Industrial Sewing Machines Market Size 2024-2028

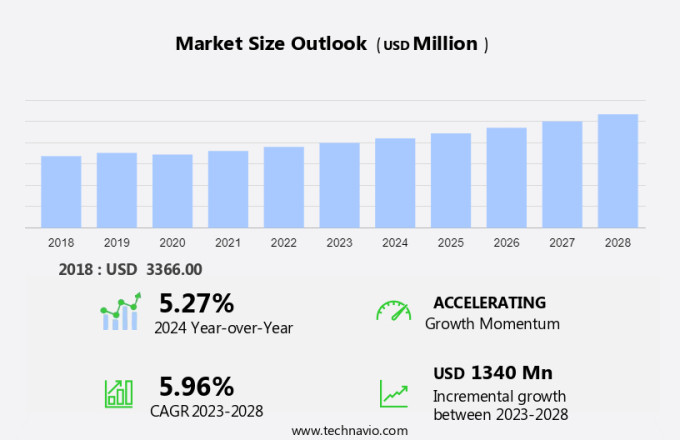

The industrial sewing machines market size is forecast to increase by USD 1.34 billion at a CAGR of 5.96% between 2023 and 2028. The market is experiencing significant growth, driven by several key factors. The expansion of the automotive industry is a major growth driver, as automotive manufacturers increasingly rely on industrial sewing machines to produce upholstery and other textile components. Additionally, the rise in online sales of garments is fueling demand for efficient and high-volume sewing machines to meet the production needs of e-commerce retailers. However, the high price of industrial sewing machines presents a challenge for small and medium-sized enterprises, limiting their ability to invest in advanced technology. Despite this, the market is expected to continue growing, driven by increasing automation and the adoption of smart technologies in manufacturing processes.

Industrial sewing machines are specialized machines designed for heavy-duty tasks in various industries. These machines use different materials such as metal and plastic for their construction, catering to diverse applications. The throat space, stitches per minute, and threading systems are essential features that determine the efficiency and productivity of industrial sewing machines. Needles used in industrial sewing machines come in various sizes and materials, including metal and plastic, to accommodate various materials and stitching techniques. Industrial sewing machines offer computerized interfaces for easier operation and precision. Sewing techniques used in industrial applications include straight stitch, lockstitch, and chain stitch, among others.

Furthermore, industrial sewing machines are extensively used in garments, furniture, cars, and automotive interiors industry, among others. The technology development in industrial sewing machines is continually evolving, with an increasing focus on improving efficiency, productivity, and reducing production costs. The industrial framework is undergoing significant industrialization, leading to the increasing demand for industrial sewing machines in various industries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Raised

- Cylinder bed

- Flat bed

- Post bed

- Others

- Application

- Apparel

- Non-apparel

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- France

- Middle East and Africa

- South America

- North America

By Type Insights

The raised segment is estimated to witness significant growth during the forecast period. Industrial sewing machines are integral to the production of various sewn goods, including garments, furniture, cars, and signage. These machines are designed to handle heavy-duty tasks, utilizing materials ranging from metal to thermoplastic. The throat space, or the distance between the needle and the presser foot, is a crucial factor in determining the machine's capabilities. Sewing machines come in various types, such as raised bed machines, which are positioned on top of a table for easier handling of bulky fabrics. Chain stitches and lock stitches are commonly produced using raised sewing machines. The needles and threading systems are essential components, ensuring the accuracy and quality of the stitches.

Furthermore, modern technology has introduced computerized interfaces, enhancing the sewing process with precision and consistency. Traditional craftsmanship and industrialization have coalesced, with industrial sewing machines producing stitches like straight, lock, chain, and zigzag, to cater to diverse industries. The automotive interiors industry and tent manufacturing industry significantly benefit from industrial sewing machines. These machines enable the production of high-quality stitches at increased speeds, with some machines capable of producing up to 1,500 stitches per minute. Filters are integrated into the machines to ensure cleanliness and prolong their lifespan. As technology continues to develop, industrial sewing machines will continue to adapt, ensuring the production of top-quality sewn goods.

Get a glance at the market share of various segments Request Free Sample

The raised segment accounted for USD 855.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

APAC is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Industrial sewing machines play a pivotal role in various sectors such as fashion, apparel, furniture upholstery, automotive interiors, and tent manufacturing. In workshops and factories, these machines facilitate mass production with consistency and quality, contributing significantly to the economic impact of the textile industry. Machine manufacturing companies continue to innovate, introducing technologies like Hot Air and Hot Wedge welding, Radio Frequency welding, and Signs and SEGs for enhanced craftsmanship. These advancements improve efficiency and productivity, creating jobs and boosting the global economy. Industrial sewing machines are integral to textile production, shaping the fashion industry with trendsetting designs and setting new standards for automotive interiors and furniture upholstery.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Expansion of automotive industry is the key driver of the market. Industrial sewing machines play a pivotal role in the production of various sewn goods, particularly in industries such as automotive, furniture, and garments. These machines are engineered to handle heavy-duty tasks, using materials ranging from metal to plastic. Throat space, stitches per minute, threading systems, and computerized interfaces are essential features that distinguish industrial sewing machines from their domestic counterparts. In the automotive industry, industrial sewing machines are utilized to produce a wide range of textile components, including seat belts, airbags, and upholstery. With the increasing trend towards electric vehicles, the demand for industrial sewing machines is projected to increase, as these vehicles require specialized sewing techniques and materials, such as thermoplastic materials and filters, for their production.

Furthermore, the growth of the market is driven by several factors, including the expanding automotive industry in emerging economies and the increasing demand for modern technology in traditional craftsmanship. The market is expected to witness significant development in the coming years, as industrial frameworks continue to evolve and industrialization progresses. Sewing machines are used to create various stitches, such as straight stitch, lockstitch, chain stitch, and zigzag stitch, which are essential for the production of garments, furniture, and automotive interiors. Companies like Miller Weldmaster and Digitran are leading innovators in the market, offering advanced technology and high-performance solutions to meet the demands of various industries.

In conclusion, industrial sewing machines are a vital component of the production process in industries such as automotive, furniture, and garments. With the increasing demand for electric vehicles and the expansion of the automotive industry in emerging economies, the market for industrial sewing machines is poised for significant growth in the coming years.

Market Trends

Rise in online sales of garments is the upcoming trend in the market. The market has experienced significant growth due to the increasing demand for sewn goods in various industries, including garments, furniture, and automotive interiors. Industrial sewing machines are designed to handle heavy-duty tasks and can process a wide range of materials, such as metal, plastic, and various fabrics. These machines offer high stitches per minute (SPM) rates and advanced threading systems, ensuring efficient and consistent production. Moreover, technological advancements have led to the development of computerized interfaces, enabling easier operation and increased precision. Throat space, the distance between the needle and the machine's front edge, is an essential factor in determining the machine's productivity.

Furthermore, industrial sewing machines come in various types, including straight stitch, lockstitch, chain stitch, and zigzag stitch, catering to diverse sewing techniques. Major manufacturers, such as Miller Weldmaster, produce industrial sewing machines that can process thermoplastic materials, using filters to maintain optimal sewing conditions. The sign and SEG (Soft Edge Graphics) industry also relies on industrial sewing machines to produce high-quality products. Modern technology has merged with traditional craftsmanship, leading to the production of superior sewn goods. The automotive interior industry and tent manufacturing industry are significant consumers of industrial sewing machines, contributing to the market's development and industrialization.

Market Challenge

High price of industrial sewing machines is a key challenge affecting the market growth. Industrial sewing machines are essential tools for producing sewn goods on a large scale, particularly for heavy-duty tasks involving thick materials such as leather, thermoplastic materials, and fabrics. These machines are engineered to deliver superior performance and durability, using metal components instead of plastic for added strength and reliability. High-performance motors enable these machines to handle a broader range of sewing techniques and materials, including straight stitch, lockstitch, chain stitch, and zigzag stitch. The throat space of industrial sewing machines is larger than that of traditional sewing machines, allowing for the production of larger items like garments, furniture, cars, and signs and SEGs.

Moreover, needles used in industrial sewing machines are also larger and stronger to accommodate thicker materials. Advancements in technology have led to the development of computerized interfaces, enabling users to program stitch patterns and threading systems with ease. Newer models offer features such as wireless fidelity (Wi-Fi) capabilities, allowing users to download fonts and patterns and quickly connect to the Internet. These features add to the cost of high-end industrial sewing machines, which can range from hundreds to thousands of dollars. The automotive interiors industry and tent manufacturing industry are significant consumers of industrial sewing machines, with a constant need for high-quality, durable stitching. The industrial framework of sewing has undergone significant industrialization, with a focus on modern technology and development to meet the demands of various industries. Traditional craftsmanship continues to play a role, but the integration of technology has revolutionized the way sewn goods are produced.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AMF Reece CR, s.r.o. - The company offers industrial sewing machines such as eyelet buttonhole machines, chain stitch machines, hand stitching machines, pocket welting machines, seriging and side seamer units.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BERNINA International AG

- Brother Industries Ltd.

- Feiyue Group Co. Ltd.

- Husqvarna AB

- Jack Sewing Machine Co. Ltd.

- Janome Corp.

- Juki Corp.

- Merrow Sewing Machine Co.

- Mitsubishi Electric Corp.

- Rimoldi and CF S.r.l.

- Seiko Sewing Machine Co., Ltd.

- Shang Gong Group Co. Ltd.

- SVP Singer Holdings Inc.

- Tacony Corp.

- Usha International Ltd.

- Yamato Sewing Machine Mfg Co. Ltd.

- Zoje Sewing Machine Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial sewing machines are essential tools for heavy-duty tasks in various industries, including garments, furniture, cars, and signage. These machines are designed to handle different materials such as metal, plastic, and thermoplastic materials, ensuring the production of high-quality sewn goods. The throat space, stitches per minute, and threading systems of industrial sewing machines are crucial factors that determine their efficiency and productivity. Needles and thread are the fundamental components of sewing machines. Industrial sewing machines use thicker needles and stronger threads to handle heavy materials. Sewing techniques like straight stitch, lockstitch, chain stitch, and zigzag stitch are commonly used in industrial sewing.

Traditional craftsmanship and industrialization have come together in the development of industrial sewing machines, creating an industrial framework that caters to the automotive interiors industry, tent manufacturing industry, and other sectors. Filters are essential components of industrial sewing machines, ensuring the smooth flow of thread and preventing thread breakage. The use of advanced technology, such as Digitran, enhances the performance of industrial sewing machines, making them an indispensable tool for the production of sewn goods in various industries.

Moreover, fabric, an essential raw material in sewing, plays a significant role in the choice of sewing machines and sewing techniques. Industrial sewing machines are designed to handle different fabrics, including heavy-duty materials, ensuring the production of high-quality sewn goods for various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.96% |

|

Market growth 2024-2028 |

USD 1.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.27 |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, China, Japan, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AMF Reece CR, s.r.o., BERNINA International AG, Brother Industries Ltd., Feiyue Group Co. Ltd., Husqvarna AB, Jack Sewing Machine Co. Ltd., Janome Corp., Juki Corp., Merrow Sewing Machine Co., Mitsubishi Electric Corp., Rimoldi and CF S.r.l., Seiko Sewing Machine Co., Ltd., Shang Gong Group Co. Ltd., SVP Singer Holdings Inc., Tacony Corp., Usha International Ltd., Yamato Sewing Machine Mfg Co. Ltd., and Zoje Sewing Machine Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch