Influenza Diagnostics Market Size 2024-2028

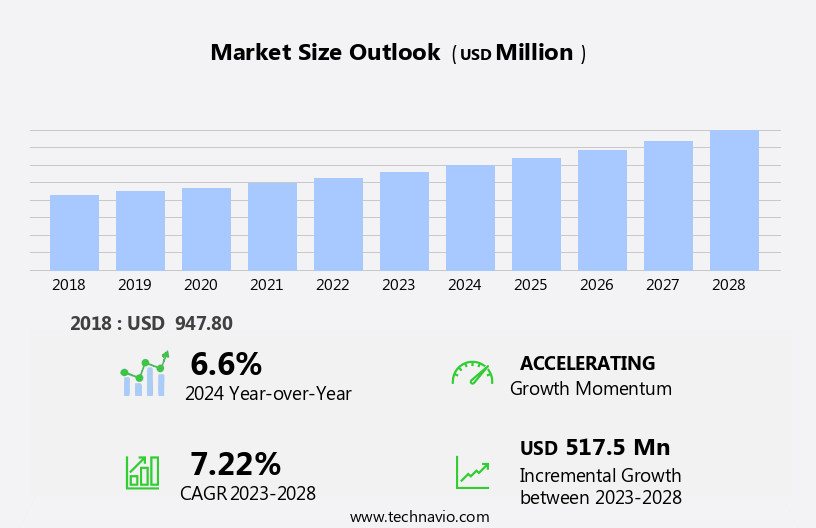

The influenza diagnostics market size is forecast to increase by USD 517.5 million at a CAGR of 7.22% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rising incidence of influenza and increasing approvals for innovative diagnostic products. According to various health organizations, influenza affects millions annually, leading to increased demand for accurate and timely diagnostic solutions. This trend is further accentuated by the ongoing COVID-19 pandemic, which has highlighted the importance of rapid and reliable diagnostic tests in controlling the spread of infectious diseases. However, market expansion is not without challenges. A significant barrier lies in the lack of adequate laboratory infrastructure, particularly in developing regions. This issue hampers the widespread adoption of advanced diagnostic technologies and creates opportunities for companies to address this unmet need by investing in affordable, portable, and easy-to-use diagnostic solutions.

- Furthermore, ongoing research and development efforts in areas such as molecular diagnostics and point-of-care testing are expected to fuel market growth, providing ample opportunities for companies to capitalize on these advancements and cater to the evolving diagnostic needs of healthcare providers and patients.

What will be the Size of the Influenza Diagnostics Market during the forecast period?

- The market encompasses a range of diagnostic technologies utilized by hospitals and clinics, healthcare providers, diagnostic laboratories, research industries, and healthcare professionals to identify and confirm influenza infections. With the potential for severe illness and respiratory deaths associated with influenza, the demand for accurate and efficient diagnostic tools remains high. The market is driven by advancements in molecular diagnostics, such as polymerase chain reaction (PCR) and nucleic acid sequence-based amplification (NASBA), and rapid diagnostic tests, including rapid antigen tests and serology tests. Sensitivity and specificity are critical factors in the selection of diagnostic tests, with a focus on minimizing false-negative and false-positive results.

- Regulatory frameworks, such as those established by the World Health Organization, play a crucial role in ensuring the safety and efficacy of diagnostic tests. Product segmentation includes viral culture tests, molecular diagnostics, and rapid diagnostic tests. The market is expected to continue growing due to the ongoing need for effective influenza diagnosis and treatment.

How is this Influenza Diagnostics Industry segmented?

