Fishing Equipment Market Size 2025-2029

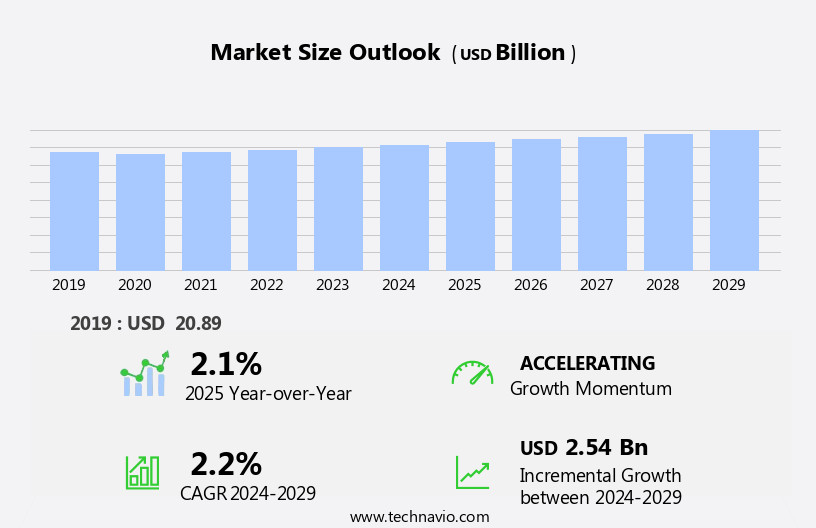

The fishing equipment market size is forecast to increase by USD 2.54 billion, at a CAGR of 2.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing popularity of recreational fishing activities. This trend is fueled by the growing number of anglers worldwide, particularly in developing regions, seeking to engage in leisure pursuits. Another key driver is the rising demand for customized sports fishing equipment, as consumers look for gear tailored to their specific needs and preferences. However, this market also faces challenges. The preference for pre-used and rental variants of fishing equipment poses a threat to manufacturers and retailers, as consumers increasingly opt for cost-effective alternatives.

- Additionally, environmental concerns and regulations aimed at reducing the impact of fishing on marine ecosystems may impact demand for certain types of fishing equipment. Companies seeking to capitalize on market opportunities must stay abreast of these trends and challenges, focusing on innovation, customization, and sustainability to meet evolving consumer demands.

What will be the Size of the Fishing Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, reflecting the dynamic nature of fishing activities across various sectors. Fishing jackets and boots offer protection from the elements, while polarized sunglasses enhance visibility. Regulations and conservation efforts, such as catch and release, shape the market, with artificial bait and insect repellent supporting sustainable practices. GPS devices and fishing waders enable precise location and depth information, enhancing the fishing experience. Line strength and rod action are crucial considerations for different fishing techniques, from inshore spinning to offshore trolling. Fishing regulations and permits vary, influencing demand for fishing licenses and permits. Night fishing, ice fishing, and fly fishing require specialized equipment, including headlamps, ice augers, and fly fishing reels.

Technological advancements continue to impact the market, with fish finders, depth sounders, and navigation charts offering real-time data. Fishing tackle boxes, lure weights, and hook sizes cater to diverse fishing styles and fish behavior. Market trends reflect the ongoing unfolding of market activities, with evolving patterns in fishing techniques, regulations, and consumer preferences. Conservation efforts, such as sustainable fishing and catch and release, remain a priority, shaping the future of the market.

How is this Fishing Equipment Industry segmented?

The fishing equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fishing rod

- Fishing reel

- Fishing lure

- Others

- Application

- Recreational

- Commercial

- Type

- Saltwater fishing equipment

- Fresh water fishing equipment

- Material Type

- Hooks

- Lines

- Sinkers & Floats

- Rods

- Reels

- Nets & Traps

- Spear & Gaffs

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- South Africa

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

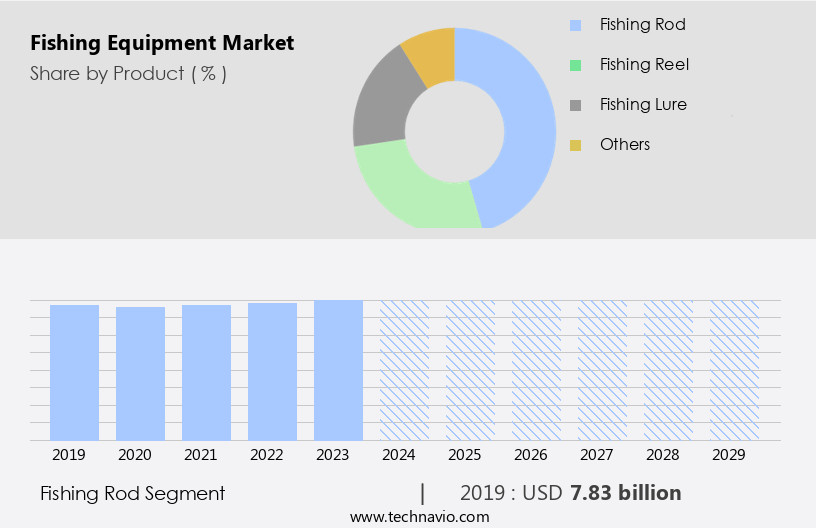

The fishing rod segment is estimated to witness significant growth during the forecast period.

Fishing rods come in various lengths, with short rods bending less than long ones. Long rods, suitable for long-distance casting and deep fishing, are popular choices for anglers. The global market offers a range of fishing rods, including casting rods, spinning rods, fly rods, and pen rods. Selection depends on the fishing environment and targeted fish species. Fishing equipment, such as fishing canoes, docks, and tackle boxes, complement fishing rods. Weighing scales are essential for measuring fish catches, while first-aid kits ensure angler safety. Fishing reels, available as spinning, baitcasting, or fly reels, are integral to the rod setup.

Nets, lures, and live bait are crucial for catching fish in both freshwater and saltwater environments. Fishing behavior influences tackle choices. For instance, offshore fishing requires heavy-duty gear, while inshore fishing calls for lighter equipment. Conservation efforts, such as catch and release, have led to the popularity of tackle designed for minimal fish harm. Additional equipment includes sun hats, fishing jackets, boots, and polarized sunglasses for angler comfort. Regulations, such as fishing licenses and permits, govern fishing activities. Navigation charts, GPS devices, and depth sounders aid in locating fish. Accessories like rod holders, line cutters, and hooks removers simplify fishing.

Fishing kayaks offer mobility and convenience. Lure weight, water depth, and current speed are critical factors in selecting the right lure. Sustainable fishing practices, such as using artificial bait and insect repellent, minimize environmental impact. Anglers engage in various fishing techniques, including trolling, spin fishing, and fly fishing. Ice fishing requires specialized equipment, such as ice fishing rods and heated fishing shelters. Overall, the market is dynamic, with constant innovation and trends shaping angler experiences.

The Fishing rod segment was valued at USD 7.83 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

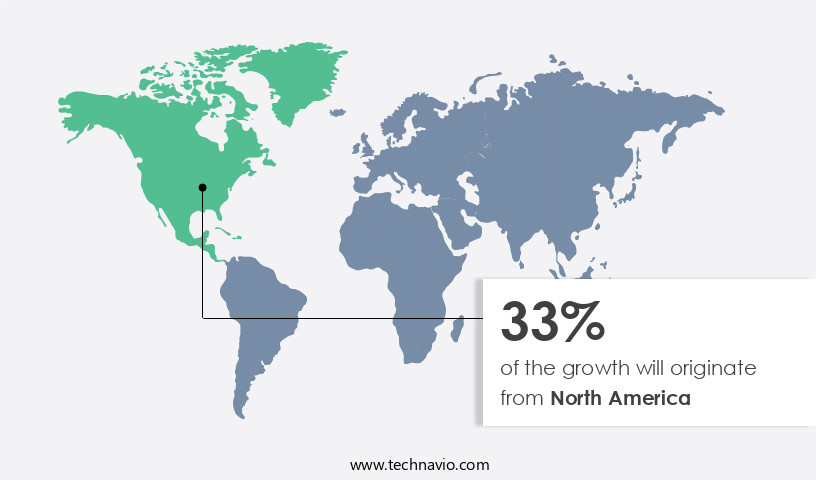

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the US dominates the market due to its popularity as a top destination for sustainable fishing practices. The American Sportfishing Association (ASA) spearheads the region's fishing industry, making it the largest fishing trade association globally. Fishing is a cherished outdoor recreational activity in the US, with participation on the rise. The industry generates substantial revenue, surpassing that of the transit and ground passenger transportation sector. Outdoor recreation spending in the US exceeds that of various product categories, including pharmaceuticals and motor vehicles. Fishing enthusiasts in the US engage in diverse angling techniques, such as saltwater fishing, surf fishing, and freshwater fishing.

