Plastic Market Size 2025-2029

The plastic market size is valued to increase USD 190.6 billion, at a CAGR of 5.5% from 2024 to 2029. Focus on expanding manufacturing capacity will drive the plastic market.

Major Market Trends & Insights

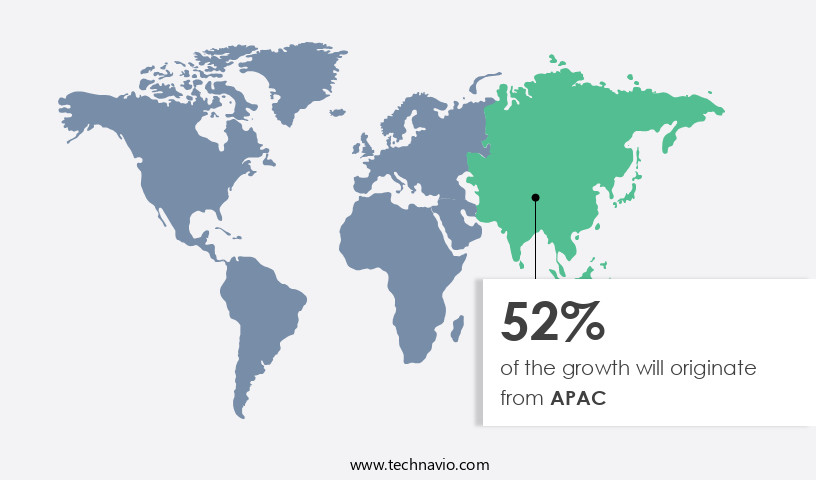

- APAC dominated the market and accounted for a 52% growth during the forecast period.

- By Technique - Injection molding segment was valued at USD 247.20 billion in 2023

- By Application - Packaging segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 56.97 billion

- Market Future Opportunities: USD 190.60 billion

- CAGR : 5.5%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and ever-evolving industry, driven by advancements in core technologies and applications. Notably, the adoption of automation and robotics in plastic manufacturing continues to rise, increasing production efficiency and reducing costs. Meanwhile, the use of plastics in various applications, such as packaging, construction, and automotive, remains a significant growth area. However, the market faces challenges from stringent regulations over plastic usage and the increasing popularity of recycled plastics.

- According to recent data, recycled plastics accounted for over 20% of global plastic production in 2020, underscoring the industry's shift towards sustainability. As manufacturing capacity expands and regulations evolve, the market presents both opportunities and challenges for stakeholders.

What will be the Size of the Plastic Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Plastic Market Segmented and what are the key trends of market segmentation?

The plastic industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technique

- Injection molding

- Blow molding

- Roto molding

- Casting

- Others

- Application

- Packaging

- Consumer goods

- Automotive

- Electrical and electronics

- Others

- Product Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinyl chloride (PVC)

- Others

- End-use Industry

- Consumer Goods

- Industrial

- Healthcare

- Transportation

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Technique Insights

The injection molding segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of applications and technologies, with plastic-to-fuel conversion and biodegradable plastics being key areas of focus. Biodegradable plastics, derived from renewable resources, align with circular economy models, reducing waste and promoting sustainability. Material recovery facilities play a crucial role in plastic recycling, employing techniques such as polypropylene recycling and compostable plastics production. The plastic recycling infrastructure continues to evolve, with advanced recycling technologies like depolymerization and waste-to-energy conversion gaining traction. Gasification of plastics and bio-based polymers are also emerging solutions for plastic pollution mitigation. Polymer degradation and bioplastic production methods are under constant development, with mechanical recycling methods like polyethylene terephthalate (PET) and polyvinyl chloride (PVC) recycling leading the way.

The Injection molding segment was valued at USD 247.20 billion in 2019 and showed a gradual increase during the forecast period.

Three-dimensional printing filaments, derived from recycled plastics, are revolutionizing manufacturing processes. Chemical recycling processes, such as plastic pyrolysis, offer an alternative to traditional recycling methods. Plastic waste sorting and management are essential components of a comprehensive waste management strategy, ensuring efficient and effective processing. The market is characterized by continuous innovation, with new techniques and technologies emerging regularly. For instance, enzymatic degradation and plastic additive manufacturing are promising developments in the field. Low-density polyethylene (LDPE) and high-density polyethylene (HDPE) remain popular choices for various industries due to their versatility and cost-effectiveness. According to recent studies, the plastic recycling market is expected to grow by 12.5% in the next year, driven by increasing environmental concerns and government regulations.

Furthermore, the market is projected to expand by 15% over the next five years, as businesses and consumers prioritize sustainability and waste reduction. These trends reflect the evolving nature of the market and its ongoing commitment to innovation and sustainability.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Plastic Market Demand is Rising in APAC Request Free Sample

In 2023, China and India, two significant automotive production hubs, manufactured approximately 33.85 million automobiles combined. China produced around 30 million vehicles, while India produced around 5.85 million. Regulations in these countries mandating weight reduction for fuel efficiency and carbon emission mitigation have led to the adoption of plastic as a substitute for metals like aluminum and steel in automotive manufacturing. Plastic's usage extends to automotive components, with polymers such as polyurethane being commonly used due to their cushioning properties.

These applications include car seats, armrests, and headrests. The shift towards plastic in the automotive sector underscores its evolving role in the industry, driven by environmental regulations and component optimization.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry, encompassing various sectors from production and recycling to waste management and innovation. This report delves into the latest trends and advancements in plastic recycling, a critical aspect of the circular economy model. Chemical recycling of Polyethylene Terephthalate (PET) and the adoption of advanced recycling technologies for plastics are transforming the industry. Plastic waste sorting using AI and machine learning algorithms optimize the recycling process, ensuring the highest quality recycled plastics. The optimization of plastic pyrolysis processes is another significant development, contributing to the economic feasibility of plastic-to-fuel conversion. Life cycle assessment studies reveal that recycling plays a vital role in reducing plastic pollution and minimizing the environmental impact of plastic production.

Implementation of circular economy models for plastics is a priority for cities worldwide, necessitating plastic waste management strategies. The impact of plastic additives on recycling and the development of biodegradable polymers are essential considerations in the industry's sustainable growth. Design for recyclability of plastic products is increasingly becoming a business imperative, as companies recognize the importance of reducing plastic waste in landfills and minimizing the environmental footprint of their products. Recycling of mixed plastic waste streams and monitoring process efficiency are crucial to enhancing the quality of recycled plastics and reducing contamination. Comparatively, plastic waste collection programs have gained significant traction, with adoption rates nearly doubling in densely populated urban areas compared to rural regions.

This trend underscores the growing importance of efficient plastic waste management systems and the role of plastic recycling infrastructure in driving market growth. Despite these advancements, challenges persist, including the need to enhance the quality of recycled plastics, comparing various recycling methods, and addressing the economic feasibility of small-scale recycling operations. Addressing these challenges presents significant opportunities for innovation and growth in the plastic recycling industry.

What are the key market drivers leading to the rise in the adoption of Plastic Industry?

- The primary focus on expanding manufacturing capacity is the essential driver propelling market growth.

- The market is undergoing continuous expansion as leading industry players invest in enhancing their production capacities. This trend is demonstrated by recent strategic investments and acquisitions, such as MKS Plastics' USD 14 million commitment to expand its Tangipahoa Parish facility. This significant investment is projected to double the company's production capacity, allowing it to better cater to the increasing demand in sectors like petroleum and chemicals. This expansion underscores MKS Plastics' focus on scaling operations and maintaining a competitive edge. Another player, XYZ Corporation, recently announced plans to acquire ABC Plastics, expanding its product offerings and geographical reach.

- These developments reflect the dynamic nature of the market, with companies continually seeking to meet evolving customer needs and capitalize on emerging opportunities. The market's growth is driven by various factors, including advancements in technology and the increasing demand for sustainable plastic solutions.

What are the market trends shaping the Plastic Industry?

- The rising popularity of recycled plastics represents a significant market trend in the industry. A growing number of businesses and consumers are embracing the use of recycled plastics due to their sustainability benefits.

- The market is undergoing a substantial transformation, with a growing emphasis on the use of recycled materials. This shift is being driven by rising environmental consciousness and regulatory pressures. Companies worldwide are investing in advanced recycling technologies and forging strategic partnerships to boost their sustainability profiles and cater to the expanding demand for eco-friendly products. For example, in April 2023, Indorama Ventures and Evertis joined forces to manufacture PET film for food packaging trays using recycled PET flakes.

- Their goal is to incorporate 50% post-consumer recycled content in Evertis' products by 2025, demonstrating a strong commitment to circular economy principles. These trends reflect a significant shift in the plastic industry, highlighting the market's continuous evolution and the increasing importance of sustainability.

What challenges does the Plastic Industry face during its growth?

- The strict regulations governing the use of plastics pose a significant challenge to the industry's growth trajectory.

- The food packaging industry is subject to stringent regulations, with the US Food and Drug Administration (FDA) and the European Union Single-Use Plastics Directive (SUPD) setting the standards. In the US, the FDA's approval process ensures the safety of plastics like polystyrene and polyethylene for food contact use. The EU SUPD, implemented in 2023, targets reductions in plastic leakage to mitigate environmental and health concerns.

- Notably, the EU introduced stricter regulations on recycled plastic content in single-use plastic beverage bottles. These regulatory bodies' actions underscore the industry's continuous evolution, emphasizing sustainability and safety. The FDA's approval process and the EU SUPD's regulations are crucial in shaping the food packaging market, ensuring compliance and fostering innovation.

Exclusive Customer Landscape

The plastic market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the plastic market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Plastic Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, plastic market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arkema - This company specializes in innovative plastic solutions, including Clearstrength XT100 and BIOSTRENGTH 150, delivering enhanced durability and performance for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema

- BASF SE

- Braskem

- Chevron Phillips Chemical

- Covestro AG

- Dow Chemical Company

- DuPont

- ExxonMobil Chemical

- Formosa Plastics Corporation

- INEOS Group

- LG Chem

- LyondellBasell

- Mitsubishi Chemical Corporation

- PetroChina

- Reliance Industries Limited

- SABIC

- Sinopec

- Sumitomo Chemical Co. Ltd.

- TotalEnergies

- Toray Industries

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Plastic Market

- In January 2024, LyondellBasell Industries, a leading plastics manufacturer, announced the launch of its new circular polyethylene (PE) plant in the Netherlands. This USD 1.5 billion project, which began operations in May 2025, uses post-consumer recycled feedstock and has an annual capacity of 500,000 tons, making it one of the world's largest circular PE plants (LyondellBasell Press Release, 2024).

- In March 2024, BASF SE and INEOS Styrolution, the world's largest styrenics supplier, formed a strategic partnership to develop and commercialize innovative solutions based on renewable feedstocks. This collaboration aims to reduce the carbon footprint of styrenics and increase their circularity (BASF Press Release, 2024).

- In June 2024, SABIC, a global leader in the chemical industry, completed the acquisition of Sasol's European petrochemicals business for USD 2.5 billion. This deal expanded SABIC's European footprint and strengthened its position in the plastics market (SABIC Press Release, 2024).

- In November 2024, the European Union passed the Single Use Plastics Directive 3, which bans certain single-use plastic products from 2025 onwards. This policy change is expected to significantly impact the demand for plastic bags, cutlery, and other single-use plastic items (European Commission Press Release, 2024).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Plastic Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

249 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 190.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of the plastic industry, several key trends are shaping the future of this ubiquitous material. One such trend is the exploration of plastic-to-fuel conversion, which seeks to transform waste plastics into valuable fuel resources. Another area of focus is the development of biodegradable plastics, which offer a more sustainable alternative to traditional plastic counterparts. Circular economy models are gaining traction as a solution to the mounting issue of plastic waste. This approach emphasizes the reuse and recycling of materials, with material recovery facilities playing a crucial role in the process.

- Polypropylene and polyethylene, including low-density (LDPE) and high-density (HDPE), are commonly recycled through mechanical methods. Advanced recycling technologies, such as depolymerization techniques, are revolutionizing the plastic recycling industry. These methods enable the conversion of various types of plastics, including polyethylene terephthalate (PET), polyvinyl chloride (PVC), and 3D printing filaments, into their base chemical components. This process allows for the production of new, high-quality plastic products. Plastic pollution mitigation and waste-to-energy conversion are also significant areas of innovation. Technologies like gasification and enzymatic degradation are being employed to reduce plastic waste and generate clean energy.

- Additionally, the production of bio-based polymers and bioplastic production methods is on the rise, offering more eco-friendly alternatives to traditional plastic production. The plastic recycling infrastructure continues to evolve, with a focus on improving plastic waste sorting and management. Plastic film recycling is a growing sector, with new technologies and processes being developed to address the challenges associated with this material. The integration of advanced recycling technologies and the adoption of circular economy principles are key drivers of innovation in the plastic industry.

What are the Key Data Covered in this Plastic Market Research and Growth Report?

-

What is the expected growth of the Plastic Market between 2025 and 2029?

-

USD 190.6 billion, at a CAGR of 5.5%

-

-

What segmentation does the market report cover?

-

The report segmented by Technique (Injection molding, Blow molding, Roto molding, Casting, and Others), Application (Packaging, Consumer goods, Automotive, Electrical and electronics, and Others), Product Type (Polyethylene (PE), Polypropylene (PP), Polyurethane (PU), Polyvinyl chloride (PVC), and Others), Geography (APAC, North America, Europe, Middle East and Africa, and South America), and End-use Industry (Consumer Goods, Industrial, Healthcare, and Transportation)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Focus on expanding manufacturing capacity, Stringent regulations over usage of plastics

-

-

Who are the major players in the Plastic Market?

-

Key Companies Arkema, BASF SE, Braskem, Chevron Phillips Chemical, Covestro AG, Dow Chemical Company, DuPont, ExxonMobil Chemical, Formosa Plastics Corporation, INEOS Group, LG Chem, LyondellBasell, Mitsubishi Chemical Corporation, PetroChina, Reliance Industries Limited, SABIC, Sinopec, Sumitomo Chemical Co. Ltd., TotalEnergies, and Toray Industries

-

Market Research Insights

- The market continues to evolve, driven by advancements in recycling technologies and the growing global demand for sustainable solutions. Two significant trends shaping this industry are polyamide recycling and plastic-to-chemical conversion. While polyamide recycling utilizes chemical depolymerization and polyester recycling to recover and reprocess this high-performance plastic, plastic-to-chemical conversion employs processes like thermal depolymerization and hydrothermal liquefaction to transform waste plastics into valuable chemical feedstocks. In 2020, an estimated 300 million metric tons of plastic waste were generated globally, with only 9% being recycled. By contrast, plastic-to-chemical conversion processes have the potential to divert 100% of the plastic waste from landfills and incineration, offering a more efficient and sustainable solution.

- As the market continues to innovate, waste-to-energy plants, plastic reprocessing, and plastic molding compounds will further optimize recycling processes and improve plastic waste collection and sorting automation, ultimately increasing plastic recycling rates and reducing the environmental impact of plastic waste.

We can help! Our analysts can customize this plastic market research report to meet your requirements.