Specialty Chemicals Market Size 2025-2029

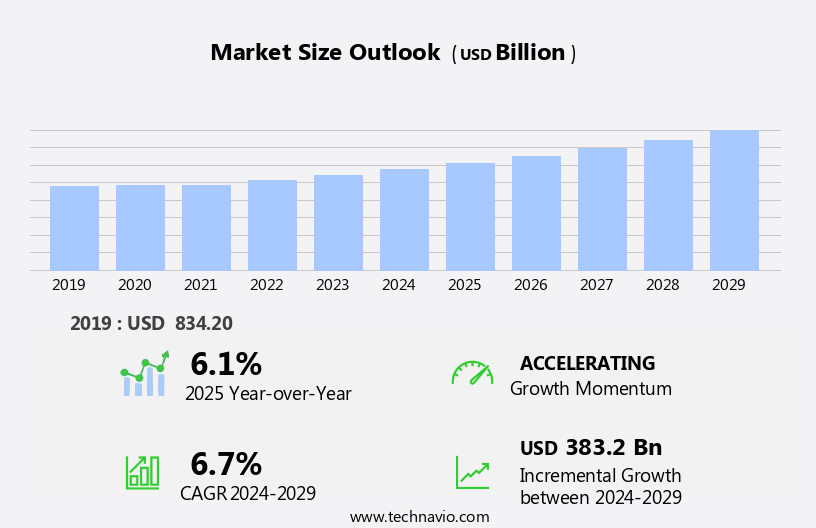

The specialty chemicals market size is forecast to increase by USD 383.2 billion, at a CAGR of 6.7% between 2024 and 2029.

- The Specialty Chemicals Market is segmented by end-user (agrochemicals, lubricant and oilfield chemicals, adhesives and sealants, industrial and institutional cleaners, others), type (plasticizers, water-based, coagulants and flocculants, scale inhibitors), product type (institutional & industrial cleaners, rubber processing chemicals, food & feed additives, cosmetic chemicals, oilfield chemicals), and geography (North America: US, Canada; Europe: France, Germany, UK; APAC: Australia, China, India, Japan, South Korea; South America: Argentina, Brazil; Middle East and Africa: UAE; Rest of World). This segmentation highlights the market's expansion, driven by growing demand for agrochemicals and oilfield chemicals, with water-based and coagulant products gaining traction, particularly in APAC and North America.

- The market is driven by the surging demand from the agrochemical industry, as specialty chemicals play a crucial role in enhancing the efficiency and effectiveness of agrochemicals. This sector's expansion is attributed to the rising adoption of specialty chemicals in the production of high-performance fertilizers and pesticides. Another significant trend is the increasing preference for bio-based chemicals due to their eco-friendly nature and sustainable production methods. However, the market faces challenges from stringent regulations and policies towards specialty chemicals, which necessitate extensive compliance and adherence to safety and environmental standards.

- Companies in the market must navigate these regulations while also addressing the growing demand for high-performance, cost-effective, and eco-friendly solutions to maintain a competitive edge. To capitalize on opportunities and overcome challenges, strategic business decisions and operational planning must prioritize innovation, regulatory compliance, and sustainable production methods.

What will be the Size of the Specialty Chemicals Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution and dynamic nature, with ongoing activities and evolving patterns shaping its various sectors. Process chemistry plays a crucial role in the production of advanced materials and pharmaceutical chemicals, while material handling and analytical chemistry ensure quality control and regulatory compliance. Hazard analysis and risk management are integral parts of material science and production processes, with a focus on safety standards and efficiency improvements. Inorganic chemistry, energy efficiency, and emissions reduction are key areas of innovation, driving the development of bio-based chemicals and green chemistry. Distribution networks and mass spectrometry enable effective product lifecycle management and predictive modeling, while separation techniques and reaction kinetics optimize cost optimization and waste management.

Organic chemistry, packaging technologies, and industrial chemicals continue to advance, with a focus on circular economy principles and sustainability. Customer relations, raw material sourcing, and sales channels are critical components of successful business strategies, with regulatory compliance and pricing strategies shaping market dynamics. Process automation, cost optimization, and liquid handling are essential for efficient production processes, while safety standards and occupational safety remain top priorities. Physical chemistry, regulatory compliance, and environmental regulations shape the landscape of the chemical manufacturing industry, with recycling technologies and supply chain management playing a significant role in the circular economy. The market for specialty chemicals is a complex and ever-changing landscape, with ongoing research and development driving innovation and growth.

From agricultural chemicals and polymer chemistry to energy efficiency and emissions reduction, the market's continuous evolution offers opportunities and challenges for companies and stakeholders alike.

