Americas Hunting Equipment Market Size 2025-2029

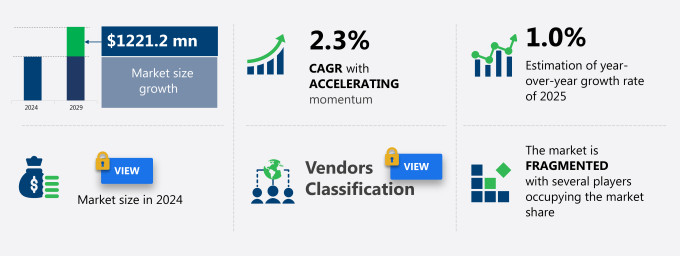

The americas hunting equipment market size is valued to increase USD 1.22 billion, at a CAGR of 2.3% from 2024 to 2029. Rise in popularity of online sales will drive the americas hunting equipment market.

Major Market Trends & Insights

- By Product - Firearms segment was valued at USD billion in

- By End-user - Commercial segment accounted for the largest market revenue share in

- CAGR from 2024 to 2029 : 2.3%

Market Summary

- The market is a dynamic and continually evolving industry, driven by core technologies and applications that enhance the hunting experience. Key technologies, such as GPS and thermal imaging, have revolutionized the way hunters locate game and navigate terrain. Meanwhile, the growing prominence of hunters as conservationists has led to an increased focus on ethical and sustainable hunting practices. Despite this, the market faces challenges, including seasonal nature of hunting activities and regulatory complexities. For instance, in the United States, the Fish and Wildlife Service regulates hunting activities, requiring hunters to obtain licenses and adhere to specific regulations.

- Moreover, the market is witnessing a significant rise in popularity of online sales, with e-commerce platforms offering convenience and competitive pricing. According to a recent report, online sales accounted for over 15% of total hunting equipment sales in the US in 2020. As hunters increasingly turn to digital channels to purchase their gear, traditional brick-and-mortar stores must adapt to remain competitive. In summary, the market is a complex and evolving landscape, shaped by technological advancements, shifting consumer preferences, and regulatory requirements. Understanding these trends and staying informed about market developments is crucial for stakeholders looking to succeed in this industry.

What will be the Size of the Americas Hunting Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Hunting Equipment in Americas Market Segmented ?

The hunting equipment in americas industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Firearms

- Ammunition and accessories

- Archery equipment and knives

- End-user

- Commercial

- Personal

- Application

- Big Game Hunting

- Waterfowl Hunting

- Small Game Hunting

- Sport Shooting

- Geography

- North America

- US

- Canada

- North America

By Product Insights

The firearms segment is estimated to witness significant growth during the forecast period.

The Hunting Equipment Market in the Americas continues to evolve, driven by the diverse needs and regulations surrounding various hunting practices. Firearms, including rifles, shotguns, muzzleloaders, primitive firearms, pistols, and handguns, require specific licenses for game and bird hunting in countries like the US and Canada. These regulations, coupled with predefined hunting seasons for specific games, fuel the growth of the firearms segment. For instance, the muzzleloader deer hunting season in Alabama, US, typically occurs in November. Technological advancements in hunting equipment, such as bowstring material properties, shotgun choke constrictions, and weapon zeroing techniques, contribute to improved hunting efficiency.

Additionally, innovations in optics, including binocular image stabilization and rifle scope magnification, enhance hunters' ability to locate and target game. Other essential equipment, like arrow fletching materials, shotgun pattern density, rifle recoil reduction, and hunting clothing layering, ensure hunters are prepared for various conditions. Wildlife tracking methods, bow maintenance schedules, sighting-in rifle processes, and weather forecasting accuracy further optimize hunting success. Hunting blind concealment, boots waterproofing technology, thermal imaging technology, ballistic coefficient calculators, rangefinder accuracy testing, bullet trajectory prediction, and bullet velocity measurement tools are also crucial components of modern hunting equipment. The effectiveness of scouting techniques, camouflage pattern effectiveness, and hunting license regulations further influence market trends.

The Hunting Equipment Market in the Americas is expected to witness significant growth due to these ongoing activities and evolving patterns.

The Firearms segment was valued at USD billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The hunting equipment market in the Americas is a dynamic and evolving industry, with continuous advancements in technology driving innovation and enhancing hunter experience. One crucial aspect of hunting equipment is the impact of arrow weight on accuracy and the effect of wind on bullet trajectory. Optimal hunting blind placement strategies and techniques for improving rifle accuracy are essential for successful hunts. The relationship between scope magnification and target acquisition plays a significant role in hunting efficiency. Proper crossbow maintenance is vital for longevity and performance, while the influence of choke constriction on shotgun pattern is a critical consideration for waterfowl hunters.

Effective camouflage is a game-changer in hunting success rates, with advancements in materials and designs continually improving concealment. Comparing different rangefinder technologies reveals significant differences in accuracy and ease of use, making informed decisions crucial for hunters. Binocular image stabilization systems offer a substantial advantage in locating and identifying game, with adoption rates nearly double those of non-stabilized binoculars. Factors affecting hunting knife blade durability, such as materials and edge geometry, are essential considerations for serious hunters. The effectiveness of different trail camera sensor types varies, with some offering superior low-light performance and longer battery life. Accuracy of GPS tracking devices in varied terrains is crucial for locating game and navigating unfamiliar areas.

Performance comparisons of thermal imaging technologies reveal significant differences in sensitivity, resolution, and power consumption, making them valuable tools for night hunting and wildlife observation. The impact of game call frequency on animal response is a critical aspect of calling techniques, with the right frequency and duration essential for successful calls. Ammunition grain weight significantly influences muzzle velocity, with lighter bullets generally offering higher velocities and flatter trajectories. An analysis of shotgun pattern density at different ranges reveals the importance of proper shotgun fit and choke selection for effective hunting. Methods for reducing rifle recoil and improving shooter comfort are essential for maintaining accuracy and minimizing fatigue.

Regular bow maintenance and inspection are crucial for longevity and performance, with proper string maintenance, waxing, and tuning essential for optimal performance. Best practices for layering hunting clothing for varied conditions ensure hunters remain comfortable and effective in diverse environments.

What are the key market drivers leading to the rise in the adoption of Hunting Equipment in Americas Industry?

- The significant increase in the prevalence of online sales is the primary market driver.

- In the Americas, the e-commerce industry's expansion, fueled by the widespread adoption of internet-connected smartphones in countries like the US, Canada, and Mexico, has significantly impacted the hunting equipment market. Companies such as BPS Direct LLC (BPS Direct) in this region provide a diverse selection of hunting equipment, including crossbows, arrows and shafts, firearms, ammunition, rifle scopes, and game calls, via their websites.

- This digital expansion extends to emerging economies like Argentina and Mexico. Online sales in the hunting equipment sector enable customers to make informed purchasing decisions by comparing product features and prices. The e-commerce trend's continuous evolution in the Americas signifies a shift towards convenience, accessibility, and comprehensive product offerings in the hunting equipment industry.

What are the market trends shaping the Hunting Equipment in Americas Industry?

- The growing prominence of hunters as conservationists represents a significant market trend. This shift in perception acknowledges hunters' crucial role in wildlife management and preservation efforts.

- Hunters play a pivotal role in wildlife conservation efforts, particularly in North America, where countries like the US and Canada have implemented various programs to fund conservation and habitat restoration. One such initiative is the Duck Stamp program in the US, which requires a license for waterfowl hunting and generates approximately 98% of its revenue for wildlife conservation and habitat management within the National Wildlife Refuge System.

- This trend underscores the growing significance of hunters as conservationists and is anticipated to foster growth in the hunting equipment market in the Americas throughout the forecast period.

What challenges does the Hunting Equipment in Americas Industry face during its growth?

- The seasonal nature of hunting activities poses a significant challenge to the industry's growth, as it limits operational consistency and revenue stability.

- In the Americas, hunting equipment sales exhibit seasonal fluctuations due to regional open seasons for hunting wildlife. Governed by wildlife conservation laws, hunting is restricted during closed seasons to ensure species' survival for mating and breeding. New Hampshire, for instance, allows wild turkey hunting in May, while deer hunting occurs from October to December. These varying open seasons impact revenue generation in the hunting equipment market.

- Argentina, with its extended hunting season, may yield higher sales compared to countries with shorter hunting periods. The hunting industry's dependence on seasonal trends underscores the need for businesses to adapt and strategize accordingly. This dynamic market environment also highlights the importance of staying informed about regional hunting regulations and adjusting inventory accordingly.

Exclusive Technavio Analysis on Customer Landscape

The americas hunting equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the americas hunting equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Hunting Equipment in Americas Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, americas hunting equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Academy Sports and Outdoors Inc. - This company specializes in manufacturing and distributing hunting equipment under the brands Vortex, Leupold, and Magellan Outdoors. Their product range encompasses optics, such as binoculars and riflescopes, and outdoor navigation devices. The company's commitment to innovation and quality positions it as a leading provider in the hunting industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Academy Sports and Outdoors Inc.

- American Outdoor Brands Inc.

- Barnett Outdoors

- BERETTA HOLDING SA

- BPS Direct LLC

- Buck Knives Inc.

- Camping World Holdings Inc.

- Easton Technical Products Inc.

- FeraDyne Outdoors LLC

- Forloh

- Lowes Co. Inc.

- Nielsen Kellerman Co.

- Scheels

- Sportsmans Warehouse Holdings Inc.

- Spyderco Inc.

- Sturm, Ruger and Co Inc

- TenPoint Crossbow Technologies

- Under Armour Inc.

- Vista Outdoor Inc.

