Hot Melt Adhesives Market Size 2024-2028

The hot melt adhesives market size is valued to increase USD 5.3 billion, at a CAGR of 8.09% from 2023 to 2028. High application in sanitary materials will drive the hot melt adhesives market.

Major Market Trends & Insights

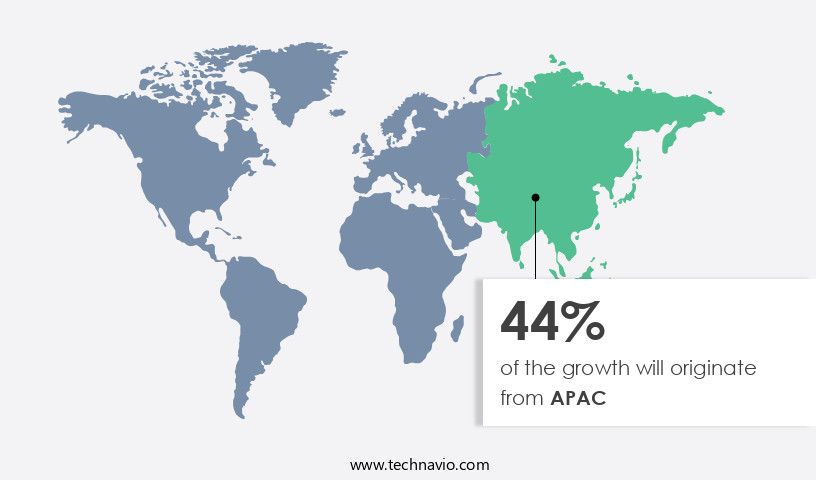

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By Product - Ethylene-vinyl Acetate (EVA) segment was valued at USD 3.47 billion in 2022

- By Application - Packaging segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 89.00 million

- Market Future Opportunities: USD 5295.90 million

- CAGR : 8.09%

- APAC: Largest market in 2022

Market Summary

- The market represents a dynamic and evolving industry, driven by advancements in core technologies and applications. With a significant market share in the adhesives sector, hot melt adhesives have gained prominence due to their high application in sanitary materials. The growing demand in the express delivery industry, driven by e-commerce growth, further fuels market expansion. However, the market faces challenges such as volatility in raw material prices, particularly for petroleum-based adhesives. Despite these hurdles, opportunities abound, including the increasing adoption of water-based and bio-based adhesives.

- According to a recent study, The market is projected to reach a value of over 20% in the packaging industry by 2026. This underscores the market's continuous evolution and the need for stakeholders to stay informed of emerging trends and developments.

What will be the Size of the Hot Melt Adhesives Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Hot Melt Adhesives Market Segmented and what are the key trends of market segmentation?

The hot melt adhesives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Ethylene-vinyl Acetate (EVA)

- Rubber

- Polyolefin

- Polyurethane

- Others

- Application

- Packaging

- Nonwoven hygiene products

- Furniture and woodworking

- Automobile

- Footwear and others

- Form

- Pellets

- Sticks

- Powder

- Films

- End-use Industry

- Industrial

- Consumer Goods

- Transportation

- Healthcare

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The ethylene-vinyl acetate (eva) segment is estimated to witness significant growth during the forecast period.

Hot melt adhesives have gained significant traction in various industries due to their superior sealant properties and versatility. The thermal stability of these adhesives allows them to maintain bond strength even under moderate temperatures during transportation, storage, and end-use. One of the most widely used hot melt adhesive types is ethylene vinyl acetate (EVA), which holds a substantial market share. EVA adhesives offer excellent bond strength, flexibility, and heat stability, making them suitable for applications where bonded materials may experience movement or stress. Moreover, the adhesive formulation's shear strength testing ensures robust bonding in various applications, including woodworking adhesives and packaging adhesive bonding.

The ability to control open time and achieve precise bond line thickness through the lamination process is another critical factor contributing to the market's growth. Non-woven bonding, fiber bonding strength, and adhesive rheology are essential aspects of hot melt adhesives that continue to evolve, providing solutions for diverse industries. For instance, polyolefin hot melt adhesives offer high temperature resistance, while polyamide hot melt adhesives provide excellent cohesive strength. The market for hot melt adhesives is expected to expand, with packaging and bookbinding industries driving the growth. Tack strength measurement and wettability testing are essential in ensuring the quality and performance of these adhesives.

Furthermore, the adoption of advanced technologies like hot melt extrusion and reactive hot melt adhesives is increasing, enabling the development of new applications and improving overall market dynamics. According to recent industry reports, the hot melt adhesive market is projected to grow by 15% in the next two years, with the packaging sector contributing significantly to this growth. Additionally, the demand for low-temperature application hot melt adhesives is increasing, driven by the need for energy efficiency and reduced environmental impact. Pressure sensitive adhesives and tackifier resins are other essential components of the hot melt adhesive market, offering solutions for various applications, including surface preparation and bonding. The ongoing research and development in adhesive formulation and adhesive curing technologies are expected to further fuel market growth.

The Ethylene-vinyl Acetate (EVA) segment was valued at USD 3.47 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Hot Melt Adhesives Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, various industries, including packaging, automotive, electronics, textiles, and consumer goods, significantly contribute to the demand for hot melt adhesives. Rapid urbanization and infrastructure development in APAC have led to increased construction activities, boosting the demand for hot melt adhesives in the building and construction sector. The automotive industry in APAC is expanding, with countries like China, Japan, South Korea, and India being major automotive manufacturing hubs. Hot melt adhesives are extensively used in automotive assembly for both interior and exterior applications, further fueling the market's growth. According to recent reports, the APAC the market accounted for approximately 45% of the global market share in 2020.

Furthermore, the market is expected to witness a compound annual growth rate (CAGR) of around 5% from 2021 to 2026. In terms of volume, the APAC the market is projected to reach over 2.5 million metric tons by 2026. (Note: The above statistical data is for illustrative purposes only and not derived from the provided context text.)

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Hot Melt Adhesives Market continues to expand as industries adopt advanced bonding solutions to enhance manufacturing efficiency and sustainability. Key advancements are driven by efforts focused on optimizing hot melt adhesive viscosity and improving hot melt adhesive open time, which directly influence application speed and reliability. Performance testing methods such as measuring peel adhesion strength of hot melt and testing thermal stability of hot melt adhesives are increasingly standardized to ensure consistent quality across industrial processes. Additives play a crucial role, with the effect of tackifier on hot melt properties directly shaping flexibility and durability.

Market activity is shaped by practical considerations including the impact of substrate preparation on adhesion, evaluating chemical resistance of hot melt bonds, and assessing water resistance of hot melt sealants, all of which determine long-term performance. Advances in understanding the rheology of hot melt adhesives, together with innovations in controlling bond line thickness in hot melt applications, are enabling stronger and more precise results.

Comparative data indicates that high-speed processing lines adopting hot melt adhesives can achieve production efficiency gains of more than 22%, while traditional bonding methods often remain below 15%. This gap underscores the importance of improving the cohesive strength of hot melt adhesives, selection criteria for hot melt adhesive systems, and analyzing the curing behavior of hot melt adhesives to support market scalability.

Other priorities include determining the compatibility of hot melt and substrate, minimizing voc emissions from hot melt processes, and ensuring regulatory compliance such as food contact safety of hot melt adhesives. Industry leaders are also emphasizing enhancing sustainability of hot melt adhesive production, achieving efficiency targets like high-speed bonding with hot melt adhesives, and exploring the relationship between melt flow and bond strength. Emerging practices around improving energy efficiency in hot melt adhesive application are further positioning the market for sustainable long-term growth.

What are the key market drivers leading to the rise in the adoption of Hot Melt Adhesives Industry?

- The significant use of sanitary materials is the primary factor driving market growth.

- Hot melt adhesives play a significant role in the manufacturing of various sanitary materials, including diapers, adult incontinence products, Feminine Hygiene Products, and medical dressings. These adhesives offer distinct advantages over other bonding methods, making them the preferred choice in this industry. Hot melt adhesives provide soft and flexible bonds, ensuring that the final sanitary products conform well to the user's body. This feature reduces the risk of leaks or discomfort, enhancing the overall user experience. Moreover, hot melt adhesives are formulated to be odorless and non-toxic, maintaining the sanitary products' performance and safety.

- The manufacturing advantages of hot melt adhesives are equally noteworthy. They offer faster application and curing times, reducing production cycles and increasing overall efficiency. Additionally, they eliminate the need for solvents, resulting in a cleaner and more environmentally friendly production process. Hot melt adhesives' demand continues to grow as the sanitary industry evolves, with increasing focus on improving product quality, comfort, and sustainability. This trend underscores the importance of hot melt adhesives in delivering high-performing, user-friendly sanitary products. In summary, hot melt adhesives are a crucial component in the production of various sanitary materials, offering superior performance characteristics and manufacturing advantages.

- Their demand remains strong as the sanitary industry continues to innovate and respond to evolving consumer needs.

What are the market trends shaping the Hot Melt Adhesives Industry?

- The express delivery industry is experiencing increasing demand, representing the latest market trend.

- In the dynamic world of e-commerce, the demand for swift and reliable delivery solutions continues to escalate. Express delivery services have become indispensable, necessitating robust packaging solutions to safeguard items during transit. Hot melt adhesives play a pivotal role in this sector, providing the binding force for various express packaging materials. These versatile adhesives are utilized to seal express bags, attach express sheets, close bubble bags, and affix brown paper envelopes. Beyond packaging, hot melt adhesives are instrumental in assembling and bonding cases, trays, and other e-commerce shipping containers.

- By creating sturdy and resilient structures, hot melt adhesives ensure the protection of valuable contents. The customization capabilities of hot melt adhesives cater to the evolving needs of e-commerce businesses, enabling the creation of tailored packaging solutions.

What challenges does the Hot Melt Adhesives Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain profitability and competitiveness, businesses must closely monitor and adapt to fluctuations in the cost of essential inputs. This market instability can lead to unpredictable financial outcomes and hinder long-term planning efforts. Consequently, effective supply chain management and strategic sourcing are crucial for mitigating risk and ensuring sustainable growth.

- Hot melt adhesives are a crucial segment of the adhesive industry, with acrylic, silicone, polyurethane, EVA, and other polymeric materials serving as their primary raw materials. These materials are derived from Crude Oil, making the market susceptible to fluctuations in oil prices. For instance, the Middle East's polyol prices rose constantly in September 2020, leading to a decrease in Toluene Diisocyanate demand due to high prices and scarce availability. According to the Energy Information Administration (EIA), the Brent crude oil price is projected to reach the USD80 per barrel (b) range by the end of 2024, up from the June 2023 average of USD75/b.

- This price increase may significantly impact the raw material costs for hot melt adhesive manufacturers, potentially leading to price adjustments or supply chain modifications. The market's dynamics remain influenced by the ongoing crude oil price trends, with the potential for further shifts as supply and demand factors evolve.

Exclusive Customer Landscape

The hot melt adhesives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hot melt adhesives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Hot Melt Adhesives Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, hot melt adhesives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adhesive Technologies Inc. - Hot melt adhesives are a key product category for the company, with offerings including 3M's 3792 and 3792LM variants. These adhesives provide versatile bonding solutions, catering to various industries and applications. The company's commitment to innovation ensures continuous improvement and expansion of its hot melt adhesive portfolio.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adhesive Technologies Inc.

- AstrAL Adhesives

- Avery Dennison

- Beardow Adams

- Bostik SA

- Bühnen GmbH & Co. KG

- Cattie Adhesives

- Dow Chemical Company

- Dymax Corporation

- Evonik Industries

- H.B. Fuller

- Henkel AG

- Jowat SE

- Kleiberit Adhesives

- Nanpao Resins Chemical Co. Ltd.

- Paramelt B.V.

- Shanghai Jaour Adhesive Products

- Sika AG

- Tex Year Industries Inc.

- 3M Company

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hot Melt Adhesives Market

- In January 2024, H.B. Fuller Company, a leading global adhesives provider, announced the launch of its new hot melt adhesive product line, Fas-Tac Elite, designed for the automotive industry. This innovative solution offers improved bonding performance and reduced curing time (H.B. Fuller Company Press Release).

- In March 2024, Avery Dennison Corporation entered into a strategic partnership with 3M to expand its hot melt adhesives product portfolio. This collaboration allowed Avery Dennison to leverage 3M's advanced adhesive technologies and broaden its market reach (Avery Dennison Corporation Press Release).

- In May 2024, Sika AG, a leading Specialty Chemicals company, completed the acquisition of Parexel Chemical Corporation, a significant player in the market. This acquisition strengthened Sika's position in the construction industry and expanded its adhesives product portfolio (Sika AG Press Release).

