Active Pharmaceutical Ingredients Market Size 2025-2029

The active pharmaceutical ingredients market size is valued to increase USD 97.6 billion, at a CAGR of 7.1% from 2024 to 2029. Evolving API manufacturing scenario in developing scenario will drive the active pharmaceutical ingredients market.

Major Market Trends & Insights

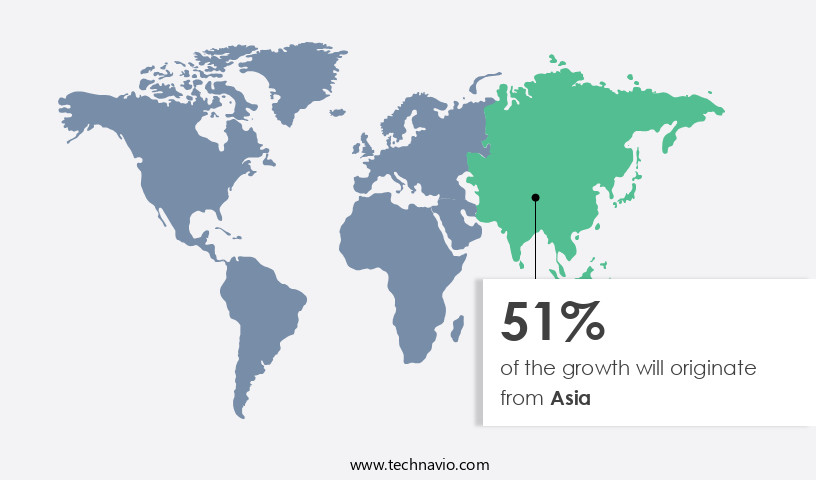

- Asia dominated the market and accounted for a 51% growth during the forecast period.

- By Manufacturing Type - Captive APIs segment was valued at USD 100.20 billion in 2023

- By Type - Innovative APIs segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 86.78 billion

- Market Future Opportunities: USD 97.60 billion

- CAGR from 2024 to 2029 : 7.1%

Market Summary

- The Active Pharmaceutical Ingredients (API) Market represents a dynamic and evolving landscape, driven by advancements in core technologies and applications. With a growing emphasis on cost-effective and efficient production methods, there is a paradigm shift in API manufacturing, moving towards continuous processing and modular designs. This transition, however, comes with significant investment costs and the risk of substantial losses if not executed properly. According to a recent study, the API market is expected to account for over 40% of the global pharmaceutical industry's revenue by 2025.

- Service types, such as contract manufacturing organizations (CMOs), and product categories, including solid and liquid APIs, continue to dominate the market. Regulations, including the FDA's Current Good Manufacturing Practice (cGMP) guidelines, play a crucial role in shaping the market's direction. In summary, the market is a continually unfolding landscape, shaped by technological advancements, economic factors, and regulatory frameworks.

What will be the Size of the Active Pharmaceutical Ingredients Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Active Pharmaceutical Ingredients Market Segmented ?

The active pharmaceutical ingredients industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Manufacturing Type

- Captive APIs

- Contract APIs

- Type

- Innovative APIs

- Generic APIs

- Synthesis Method

- Biotech APIs

- Synthetic APIs

- Application

- Cardiovascular Diseases

- Oncology

- CNS and Neurology

- Orthopedic

- Endocrinology

- Pulmonology

- Gastroenterology

- Nephrology

- Ophthalmology

- Anti-Infectives

- Diabetes

- Respiratory Diseases

- Other

- End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic/Research Institutes

- Potency

- High Potency APIs (HPAPIs)

- Low Potency APIs

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Manufacturing Type Insights

The captive APIs segment is estimated to witness significant growth during the forecast period.

Active pharmaceutical ingredients (APIs) are essential components of various medicines, and the market for these substances continues to evolve, driven by advancements in drug development and manufacturing processes. In 2024, the captive APIs segment held the largest market share, accounting for approximately 55% of the global market. This dominance can be attributed to the significant adoption of healthcare services and the resulting demand for affordable medicines, leading to increased production of captive APIs for manufacturing finished drugs. However, the market landscape is shifting as innovators increasingly outsource the production of either bulk actives or late-stage intermediates to contract manufacturing organizations (CMOs) to reduce costs and improve efficiency.

