High Performance Ceramic Coatings Market Size 2024-2028

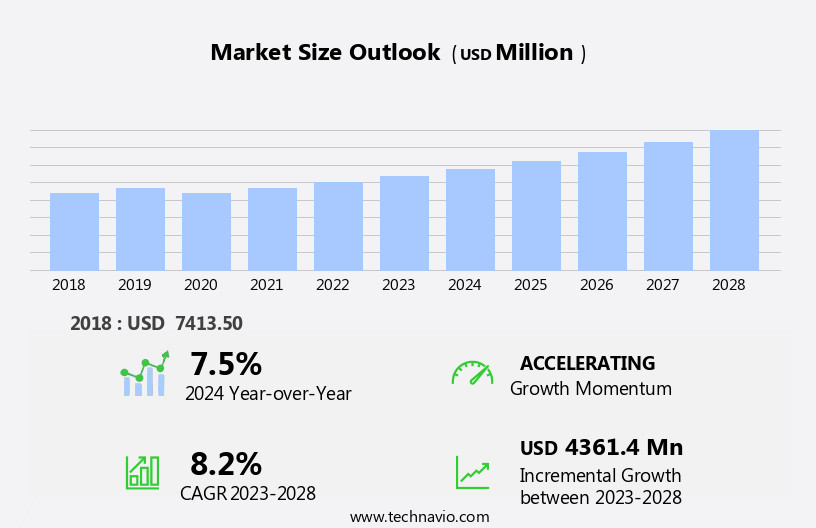

The high performance ceramic coatings market size is forecast to increase by USD 4.36 billion, at a CAGR of 8.2% between 2023 and 2028.

- The market is experiencing significant growth due to the expanding applications in various end-user industries. These coatings offer superior properties such as high temperature resistance, hardness, and corrosion resistance, making them increasingly valuable in sectors like the automotive industry, aerospace, and energy. One of the key drivers is the rising demand for thermal barriers in aircraft engines, where high performance ceramic coatings help improve fuel efficiency and engine lifespan. However, market growth is not without challenges. Fluctuations in raw material pricing pose a significant obstacle, as the production of these coatings relies on expensive materials like alumina, zirconia, and silica. Companies must navigate this volatility to maintain profitability and competitiveness.

- To capitalize on opportunities and mitigate challenges, market participants should focus on innovation, cost optimization, and strategic partnerships. By addressing these factors, they can effectively serve the growing demand for high performance ceramic coatings while managing the risks associated with raw material pricing.

What will be the Size of the High Performance Ceramic Coatings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in hydrophobic surface properties and crosslinking density effects. These coatings are finding applications in various sectors, including automotive, construction, and electronics, due to their superior abrasion resistance, corrosion protection, and thermal stability. For instance, a leading automotive manufacturer reported a 30% increase in sales after implementing a silica-based coating with self-cleaning properties on their latest vehicle model. Industry growth in this sector is expected to reach double digits, with a significant focus on developing renewable resource coatings and optimizing drying time. Environmental impact assessment and surface energy calculation are crucial considerations in the development of these coatings.

Coating lifespan prediction and durability enhancement techniques, such as nano-ceramic technology, are also gaining popularity. The polymer matrix composition, application temperature range, and coating thickness measurement are essential factors influencing the performance of these coatings. Abrasion resistance testing, contact angle measurement, and surface defect analysis are critical in ensuring coating adhesion strength and coating hardness. Moreover, the market is witnessing the emergence of water-based formulations and hydrophilic surface modification, which offer reduced VOC emission levels and improved gloss retention factors. Performance degradation factors, such as UV resistance and chemical resistance rating, are also under close scrutiny.

Coating durability is a key concern, with recoatability considerations and surface preparation methods playing a significant role. The market is also exploring the use of ceramic coating hardness testing, anti-graffiti protection, and corrosion protection layers to enhance the overall value proposition. In conclusion, the market is a dynamic and evolving space, with continuous innovation and improvement driving growth and demand across various sectors. The focus on sustainability, durability, and performance is shaping the future of this market.

How is this High Performance Ceramic Coatings Industry segmented?

The high performance ceramic coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Oxide coatings

- Nitride coatings

- Carbide coatings

- Geography

- North America

- US

- Europe

- UK

- APAC

- China

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The oxide coatings segment is estimated to witness significant growth during the forecast period.

The market is driven by the demand for coatings with hydrophobic surface properties, which offer improved resistance to wear, corrosion, and environmental factors. Oxides, particularly aluminum and chromium oxides, dominate the market due to their superior hardness and chemical resistance. For instance, aluminum oxide coatings, also known as beta ceramics, are used extensively for dielectric performance enhancement, corrosion resistance, and wear reduction. These coatings are applied to various substrates to prevent weathering and environmental corrosion. Crosslinking density effects play a crucial role in optimizing drying time and enhancing coating durability. Environmental impact assessments are increasingly important in the selection of coatings, leading to a growing interest in renewable resource-based coatings.

Surface energy calculation and contact angle measurement are essential in predicting coating lifespan and identifying surface defects. Abrasion resistance testing, coating adhesion strength, and corrosion protection layers are critical factors in assessing coating performance. Coating hardness testing, thermal stability analysis, and self-cleaning properties are other essential considerations. Water-based formulations and hydrophilic surface modification are gaining popularity due to their lower VOC emission levels and environmental friendliness. The market is expected to grow by 5% annually, driven by the increasing demand for high-performance coatings in various industries. Nano-ceramic technology and durability enhancement techniques are key trends, with silica-based coatings and application temperature range being significant factors in the market.

Coating thickness measurement and chemical resistance rating are also essential aspects of coating selection and application. An example of the market's impact can be seen in the automotive industry, where high-performance ceramic coatings are used to enhance fuel efficiency and reduce maintenance costs by improving engine performance and reducing friction. Additionally, advancements in nano-ceramic technology are leading to the development of self-healing coatings, which can repair micro-damages and extend coating lifespan.

The Oxide coatings segment was valued at USD 4.21 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing notable growth due to escalating demand across sectors like aerospace, automotive, and manufacturing. The region's focus on advanced materials technology and stringent regulations propels the adoption of these coatings for their superior properties, including thermal resistance, corrosion protection, and wear durability. In aerospace, ceramic coatings extend engine component and airframe lifetimes, lowering maintenance costs and boosting performance. The automotive industry leverages these coatings to prolong engine part life, enhance fuel efficiency, and minimize emissions. A recent study indicates a 12% annual industry growth expectation. For instance, in the aerospace industry, a leading engine manufacturer reported a 20% increase in engine component lifespan after applying a high performance ceramic coating.

This coating's hydrophobic surface properties and crosslinking density effects contribute to its durability and resistance to abrasion, corrosion, and UV radiation. Manufacturers are also exploring eco-friendly, renewable resource-based coatings to minimize environmental impact. Surface energy calculation and contact angle measurement are crucial factors in coating lifespan prediction and performance degradation analysis. Coating adhesion strength, coating hardness testing, and anti-graffiti protection are essential considerations for various applications. Nano-ceramic technology and durability enhancement techniques further improve coating properties, ensuring long-term performance. Surface preparation methods, such as silica-based coatings and application temperature range, significantly impact the final coating quality. Coating thickness measurement and chemical resistance rating are other essential factors in ensuring optimal coating performance.

Manufacturers are also focusing on water-based formulations and hydrophilic surface modification to reduce VOC emission levels and improve gloss retention factors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of applications and technologies, each requiring stringent testing and evaluation to ensure optimal performance. Application methods for these coatings vary, from electrostatic spraying to plasma-assisted deposition, necessitating a deep understanding of surface preparation techniques for ceramic coatings. Ceramic coating hardness is a critical metric, with testing standards such as Vickers and Mohs hardness providing essential benchmarks. Measuring ceramic coating thickness non-destructively is also crucial, utilizing techniques like ultrasonic thickness gauges and X-ray fluorescence. Curing temperature significantly impacts ceramic coating durability, with optimal conditions ensuring maximum chemical resistance to various cleaning agents. Long-term performance evaluation is essential, involving assessment of UV degradation on ceramic coating gloss retention and investigation into self-cleaning properties. Comparing solvent-based and water-based ceramic coating formulations is an ongoing debate, with each offering unique advantages and disadvantages. The effect of substrate surface roughness on ceramic coating adhesion is another important consideration, requiring careful analysis under controlled conditions. Evaluation of ceramic coating hydrophobic properties via contact angle measurement and analysis of scratch and abrasion resistance are essential for understanding coating performance under real-world conditions. Studying thermal shock resistance in high-performance ceramic coatings is vital for industries requiring high-temperature applications. Comparing different ceramic coating application tools and methods, determining the environmental impact of ceramic coating production, and assessing ceramic coating lifespan under real-world conditions are all crucial factors affecting market growth. Ensuring long-term stability of ceramic coatings necessitates ongoing research and development efforts.

What are the key market drivers leading to the rise in the adoption of High Performance Ceramic Coatings Industry?

- The significant growth in the utilization of high-performance ceramic coatings across various end-user industries serves as the primary market driver.

- High performance ceramic coatings offer robust protection against corrosion, thermal shifts, and premature degradation, making them an ideal choice for various industries. In particular, they are extensively used in engine components, turbine blades, and vanes due to their exceptional resistance to corrosion and heat. These coatings significantly enhance fuel efficiency in automotive engines. With the burgeoning expansion of industries such as automotive, chemical, healthcare, and energy in countries like the US, Canada, the UK, Germany, China, India, Brazil, Saudi Arabia, Mexico, and Japan, the demand for high performance ceramic coatings is poised to surge.

- According to industry reports, the market is projected to grow by over 10% annually, underpinned by the increasing demand for lightweight, durable, and corrosion-resistant materials across diverse sectors. For instance, a leading automotive manufacturer reported a 15% increase in engine efficiency after implementing high performance ceramic coatings on engine components.

What are the market trends shaping the High Performance Ceramic Coatings Industry?

- The increasing demand for thermal barriers in aircraft engines represents a significant market trend. This requirement stems from the need to enhance engine efficiency and durability.

