Ibuprofen Active Pharmaceutical Ingredient (API) Market Size 2025-2029

The ibuprofen active pharmaceutical ingredient (api) market size is forecast to increase by USD 27389 thousand at a CAGR of 2.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing geriatric population and a paradigm shift towards contract manufacturing organizations (CMOs) for API production. The aging demographic is leading to a higher demand for pain relief medications, including those containing ibuprofen. Furthermore, the trend towards outsourcing API manufacturing to CMOs allows pharmaceutical companies to focus on their core competencies while reducing production costs and ensuring regulatory compliance. However, the market is not without challenges. Stringent regulations on ibuprofen API production, particularly in developed markets, necessitate significant investments in research and development and adherence to Good Manufacturing Practices (GMP) to ensure product quality and safety.

- Additionally, price pressures and intense competition from both established players and emerging economies can impact profitability. Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on innovation, regulatory compliance, and strategic partnerships to maintain a competitive edge.

What will be the Size of the Ibuprofen Active Pharmaceutical Ingredient (API) Market during the forecast period?

- Ibuprofen, a widely used nonsteroidal anti-inflammatory drug (NSAID), is a significant active pharmaceutical ingredient (API) in the healthcare industry. The market for ibuprofen APIs is driven by various factors, including price trends, regulatory affairs, and bioequivalence. Ibuprofen's formulation and manufacturing process involve considerations such as salt selection, strength, patient safety, quality assurance, sustainability initiatives, and process validation. Ibuprofen's market dynamics are shaped by packaging standards, ester formation, stability testing, clinical trials, manufacturing capacity, production costs, dosage, and patent landscape. Ibuprofen's therapeutic applications span various indications, necessitating analytical methods to ensure drug interactions are minimized. Regulatory compliance is crucial in the ibuprofen API market, with regulatory bodies overseeing aspects like bioequivalence, patient safety, and quality assurance.

- Ibuprofen's salt selection and formulation impact its therapeutic efficacy and patient compliance. Ibuprofen's manufacturing process must ensure sustainability initiatives, stability testing, and process validation to meet market demands. Ibuprofen's market dynamics are influenced by various factors, including the cost of production, regulatory requirements, and consumer preferences. Ibuprofen's patent landscape and therapeutic applications continue to evolve, with ongoing clinical trials exploring new indications and formulations. The ibuprofen API market is a dynamic and complex landscape, requiring continuous monitoring and adaptation to meet the evolving needs of healthcare providers and patients.

How is this Ibuprofen Active Pharmaceutical Ingredient (API) Industry segmented?

The ibuprofen active pharmaceutical ingredient (api) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Pharmaceutical

- Contract manufacturing organizations

- Product

- Prescription

- Over-the-counter

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The pharmaceutical segment is estimated to witness significant growth during the forecast period.

The pharmaceutical industry is witnessing significant advancements, particularly in the area of Metal Additive Manufacturing. Ibuprofen API, a widely utilized pharmaceutical compound, exemplifies this progress. Known for its versatility, Ibuprofen API is employed extensively in pain relief applications. It alleviates mild to moderate pain, including toothaches, migraines, and menstrual cramps. As an analgesic and antipyretic agent with anti-inflammatory properties, Ibuprofen API plays a pivotal role in managing disorders like rheumatoid arthritis and osteoarthritis. The compound works by inhibiting the production of prostaglandins, hormones responsible for pain and inflammation. By blocking prostaglandin synthesis, Ibuprofen effectively reduces discomfort and swelling.

Process optimization and API purity are essential aspects of pharmaceutical manufacturing. Contract manufacturing and patent protection ensure the intellectual property rights of pharmaceutical companies. Regulatory compliance and quality control are integral to drug delivery and pharmaceutical research. Pharmaceutical excipients, raw materials, and dosage forms are crucial components of drug formulation. API stability, pharmacokinetic studies, and analytical techniques are essential for ensuring the efficacy and safety of brand and generic drugs. Cost reduction and green chemistry are driving forces in pharmaceutical manufacturing. Controlled release, oral solid dosage, and topical preparations are various dosage forms used to enhance drug efficacy.

Drug delivery systems, including Ibuprofen API, are undergoing continuous innovation to improve patient outcomes. The pharmaceutical industry's evolving landscape is shaped by these trends and the ongoing development of new technologies.

Get a glance at the market report of share of various segments Request Free Sample

The Pharmaceutical segment was valued at USD 138764.60 thousand in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

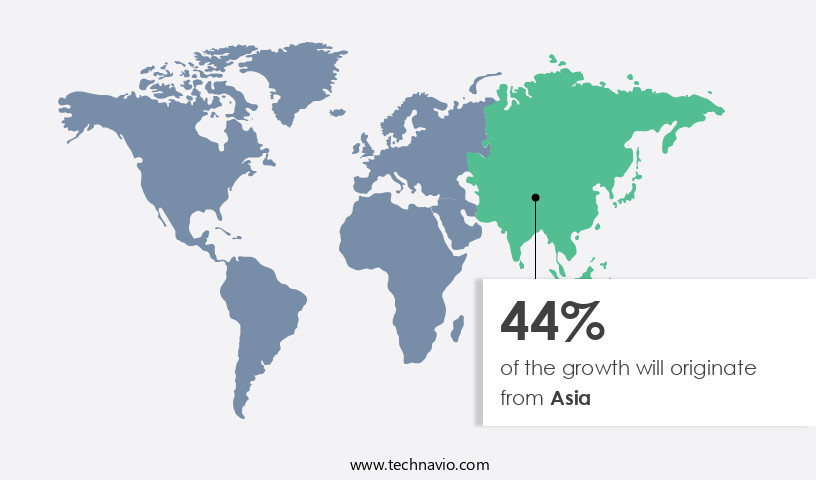

Asia is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The ibuprofen API market in Asia is experiencing significant growth due to the increasing prevalence of various therapeutic areas, such as pain relief from conditions like migraines and chronic illnesses. Factors including stressful lifestyles, climate changes, and increasing pollution levels contribute to the rise in these health issues. Pharmaceutical research and development in the region are focusing on process optimization and API synthesis to meet the growing demand for ibuprofen APIs. Moreover, the expansion of pharmaceutical manufacturing in Asia, particularly in countries like China and India, is driving the market growth. The cost-effective manufacturing environments in these countries have attracted numerous pharmaceutical and biotechnological companies, leading to an increase in production facilities.

Additionally, the growing geriatric population in Asia, which is more susceptible to these medical conditions, will further fuel the market's expansion. Pharmaceutical companies are also focusing on patent protection, regulatory compliance, and quality control to ensure the production of pharmaceutical-grade ibuprofen APIs. Drug delivery systems, such as controlled release and topical preparations, are also gaining popularity to enhance the efficacy and patient compliance. The market for ibuprofen APIs is expected to continue its growth trajectory, with a focus on cost reduction, intellectual property protection, and pharmacokinetic studies to optimize drug formulation and dosage forms. Raw materials, excipients, and analytical techniques play a crucial role in the ibuprofen API manufacturing process.

Contract manufacturing organizations (CMOs) and suppliers of these raw materials and excipients are essential partners in ensuring the supply chain's smooth functioning. Green chemistry and sustainable manufacturing practices are also gaining importance in the industry to minimize the environmental impact of pharmaceutical manufacturing.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ibuprofen Active Pharmaceutical Ingredient (API) Industry?

- Increasing geriatric population is the key driver of the market.

- The market is experiencing growth due to the increasing prevalence of chronic illnesses among the aging population. With the number of adults aged 65 and above projected to double by 2030, reaching nearly 71 million in the US alone, the demand for effective therapeutic solutions, including ibuprofen APIs, is on the rise. Advanced healthcare infrastructure and high disposable income levels in mature markets enhance access to state-of-the-art diagnostic technologies, further fueling market growth.

- Ibuprofen APIs are widely used to treat various conditions such as chronic pain, osteoarthritis, and comorbidities that significantly impact the daily functioning of elderly individuals. The expanding geriatric population and the resulting healthcare needs present significant opportunities for market participants.

What are the market trends shaping the Ibuprofen Active Pharmaceutical Ingredient (API) Industry?

- Paradigm shift in API manufacturing is the upcoming market trend.

- The market has seen a notable shift from in-house production to outsourcing in recent decades. Traditionally, pharmaceutical companies handled the entire process of discovering, developing, and manufacturing ibuprofen APIs in-house. However, the global market for ibuprofen APIs has expanded beyond early-stage intermediates to include advanced intermediates and final dosage forms, particularly for generic drugs. This shift towards outsourcing is driven by several factors, including industry trends, the high cost of acquiring new in-house technologies, and the need to optimize internal capacity.

- Initially, outsourcing focused on early-stage intermediates, but it has since grown to encompass advanced stages of the production process. Companies must carefully consider these factors when deciding to outsource ibuprofen API production.

What challenges does the Ibuprofen Active Pharmaceutical Ingredient (API) Industry face during its growth?

- Stringent regulations on ibuprofen API is a key challenge affecting the industry growth.

- Ibuprofen Active Pharmaceutical Ingredients (APIs) undergo rigorous evaluation by regulatory authorities to ensure safety, efficacy, and potential interactions. Failure to meet these criteria may result in a complete response letter (CRL), requiring additional data and potentially necessitating further clinical trials, increasing research and development costs. In some instances, drug applicants may choose to abandon their applications and discontinue trials altogether due to these regulatory hurdles. These challenges pose significant obstacles for pharmaceutical companies, potentially hindering the growth of the global ibuprofen API market during the forecast period.

