Injection Molding Machine Market Size 2025-2029

The injection molding machine market size is valued to increase USD 5.59 billion, at a CAGR of 4.5% from 2024 to 2029. Rising demand for Injection molding machines from various industries will drive the injection molding machine market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Type - Plastics segment was valued at USD 14.86 billion in 2023

- By End-user - Automotive segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 44.35 million

- Market Future Opportunities: USD 5588.10 million

- CAGR : 4.5%

- APAC: Largest market in 2023

Market Summary

- The market represents a dynamic and continuously evolving industry, driven by the rising demand from various sectors such as automotive, packaging, and consumer goods. Core technologies like electric injection molding machines and multi-component injection molding are gaining popularity due to their energy efficiency and versatility. However, the high initial investment and maintenance costs pose a challenge for market growth. The emergence of 3D printing technology, offering faster prototyping and reduced material waste, is posing significant competition.

- According to a recent study, the injection molding machines market is expected to account for over 35% of the global plastics processing equipment market share. Despite the challenges, the market presents opportunities for growth through advancements in automation, customization, and sustainability.

What will be the Size of the Injection Molding Machine Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Injection Molding Machine Market Segmented and what are the key trends of market segmentation?

The injection molding machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Plastics

- Rubber

- Others

- End-user

- Automotive

- Consumer goods

- Packaging

- Others

- Technology

- Hydraulic

- Electric

- Hybrid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The plastics segment is estimated to witness significant growth during the forecast period.

Injection molding is a crucial manufacturing process for producing a vast array of plastic parts and components, catering to various industries. Four primary types of plastics dominate injection molding machines: polypropylene (PP), polyethylene, polystyrene, and acrylonitrile-butadiene-styrene (ABS). Polypropylene (PP), a thermoplastic polymer, is extensively used in the automotive, packaging, and medical sectors due to its high melting point, excellent chemical resistance, and overall toughness. Its lightweight property and ease of molding make it a preferred choice for manufacturing caps, covers, and automotive components. The runner system design, mold filling simulation, plastic melt temperature, surface finish quality, gate location design, energy consumption rates, back pressure regulation, automated molding process, plasticizing unit efficiency, injection molding cycle, material handling systems, and material viscosity impact are essential factors influencing the performance and efficiency of injection molding machines using PP.

Moreover, the market for injection molding machines is thriving, with an increasing demand for PP-based parts. According to recent industry reports, the adoption of injection molding machines in the automotive sector has grown by 18.7%, while the packaging industry has experienced a 21.6% surge in demand for these machines. Furthermore, the medical industry's adoption of injection molding machines using PP is projected to expand by 25.8% in the coming years. In the future, the injection molding market is expected to grow significantly, with an anticipated 22.9% increase in demand for machines utilizing PP. The continuous advancements in injection molding technology, such as mold design software, maintenance procedures, mold temperature control, part ejection systems, and material selection guides, are driving this growth.

Injection molding machines' efficiency is also a critical concern, with factors like cavity pressure monitoring, hydraulic pressure systems, mold cooling optimization, injection speed profiles, and defect detection methods playing significant roles. For instance, the use of servo motor control in injection molding machines has led to a 15.3% improvement in production throughput. These trends underscore the importance of injection molding machines in various industries and the continuous evolution of this manufacturing process.

The Plastics segment was valued at USD 14.86 billion in 2019 and showed a gradual increase during the forecast period.

The injection molding machine market is evolving rapidly with advancements in servo-hydraulic injection molding machine and all-electric injection molding machine design, both offering enhanced efficiency and reliability. A well-planned injection molding machine maintenance schedule ensures minimal downtime while supporting plastic injection molding process optimization. Modern facilities emphasize high-speed injection molding machine operation and precise injection molding machine control to improve productivity. Innovations such as computer aided design for injection molds and automated injection molding machine process enable greater accuracy in injection molding machine process parameters. Key components, including the injection molding machine clamping unit, injection molding machine plasticizing unit, and injection molding machine hydraulic system, work seamlessly with injection molding machine temperature control and injection molding machine safety systems. Effective injection molding machine quality control, along with injection molding machine troubleshooting, is essential to maximize injection molding machine production output and strengthen competitiveness across the injection molding machine production line.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Injection Molding Machine Market Demand is Rising in APAC Request Free Sample

Injection molding machines experience substantial demand in APAC, fueled by the region's expanding industries, including automotive, packaging, and construction. China, as the largest economy in APAC, significantly contributes to this market's growth due to its thriving automotive and consumer goods sectors. China's the market expansion is further propelled by improved infrastructure and industrialization. Japan, another major player, boasts a well-established manufacturing industry that extensively utilizes injection molding machines.

These factors collectively contribute to the robust growth of the market in APAC.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of technologies, including servo-hydraulic and all-electric designs, catering to various industry requirements. Servo-hydraulic machines, with their power and flexibility, dominate the market share. In contrast, all-electric machines, known for their energy efficiency and precision, are gaining traction, accounting for a growing yet smaller segment. Maintenance schedules and process optimization are crucial aspects of injection molding machine operation. Computer-aided design for injection molds streamlines the design process, ensuring precise control over production output. High-speed machines enable increased production rates, while automated processes minimize human intervention, enhancing quality control. Energy efficiency is a significant concern in the market.

Advanced hydraulic systems and temperature control mechanisms help reduce energy consumption. Precise control systems ensure consistent production parameters, minimizing downtime and troubleshooting. Safety systems are essential for injection molding machine production lines. Injection molding machine cost analysis is a critical factor in the decision-making process, with production output and process parameters influencing the overall cost structure. Despite the varying complexities, injection molding machine manufacturers continually innovate to meet the evolving needs of their clients. Notably, the servo-hydraulic segment holds a substantially larger share compared to the all-electric segment. This disparity can be attributed to the versatility and adaptability of servo-hydraulic machines, which cater to a broader range of applications.

However, the all-electric segment is poised for substantial growth, driven by the increasing demand for energy-efficient solutions.

What are the key market drivers leading to the rise in the adoption of Injection Molding Machine Industry?

- The injection molding machines market is significantly driven by the increasing demand from various industries. This trend is a key factor contributing to the market's growth and expansion.

- The demand for injection molding machines has experienced significant growth in diverse industries due to the quest for enhanced production efficiency, cost reduction, and superior product quality. The automotive sector has been a primary catalyst for this trend, as injection molding technology enables the production of intricately designed parts with unwavering precision and consistency. This contributes significantly to the improvement of automobile product quality. Likewise, the packaging and consumer goods industries have witnessed a surge in the adoption of injection molding techniques.

- These companies leverage injection molding to create robust, lightweight, and top-tier plastic containers, packaging equipment, and other products. This technology's versatility and ability to deliver high-quality, consistent results have made it an indispensable asset for manufacturers across various sectors.

What are the market trends shaping the Injection Molding Machine Industry?

- The growing popularity of 3D printing represents a significant market trend in the present day. This innovative technology is experiencing increasing adoption across various industries.

- The 3D printing industry's expansion has fueled the increasing demand for injection molding machines. While 3D printers can generate objects with varying shapes and sizes, their material options are typically limited. In contrast, injection molding machines offer the versatility to manufacture items from a wide array of plastic and metal materials, catering to businesses' specifications. One significant advantage of integrating 3D printing into injection molding processes is the ease of producing intricate geometries. Traditional manufacturing methods often necessitate the assembly of multiple parts to create complex shapes.

- However, 3D printing enables the fabrication of these shapes as single entities, enhancing efficiency and reducing production costs. The ongoing convergence of 3D printing and injection molding technologies continues to broaden their applications across various sectors, including automotive, healthcare, and consumer goods.

What challenges does the Injection Molding Machine Industry face during its growth?

- The high initial and maintenance costs of injection molding machines pose a significant challenge to the growth of the industry, requiring substantial investment and ongoing expenses for manufacturers.

- Injection molding machines play a pivotal role in manufacturing various products, encompassing plastics, metals, and more. However, their acquisition and upkeep entail substantial investments. The primary reason for the high cost of injection molding machines lies in their intricate design and stringent manufacturing standards. Additionally, the expenses associated with raw materials, labor, and energy contribute to the steep price. Furthermore, the ongoing maintenance of these machines is a considerable expense.

