis, monitoring chronic conditions, and ensuring safe practices in blood bank testing, serving both clinical laboratories and hospitals (end-users).

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hematology Analyzers and Reagents Industry?

- The adoption of hematology analyzer solutions is crucial for expanding the market reach, particularly among smaller and mid-sized laboratories. These advanced tools enable efficient and accurate diagnosis and management of blood disorders, making them an indispensable asset for medical facilities of all sizes.

- In the realm of diagnostic laboratory testing, hematology analyzers play a pivotal role in delivering precise results for various blood parameters. Automated hematology analyzers, in particular, have gained significant traction due to their efficiency and accuracy. These systems streamline sample preparation, data management, and analysis processes, ensuring timely and reliable results. Hemoglobin analyzers and differential analyzers, key components of hematology systems, facilitate the measurement of hemoglobin concentration and differential count of various blood cells, respectively. Calibration fluids and reagent management systems are essential for maintaining the accuracy and consistency of these analyzers. Adherence to Clinical Laboratory Improvement Amendments (CLIA) regulations is crucial for laboratories to ensure the validity and reliability of their test results.

- Automated hematology analyzers, with their data management software, help laboratories maintain compliance with these regulations. Flow cytometry, another advanced technology, offers multidimensional analysis of blood cells, providing comprehensive diagnostic information. Automated systems in flow cytometry enable efficient data acquisition and analysis, enhancing the diagnostic capabilities of laboratories. In summary, automated hematology solutions, including analyzers, data management software, calibration fluids, and reagent management systems, contribute significantly to the efficiency, accuracy, and productivity of clinical laboratories. They provide valuable data-driven insights, reduce human error, and enable compliance with regulatory requirements.

What are the market trends shaping the Hematology Analyzers and Reagents Industry?

- The healthcare sector is witnessing an escalating trend towards the implementation of automated systems. This technological advancement is increasingly becoming a necessity rather than an option.

- Small and mid-sized laboratories have traditionally relied on manual methods for hematology analysis due to the high cost and complexity of automated solutions. However, market companies have recognized this need and have introduced cost-effective, automated hematology analyzers and reagents specifically designed for these laboratories. For instance, Beckman Coulter Inc., a leading player in the market, launched the DxH 560 AL in 2021. This autoload hematology analyzer is tailored to small and mid-sized laboratories, reducing their time and resource constraints. The market trend towards automated solutions is gaining traction, as these laboratories seek to enhance efficiency and maintain regulatory compliance.

- Sample storage and control materials are crucial components of hematology analysis, and companies are focusing on providing high-quality solutions to meet the demands of this market segment. The availability of these specialized products has led to increased adoption of hematology analyzers among small and mid-sized laboratories. In summary, the market for hematology analyzers and reagents is witnessing growth due to the increasing demand for automated solutions from small and mid-sized laboratories. companies are responding to this trend by introducing cost-effective, specialized products, such as platelet analyzers and immunohematology analyzers, to meet the unique needs of this market segment.

- Additionally, regulatory compliance and the availability of high-quality sample storage and control materials are essential factors driving market growth.

What challenges does the Hematology Analyzers and Reagents Industry face during its growth?

- Rural areas present a significant challenge to the industry's growth due to limited accessibility.

- The market faces a significant challenge due to inadequate access to healthcare services in rural regions. These areas typically lack medical facilities and qualified personnel, leading to a scarcity of hematology analyzers and testing reagents. Consequently, the diagnosis and management of blood diseases in these areas are hindered. Healthcare infrastructure and resources are often unevenly distributed, making it challenging for patients in rural areas to access hematological testing and treatments in a timely manner. The absence of readily available equipment and reagents for hematological testing can result in delayed diagnoses and treatments, potentially compromising patient outcomes.

- To address this issue, it is crucial to prioritize investments in healthcare infrastructure and resources in rural areas, ensuring the availability and affordability of hematology analyzers and reagents. Quality assurance, turnaround time, technical support, and the use of manual hematology systems, assay kits, and coagulation analyzers can help improve the accessibility and accuracy of hematological testing in rural regions.

Exclusive Customer Landscape

The hematology analyzers and reagents market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hematology analyzers and reagents market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hematology analyzers and reagents market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in providing advanced hematology solutions, including analyzers like the CELL DYN Sapphire and CELL DYN Ruby, and accompanying reagents. Their offerings facilitate accurate and efficient blood cell analysis for various diagnostic applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Bio Rad Laboratories Inc.

- BioSystems SA

- Boule Diagnostics AB

- Danaher Corp.

- EKF Diagnostics Holdings Plc

- Erba Diagnostics FZ LLC

- F. Hoffmann La Roche Ltd.

- Heska Corp.

- HORIBA Ltd.

- Mindray Bio medical Electronics Co. Ltd.

- NeoMedica

- Nihon Kohden Corp.

- Siemens AG

- STRATEC SE

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

- Toyobo Co. Ltd.

- URIT Medical Electronic Co. Ltd.

- Zoetis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hematology Analyzers And Reagents Market

- In January 2024, Sysmex Corporation, a leading global supplier of in vitro diagnostic systems and reagents, announced the launch of its new XN-9100 STAT hematology analyzer. This advanced system, featuring improved accuracy and efficiency, was designed to meet the growing demand for rapid and precise hematology analysis (Sysmex Corporation Press Release, 2024).

- In March 2024, Roche Diagnostics and Illumina, Inc. Entered into a strategic partnership to integrate Illumina's next-generation sequencing (NGS) technology into Roche's hematology offerings. This collaboration aimed to enhance the diagnostic capabilities of hematology analyzers by incorporating genomic information (Roche Diagnostics Press Release, 2024).

- In May 2024, Beckman Coulter, a Danaher company, completed the acquisition of Horiba Medical, a global leader in clinical chemistry and immunoassay systems. This acquisition expanded Beckman Coulter's portfolio in the diagnostics market, particularly in the hematology segment (Beckman Coulter Press Release, 2024).

- In February 2025, the US Food and Drug Administration (FDA) granted 510(k) clearance to Abbott's new flagship hematology analyzer, the Architect i-2000SR. This clearance marked the entry of Abbott's latest system into the US market, further strengthening its position in The market (Abbott Laboratories Press Release, 2025).

Research Analyst Overview

- The market encompasses various technologies and applications, including Prothrombin Time (PT) testing, thrombocytopenia screening, cell morphology analysis, and hemostasis testing. Remote diagnostics and preventive healthcare are driving market growth, enabling early detection and treatment of conditions such as anemia and leukemia. Advanced technologies like machine learning (ML) and artificial intelligence (AI) are revolutionizing predictive diagnostics, with applications in D-dimer testing, hemoglobinopathy testing, and fibrinogen assays. Data analytics and microfluidic technology are also transforming plasma and serum analysis, while automated differential count and optical detection enhance accuracy and efficiency.

- Clinical trials continue to explore the potential of novel techniques like manual differential count, whole blood analysis, and electrochemical detection. The integration of these advanced technologies is reshaping the hematology landscape, offering improved diagnostic capabilities and enhanced patient care.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hematology Analyzers and Reagents Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.95% |

|

Market growth 2024-2028 |

USD 3911.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.54 |

|

Key countries |

US, Canada, Germany, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hematology Analyzers and Reagents Market Research and Growth Report?

- CAGR of the Hematology Analyzers and Reagents industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hematology analyzers and reagents market growth of industry companies

We can help! Our analysts can customize this hematology analyzers and reagents market research report to meet your requirements.