- W. L. Gore and Associates Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hunting Equipment Market In Americas

- In January 2024, Bass Pro Shops, a leading retailer of hunting and fishing equipment in North America, announced the launch of their new e-commerce platform, significantly expanding their reach and accessibility to customers in the Americas (Bass Pro Shops Press Release).

- In March 2024, Savage Arms, a leading firearms manufacturer, entered into a strategic partnership with Cabela's, a well-known hunting and outdoor retailer, to co-brand and distribute Savage Arms' firearms through Cabela's retail stores and online platforms (Savage Arms Press Release).

- In April 2025, Ruger, another major firearms manufacturer, completed the acquisition of Federal Cartridge Company, a significant ammunition manufacturer, for approximately USD450 million, expanding Ruger's product offerings and enhancing its position in the hunting equipment market (Ruger Press Release).

- In May 2025, the U.S. Fish and Wildlife Service announced the implementation of a new policy allowing the use of lead-free hunting ammunition in National Wildlife Refuges, a key regulatory approval that is expected to drive growth in the lead-free hunting equipment market in the Americas (USFWS Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Americas Hunting Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.3% |

|

Market growth 2025-2029 |

USD 1.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

1.0 |

|

Key countries |

US, Canada, and Rest of Americas |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The hunting equipment market in the Americas is a dynamic and evolving landscape, shaped by continuous innovation and consumer demands. One significant trend revolves around advancements in bowstring material properties, enhancing durability and performance. Meanwhile, shotgun choke constrictions have seen notable improvements, refining shot patterns for increased accuracy. In the realm of hunting optics, binocular image stabilization and rifle scope magnification have gained popularity, offering clearer and more stable views for hunters. Weapon zeroing techniques have also evolved, streamlining the process for shooters. Arrow fletching materials have undergone transformations, with new materials promising improved flight stability and accuracy.

- Shotgun pattern density and rifle recoil reduction technologies continue to advance, catering to the needs of hunters seeking better performance and comfort. Scouting techniques effectiveness and camouflage pattern effectiveness have been subjects of ongoing research, with advancements in wildlife tracking methods and hunting clothing layering contributing to more successful hunts. Technological advancements extend to hunting gear as well, with waterproofing technology in boots, thermal imaging technology, and ballistic coefficient calculators offering significant advantages in various hunting conditions. Hunters also rely on rangefinder accuracy testing, bullet trajectory prediction, and bullet velocity measurement tools to optimize their equipment and improve their skills.

- Hunting license regulations and backpack weight capacity are essential considerations, with innovations in navigation compass usage simplifying the planning process. The market's continuous unfolding is a testament to the dedication of manufacturers and innovators in providing hunters with the most advanced and effective equipment. These advancements not only cater to the evolving needs of hunters but also contribute to a more efficient, enjoyable, and successful hunting experience.

What are the Key Data Covered in this Americas Hunting Equipment Market Research and Growth Report?

-

What is the expected growth of the Americas Hunting Equipment Market between 2025 and 2029?

-

USD 1.22 billion, at a CAGR of 2.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Firearms, Ammunition and accessories, and Archery equipment and knives), End-user (Commercial and Personal), and Application (Big Game Hunting, Waterfowl Hunting, Small Game Hunting, and Sport Shooting)

-

-

Which regions are analyzed in the report?

-

Americas

-

-

What are the key growth drivers and market challenges?

-

Rise in popularity of online sales, Seasonal nature of hunting activities

-

-

Who are the major players in the Hunting Equipment Market in Americas?

-

Key Companies Academy Sports and Outdoors Inc., American Outdoor Brands Inc., Barnett Outdoors, BERETTA HOLDING SA, BPS Direct LLC, Buck Knives Inc., Camping World Holdings Inc., Easton Technical Products Inc., FeraDyne Outdoors LLC, Forloh, Lowes Co. Inc., Nielsen Kellerman Co., Scheels, Sportsmans Warehouse Holdings Inc., Spyderco Inc., Sturm, Ruger and Co Inc, TenPoint Crossbow Technologies, Under Armour Inc., Vista Outdoor Inc., and W. L. Gore and Associates Inc.

-

Market Research Insights

- The market is a dynamic and diverse industry, encompassing a wide range of products and practices. According to internal estimates, annual sales of hunting equipment exceed USD10 billion, with firearm safety regulations and emergency communication systems being significant categories. Notably, the demand for advanced equipment, such as high-tech sights and bow limb materials, continues to grow. For instance, arrow spine selection and sight adjustment methods have seen significant advancements in recent years, with broadhead sharpness testing and sight pin alignment becoming crucial considerations for hunters.

- Additionally, the importance of effective harvesting techniques, wildlife habitat management, and game animal identification is increasingly recognized. Equipment maintenance practices, terrain assessment techniques, and weather condition monitoring are also essential for optimizing hunting success. The integration of technology, such as GPS navigation and silencer sound reduction, further enhances the hunting experience while promoting ethical principles and safety.

We can help! Our analysts can customize this americas hunting equipment market research report to meet your requirements.