Immunohematology Market Size 2024-2028

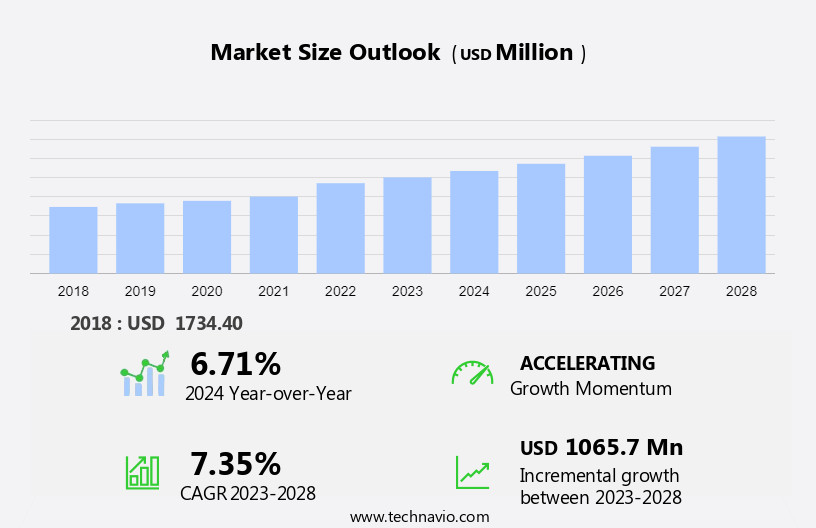

The immunohematology market size is forecast to increase by USD 1.07 billion at a CAGR of 7.35% between 2023 and 2028.

- The market is witnessing significant growth due to the shift by healthcare services towards automated immunohematology analyzers. This trend is driven by the need for accurate and efficient blood testing to ensure patient safety and reduce manual errors. Furthermore, there is a paradigm shift towards molecular immunohematology, which offers more precise and personalized diagnosis and treatment options.

- However, the high maintenance cost and low reimbursement for blood components remain challenges for market growth. Automation in immunology and hematology analyzers, along with advanced software solutions, are key areas of focus for market participants to address these challenges and cater to the evolving needs of the healthcare industry.

- The market is expected to continue its growth trajectory, driven by these trends and the increasing demand for advanced blood testing solutions.

What will be the Size of the Immunohematology Market During the Forecast Period?

- The market encompasses a range of services and technologies essential to the collection, testing, processing, and transfusion of blood and blood components. This market is driven by the increasing prevalence of trauma cases requiring blood transfusion services, infusion therapy devices, elective surgical procedures, and the management of various blood disorders such as leukemia, hemophilia, and sickle cell disease. Immunohematology tests play a critical role in ensuring the safety and compatibility of blood products, preventing immunity-related reactions, transplant-related reactions, and pregnancy-related complications. The market space is further expanded by the need for blood products in HIV treatment and the ongoing efforts to address infections associated with blood transfusion and blood banking.

- Advancements in immunohematology technologies continue to improve the accuracy and efficiency of antigen and antibody detection, reducing the risk of hemolysis and other adverse reactions. Awareness campaigns and advancements in healthcare services, storage, and blood component services further fuel market growth. The market is expected to experience significant expansion, particularly in response to the ongoing coronavirus pandemic and the resulting increase in demand for blood products.

How is this Immunohematology Industry segmented and which is the largest segment?

The immunohematology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Analyzers and systems