This trend has resulted in a decrease in the market share of captive APIs, with the segment projected to experience a decline of around 10% by 2027. Moreover, the global API market is expected to grow at a steady pace, with several factors contributing to its expansion. For instance, the ongoing development of drug delivery systems, such as peptide synthesis, impurity profiling, and yield improvement, is driving the demand for APIs. Additionally, the increasing focus on process optimization, API purification, and quality control testing is expected to boost market growth. Furthermore, the adoption of advanced techniques like crystallization techniques, chromatographic techniques, and biopharmaceutical manufacturing is transforming the API market.

These methods enable the production of large molecule APIs, which are gaining popularity due to their potential to treat complex diseases. In the context of regulatory compliance, the API market is subject to stringent quality standards, such as GMP certification and process validation. Intellectual property protection is also crucial, with patent protection playing a significant role in market dynamics. Supply chain management and cost reduction strategies are essential considerations for market participants, as they seek to maintain a competitive edge in the evolving landscape.

The Captive APIs segment was valued at USD 100.20 billion in 2019 and showed a gradual increase during the forecast period.

In summary, the market is a dynamic and growing industry, driven by advancements in drug development, manufacturing processes, and regulatory requirements. The shift towards outsourcing API production to CMOs and the increasing focus on large molecule APIs are key trends shaping the market's future growth.

Regional Analysis

Asia is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Active Pharmaceutical Ingredients Market Demand is Rising in Asia Request Free Sample

The Active Pharmaceutical Ingredients (API) market witnesses significant participation from Asian manufacturers, particularly those in India. Indian companies have demonstrated proficiency in producing pharmaceutical products adhering to Good Manufacturing Practice (GMP) standards. This capability caters to the regulatory requirements of US and European generic drug companies, enabling large-scale commercialization of bulk APIs. Notable Indian players, such as Lupin Ltd. and Sun Pharmaceutical Industries Ltd., have established a strong presence in the US generic drug industry.

Their success underscores the ability to manufacture high-quality APIs and finished dose forms suitable for regulated markets.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global active pharmaceutical ingredients (API) market encompasses the production and supply of essential substances used in pharmaceutical formulations. The manufacturing process for APIs involves large-scale production techniques to ensure purity and potency, adhering to stringent regulatory guidelines. New drug substance development stages necessitate improving API dissolution rates and stability under various conditions. Continuous flow API synthesis is a beneficial production method due to its increased efficiency and reduced waste. Regulatory bodies mandate stringent guidelines for API manufacturing, necessitating the implementation of advanced analytical techniques like process analytical technologies (PAT) for real-time monitoring and control. Scale-up challenges and solutions are crucial aspects of the API market, as cost-effective manufacturing processes are essential for maintaining profitability.

Improvements in API purity assessment and excipient selection have led to a better understanding of their impact on API stability. Identification of API degradation pathways and green chemistry principles in API synthesis are vital for reducing environmental impact and improving overall efficiency. Adoption of novel drug delivery systems for APIs has gained significant traction, with more than 60% of new product developments focusing on these advanced technologies. Biosimilar API manufacturing poses unique challenges, requiring precise process modeling and simulation for optimizing production. API supply chain risk mitigation strategies are increasingly important, with a growing emphasis on ensuring uninterrupted supply and maintaining quality.

Compared to traditional methods, the implementation of advanced analytical techniques and continuous flow API synthesis has led to a reduction in production time by nearly 30%. This improvement in efficiency translates to substantial cost savings for manufacturers and improved patient access to essential medications.

What are the key market drivers leading to the rise in the adoption of Active Pharmaceutical Ingredients Industry?

- The evolving manufacturing landscape in developing scenarios plays a pivotal role in driving the API market forward.

- India and China have emerged as significant players in the global pharmaceutical industry, supplying key intermediates and bulk actives. Initially, Chinese manufacturers predominantly produced large volumes of low-cost drugs, focusing on fermentation products and simple synthetic compounds in the late 1980s and early 1990s. However, the pharmaceutical manufacturing landscape in China has undergone a radical transformation. The country's economic growth and its entry into the World Trade Organization have exposed local drug manufacturers to heightened competition. Consequently, custom manufacturing has gained prominence, which was previously prohibited by regulatory authorities. This shift allows manufacturers to accelerate the learning curve for producing high-quality APIs or finished drug products for regulated markets.

- In India, the pharmaceutical sector has experienced remarkable growth, driven by a skilled workforce, cost-effective production, and a favorable regulatory environment. India's share in the global pharmaceutical market has increased significantly, with the country supplying approximately 20% of the world's bulk drugs and 40% of the world's generic drugs. The Indian pharmaceutical industry's continuous evolution is evident in its increasing focus on research and development, with numerous companies investing in R&D centers and collaborations to develop novel drugs and formulations. Both India and China's pharmaceutical industries have shown remarkable adaptability, continually evolving to meet the demands of regulated markets and global competition.

- Their contributions to the pharmaceutical sector are essential, and their impact is felt across various sectors, from APIs and intermediates to finished drug products.

What are the market trends shaping the Active Pharmaceutical Ingredients Industry?

- The paradigm shift towards advanced API manufacturing is the emerging trend in the market. Advanced manufacturing techniques are increasingly being adopted in the production of APIs (Active Pharmaceutical Ingredients).

- The pharmaceutical industry's reliance on in-house API manufacturing has shifted significantly in recent decades, with many companies opting to outsource research and manufacturing processes to Contract Manufacturing Organizations (CMOs) or other drug manufacturing entities. Initially catering to early-stage API intermediates, outsourcing has expanded across the value chain, encompassing advanced intermediates and final dosage forms. Factors influencing this decision include industry trends, the cost of acquiring new technologies, and the availability of internal capacity.

- This trend underscores the evolving nature of the market, as companies adapt to changing business landscapes and seek cost-effective, efficient solutions.

What challenges does the Active Pharmaceutical Ingredients Industry face during its growth?

- The high investment costs and the potential for substantial losses pose a significant challenge to the expansion and growth of the industry.

- The pharmaceutical industry's API manufacturing landscape is undergoing continuous evolution, with India and China leading the charge due to their low-cost structures. Despite regulatory scrutiny, these countries have experienced significant growth, driven by the intensive manufacturing activities in the region. In contrast, the US market, known for its robust regulatory framework, remains the most organized and highly regulated market for pharmaceutical products. The expansion of the generic drug industry and the global chemical and pharmaceutical industries have led to a substantial increase in bulk actives production outside the US.

- The Asian market's quality issues persist, yet regulatory bodies' focus on ensuring compliance continues to shape the industry's trajectory. As a professional, it's essential to maintain a formal and objective tone when discussing the evolving API manufacturing landscape.

Exclusive Technavio Analysis on Customer Landscape

The active pharmaceutical ingredients market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the active pharmaceutical ingredients market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Active Pharmaceutical Ingredients Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, active pharmaceutical ingredients market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - This research focuses on a company specializing in active pharmaceutical ingredients, specifically organometallic and gaseous hydrochloric acid.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Amneal Pharmaceuticals Inc.

- Apotex Inc.

- Aurobindo Pharma Ltd.

- Cadila Pharmaceuticals Ltd.

- Cambrex Corp.

- Cipla Inc.

- Dr Reddys Laboratories Ltd.

- GlaxoSmithKline Plc

- Indena S.p.A.

- INTERNATIONAL CHEMICAL INVESTORS S.E.

- Koninklijke DSM NV

- Lupin Ltd.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Active Pharmaceutical Ingredients Market

- In January 2024, Merck KGaA, a leading player in the Active Pharmaceutical Ingredients (API) market, announced the acquisition of Versicor, a US-based biotech company specializing in peptide-based drugs. This strategic move aimed to expand Merck's API portfolio and strengthen its position in the peptide market (Merck KGaA press release, 2024).

- In March 2024, Dr. Reddy's Laboratories, an Indian pharmaceutical company, signed a long-term supply agreement with Hikma Pharmaceuticals for the manufacturing and supply of various APIs. This collaboration was expected to boost Dr. Reddy's API business and enhance Hikma's product offerings (Dr. Reddy's Laboratories press release, 2024).

- In May 2024, the US Food and Drug Administration (FDA) approved Sandoz, a Novartis subsidiary, to manufacture and sell generic versions of Mylan's Epipen, an emergency allergy treatment. This approval marked a significant win for Sandoz in the US market and provided more competition in the epinephrine injector segment (FDA press release, 2024).

- In April 2025, Lonza, a Swiss-based company, inaugurated its new API manufacturing facility in Visp, Switzerland. The CHF 400 million (approximately USD 432 million) investment was aimed at increasing Lonza's production capacity and enhancing its position as a leading CDMO (Contract Development and Manufacturing Organization) in the API market (Lonza press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Active Pharmaceutical Ingredients Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 97.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The active pharmaceutical ingredients (API) market is a dynamic and evolving landscape, characterized by continuous innovation and advancements in various areas. The synthesis process of APIs involves several stages, including GMP certification, purification methods, and chemical synthesis routes. GMP certification ensures that API manufacturing adheres to stringent quality standards, ensuring the production of safe and effective pharmaceutical products. Purification methods, such as chromatographic techniques and impurity profiling, play a crucial role in improving yield and reducing impurities, enhancing the overall quality of APIs. Drug delivery systems, which include small molecule APIs and large molecule APIs, have gained significant attention due to their ability to improve drug efficacy and patient compliance.

