Influenza Vaccine Market Size 2024-2028

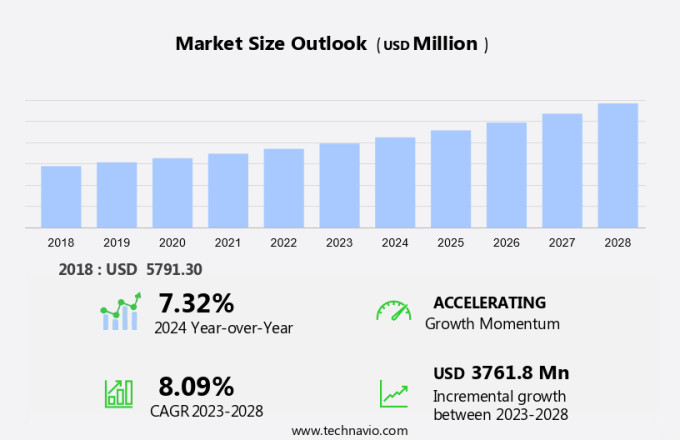

The influenza vaccine market size is forecast to increase by USD 3.76 billion at a CAGR of 8.09% between 2023 and 2028. The market is experiencing significant growth due to the increasing prevalence and incidence of severe influenza cases, particularly among children. The Global Influenza Program's emphasis on vaccination as a preventative measure is driving market expansion. Combination vaccines, which offer protection against multiple strains of the virus, are gaining popularity due to their convenience and effectiveness. Furthermore, the development of mRNA vaccines, which utilize advanced technology to produce a more potent immune response, is a promising trend in the market. The market for Influenza vaccines encompasses various types, including inactivated vaccines, live attenuated vaccines, quadrivalent vaccines, mono vaccine, trivalent vaccines, pnemucoccol vaccine, pediatric vaccines, and adult vaccines. Despite these advancements, challenges persist, including the difficulty in diagnosing influenza due to its non-specific symptoms and the need for annual revaccination to maintain immunity. Overall, the market is poised for continued growth as the demand for effective vaccines to prevent the spread of influenza remains high.

Market Analysis

The market is a significant sector within the global healthcare industry, with a continuous demand due to the seasonal nature of the influenza virus and the ongoing threat of potential pandemics. This market caters to various demographics, including children and adults, through various vaccine types and administration methods. Seasonal influenza vaccines are the primary focus of the market, with two main types: inactivated vaccines and live attenuated vaccines. Inactivated vaccines, also known as flu shots, use killed viruses to stimulate an immune response, while live attenuated vaccines, or nasal sprays, use weakened live viruses.

Furthermore, both types offer protection against the three or four strains of the virus predicted to cause the most significant impact during a season. Quadrivalent vaccines, a more recent addition to the market, protect against an additional B strain, broadening the scope of coverage and potentially reducing the risk of infection. Trivalent vaccines, which protect against three strains, continue to be available and are often used in mass vaccination programs. The pediatric segment of the market is of significant importance due to the vulnerability of children to severe influenza cases. The global influenza program, a collaborative effort between the World Health Organization (WHO) and various national health organizations, plays a crucial role in ensuring the availability of vaccines for children and other at-risk populations.

In addition, combination vaccines, which offer protection against influenza and other diseases, are gaining popularity in the market due to their convenience and potential for reducing the number of vaccinations required. MRNA vaccines, a newer technology, have shown promising results in clinical trials and may become a significant player in the market in the coming years. The market is influenced by several factors, including the severity of seasonal epidemics, the availability and affordability of vaccines, and the public's perception of vaccine efficacy and safety. Hospital and retail pharmacies serve as essential distribution channels for these vaccines, ensuring they reach the end consumer in a timely and convenient manner.

