Industrial Food Milling Machines Market Size 2024-2028

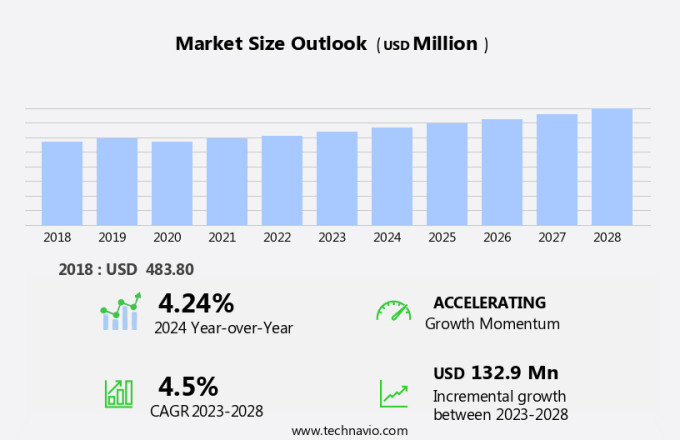

The industrial food milling machines market size is forecast to increase by USD 132.9 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing utilization of milling machines In the food industry. This trend is driven by the advantages offered by these machines, such as improved product quality and efficiency. Additionally, the influx of advanced technologies in milling machines, including automation and energy-efficient designs, is further fueling market growth. However, energy and cost concerns continue to pose challenges for market participants. Producers are focusing on developing machines that address these issues while maintaining high levels of performance and productivity. Overall, the market is expected to witness steady growth In the coming years, driven by these key factors.

What will be the Size of the Industrial Food Milling Machines Market During the Forecast Period?

- The market experiences continuous growth due to the increasing demand for processed and value-added food products. Flour and spices are major applications driving market expansion. However, rising energy concerns in various industries have led to the development of energy-efficient milling machines. These machines incorporate advanced features such as rotary cutting tools, saddles, spindles, arbors, worktables, headstocks, overarms, and part fixtures. Part design and machine setup are critical factors influencing milling performance. Efficient workpiece fixtures ensure precise part alignment, while optimized feed rates, rotational speeds, tool diameters, cutting speeds, and part inspection techniques contribute to improved productivity and reduced wastage. Overall, the market is characterized by a focus on innovation, energy efficiency, and cost-effectiveness.

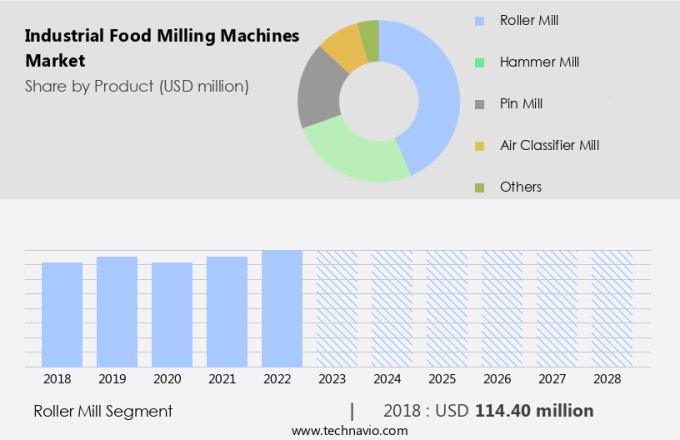

How is this Industrial Food Milling Machines Industry segmented and which is the largest segment?

The industrial food milling machines industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Roller mill

- Hammer mill

- Pin mill

- Air classifier mill

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Product Insights

- The roller mill segment is estimated to witness significant growth during the forecast period.

Industrial food milling machines, specifically roller mills, utilize cylindrical rollers mounted on horizontal axes that rotate towards each other for crushing or grinding food materials. Two-roller and four-roller mills are common types, with food particles introduced at the mill's top. The milling process employs compression and shearing forces as the food particles pass through the nip, the space between the rollers. Roller mills' nip size must be adjusted based on the food type. Flour and spices are common applications. In industrial settings, energy concerns and workforce efficiency are paramount. Milling machines come in various types, including vertical milling machines, horizontal milling machines, and universal milling machines.

Each machine type has distinct axes, structures, and functions, such as milling, drilling, boring, threading, slotting, and gear milling. Machine setup, workpiece fixture, and part design are crucial factors. Milling operations include slab milling, face milling, end milling, and gang milling. Milling speeds, feed rates, and rotational speeds are essential variables. Roller mills' efficiency and precision contribute to the food industry's productivity and profitability.

Get a glance at the Industrial Food Milling Machines Industry report of share of various segments Request Free Sample

The Roller mill segment was valued at USD 114.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth due to the increasing demand for milled food products, particularly grains, legumes, and cereals. The US, with its vast agricultural output, is a significant contributor to this market, hosting numerous milling plants for wheat, oats, and barley. Canada is also expected to see notable growth In the forecast period, given its production of various milled food products. Industrial food milling machines perform various functions, including milling, drilling, boring, threading, slotting, and gear cutting, among others. Machines come in different structures, such as vertical milling machines, horizontal milling machines, and universal milling machines, with various axes and milling operations like slab milling, face milling, end milling, and form milling.

Machine setup, workpiece fixture, and part inspection are crucial aspects of milling processes. Industrial food milling machines' efficiency and productivity are influenced by factors such as feed rate, rotational speed, tool diameter, cutting speed, feed speed, depth of cut, and spindle orientation.

Market Dynamics

Our industrial food milling machines market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Food Milling Machines Industry?

Rise in use of milling machines in food industry is the key driver of the market.

- Industrial food milling machines play a significant role In the food processing industry, particularly In the preparation of flours and spices. These machines are designed with high-quality materials and workmanship to ensure efficient and sanitary production. The increasing demand for these machines in low-income regions, where food processing is a growing industry, is driving market growth. Milling machines come in various types, including vertical milling machines, horizontal milling machines, and universal milling machines. Rotary cutting tools, such as drills, borers, threaders, slotters, and gears, are essential functions of these machines. Their shapes vary, from flat surfaces for Eli Whitman's early invention of milling machines to irregular surfaces for rifle parts machining.

- Milling functions include milling, feeding rate, part inspection, rotational speed, tool diameter, cutting speed, feed speed, depth of cut, spindle orientation, and machine structure. The structure of milling machines includes parts such as columns, knees, saddles, spindles, arbors, headstocks, overarms, part designs, machine setup, workpiece fixtures, and milling operations. Milling operations include slab milling, face milling, end milling, gang milling, straddle milling, form milling, peripheral milling, plunge milling, saw milling, groove milling, thread milling, cam milling, gear milling, angle milling, profile milling, side milling, and face milling techniques. The control method for milling machines ranges from manual to tracer-controlled and CNC.

- The use of industrial food milling machines is essential for the production of various food products, making it a vital market with continuous growth potential.

What are the market trends shaping the Industrial Food Milling Machines Industry?

Influx of improved technologies in milling machines is the upcoming market trend.

- Industrial food milling machines have witnessed significant advancements with the integration of innovative technologies. One such development is the automatic milling gap adjustment system. This technology optimally sets the milling gap between the rotor and stator of a food milling machine, enabling adjustments according to recipe modifications during production. FrymaKoruma's Toothed colloid mill (MZ) is an example of this technology. Another technological advancement is roll technology, which is utilized in roller mills. Two primary types of roll technology exist: FERAN rolls and TITAN rolls. These rolls enhance the milling process by ensuring efficient grinding and reducing energy consumption, which is crucial in addressing rising energy concerns in low-income regions.

- Milling functions such as drilling, boring, threading, slotting, and gear milling are essential in shaping and manufacturing various food products. Machining techniques like face milling, end milling, and gang milling are applied to create flat and irregular surfaces. Machines like vertical milling machines, horizontal milling machines, and universal milling machines serve various purposes with different machine structures, including column, knee, saddle, spindle, arbor, headstock, overarm, and axes. Machine setup, workpiece fixture, and part design are crucial factors in milling machine operations. Milling speeds, feed rates, rotational speed, tool diameter, cutting speed, feed speed, depth of cut, and spindle orientation are essential factors influencing the milling process.

- Milling machine operations include slab milling, face milling, end milling, straddle milling, form milling, peripheral milling, plunge milling, saw milling, groove milling, thread milling, cam milling, gear milling, angle milling, profile milling, side milling, and face milling techniques. Milling machine control methods range from manual to tracer-controlled and CNC systems. These advancements aim to increase productivity, improve product quality, and reduce labor-intensive processes In the food milling industry.

What challenges does the Industrial Food Milling Machines Industry face during its growth?

Energy and cost concerns is a key challenge affecting the industry growth.

- The food milling industry is characterized by high energy consumption due to the intensive nature of the milling process. In particular, the grinding of flours and spices is a significant energy consumer, with wet corn milling being one of the most power-hungry operations. The milling process in a flour plant accounts for approximately three-quarters of the total energy consumption, with an average energy usage of over 1.186 megajoules (MJ) per ton of flour produced. The milling industry's energy demands stem from the large motors required to power rotary cutting tools such as milling machines, which perform various functions on workpieces, including shaping flat and irregular surfaces, drilling, boring, threading, slotting, and machining gears.

- These machines come in various types, including vertical milling machines, horizontal milling machines, universal milling machines, and specialized machines like knee-type milling machines, planer-type milling machines, C-frame milling machines, and gantry milling machines. The milling process involves machine setup, workpiece fixture, and milling operations such as slab milling, face milling, end milling, gang milling, straddle milling, form milling, peripheral milling, plunge milling, saw milling, groove milling, thread milling, cam milling, gear milling, angle milling, profile milling, and side milling. Milling machine operations require precise control of parameters such as feed rate, part inspection, rotational speed, tool diameter, cutting speed, feed speed, depth of cut, and spindle orientation.

- Despite the energy demands, advancements in machine structure, control methods, and machine setup continue to improve the efficiency and productivity of the food milling industry.

Exclusive Customer Landscape

The industrial food milling machines market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial food milling machines market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial food milling machines market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alapala - Industrial food milling machines are essential equipment for processing grains and cereals into various food products. These machines cater to diverse applications, including flour milling and maize milling. The industrial food milling sector encompasses the production of machinery used to grind, crush, and pulverize raw materials into desired textures and sizes. This equipment is integral to the food processing industry, enabling the production of a wide range of consumer goods from baked items to animal feed. Industrial food milling machines offer versatility, efficiency, and consistent product quality, making them an indispensable investment for food manufacturers and processors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alapala

- Alvan Blanch Development Co.

- Beccaria S.r.l.

- Brabender GmbH and Co. KG

- Buhler AG

- Erich NETZSCH GmbH and Co. Holding KG

- FRITSCH GmBH

- FUCHS Maschinen AG

- Glen Mills Inc.

- Hosokawa Micron Corp.

- IDEX Corp.

- IKA Werke GmbH and CO. KG

- Isimsan Muh. San ve Tic. A.S.

- Jas Enterprises

- Kice Industries Inc.

- Mill Powder Tech Co. Ltd.

- Omas Srl

- Proxes GmbH

- Royal Duyvis Wiener BV

- Satake Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial food milling machines play a significant role In the production process of various food industries. These machines are designed to process and refine raw food materials into desired textures and sizes, enhancing the overall quality and consistency of food products. The food milling market is driven by several factors. The increasing demand for processed and convenience food products is a major factor driving the growth of the market. Additionally, the need for efficient and automated production processes to meet the rising consumer demands and maintain competitiveness In the market is also fueling the market's growth. Food milling machines offer several advantages over traditional methods of food processing.

They enable faster production rates, reduce labor requirements, and ensure consistent product quality. Furthermore, these machines can process a wide range of food materials, including grains, legumes, fruits, and vegetables, making them versatile tools for food manufacturers. The food milling machines market is segmented based on various factors, including machine structure and functions. Machine structure includes vertical milling machines, horizontal milling machines, universal milling machines, and others. Vertical milling machines are commonly used for machining complex shapes and contours, while horizontal milling machines are suitable for large-scale production of flat surfaces. Universal milling machines offer the flexibility to perform various milling operations, making them a popular choice for food manufacturers.

Functions of food milling machines include slab milling, face milling, end milling, gang milling, straddle milling, form milling, peripheral milling, plunge milling, saw milling, groove milling, thread milling, cam milling, gear milling, angle milling, profile milling, and side milling. Each function serves a unique purpose in food processing, and the choice of function depends on the specific food material and desired texture or shape. Food milling machines operate using various control methods, including manual, tracer-controlled, and CNC. Manual milling machines require manual intervention for each milling operation, making them less efficient compared to automated machines. Tracer-controlled milling machines use a tracer to guide the cutting tool, providing greater accuracy and consistency.

CNC milling machines offer the highest level of automation, allowing for precise control over milling operations and reducing the need for manual intervention. The food milling machines market is expected to continue growing due to the increasing demand for processed food products and the need for efficient and automated production processes. Additionally, advancements in machine technology, such as the integration of artificial intelligence and machine learning, are expected to further enhance the capabilities of food milling machines and drive market growth. In conclusion, industrial food milling machines play a crucial role In the production process of various food industries, offering advantages such as faster production rates, reduced labor requirements, and consistent product quality.

The market for food milling machines is driven by several factors, including the increasing demand for processed food products and the need for efficient and automated production processes. The market is segmented based on machine structure and functions, with various control methods available to suit different production needs. The future of the food milling machines market looks promising, with advancements in machine technology expected to further enhance the capabilities of these machines and drive market growth.

|

Industrial Food Milling Machines Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

148 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 132.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.24 |

|

Key countries |

US, China, UK, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Food Milling Machines Market Research and Growth Report?

- CAGR of the Industrial Food Milling Machines industry during the forecast period

- Detailed information on factors that will drive the Industrial Food Milling Machines growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial food milling machines market growth of industry companies

We can help! Our analysts can customize this industrial food milling machines market research report to meet your requirements.