- Regulatory agencies meticulously assess the drug's pharmacological properties, pharmacodynamic effects, and potential interactions before granting approval. This thorough examination is crucial to ensure patient safety and efficacy. Despite these challenges, the ibuprofen API market continues to grow due to its widespread use in pain relief medications and other therapeutic applications.

Exclusive Customer Landscape

The ibuprofen active pharmaceutical ingredient (api) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ibuprofen active pharmaceutical ingredient (api) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ibuprofen active pharmaceutical ingredient (api) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arch Pharmalabs Ltd. - The company provides an ibuprofen-based anti-inflammatory agent, engineered to alleviate minor aches and pains, including headaches and muscle discomfort. This over-the-counter medication effectively reduces fever, offering relief for various discomforts. Its non-prescription status ensures accessibility for individuals seeking quick pain relief.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arch Pharmalabs Ltd.

- Athos Chemicals Pvt. Ltd.

- Azelis SA

- BASF SE

- Chemino Pharma Ltd.

- Dr Reddys Laboratories Ltd.

- Granules India Ltd.

- HELM AG

- IOL Chemicals and Pharmaceuticals Ltd.

- Mallinckrodt Plc

- Octavius Pharma Pvt. Ltd.

- Otto Brandes GmbH

- Piramal Enterprises Ltd.

- Rochem International Inc.

- SI Group Inc.

- Sino-US Zibo Xinhua-Perrigo Pharmaceutical Co. Ltd.

- Solara Active Pharma Sciences Ltd

- Strides Pharma Science Ltd.

- Teva Pharmaceutical Industries Ltd.

- Titan Lab Pvt Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market: A Comprehensive Overview The Ibuprofen API market represents a significant segment within the broader pharmaceutical industry. This market is characterized by continuous advancements in technology, regulatory requirements, and research and development efforts aimed at enhancing the production, purity, and stability of Ibuprofen APIs. Process optimization is a critical aspect of the Ibuprofen API market. Pharmaceutical companies are continually seeking ways to streamline their manufacturing processes to improve efficiency and reduce costs. This includes the optimization of API synthesis methods and the use of advanced analytical techniques for quality control and assurance. API purity is another essential factor driving the Ibuprofen API market.

The demand for high-purity APIs is increasing due to the growing preference for pharmaceutical-grade products. This trend is particularly noticeable in the over-the-counter (OTC) sector, where consumers are increasingly seeking effective and safe pain relief solutions. Clinical trials and pharmaceutical research play a crucial role in the development of new Ibuprofen API applications. These trials help to establish the safety and efficacy of Ibuprofen APIs in various therapeutic areas, including pain relief, menstrual cramps, rheumatoid arthritis, and dental pain. Raw materials and their sourcing are essential considerations in the Ibuprofen API market. Pharmaceutical companies are constantly seeking reliable and cost-effective suppliers of raw materials to ensure a steady supply of APIs for their manufacturing processes.

This has led to increased focus on supply chain optimization and the adoption of green chemistry principles to reduce the environmental impact of API production. Patent protection and regulatory compliance are critical issues in the Ibuprofen API market. Pharmaceutical companies invest heavily in research and development to secure intellectual property rights for their APIs. Regulatory compliance is also a significant challenge, with stringent requirements for quality control, drug delivery systems, and drug formulation. The Ibuprofen API market is diverse, with a range of dosage forms and delivery systems available. Oral solid dosage forms are the most common, but topical preparations and controlled-release formulations are also gaining popularity.

The market is also witnessing increased interest in the development of generic drugs, which offer cost advantages and expanded access to healthcare. Pharmaceutical manufacturing processes are evolving to meet the demands of the Ibuprofen API market. Contract manufacturing is becoming increasingly popular, allowing smaller companies to access specialized manufacturing capabilities and economies of scale. Cost reduction is a key driver of these trends, with companies seeking to minimize production costs while maintaining quality and regulatory compliance. In conclusion, the Ibuprofen API market is a dynamic and complex industry that is driven by a range of factors, including process optimization, API purity, clinical trials, raw materials, patent protection, regulatory compliance, and drug delivery systems.

These trends are shaping the future of the market and presenting new opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.1% |

|

Market growth 2025-2029 |

USD 27389 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

US, India, China, Germany, UK, Japan, Canada, Brazil, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ibuprofen Active Pharmaceutical Ingredient (API) Market Research and Growth Report?

- CAGR of the Ibuprofen Active Pharmaceutical Ingredient (API) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ibuprofen active pharmaceutical ingredient (api) market growth of industry companies

We can help! Our analysts can customize this ibuprofen active pharmaceutical ingredient (api) market research report to meet your requirements.