Furthermore, swine flu vaccines, while not a regular component of the seasonal the market, are produced and distributed in response to outbreaks or pandemics. The production and distribution of these vaccines require a rapid response and significant resources, highlighting the importance of a strong global influenza program and the flexibility of vaccine manufacturers. In conclusion, the market is a dynamic and evolving sector within the healthcare industry. With ongoing research and development, the market continues to offer new solutions to protect against the influenza virus, ensuring public health and safety.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Hospitals and pharmacies

- Government and institutional

- Others

- Type

- Live attenuated influenza vaccines

- Recombinant influenza vaccines

- Geography

- North America

- Canada

- US

- Europe

- UK

- Asia

- China

- India

- Rest of World (ROW)

- North America

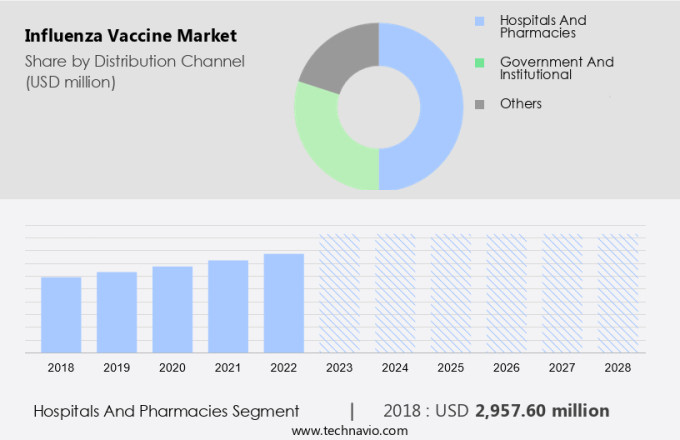

By Distribution Channel Insights

The hospitals and pharmacies segment is estimated to witness significant growth during the forecast period.The market in the US is categorized by distribution channels into hospitals and retail pharmacies. Hospitals serve a significant function in the distribution process, as they administer vaccines primarily to high-risk populations, including the elderly and those with pre-existing health conditions. Hospitals may procure vaccines directly from manufacturers and distribute them to other healthcare facilities and pharmacies. Retail pharmacies also contribute significantly to the distribution of influenza vaccines. They offer ease of access to the general public, enabling more individuals to get vaccinated conveniently. Pharmacies can acquire vaccines either from manufacturers or distributors, administering them on-site or supplying them to healthcare providers. The market in the US is a crucial sector, with Swine flu vaccine and regular flu vaccines, such as the flu shot, being essential offerings.

Get a glance at the market share of various segments Request Free Sample

The hospitals and pharmacies segment accounted for USD 2.96 billion in 2018 and showed a gradual increase during the forecast period.

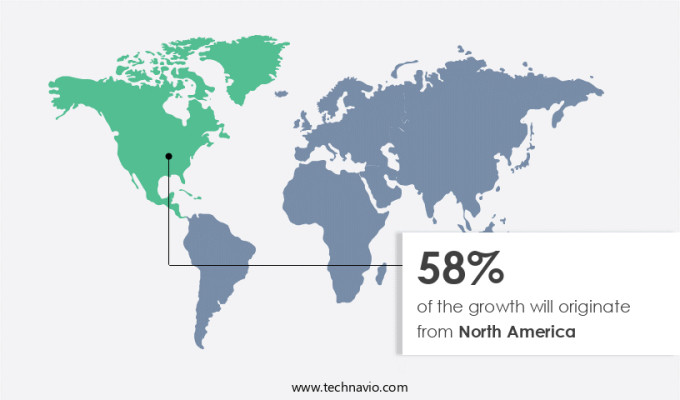

Regional Insights

North America is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Influenza viruses cause regional epidemics resulting in numerous deaths and flu cases annually. In North America, the market is expected to maintain its dominance due to the presence of organizations like the Centers for Disease Control and Prevention (CDC) and the Pan American Health Organization (PAHO), which advocate for vaccination schedules. Major influenza vaccines in the region include BOOSTRIX, INFANRIX, Pediarix, BEXSERO, MENVEO, and influenza. The incidence of various infectious diseases, including influenza, has been on the rise in developed nations of North America.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing prevalence and incidence of influenza is the key driver of the market. The Influenza virus continues to pose a significant health concern, with regional epidemics resulting in substantial deaths and flu cases in the US and globally. According to the CDC, an estimated 34 to 65 million people contracted influenza in the US during 2023, leading to hospitalizations ranging from 390,000 to 820,000 cases. The increasing prevalence and incidence of severe influenza cases, particularly among children, have fueled the demand for effective vaccines.