The influenza diagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals and diagnostic laboratories

- Academic and research centers

- Homecare

- Type

- Point-of-care testing

- Immunodiagnostics

- Molecular diagnostics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

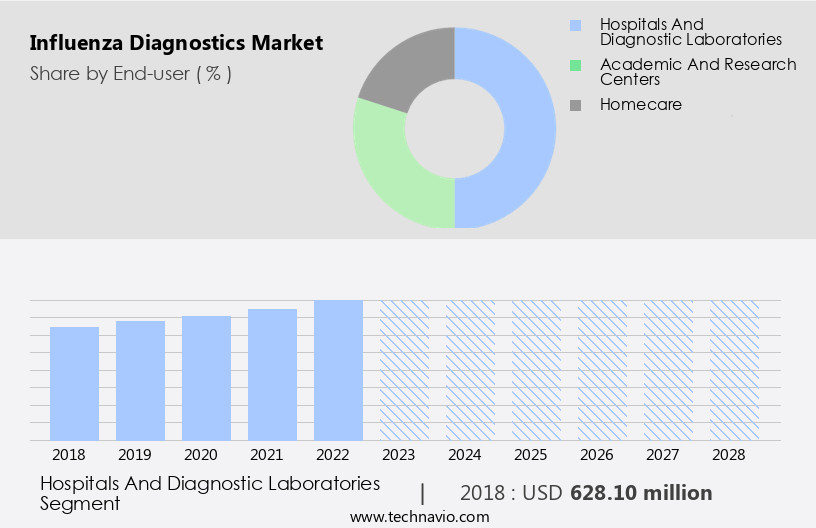

The hospitals and diagnostic laboratories segment is estimated to witness significant growth during the forecast period.

The World Health Organization (WHO) highlights the importance of accurate and timely influenza diagnostics in the medical sector. Influenza diagnostics refer to the tests and procedures used to identify influenza viruses, with hospitals and diagnostic laboratories being a significant segment. These institutions handle a substantial number of influenza cases, necessitating efficient and precise diagnostic tools to determine the infection and appropriate treatment interventions. Hospitals and diagnostic laboratories prioritize prompt diagnosis and effective management of influenza cases to mitigate the disease burden, which includes severe illness and respiratory deaths. Influenza diagnostic tests come in various types, including antigen tests, multiplex assays, molecular diagnostic tests, viral culture tests, serology tests, and rapid diagnostic tests.

Each test type offers unique advantages in terms of sensitivity and specificity, medical procedures, and time to result. For instance, rapid antigen tests are ideal for point-of-care settings due to their quick turnaround time, while molecular diagnostic assays provide higher sensitivity and specificity. Healthcare providers, including hospitals, clinics, primary care offices, urgent care centers, and diagnostic laboratories, rely on these diagnostic tools to ensure accurate and timely influenza diagnoses. False-negative and false-positive results can impact patient care and public health measures, making it crucial to choose the right diagnostic tool for each application. In The market, various diagnostic instruments and techniques are employed, including molecular diagnostics, viral culture, serological assays, and respiratory pathogens detection.

These diagnostic tools contribute to the overall healthcare infrastructure by enabling healthcare professionals to make informed decisions regarding patient care and treatment.

Get a glance at the market report of share of various segments Request Free Sample

The Hospitals and diagnostic laboratories segment was valued at USD 628.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

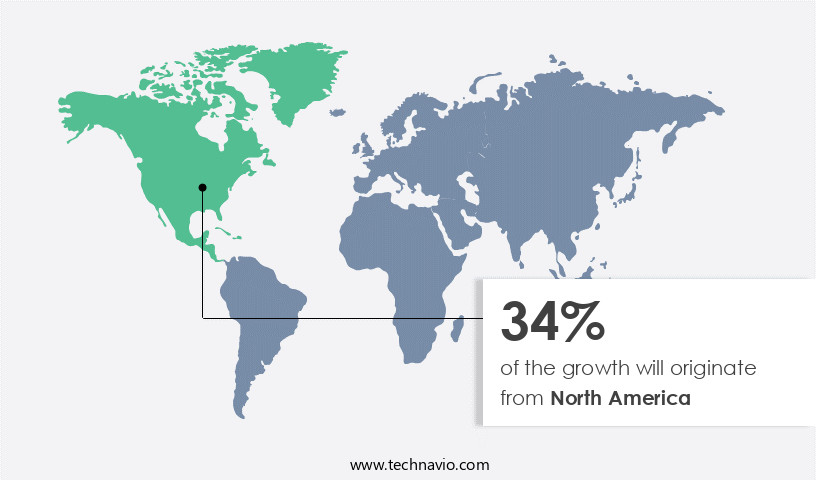

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The World Health Organization (WHO) highlights the importance of accurate and timely influenza diagnostics to guide treatment decisions, inform public health measures, and reduce the burden of severe illness and respiratory deaths. The market encompasses various diagnostic technologies, including antigen tests, molecular diagnostic tests, viral culture tests, serology tests, and rapid diagnostic tests. Healthcare providers in hospitals and clinics, research laboratories, and primary care offices utilize these diagnostic tools to identify influenza infections. The prevalence of influenza and the need for early intervention make sensitivity and specificity crucial factors in choosing diagnostic tests. Traditional diagnostic tests, such as viral culture and serological assays, offer high sensitivity but require medical procedures and extended turnaround times.

In contrast, rapid antigen tests and molecular diagnostic assays provide quick results, making them suitable for point-of-care settings. However, false-negative and false-positive results can impact the accuracy of these tests. The medical sector relies on diagnostic laboratories to process influenza samples using various techniques, such as molecular diagnostics and serology. Instruments used in molecular diagnostics, like polymerase chain reaction (PCR), are essential for identifying influenza viruses and monitoring their genetic changes. The research industries also contribute to the development and validation of new diagnostic tools and techniques. In , influenza diagnostics play a vital role in the early identification and management of influenza infections.

The market for these diagnostics is driven by the disease burden, the need for accurate and timely results, and the availability of advanced diagnostic technologies. The regulatory framework ensures the safety and efficacy of these diagnostic tools, contributing to their widespread adoption in healthcare settings.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Influenza Diagnostics Industry?

- Rising incidence of influenza is the key driver of the market.

- Influenza, a common viral infection, affects a substantial portion of the global population annually. The increasing incidence of influenza cases necessitates early detection and appropriate management, driving the growth of the market. According to the Centers for Disease Control and Prevention (CDC), during the 2023-2024 season in the US, there were approximately 360,000 to 750,000 hospitalizations due to influenza. Seasonal outbreaks of influenza, which typically occur during colder months, result in a sudden increase in cases, leading to a heightened demand for diagnostic testing to identify and monitor the virus's spread.

- The market for influenza diagnostics continues to expand to meet these testing requirements.

What are the market trends shaping the Influenza Diagnostics Industry?

- Rising approvals for influenza diagnostic products is the upcoming market trend.

- The market is witnessing significant growth due to the increasing focus of prominent companies on developing and upgrading diagnostic products to meet regulatory compliance requirements. Regulatory bodies such as the US Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the China Food and Drug Administration (CFDA) have led to an increasing number of product approvals for influenza diagnosis. companies are primarily concentrating on creating rapid diagnosis solutions to cater to the growing demand for quick results.

- As of 2023, there has been a notable in US FDA clearances for nucleic acid detection technique-based products, which are commercially available in The market. This trend is expected to continue, driving market growth in the coming years.

What challenges does the Influenza Diagnostics Industry face during its growth?

- Lack of laboratory infrastructure in developing regions is a key challenge affecting the industry growth.

- Influenza diagnostics face challenges in developing countries due to limited access to well-equipped laboratories. This hinders timely and accurate diagnosis of influenza cases. Insufficient infrastructure, a shortage of trained personnel, and limited availability of diagnostic tools and reagents are contributing factors. The absence of adequate laboratory resources and equipment, including specialized instruments and technologies, hampers the ability to conduct a high volume of tests.

- Consequently, testing capacity may be significantly lower than demand, leading to delays in diagnosis and treatment. Developing countries require investments in laboratory infrastructure and human resources to address these challenges and improve influenza diagnostics.

Exclusive Customer Landscape

The influenza diagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the influenza diagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, influenza diagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in the development and distribution of innovative sports products, catering to a global market. Our offerings encompass a diverse range of equipment and apparel designed to enhance athletic performance and promote an active lifestyle. Through rigorous research and development, we continually push the boundaries of sports technology to deliver cutting-edge solutions for athletes at all levels. Our commitment to quality and customer satisfaction sets us apart in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Becton Dickinson and Co.

- BICO Group AB

- Bio Rad Laboratories Inc.

- Biocartis NV

- bioMerieux SA

- Danaher Corp.

- DiaSorin SpA

- F. Hoffmann La Roche Ltd.

- Hologic Inc.

- Princeton BioMeditech Corp.

- QIAGEN NV

- Quidelortho Corp.

- Response Biomedical Corp.

- SA Scientific Ltd.

- Sd Biosensor Inc.

- Sekisui Chemical Co. Ltd.

- Siemens Healthineers AG

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Influenza, a highly contagious viral infection, continues to pose a significant challenge to healthcare systems worldwide. The timely and accurate diagnosis of influenza is crucial for effective intervention and treatment, reducing the disease burden and preventing the spread of infection. Diagnostic technologies play a vital role in identifying influenza viruses, enabling healthcare providers to make informed decisions and implement appropriate public health measures. The regulatory framework governing diagnostic tests for influenza is stringent, ensuring the accuracy, safety, and efficacy of these tools. Traditional diagnostic tests, such as viral culture and serology, have been the mainstay of influenza diagnosis for decades.

However, advancements in diagnostic technologies have led to the emergence of new test types, including antigen tests, multiplex assays, and molecular diagnostic tests. Healthcare providers in various settings, including hospitals and clinics, research laboratories, and primary care offices, rely on these diagnostic tools to identify influenza infections. The severity of illness and the need for rapid results often dictate the choice of diagnostic test. Severe cases may require more invasive and time-consuming tests, such as viral culture, while rapid antigen tests and molecular diagnostic assays are preferred in point-of-care settings. Influenza viruses are constantly evolving, necessitating the development of new diagnostic tests and the updating of existing ones.

The sensitivity and specificity of these tests are essential factors in ensuring accurate diagnosis. False-negative results can lead to delayed treatment and potential complications, while false-positive results can result in unnecessary treatment and increased healthcare costs. The medical sector has witnessed a in the adoption of diagnostic tools for influenza and other respiratory pathogens. The prevalence of influenza and the associated respiratory deaths underscore the importance of early and accurate diagnosis. Hospitals, clinics, urgent care centers, and diagnostic laboratories have integrated these tools into their healthcare infrastructure to improve patient care and outcomes. Healthcare professionals in various settings use these diagnostic tools to make informed decisions regarding treatment and infection control.

The choice of diagnostic test depends on various factors, including the availability of resources, the severity of illness, and the need for rapid results. The use of these diagnostic tools has led to improved patient care, reduced healthcare costs, and more effective public health interventions. The research industries continue to invest in the development of new diagnostic technologies for influenza and other respiratory pathogens. These advancements are expected to improve the accuracy, speed, and accessibility of diagnostic tests, enabling earlier intervention and better patient outcomes. The ongoing research into diagnostic tools for influenza and other respiratory pathogens is crucial for addressing the disease burden and improving healthcare infrastructure.

In , diagnostic technologies play a crucial role in the diagnosis and management of influenza infections. The regulatory framework ensures the accuracy, safety, and efficacy of these tools, enabling healthcare providers to make informed decisions and implement appropriate interventions. The ongoing advancements in diagnostic technologies are expected to improve patient care, reduce healthcare costs, and enhance public health measures.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.22% |

|

Market growth 2024-2028 |

USD 517.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.6 |

|

Key countries |

US, China, Germany, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Influenza Diagnostics Market Research and Growth Report?

- CAGR of the Influenza Diagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the influenza diagnostics market growth of industry companies

We can help! Our analysts can customize this influenza diagnostics market research report to meet your requirements.