- Reagents

- End-user

- Hospitals

- Blood banks

- Diagnostic laboratories

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Product Insights

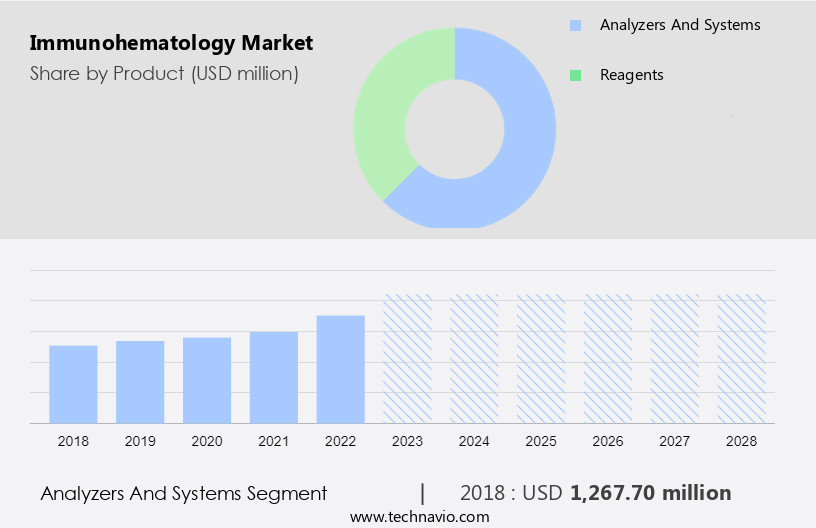

The analyzers and systems segment is estimated to witness significant growth during the forecast period. The market is driven by the increasing demand for automated analyzers in blood banks and advanced immunohematology systems. With large blood banks, such as the National Health Service Blood and Transplantation Center (NHSBT) In the UK, storing over 900 gallons of blood and processing thousands of donations weekly, the need for efficient and accurate blood screening is paramount. Automated analyzers streamline the testing process, enabling blood banks and Tier 1 hospitals to perform up to 200-300 tests daily for blood transfusion. Key technologies in this market include next-generation immunohematology analyzers, hematology devices, and transfusion systems.

Immunohematology tests, such as those for anemia, blood malignancies, hemorrhagic diseases, and blood-borne infections, are crucial for diagnosing and managing various conditions, including leukemia, sickle cell disease, and hemophilia. The market space is further influenced by regulations, awareness campaigns, and advancements in healthcare services, including emergency assistance, blood component services, and coronavirus research.

Get a glance at the Immunohematology Industry report of share of various segments Request Free Sample

The Analyzers and systems segment was valued at USD 1.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

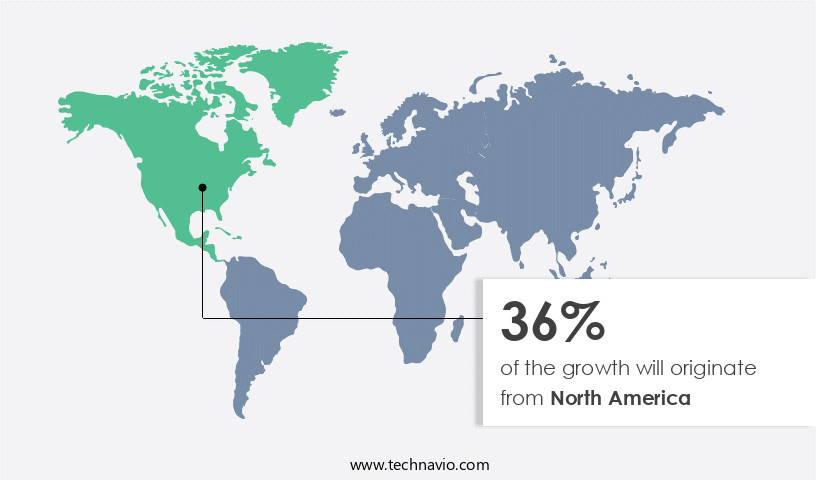

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth due to the rising incidence of hospital-acquired infections (HAIs) and the increasing demand for blood transfusion services in elective surgical procedures and trauma cases. According to the Centers for Disease Control and Prevention (CDC), approximately 3.2% of patients In the US acquire a HAI daily. Globally, 5-10% of individuals in both developed and developing countries have HAIs at any given time. HAIs include infections such as pneumonia and bloodstream infections. The market's expansion is attributed to government awareness programs and the Affordable Care Act's emphasis on medical safety. Blood disorders like leukemia, anemia, sickle cell disease, and hemophilia are other significant drivers.

Immunohematology devices, including automatic and semi-automatic analyzers, microplates, biochips, gel cards, and polymerase chain reaction, play a crucial role in diagnosing and treating immunological disorders and blood-borne infections like HIV and hepatitis. The market encompasses private and public entities, blood banks, and transfusion systems. Market growth may be influenced by factors such as increased storage capabilities, software upgrades, and the automation of devices. However, challenges include the spread of infection in healthcare settings, healthcare practitioner hesitation, and sluggish growth due to regulatory requirements and market saturation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Immunohematology Industry?

- Shift by end-users to automated immunohematology analyzers is the key driver of the market.Immunohematology analyzers play a crucial role in blood transfusion services, particularly in trauma cases and elective surgical procedures. These devices are essential for detecting antigens and antibodies in blood samples to prevent immunity-related reactions, transplant-related reactions, and pregnancy-related reactions. The increasing prevalence of blood disorders, such as leukemia, hemophilia, sickle cell disease, and blood malignancies, necessitates regular blood testing. Manufacturers are addressing the need for automation in immunohematology testing by developing semi-automatic and fully-automated analyzers. For instance, Grifols' DG Reader Net and Ortho Clinical Diagnostics' ORTHO VISION Analyzer are automated solutions that can screen large volumes of blood samples quickly and accurately.

- The BioVue method, a microplate-based assay, and polymerase chain reaction (PCR) are advanced technologies used in immunohematology testing. The market for immunohematology devices is driven by the growing demand for blood transfusion services, increasing awareness of blood-borne infections, and the need for improved diagnosis efficacy and analysis time. According to a study published in PLOS One, the global prevalence of leukemia was estimated to be 43.4 cases per 100,000 individuals, with new cases and deaths increasing each year. This highlights the importance of accurate and efficient immunohematology testing in healthcare services.

- Blood collection, processing, storage, and transfusion systems rely on immunohematology devices to ensure the safety and effectiveness of blood products. In public and private healthcare settings, awareness campaigns and blood donation camps are essential for increasing awareness of blood associated diseases and infections. Regulations governing the spread of infection and healthcare practitioner training are crucial to maintaining the quality of immunohematology testing. In summary, the market is growing due to the increasing demand for blood transfusions, the need for advanced testing technologies, and the importance of ensuring the safety and efficacy of blood products. Automated and semi-automated immunohematology analyzers are key to reducing human errors and improving diagnosis efficacy in blood banks and hospitals.

What are the market trends shaping the Immunohematology Industry?

- Paradigm shift toward molecular immunohematology is the upcoming market trend. Immunohematology, a critical field in healthcare, focuses on the study of the immune system's response to various blood components. Molecular analysis, a key component of immunohematology, plays a pivotal role in detecting the molecular and genetic basis of antigens, thereby ensuring compatibility during blood transfusion from unrelated donor registries. This method's adoption has escalated alongside serological and HLA typing, with numerous blood banks and hospitals integrating it into their processes. The shift towards molecular immunohematology will significantly drive The market's growth. Blood disorders, such as leukemia, hemophilia, sickle cell disease, and anemia, necessitate immunohematology tests for diagnosis and treatment. Trauma cases, elective surgical procedures, and transplant-related procedures further expand the demand for blood transfusion services and immunohematology devices. The market encompasses various devices, including automatic analyzers, semi-automatic analyzers, microplates, biochips, gel cards, and hematology analyzers, among others.

- The market caters to public and private healthcare settings, with an increasing focus on research and development in this domain. Key areas of focus include the automation of devices, software up-gradation, increased storage capabilities, and the development of new reagents. Market dynamics are influenced by factors such as the prevalence of blood-borne infections, hematological disorders, and the need for emergency assistance. Immunohematology technologies play a crucial role in addressing blood associated diseases, including infections and malignancies like leukemia, lymphoma, and anemia. The World Health Organization reports an increasing number of leukemia new cases, deaths, and prevalence, underscoring the importance of early diagnosis and effective treatment.

- The research fraternity and healthcare associations collaborate to develop regulations that ensure the spread of infection is minimized during blood collection, processing, and storage. Healthcare practitioners rely on immunohematology devices and transfusion systems to provide blood component services, with fully-automated devices and transfusion systems gaining popularity for their diagnosis efficacy and analysis time. Immunity-related reactions, transplant-related reactions, and pregnancy-related reactions necessitate the use of immunohematology tests to ensure patient safety. The market faces challenges, such as the hesitation towards plasma therapy and the sluggish growth due to the ongoing coronavirus pandemic.

- However, the market's potential for growth is immense, with the increasing number of elective surgeries and non-urgent clinical interventions, emergency authorization for convalescent plasma therapy, and the development of new immunohematology technologies. The immune system's role in maintaining overall health and the potential for personalized medicine further underscore the importance of immunohematology In the healthcare services landscape.

What challenges does the Immunohematology Industry face during its growth?

- High maintenance cost and low reimbursement for blood components is a key challenge affecting the industry growth. Immunohematology, a critical field in healthcare services, encompasses the diagnosis and management of various blood disorders, including anemia, blood malignancies, hemorrhagic diseases, and blood-borne infections. The market for immunohematology is driven by the increasing number of trauma cases, elective surgical procedures, and the prevalence of blood associated diseases such as leukemia, sickle cell disease, hemophilia, and HIV. Blood donation and blood banks play a pivotal role in this market. The cost of maintaining blood components, including labor, reagents, and disposables, as well as storage, is increasing the cost burden on these entities.

- The market for immunohematology devices, transfusion systems, and fully-automated devices is witnessing increased storage capabilities and software upgrades to enhance diagnosis efficacy and reduce analysis time. However, the hesitation among consumers towards plasma therapy due to transfusion-related reactions, immunity-related reactions, and pregnancy-related reactions, as well as regulatory requirements, is hindering the market's growth. The research fraternity and healthcare associations are focusing on awareness campaigns, clinical trials, and regulations to mitigate the spread of infection and ensure the safety and efficacy of immunohematology technologies. The market space for immunohematology is vast, with applications in public and private healthcare settings, blood collection, blood processing, blood testing, and blood storage.

Exclusive Customer Landscape

The immunohematology market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the immunohematology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, immunohematology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Becton Dickinson and Co. - The market encompasses a range of diagnostic products, with the company supplying solutions such as BD Vacutainer serum tubes and BD Vacutainer EDTA tubes. These products facilitate blood sample collection for immunohematological testing, ensuring accurate and reliable results. The company's offerings cater to various diagnostic applications, contributing to the advancement of the field.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Becton Dickinson and Co.

- Biomed Global

- Bio Rad Laboratories Inc.

- biosurfit SA

- Cardinal Health Inc.

- Calibre Scientific Inc.

- Danaher Corp.

- DIAGAST SAS

- Grifols SA

- Hemo bioscience Inc.

- HUMAN Gesellschaft fur Biochemica und Diagnostica mbH

- Institut de Biotechnologies Jacques Boy

- MAK SYSTEM S.A.

- Merck KGaA

- Mesa Laboratories Inc.

- Quotient Ltd.

- Siemens AG

- Thermo Fisher Scientific Inc.

- Tulip Diagnostics Pvt. Ltd.

- Werfenlife SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of services and technologies that facilitate the diagnosis, treatment, and management of various hematological disorders and associated diseases. This market plays a crucial role in ensuring the availability of safe and effective blood transfusion services for trauma cases and elective surgical procedures. Immunohematology tests are integral to identifying antigens and antibodies in blood samples, which is essential for the successful matching of donor and recipient blood during transfusions. These tests help prevent hemolysis, a potentially life-threatening condition where red blood cells are destroyed, and ensure the compatibility of blood products for various patient populations.

The market is driven by the increasing prevalence of hematological disorders, hemorrhagic diseases, and blood-borne infections. These conditions necessitate regular blood testing, transfusion, and storage services. Trauma centers and hospitals rely on immunohematology services to provide emergency assistance to patients, making this market a vital component of healthcare services. Despite the growing demand for immunohematology services, the market faces challenges such as the spread of infection, regulatory requirements, and hesitation from consumers. The COVID-19 pandemic has further complicated matters, leading to a sluggish growth in some regions. The market space for immunohematology technologies is diverse, with various devices and reagents available.

Automatic and semi-automatic analyzers, microplates, biochips, gel cards, and polymerase chain reaction (PCR) are some of the commonly used technologies. Hematology analyzers and transfusion systems are essential components of immunohematology laboratories. Fully-automated devices and software upgrades have revolutionized the market, offering increased storage capabilities and faster analysis times. Basic machines and manual methods still have their place, particularly in resource-limited settings. The market for immunohematology devices and technologies is segmented into various categories, including reagents, antigens, antibodies, and diagnostic kits. Human antiglobulin, hematology tests, genetic material (DNA, RNA), and viral load assays are some of the key products in this market.

Immunohematology services are provided by both public and private entities. Public healthcare settings, such as government hospitals and blood banks, play a crucial role in providing essential services to underserved populations. Private entities, on the other hand, offer advanced technologies and specialized services to cater to the needs of individual patients and hospitals. Awareness programs and campaigns are essential for increasing public awareness about the importance of blood donation and the role of immunohematology services in ensuring the safety and efficacy of blood transfusions. These initiatives help build trust and confidence in the healthcare system and encourage more people to donate blood.

The market is subject to various regulations aimed at ensuring the safety and efficacy of blood products and transfusion services. Compliance with these regulations is crucial for maintaining the trust and confidence of patients and healthcare practitioners. It plays a vital role in ensuring the availability of safe and effective blood transfusion services for various patient populations. The market is driven by the increasing prevalence of hematological disorders and blood-borne infections, but faces challenges such as regulatory requirements, hesitation from consumers, and the spread of infection. The market space is diverse, with various devices, reagents, and technologies available to cater to the needs of different patient populations and healthcare settings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.35% |

|

Market growth 2024-2028 |

USD 1.07 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.71 |

|

Key countries |

US, Germany, UK, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Immunohematology Market Research and Growth Report?

- CAGR of the Immunohematology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the immunohematology market growth of industry companies

We can help! Our analysts can customize this immunohematology market research report to meet your requirements.