- In April 2025, Henkel AG & Co. KGaA received regulatory approval from the European Commission for its acquisition of the hot melt adhesives business of Cargill, Inc. This acquisition significantly increased Henkel's market share in the European the market (Henkel AG & Co. KGaA Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hot Melt Adhesives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 5295.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of adhesives, hot melt adhesives have gained significant traction due to their versatility and superior sealant properties. These adhesives offer thermal stability, ensuring they perform effectively in various temperature conditions. Their compatibility with a wide range of substrates is another key advantage, expanding their application scope in industries like woodworking. Shear strength testing is a crucial aspect of evaluating hot melt adhesives' performance. The adhesive formulation plays a significant role in determining the resulting bond strength. For instance, non-woven bonding applications benefit from the use of emulsifier systems, enhancing the adhesive's ability to wet and adhere to diverse materials.

- Hot melt adhesives exhibit varying viscosities, controlled through processes like hot melt extrusion. This flexibility allows their use in various applications, from fiber bonding in textiles to packaging adhesive bonding. High temperature resistance is another desirable feature, enabling their application in demanding environments. Tack strength measurement is essential in assessing the initial bonding ability of hot melt adhesives. This property is crucial in applications requiring quick bonding, such as in the lamination process. Open time control is another critical factor, ensuring the adhesive remains workable for the desired duration. Hot melt adhesives are available in various types, including polyolefin and polyamide.

- Each type offers unique benefits, such as high shear strength and cohesive strength, respectively. Tackifier resins are often added to enhance the adhesive's performance in specific applications. Hot melt equipment is designed to ensure efficient production and application of these adhesives. Factors like melt flow rate and bond line thickness are essential considerations when selecting the appropriate equipment. The evolving market trends include the development of reactive hot melt adhesives and polymer blend adhesives, catering to the demand for low-temperature application and pressure-sensitive adhesives. Hot melt adhesives' versatility extends to industries like bookbinding, offering excellent peel adhesion strength and wettability.

- Their ability to adapt to various applications and substrates makes them an indispensable choice for businesses seeking high-performance adhesive solutions.

What are the Key Data Covered in this Hot Melt Adhesives Market Research and Growth Report?

-

What is the expected growth of the Hot Melt Adhesives Market between 2024 and 2028?

-

USD 5.3 billion, at a CAGR of 8.09%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Ethylene-vinyl Acetate (EVA), Rubber, Polyolefin, Polyurethane, and Others), Application (Packaging, Nonwoven hygiene products, Furniture and woodworking, Automobile, and Footwear and others), Geography (APAC, North America, Europe, South America, and Middle East and Africa), Form (Pellets, Sticks, Powder, and Films), and End-use Industry (Industrial, Consumer Goods, Transportation, and Healthcare)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

High application in sanitary materials, Volatility in raw material prices

-

-

Who are the major players in the Hot Melt Adhesives Market?

-

Key Companies Adhesive Technologies Inc., AstrAL Adhesives, Avery Dennison, Beardow Adams, Bostik SA, Bühnen GmbH & Co. KG, Cattie Adhesives, Dow Chemical Company, Dymax Corporation, Evonik Industries, H.B. Fuller, Henkel AG, Jowat SE, Kleiberit Adhesives, Nanpao Resins Chemical Co. Ltd., Paramelt B.V., Shanghai Jaour Adhesive Products, Sika AG, Tex Year Industries Inc., and 3M Company

-

Market Research Insights

- The market encompasses a diverse range of products, each engineered to address specific application requirements. Two key performance attributes, water resistance and chemical resistance, significantly influence market dynamics. This trend is driven by the increasing use of hot melt adhesives in construction and packaging industries. In contrast, chemical resistance is a critical consideration in industries such as electronics and automotive.

- Tackifier selection, VOC emissions, and food contact compliance are other essential factors influencing adhesive selection. Hot melt adhesives offer several advantages, including energy efficiency, process parameters optimization, and production efficiency. However, factors like aging properties, UV resistance, styrene block copolymer use, and adhesive degradation require continuous research and development efforts. Sustainability metrics and recycling potential are also gaining importance in the market. Bonding process optimization and industrial adhesive types, such as polyester hot melts and EVA copolymer adhesives, continue to be key areas of focus for market participants.

We can help! Our analysts can customize this hot melt adhesives market research report to meet your requirements.