How is this Specialty Chemicals Industry segmented?

The specialty chemicals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Agrochemicals

- Lubricant and oilfield chemicals

- Adhesives and sealants

- Industrial and institutional cleaners

- Others

- Type

- Plasticizers

- Water-based

- Coagulants and flocculants

- Scale inhibitors

- Product Type

- Institutional & Industrial Cleaners

- Rubber Processing Chemicals

- Food & Feed Additives

- Cosmetic Chemicals

- Oilfield Chemicals

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Argentina

- Brazil

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By End-user Insights

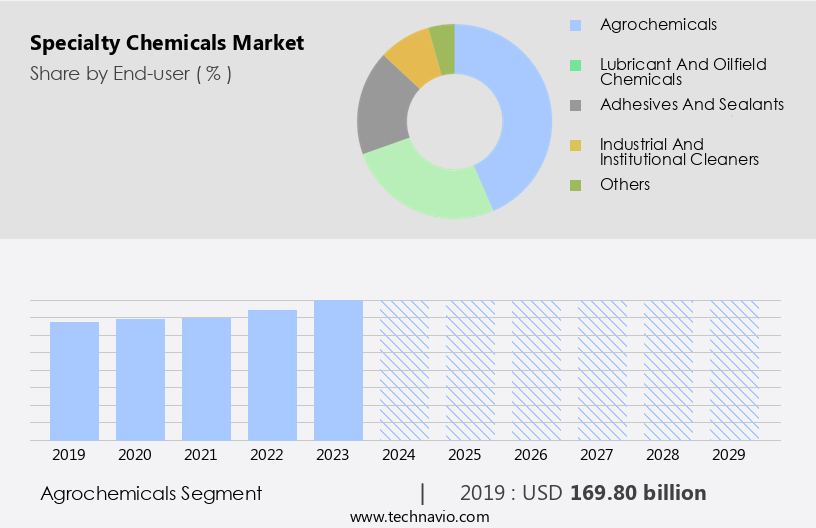

The agrochemicals segment is estimated to witness significant growth during the forecast period.

Agrochemicals, encompassing fertilizers and pesticides, play a pivotal role in modern agriculture, enhancing crop quality and yield. Fertilizers, categorized as nitrogenous, potassic, phosphatic, and others, provide essential nutrients for plant growth. Pesticides, including insecticides, herbicides, bio-pesticides, and others, safeguard crops from pests and diseases. The agrochemicals market is poised for moderate growth due to the expansion of contemporary farming practices like floriculture and horticulture. Increasing farmer literacy and awareness about the importance of agrochemicals in major agricultural economies further fuel market growth.

Additionally, the integration of advanced technologies, such as data analytics, process control, and automation, in agricultural production processes optimizes cost and enhances efficiency. Regulatory compliance, environmental regulations, and recycling technologies are crucial factors shaping the agrochemicals industry landscape. The market's evolution reflects the continuous pursuit of improving agricultural productivity while ensuring safety and sustainability.

The Agrochemicals segment was valued at USD 169.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

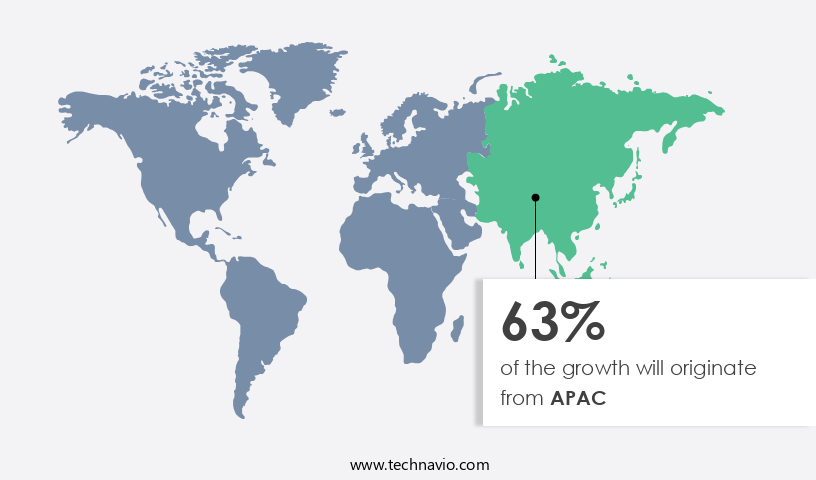

APAC is estimated to contribute 63% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing notable growth, driven by various industries and applications. In countries such as China, Japan, India, Vietnam, South Korea, Malaysia, and Australia, the demand for specialty chemicals is increasing due to rapid industrialization and expanding consumer goods production. China, Japan, South Korea, and India are the major markets, with significant demand for agrochemicals, plastic additives, food additives, and adhesives and sealants. The agricultural sector, with its large farmlands and fertile soil, is a significant contributor to the region's economy and population growth. The increasing demand for food grains and the growing population have led to a surge in the use of agrochemicals, particularly in China and India.

Plastic additives are also in high demand due to the increasing production of consumer goods. Material handling, analytical chemistry, hazard analysis, material science, quality control, advanced materials, production processes, and quality assurance are essential aspects of the specialty chemicals industry. Data analytics, product lifecycle management, waste management, regulatory compliance, and pricing strategies are crucial for businesses to remain competitive. Circular economy, safety standards, efficiency improvements, and occupational safety are essential considerations for sustainable growth. The production of industrial chemicals, including inorganic and organic chemicals, polymer chemistry, and energy efficiency, plays a significant role in the market.

Energy efficiency and emissions reduction are key priorities for businesses to reduce their environmental impact. Distribution networks, mass spectrometry, separation techniques, and recycling technologies are essential for effective supply chain management. Marketing strategies, sales channels, and customer relations are essential for businesses to succeed in the competitive the market. Process safety, water treatment, and regulatory compliance are crucial for maintaining a strong reputation and ensuring long-term success.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Global Specialty Chemicals Market is a dynamic sector, characterized by diverse specialty chemicals applications across various industries. Analysis of the specialty chemicals market size and specialty chemicals market trends reveals significant growth, driven by increasing demand for high-performance and sustainable chemicals. Key segments include food additives, personal care chemicals, and construction chemicals, alongside critical electronic chemicals and water treatment chemicals. Leading chemical manufacturers are heavily investing in green chemistry and developing bio-based chemicals to meet evolving regulatory landscapes and consumer preferences. This highly specialized industrial chemicals sector, encompassing performance chemicals and adhesives and sealants, is pivotal to modern industries. Comprehensive chemical industry analysis and the latest chemical market forecast highlight continued innovation within the specialty chemical industry.

What are the key market drivers leading to the rise in the adoption of Specialty Chemicals Industry?

- The agrochemical industry's growing requirement for specialty chemicals serves as the primary market driver.

- The market is experiencing significant growth due to the increasing demand for yield-enhancing agrochemicals. With the world population continuing to grow and arable land becoming increasingly limited, there is a pressing need to increase crop yields to meet the food requirements of the global population. In response, specialty chemical companies are developing innovative solutions through process chemistry, material science, and advanced materials. These agrochemicals are essential for improving crop productivity and ensuring food security, particularly in rural areas of emerging markets such as India and China. Moreover, the market is driven by the advancements in material handling, analytical chemistry, and quality control.

- These technologies enable efficient production processes, hazard analysis, and waste management, thereby contributing to the market's growth. Additionally, the adoption of data analytics, product lifecycle management, and quality assurance practices further enhances the market's potential. The demand for specialty chemicals extends beyond the agriculture industry, with applications in pharmaceutical chemicals, bio-based chemicals, and various other industries. The market's growth is further propelled by the increasing focus on material science and the development of advanced materials for various applications. Overall, the market is poised for continued growth due to its essential role in addressing the challenges of food security, material efficiency, and sustainable production processes.

What are the market trends shaping the Specialty Chemicals Industry?

- The growing demand for bio-based chemicals represents a significant market trend in the industry. These eco-friendly alternatives to traditional petrochemicals are increasingly preferred due to their renewable source and reduced environmental impact.

- The market encompasses various sectors, including bio-based chemicals, which are gaining traction as eco-friendly alternatives to traditional petroleum-based products. Bio-based lubricants, derived from renewable feedstocks like plant-based oil and sugar, employ techniques such as fermentation, ultrafiltration, and crystallization. These environmentally friendly lubricants help mitigate volatile organic compounds (VOCs) and toxic gases released from vehicles, contributing to ecological balance. Countries like Canada, the US, and Germany are focusing on their development. In contrast, developing economies such as China, Japan, and India, as well as developed regions, are increasingly adopting green, sustainable lubricants and energy-saving resin systems. Process control, product development, and cost optimization are key market drivers.

- NMR spectroscopy and process automation aid in ensuring product quality and efficiency improvements. Regulatory compliance, pricing strategies, and safety standards are essential considerations. The circular economy concept emphasizes the importance of preserving resources and reducing waste, making it a significant trend. Occupational safety remains a top priority, ensuring the well-being of workers and minimizing risks.

What challenges does the Specialty Chemicals Industry face during its growth?

- The stringent regulations and policies governing the specialty chemicals industry pose a significant challenge to its growth. This challenge arises from the need for companies to comply with intricate rules and guidelines, which can increase operational costs and limit innovation. Adhering to these regulations requires a substantial investment in resources and expertise, potentially hindering the industry's ability to expand and remain competitive.

- Specialty chemicals, encompassing sectors such as agricultural chemicals, polymer chemistry, inorganic chemistry, and organic chemistry, face stringent regulations from the US Environmental Protection Agency (EPA) and the European Union's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regarding the volatile organic compound (VOC) content. For instance, the Massachusetts Department of Environmental Protection (MassDEP) imposed guidelines on VOC content in adhesives and sealants in August 2013. Regulation 310 CMR 7.18(30) in the US sets a VOC limit for adhesives used in industrial and commercial applications. Similarly, California has established VOC limits for various products, including adhesives and sealants.

- These regulations pose a challenge to market growth. To mitigate risks, companies employ risk assessment and management strategies, utilizing advanced technologies like mass spectrometry and separation techniques for VOC analysis. Additionally, the emphasis on energy efficiency and emissions reduction drives the adoption of green chemistry and reaction kinetics in the development of specialty chemicals. Predictive modeling is also used to optimize production processes and minimize waste.

Exclusive Customer Landscape

The specialty chemicals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the specialty chemicals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, specialty chemicals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Company - This company specializes in the production and supply of a diverse array of high-performance chemicals, including Bromine Specialties, Catalysts, and Lithium compounds.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Company

- ADEKA Corporation

- Akzo Nobel N.V.

- Albemarle Corporation

- Arkema

- Ashland Inc.

- Baker Hughes

- BASF SE

- Clariant

- Covestro AG

- Croda International Plc

- Dow Inc.

- Dupont De Nemours, Inc.

- Ecolab Inc.

- Evonik Industries AG

- H.B. Fuller

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Kemira

- LANXESS

- Linde PLC

- Lonza

- Nouryon

- Solvay

- SONGWON Industrial Co. Ltd.

- The Lubrizol Corporation

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Specialty Chemicals Market

- In January 2024, BASF SE, the German multinational chemical producer, announced the launch of its new specialty chemical product, "EcoSolvent Baydur N," a waterborne polyurethane system for automotive components, at the International Motor Show in Germany (sources: BASF press release). This innovative product is expected to reduce the carbon footprint of automotive manufacturing.

- In March 2024, Dow Inc. And Corning Incorporated entered into a strategic collaboration to develop advanced materials for the high-growth electronics market (sources: Dow Inc. Press release). This partnership combines Dow's specialty chemical expertise with Corning's advanced materials science, aiming to create new solutions for the semiconductor industry.

- In May 2024, Lanxess AG, a leading specialty chemicals company, completed the acquisition of Chemtura Corporation's Additives business for â¬1.5 billion (sources: Lanxess press release). This acquisition significantly expanded Lanxess' additives portfolio and increased its market presence in the Americas.

- In April 2025, the European Chemicals Agency (ECHA) approved the renewal of Dow's Dowicil 101 HF, a specialty chemical used in water treatment applications (sources: ECHA press release). This approval, following a rigorous evaluation process, ensures the continued availability and safe use of this essential product in the European market.

Research Analyst Overview

- The market encompasses a diverse range of products, including specialty polymers, chemical additives, and enzyme technology, among others. To stay competitive, companies in this industry prioritize continuous improvement through lean manufacturing, inventory management, and six sigma methodologies. Trade shows and industry events provide opportunities for brand building and market penetration, while intellectual property protection is crucial for maintaining a competitive advantage. Pricing models and sales forecasting are essential components of business development, requiring accurate demand forecasting and effective logistics management. Regulatory affairs and compliance with industry standards are also key considerations, particularly in areas such as water purification, air purification, and hazardous waste management.

- Strategic alliances and joint ventures can help expand global supply chains and improve supply chain resilience. Effective marketing communications and target marketing are essential for reaching customers in a crowded marketplace. Customs regulations and customer segmentation are also important factors in international trade. Product registration and wastewater treatment are critical areas of focus for sustainability-conscious businesses. Best practices in these areas can lead to cost savings and improved environmental performance. Overall, the market is dynamic and complex, requiring a deep understanding of market trends and customer needs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Specialty Chemicals Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 383.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.1 |

|

Key countries |

US, China, India, Japan, South Korea, Germany, Canada, Australia, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Specialty Chemicals Market Research and Growth Report?

- CAGR of the Specialty Chemicals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the specialty chemicals market growth of industry companies

We can help! Our analysts can customize this specialty chemicals market research report to meet your requirements.