They utilize a range of equipment, including fishing canoes, reels, nets, lures, and weighing scales, to enhance their angling experience. Conservation efforts, such as catch and release, are integral to maintaining healthy fish populations and ecosystems. Fishing equipment essentials like first-aid kits, sun hats, fishing jackets, fishing boots, and polarized sunglasses ensure angler safety and comfort. Anglers also employ fishing docks, fishing piers, and fishing boats to access various water bodies. Navigation charts, GPS devices, and depth sounders aid in locating fish and optimizing fishing spots. Fishing regulations and permits are crucial in ensuring sustainable angling practices.

Anglers use fishing rods, fishing lines, and fishing weights to cast their lines and catch fish. They employ various fishing techniques, such as bait fishing, spin fishing, and trolling, using equipment like spinning reels, baitcasting reels, and trolling reels. Anglers also use fishing floats, fishing lures, and fishing hooks to attract fish. They employ various types of fishing lines, such as monofilament lines and braided lines, to optimize their angling experience. Hook sizes, lure weights, and knot strength are essential considerations for effective angling. Fishing enthusiasts engage in various fishing styles, such as ice fishing, fly fishing, and offshore fishing.

They use specialized equipment like ice fishing equipment, fly fishing reels, and offshore fishing gear to optimize their angling experience. Anglers also employ fishing vests, tackle boxes, and fishing tackle storage solutions to organize and transport their equipment. Anglers employ various conservation efforts, such as catch and release, to preserve fish populations and ecosystems. They also use sustainable fishing practices, such as using artificial bait and insect repellent, to minimize environmental impact. Anglers adhere to fishing regulations and permits to ensure sustainable angling practices. Anglers also use various accessories, such as fishing kayaks, fishing rods, and landing nets, to enhance their angling experience.

They employ line cutters, hooks removers, and fishing hooks to optimize their equipment and ensure efficient angling. Anglers also use fishing weights, fishing licenses, and fishing permits to optimize their angling experience and comply with regulations. In conclusion, the US the market is a significant contributor to the outdoor recreation industry, driven by the popularity of fishing as a recreational activity and the country's commitment to sustainable fishing practices. Anglers utilize a diverse range of equipment and techniques to optimize their angling experience while adhering to conservation efforts and regulations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to anglers of all levels, offering a diverse range of products designed to enhance their fishing experience. From rods and reels to lures and lines, this market encompasses essential gear for various fishing techniques. Anglers seek out fishing tackle boxes, nets, and waders to store and transport their equipment. Boat owners invest in motorized boats, kayaks, and canoes for access to remote fishing spots. Additionally, fish finders, GPS devices, and underwater cameras help locate and identify fish, while fishing clothing and safety equipment ensure comfort and protection. The market further provides accessories like fishing pliers, hooks, and baits, ensuring a complete fishing solution. Sustainable and eco-friendly options are increasingly popular, with biodegradable baits and reusable tackle boxes gaining traction. Overall, the market is a thriving industry that caters to the needs and preferences of anglers worldwide.

What are the key market drivers leading to the rise in the adoption of Fishing Equipment Industry?

- The significant growth in recreational fishing activities serves as the primary catalyst for market expansion.

- Fishing equipment sales continue to thrive due to the increasing participation in recreational fishing, making it the second most popular outdoor activity in the US, following jogging. In 2023, an estimated one billion fish were caught and released by recreational anglers in the US. The activity can be enjoyed in both freshwater and saltwater environments, with many industrialized nations utilizing exclusive fish stocks for recreational purposes. The variety of fishing techniques includes fly fishing, ice fishing, spin fishing, trolling, and deep sea fishing, each requiring specific equipment. For instance, fly fishing reels and rods cater to the fly fishing technique, while hard plastic lures, fishing floats, and lure weights are essential for spin fishing.

- Ice fishing necessitates specialized equipment like ice fishing rods and rod holders. Furthermore, advanced technologies like fish finders and hook sizes cater to diverse fishing conditions and preferences. Tackle storage solutions and reel drags are essential accessories to maintain the functionality and longevity of fishing equipment. Regardless of the technique or water depth, the demand for fishing equipment remains strong due to the immersive and harmonious experience it offers.

What are the market trends shaping the Fishing Equipment Industry?