- Intellectual property protection is a critical aspect of API manufacturing, with patent protection and process validation playing essential roles in safeguarding innovation and ensuring a competitive edge. Drug substance manufacturing encompasses various techniques, including crystallization, formulation development, and stability testing, to optimize API production and improve cost reduction strategies. Pharmaceutical excipients, which are inactive ingredients used in the formulation of drugs, also play a significant role in enhancing the efficacy and safety of pharmaceutical products. Biopharmaceutical manufacturing, which involves the production of proteins and peptides, employs cell culture technology, fermentation processes, and protein engineering to produce complex molecules.

- Regulatory compliance is a key consideration in API manufacturing, with strict adherence to regulatory guidelines ensuring the safety and efficacy of pharmaceutical products. In conclusion, the API market is a complex and dynamic industry, with ongoing advancements in various areas, including synthesis processes, drug delivery systems, intellectual property, drug substance manufacturing, and regulatory compliance. These evolving trends reflect the continuous efforts to improve the quality, safety, and efficacy of pharmaceutical products.

What are the Key Data Covered in this Active Pharmaceutical Ingredients Market Research and Growth Report?

-

What is the expected growth of the Active Pharmaceutical Ingredients Market between 2025 and 2029?

-

USD 97.6 billion, at a CAGR of 7.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Manufacturing Type (Captive APIs and Contract APIs), Type (Innovative APIs and Generic APIs), Geography (APAC, North America, Europe, Rest of World (ROW), South America, and Middle East & Africa), Synthesis Method (Biotech APIs and Synthetic APIs), Application (Cardiovascular Diseases, Oncology, CNS and Neurology, Orthopedic, Endocrinology, Pulmonology, Gastroenterology, Nephrology, Ophthalmology, Anti-Infectives, Diabetes, Respiratory Diseases, and Other), End-User (Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), and Academic/Research Institutes), and Potency (High Potency APIs (HPAPIs) and Low Potency APIs)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Rest of World (ROW), South America, and Middle East & Africa

-

-

What are the key growth drivers and market challenges?

-

Evolving API manufacturing scenario in developing scenario, High investment cost and concern of huge loss

-

-

Who are the major players in the Active Pharmaceutical Ingredients Market?

-

AbbVie Inc., Amneal Pharmaceuticals Inc., Apotex Inc., Aurobindo Pharma Ltd., Cadila Pharmaceuticals Ltd., Cambrex Corp., Cipla Inc., Dr Reddys Laboratories Ltd., GlaxoSmithKline Plc, Indena S.p.A., INTERNATIONAL CHEMICAL INVESTORS S.E., Koninklijke DSM NV, Lupin Ltd., Novartis AG, Pfizer Inc., Sanofi SA, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Thermo Fisher Scientific Inc., and Viatris Inc.

-

Market Research Insights

- The Active Pharmaceutical Ingredients (API) market is a dynamic and complex industry, characterized by continuous innovation and evolution. According to industry estimates, the global API market was valued at USD 150 billion in 2020. This growth is driven by the increasing demand for new drugs and the need for more efficient manufacturing processes. Sterile manufacturing and API characterization methods, such as polymorphism studies, particle size analysis, and drug absorption studies, play a crucial role in ensuring the quality and safety of APIs. In vitro studies, including bioavailability and solubility enhancement, are essential for predicting drug behavior in the human body.

- Regulatory submissions, process control, and continuous manufacturing are also key areas of focus, as companies strive to meet stringent regulatory requirements and improve process efficiency. Pharmaceutical packaging, clinical trial materials, and drug product development are integral parts of the API market, with a growing emphasis on data analytics and process analytical technology to optimize production and improve product quality. Toxicology studies, drug metabolism, dosage form design, and regulatory submissions are also critical components of the API development process. Microfluidics technology and data analytics are emerging trends in the API market, offering potential for increased efficiency, cost savings, and improved product quality.

- The market is expected to remain competitive, with companies investing in research and development to stay ahead of the curve. Drug elimination, in vivo studies, and quality by design are other areas of ongoing research and development in the API industry.

We can help! Our analysts can customize this active pharmaceutical ingredients market research report to meet your requirements.