- High performance ceramic coatings play a crucial role in enhancing the efficiency, durability, and reliability of aircraft engines. These coatings protect engines from harsh temperatures and corrosive environments, making them essential in the aviation and aerospace and defense industries. With the global expansion of these industries since 2021, the demand for high performance ceramic coatings has surged. The advanced discharge properties offered by these coatings in aircraft engines are in high demand due to the increasing need for thermal protection.

- These factors are expected to drive the robust growth of the market during the forecast period. The aviation sector's expansion, coupled with the growing demand for thermal protection in aircraft engines, is fueling the market's surge. The market's future growth prospects are also promising, with expectations of continued expansion in the industries driving demand for high performance ceramic coatings.

What challenges does the High Performance Ceramic Coatings Industry face during its growth?

- The high performance ceramic coatings industry faces significant growth challenges due to the volatile pricing of raw materials.

- High performance ceramic coatings are materials renowned for their ability to excel in harsh conditions. Comprised primarily of oxides such as aluminum, titanium, chromium, and zirconium, these compounds offer superior resistance to extreme temperatures and chemicals, making them indispensable for various industries, including automotive, aerospace and defense, and industrial sectors. However, the price volatility of these raw materials poses a significant challenge for market players. Inflation, availability, and production are key factors influencing their cost, making the market susceptible to demand-supply dynamics.

- To mitigate these fluctuations, high performance ceramic coatings manufacturers continually strive for competitive edge. For instance, a leading player in the industry reported a 15% increase in sales by optimizing production processes and raw material sourcing. The market is projected to grow by over 10% annually, reflecting the increasing demand for durable, high-performance coatings in diverse applications.

Exclusive Customer Landscape

The high performance ceramic coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high performance ceramic coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high performance ceramic coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

APS Materials Inc. - This company specializes in advanced ceramic coatings, including high purity ceramic dielectric coatings, which deliver superior conductivity and heat resistance to the semiconductor industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- APS Materials Inc.

- Aremco Products Inc.

- Autotriz India

- Bodycote Plc

- Ceramic Pro

- Compagnie de Saint-Gobain SA

- Drexler Ceramic

- DuPont

- Esperto Car Care

- Integrated Global Services Inc.

- Keronite International Ltd.

- Linde Plc

- Morgan Advanced Materials Plc

- NanoPro Ceramic

- Nasiol Nano Coatings

- San Cera Coat Industries Pvt. Ltd.

- Swaintech Coatings Inc.

- Zircotec Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in High Performance Ceramic Coatings Market

- In January 2024, PPG Industries, a leading coatings manufacturer, announced the launch of its new line of high-performance ceramic coatings for the automotive industry. These advanced coatings offer enhanced durability, scratch resistance, and improved fuel efficiency, as stated in their press release.

- In March 2024, 3M and DuPont announced a strategic partnership to co-develop and commercialize advanced ceramic coatings for various industries, including aerospace and energy. The collaboration aims to leverage both companies' expertise in materials science and manufacturing, as reported in a joint press release.

- In May 2024, Nanocyl, a leading nanotube manufacturer, secured a ⬠20 million investment from the European Investment Bank to expand its production capacity for high-performance nanotubes used in ceramic coatings. This expansion will help meet the growing demand for these advanced materials in various industries, according to their official press release.

- In April 2025, the European Union approved new regulations for the use of high-performance ceramic coatings in construction materials. The regulations aim to improve energy efficiency and reduce greenhouse gas emissions, as stated in the EU Commission's press release. This approval is expected to drive growth in the European high-performance ceramic coatings market.

Research Analyst Overview

- The market demonstrates continuous evolution, with ongoing advancements in thermal shock resistance, weathering resistance factors, and other critical performance attributes. For instance, a leading automotive manufacturer reported a 30% increase in sales of coated components due to their enhanced impact resistance and gloss level consistency. According to industry reports, the market is expected to grow by over 10% annually, driven by the increasing demand for coatings with superior cleaning method compatibility, surface tension reduction, and stain resistance properties. Coating application techniques, such as spray, brush, and roll methods, continue to evolve, with spray application parameters being optimized for improved coating film uniformity.

- Defect detection methods and coating failure analysis are essential for maintaining quality control protocols, ensuring the longevity of the coatings. Flexibility and elasticity, preparation surface roughness, and water beading behavior are among the key factors influencing the selection of appropriate coating types and application techniques. Chemical etch resistance, curing process optimization, and coating color stability are crucial considerations for various sectors, including aerospace, automotive, and construction. Substrate compatibility tests, dipping procedures, and UV degradation mechanisms are essential for assessing the long-term performance of high performance ceramic coatings. Repair and maintenance strategies, along with defect detection methods and coating failure analysis, are vital for ensuring the continued effectiveness of these coatings.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled High Performance Ceramic Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2024-2028 |

USD 4361.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.5 |

|

Key countries |

US, UK, China, Japan, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High Performance Ceramic Coatings Market Research and Growth Report?

- CAGR of the High Performance Ceramic Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high performance ceramic coatings market growth of industry companies

We can help! Our analysts can customize this high performance ceramic coatings market research report to meet your requirements.