- The increasing preference for tailor-made fishing equipment represents a significant market trend. Customization is becoming increasingly important for anglers, driving demand in this sector.

- The market is witnessing growth due to several strategies adopted by companies to cater to the specific needs of customers. One such strategy is the provision of customized fishing equipment. This trend enables buyers to tailor their gear according to their unique requirements, thereby fostering stronger customer relationships. Customized fishing equipment offers various benefits, including improved performance, comfort, and adherence to conservation efforts such as catch and release. Innovative companies in the market, like Innovative Reel Technologies, are offering customized reels through patent-pending designs. These customized reels not only meet the specific demands of anglers but also contribute to the growth of the market.

- Fishing enthusiasts are increasingly opting for customized equipment, leading to an increase in sales of such models. Moreover, the market growth is driven by the development of advanced technologies in fishing equipment, such as GPS devices, line strength indicators, and artificial bait. These technologies enhance the fishing experience, making it more efficient and enjoyable. Additionally, sustainable fishing practices, including insect repellent and night fishing, are gaining popularity, further fueling market growth. Fishing regulations and the availability of fishing licenses and permits also influence market dynamics. Fishing equipment essentials like fishing jackets, fishing boots, polarized sunglasses, fishing waders, and landing nets are in high demand.

- Companies are focusing on providing high-quality, durable, and functional equipment to meet the needs of anglers. The market is expected to continue its growth trajectory during the forecast period, driven by these trends and the increasing popularity of fishing as a recreational activity.

What challenges does the Fishing Equipment Industry face during its growth?

- The preference for pre-owned and rental variants of fishing equipment poses a significant challenge to the industry's growth, as consumers increasingly seek cost-effective alternatives to new equipment.

- The market experiences varying demand from end-users, with some preferring advanced, feature-rich products while others opt for cost-effective, pre-owned equipment. Fishing rods, lines, weights, hooks, and lures are essential components of fishing equipment. While some anglers prioritize high-performance fishing boats and advanced technologies like depth sounders and navigation charts, others rely on basic equipment for bait fishing. Pre-owned fishing equipment, including fishing rods, lines, hooks, and lures, are widely available through various channels. End-users can find these items in repair shops and online marketplaces such as Gumtree and eBay. The affordability of pre-owned equipment is a significant factor in its popularity, especially among budget-conscious buyers.

- However, this trend poses a challenge to market growth as it may deter sales of new fishing equipment. The market dynamics are influenced by factors such as the availability of pre-owned equipment, end-users' preferences, and the competitive landscape. Companies are responding by offering a range of products catering to various segments, including budget-conscious buyers and those seeking high-performance equipment. The market is expected to remain competitive, with ongoing innovation and product development driving growth.

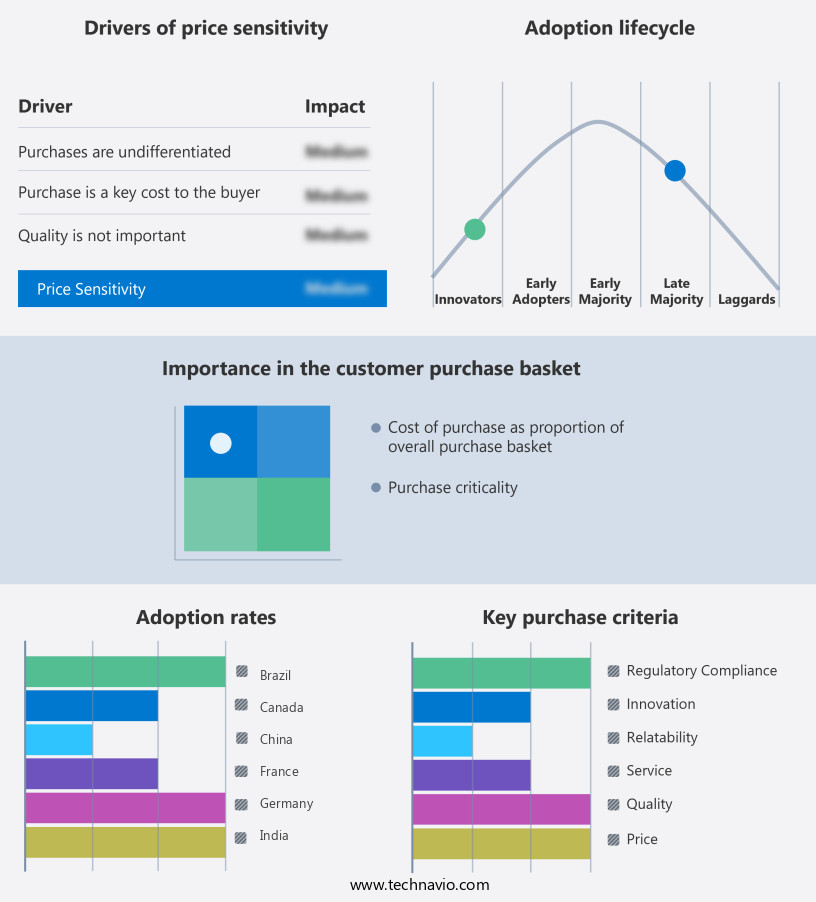

Exclusive Customer Landscape

The fishing equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fishing equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fishing equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Shimano Inc. - This company specializes in supplying top-tier fishing equipment for avid anglers. Product range encompasses AFTCO fishing gloves, performance underwear, fishing hats, and sun protection masks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Shimano Inc.

- Pure Fishing Inc.

- Daiwa Corporation

- Rapala VMC Corporation

- Newell Brands

- Gamakatsu Co. Ltd.

- Okuma Fishing Tackle Co. Ltd.

- Johnson Outdoors Inc.

- Maver UK Ltd.

- Sea Master Enterprise Co. Ltd.

- Rome Specialty Company Inc.

- PRADCO Outdoor Brands

- Globeride Inc.

- Weihai Guangwei Group Co. Ltd.

- Tica Fishing Tackle

- Eagle Claw Fishing Tackle Co.

- AFTCO Mfg. Co. Inc.

- Jarvis Walker Pty Ltd.

- St. Croix Rods

- O. Mustad & Son A.S.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fishing Equipment Market

- In January 2024, Fishing Equipment Inc. Announced the launch of their revolutionary new product, the "Smart Fisherman Kit," which includes an advanced fish finder system and a Mobile Application for real-time data analysis. This innovation aims to enhance the fishing experience for both amateur and professional anglers (Fishing Equipment Inc. Press release).

- In March 2024, Seaborn Marine and AquaTech Corporation entered into a strategic partnership to develop eco-friendly fishing vessels equipped with solar panels and advanced fish handling systems. This collaboration intends to reduce the carbon footprint of the fishing industry and improve sustainability practices (Seaborn Marine press release).

- In April 2025, Oceanic Holdings, a leading fishing equipment manufacturer, completed the acquisition of Blue Wave Technologies, a pioneer in underwater drone technology. This acquisition is expected to expand Oceanic Holdings' product portfolio and strengthen its position in the high-growth underwater exploration market (Oceanic Holdings SEC filing).

- In May 2025, the European Union passed the "Sustainable Fishing Equipment Regulation," mandating the use of eco-friendly fishing equipment and implementing stricter emission standards for fishing vessels. This policy change is expected to significantly impact the market, driving demand for sustainable and efficient solutions (European Parliament press release).

Research Analyst Overview

- The market encompasses a diverse range of products, from materials science in knot tying techniques to sustainable fishing strategies and apparel. Industry trends indicate a growing emphasis on price strategies, customer feedback, and quality control in manufacturing processes. Materials science plays a crucial role in the development of high-performance and durable fishing equipment. Marketing campaigns leverage fishing techniques, guides, and tournaments to engage customers and build brand loyalty. Distribution channels and supply chain management are essential for reaching diverse customer segments, including those with specific fishing preferences for various fish species. Product differentiation through design optimization and ethical sourcing also appeals to eco-conscious consumers.

- Fishing regulations compliance and safety are integral to the market, with education and apparel serving as essential components. Price strategies are influenced by customer segmentation and competition, with online sales and social media marketing playing increasingly significant roles. Fishing accessories, such as packaging materials and fishing charters, cater to various user experiences and performance testing needs. Sustainability initiatives and fishing regulations compliance are critical for long-term market growth. Overall, the market is a dynamic and evolving landscape, with continuous innovation in product development, design, and manufacturing processes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fishing Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.2% |

|

Market growth 2025-2029 |

USD 2.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

US, China, Canada, Germany, Brazil, India, UK, France, Japan, and South Africa |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fishing Equipment Market Research and Growth Report?

- CAGR of the Fishing Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fishing equipment market growth of industry companies

We can help! Our analysts can customize this fishing equipment market research report to meet your requirements.