Moreover, seasonal influenza vaccines, available in various forms such as inactivated, live attenuated, quadrivalent, trivalent, pediatric, and adult vaccines, are readily accessible at hospitals and retail pharmacies. The market for influenza vaccines is witnessing growth due to the availability of these diverse vaccine strains and types. In addition, combination vaccines, mRNA vaccines, and Swine flu vaccines are also gaining popularity.

Market Trends

Need for revaccination is the upcoming trend in the market. Influenza, caused by the Influenza virus, poses a significant health risk, leading to hospitalizations and deaths, particularly among children and adults with underlying health conditions. To mitigate the impact of seasonal influenza epidemics, annual vaccination is essential. These vaccines are available at hospital & retail pharmacies and can be administered as flu shots or nasal spray vaccines. The vaccine strains are updated annually to align with the circulating virus, ensuring optimal immune response. The availability of combination vaccines, mRNA vaccines, and Swine flu vaccines further expands the market.

Furthermore, severe influenza cases necessitate vaccination, as the immune response declines over time, and the virus evolves, necessitating annual vaccination. The Global Influenza Program and various research organizations continually monitor influenza virus developments to ensure the vaccine strains remain effective.

Market Challenge

Difficulty in diagnosis is a key challenge affecting the market growth. The market encounters complexities in diagnosing influenza due to its similarities with other respiratory infections. Influenza, like the common cold or respiratory syncytial virus (RSV), can present with symptoms such as fever, cough, sore throat, and fatigue. This overlap makes it challenging to distinguish influenza from other conditions based on clinical symptoms alone. The importance of accurate diagnosis lies in effective prevention and treatment, as well as determining the appropriate vaccine strain. Seasonal influenza vaccines, including inactivated, live attenuated, quadrivalent, trivalent, pediatric, adult, and combination vaccines, are available through hospitals and retail pharmacies. Vaccine strains are updated annually to account for the evolving influenza virus.

In addition, the availability of various vaccine types caters to diverse populations, from children to adults. MRNA vaccines, Swine flu vaccine, and flu shots, including nasal spray vaccines, are among the offerings in the market. Ensuring an adequate immune response is essential to combat severe influenza cases and reduce deaths.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Altimmune Inc. - The company offers influenza vaccines such as NasoVax

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AstraZeneca Plc

- Baxter International Inc.

- BioDiem Ltd.

- BiondVax Pharmaceuticals Ltd.

- CSL Ltd.

- Emergent BioSolutions Inc.

- F. Hoffmann La Roche Ltd.

- FluGen Inc.

- GlaxoSmithKline Plc

- Mitsubishi Chemical Group Corp.

- Novavax Inc.

- Otsuka Holdings Co. Ltd.

- Pfizer Inc.

- Sanofi SA

- Shijiazhuang Yiling Pharmaceutical Co Ltd.

- SK Chemicals Co. Ltd.

- Vaccitech Plc

- Vaxart Inc.

- Vaxine Pty Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Influenza, caused by the influenza virus, can lead to regional epidemics and tragic deaths each year. Flu cases vary, but the virus's unpredictability makes annual vaccines essential. Two main types of influenza vaccines exist: inactivated and live attenuated. Inactivated vaccines contain dead viruses, while live attenuated vaccines have weakened live viruses. Quadrivalent and trivalent vaccines protect against different strains. Pediatric and adult vaccines are available at hospitals and retail pharmacies. Severe influenza cases, particularly among children, can lead to complications and hospitalization. The global influenza program continually updates vaccine strains to combat new threats, including combination vaccines and mRNA vaccines.

Furthermore, vaccines stimulate the immune response, reducing the risk of infection and severe cases. The availability of vaccines varies, so check with your healthcare provider for the latest information. Protect yourself and your family against influenza â get vaccinated today.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 3.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 58% |

|

Key countries |

US, UK, China, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Altimmune Inc., AstraZeneca Plc, Baxter International Inc., BioDiem Ltd., BiondVax Pharmaceuticals Ltd., CSL Ltd., Emergent BioSolutions Inc., F. Hoffmann La Roche Ltd., FluGen Inc., GlaxoSmithKline Plc, Mitsubishi Chemical Group Corp., Novavax Inc., Otsuka Holdings Co. Ltd., Pfizer Inc., Sanofi SA, Shijiazhuang Yiling Pharmaceutical Co Ltd., SK Chemicals Co. Ltd., Vaccitech Plc, Vaxart Inc., and Vaxine Pty Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch