High-End Stick Vacuum Cleaner Market Size 2024-2028

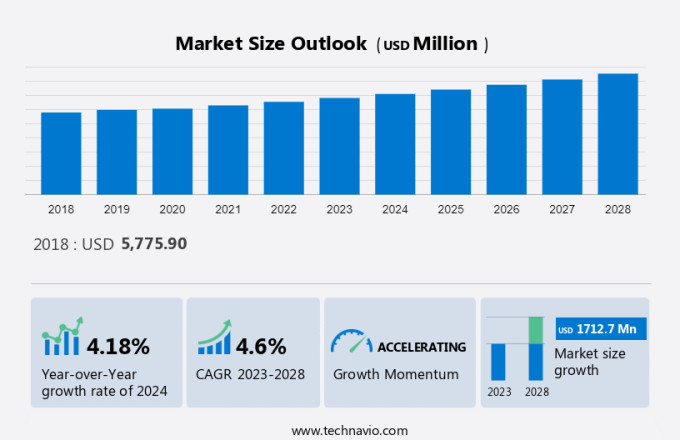

The high-end stick vacuum cleaner market size is forecast to increase by USD 1.71 billion, at a CAGR of 4.6% between 2023 and 2028. The market is experiencing continuous expansion driven by several key factors. Firstly, the rising preference for luxury home appliances significantly contributes to market growth. Secondly, social trends in urban regions encourage the adoption of premium stick vacuum cleaners. Lastly, increasing awareness of cleanliness and hygiene further boosts market demand. These factors collectively create a favorable environment for the industry, as consumers seek high-quality, efficient cleaning solutions. The combination of luxury preferences, urban social trends, and heightened hygiene awareness ensures sustained market growth and innovation in the home appliance sector, particularly for premium cleaning products.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamic and Customer Landscape

The market is witnessing significant growth within the household cleaning appliance industry. These cleaners offer portable and cordless operation, making them ideal for various vacuuming jobs around modern households. With sleek designs and lightweight structures, they provide powerful suction and advanced filtration systems, ensuring high-performance cleaning solutions. Equipped with rechargeable batteries and intelligent sensors, cordless vacuum cleaners offer convenient navigation and efficient cleaning of draperies, cushions, and upholstery. They cater to consumers seeking heavier vacuums with cordless flexibility, eliminating the hassle of wires and reliance on electrical points. The market is driven by a demand for modern, efficient, and versatile cleaning solutions, offering a blend of convenience and performance for discerning consumers. Our researchers analyzed the market research and growth data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The increasing popularity of luxury home appliances is notably driving the market growth. High-end stick vacuums are versatile, lightweight devices that come in a variety of sizes and styles. It is perfect for any home as it can be easily stored in a closet or corner of the room. Light weight makes it easy to carry and cleans tight spaces such as stairs, corners, and tight spaces. In addition to its practicality, the luxury stick vacuum has an elegant design that will add a touch of class to any home. High-quality materials such as stainless steel and a high-gloss finish are used in many models to give them an elegant look. Therefore, it is popular with those who want to add elegance to their interior design.

In addition to style and comfort, high-end stick vacuums impress with innovative technology. Some models come with advanced features such as powerful motors and HEPA filters that trap allergens and bacteria to ensure high indoor air quality. These features make the vacuum cleaner a great choice for those who care about their family's health and well-being. It's also worth mentioning that luxury cleaners are becoming more and more popular among people with busy lives. Stick vacuums have become a time-saving device for many due to their easy handling and quick cleaning technology. It requires minimal effort and time, making it a great option for those who have a busy schedule and want to keep their home clean without taking up too much time. Many such factors are expected to drive the growth of the market during the forecast period.

Significant Market Trends

Growing demand from online retailing is identified as the major market trends. With the rapid penetration of the Internet and smartphones, online shopping has become very convenient and more and more accepted among people. Several international e-commerce platforms are available worldwide. The average amount spent per online transaction and the number of online transactions are increasing worldwide. The increasing number of Internet users and their willingness to buy are the main factors in the popularity of online trading channels. Increased internet penetration, increasing consumer confidence and propensity to shop online, rapid delivery to consumers, and the availability of a wide range of products play a major role in driving the global e-commerce industry.

Additionally, secure transactions and cash-on-delivery options have increased the demand for high-end stick vacuums for cleaning in online sales channels. This encourages Companies to focus on internet-savvy customer segments and explore online retail formats. Thus, with increasing online retail, the market is expected to witness significant growth during the forecast period.

Major Market Challenge

The availability of low-cost manual labor in developing countries may impede the growth of the market. Cheap labor in developing countries is a major challenge for the global luxury stick vacuum cleaner market. In countries such as India and China, workers such as servants are preferred over quality vacuum cleaners due to low labor costs. Thus, the demand for high-end cleaners in these countries remains low. In addition, cheap craftsmen are preferred for cleaning commercial units in the commercial sector.

In many developing countries in APAC, the informal economy accounts for a significant portion of the workforce, with the informal sector as a whole accounting for 60% of the workforce. Several countries in the region have seen a decline in the labor share of GDP. Specific problems include high youth unemployment and unemployment rates, rising inequality, and a shortage of skilled workers. Furthermore, child labor is prevalent in these developing countries. Children around the world routinely engage in paid and unpaid work that does not harm them. APAC and sub-Saharan Africa remain the regions with the highest rates of child labor. The presence of such a workforce in these regions is expected to hamper the growth of the market during the forecast period.

Key Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Market Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AB Electrolux: The company offers high-end stick vacuum cleaners such as pf91 6eb.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- AB Electrolux

- Alfred Karcher SE and Co KG.

- Atrix International Inc.

- BISSELL

- Dyson Group Co.

- iVision Vacuum srl

- JS Global Lifestyle Co. Ltd.

- Koninklijke Philips N.V.

- LG Corp.

- Midea Group Co. Ltd.

- Miele and Cie. KG

- Numatic International Ltd.

- Panasonic Holdings Corp.

- Proscenic

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- SEB Developpement SA

- Stanley Black and Decker Inc.

- Techtronic Industries Co. Ltd.

- Tineco Intelligent Technology Co. Ltd.

- Xiaomi Communications Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Distribution Channel

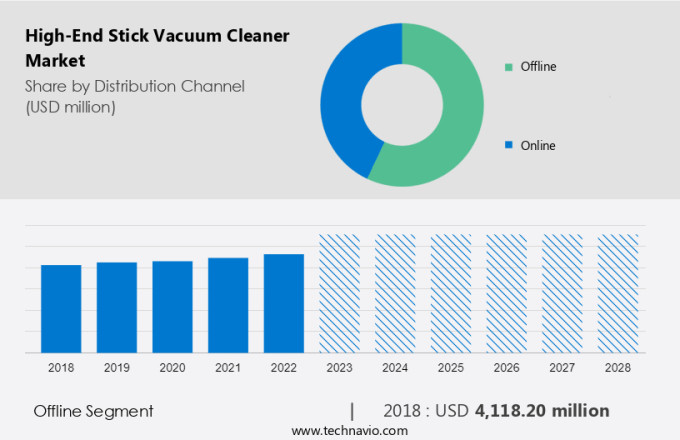

The market share growth by the offline segment will be significant during the forecast period. The offline distribution channel segment includes sales of products such as luxury vacuum cleaners through specialty stores, department stores, hypermarkets, supermarkets, convenience stores, and clubhouse stores.

Get a glance at the market contribution of various segments View the PDF Sample

The offline segment was valued at USD 4.11 billion in 2018. Sales through offline sales channels have been gradually declining over the years due to the changing consumer preference for online shopping. To drive sales through offline channels, Companies manage sales through local retailers. Meanwhile, Companies employ different marketing strategies to sell their products through offline stores. Although offline sales channels are losing market share and popularity, extensive and innovative marketing activities will lead to a steady increase in sales of high-end vacuum cleaners through offline sales channels during the forecast period.

By Region

For more insights on the market share of various regions Download PDF Sample now!

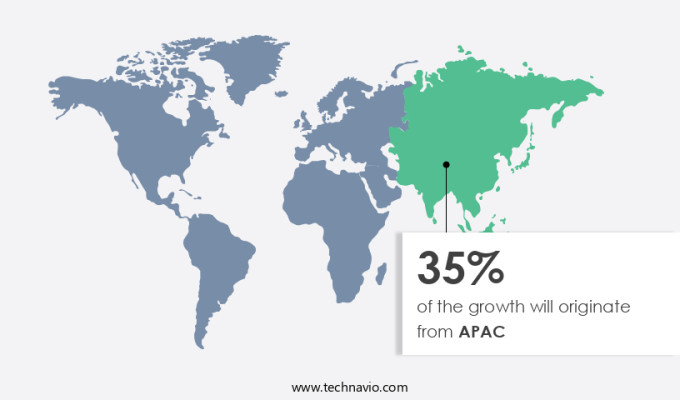

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. APAC is one of the fastest-growing markets for high-end stick vacuum cleaners. With rapid population growth and increasing urbanization, the demand for high-end vacuum cleaners has increased significantly in recent years. The rising middle-class population and disposable income in the Asia-Pacific region have emerging countries such as China, Japan, and India as major growth drivers for the regional luxury vacuum cleaner market. China is one of the largest markets for high-end stick vacuum cleaners in APAC. Rising standards of living and growing trends in home cleaning have increased the demand for top-of-the-line vacuum cleaners in the country.

In addition, the Chinese government's commitment to energy saving and environmental protection has also introduced high-quality vacuum cleaners that are energy efficient and environmentally friendly. Similarly, Japan is also an important country in the regional market for luxury vacuum cleaners. The country has a mature market and high demand for technologically advanced vacuum cleaners. Additionally, Japanese consumers want products that are not only efficient but also have advanced features such as smart sensors. These sensors help detect dirt and dust levels on the floor and adjust the vacuum's suction power accordingly. Moreover, India is emerging as an important market for quality vacuum cleaners. The country has experienced remarkable economic development, leading to a rising middle class and increasing disposable income. Due to this, the demand for high-end vacuum cleaners is increasing. Additionally, the Clean India Campaign of the Indian government has increased the awareness of hygiene and cleanliness, fueling the growth of the regional market.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Application Outlook

- Residential

- Commercial

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

You may also interested in the market reports:

-

Robotic Vacuum Cleaner Market: Robotic Vacuum Cleaner Market Analysis APAC, North America, Europe, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

-

Vacuum Cleaner Market: Vacuum Cleaner Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, Canada, China, Germany, UK - Size and Forecast

-

Stick Vacuum Cleaner Market: Stick Vacuum Cleaner Market by Application, Distribution Channel, and Geography - Forecast and Analysis

Market Analyst Overview

The market is witnessing a surge in demand, driven by progressive technological solutions and the rise of connected and smart home ecosystems. These cordless vacuum cleaners offer battery-powered convenience, catering to domestic and commercial use alike. With a lightweight design and modular attachments, they provide versatile cleaning solutions for hardwood floors, carpets, and furniture in both urban and rural areas. Designed for sustainable production methods and environmental sustainability, these cleaners appeal to eco-friendly consumers, including pet owners and allergy sufferers. Equipped with anti-tangle technologies and dust illumination characteristics, high-end stick vacuums ensure efficient cleaning with minimal interruptions, making them ideal for home, office, and premium hotel environments. The Upright vacuum cleaner operates cordlessly on battery power, eliminating the need for electrical point and wire during vacuum cleaning tasks.

|

MarketScope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market Growth 2024-2028 |

USD 1.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 35% |

|

Key countries |

China, US, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AB Electrolux, Alfred Karcher SE and Co KG., Atrix International Inc., BISSELL, Dyson Group Co., iVision Vacuum srl, JS Global Lifestyle Co. Ltd., Koninklijke Philips N.V., LG Corp., Midea Group Co. Ltd., Miele and Cie. KG, Numatic International Ltd., Panasonic Holdings Corp., Proscenic, Robert Bosch GmbH, Samsung Electronics Co. Ltd., SEB Developpement SA, Stanley Black and Decker Inc., Techtronic Industries Co. Ltd., Tineco Intelligent Technology Co. Ltd., and Xiaomi Communications Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.