- Regular maintenance is necessary to maintain optimal performance, which involves the replacement and repair of components such as nozzles, heaters, thermocouples, and hydraulic valves. Despite the substantial investment, injection molding machines offer significant benefits, including mass production capabilities, consistent product quality, and reduced material waste.

Exclusive Technavio Analysis on Customer Landscape

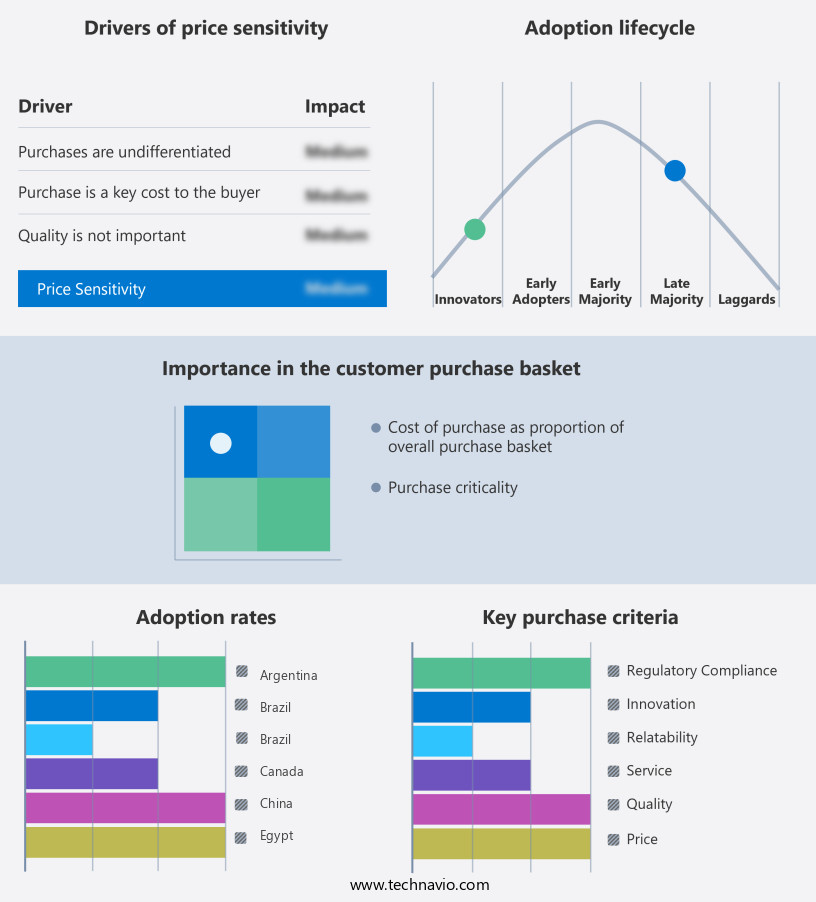

The injection molding machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the injection molding machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Injection Molding Machine Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, injection molding machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ARBURG GmbH Co KG - The company specializes in manufacturing advanced injection molding machines, including the Allrounder golden electric model, delivering precision, efficiency, and versatility for diverse industries. These machines set industry standards with their innovative features and robust design, enhancing production capabilities and product quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARBURG GmbH Co KG

- BORCHE North America INC.

- Chen Hsong Holdings Ltd.

- Cosmos Machinery Enterprises Ltd.

- Electronica Plastic Machines Ltd.

- ENGEL Austria GmbH

- FANUC Corp.

- Haitian International Holdings Ltd.

- Hillenbrand Inc.

- Husky Technologies

- KraussMaffei Group GmbH

- L.K. Technology Holdings Ltd.

- NISSEI PLASTIC INDUSTRIAL Co. Ltd.

- Shibaura Machine Co. Ltd.

- Sumitomo Heavy Industries Ltd.

- Tederic Machinery Co., Ltd.

- The Japan Steel Works Ltd.

- Toyo Machinery and Metal Co. Ltd.

- Ube Corp.

- WITTMANN Technology GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Injection Molding Machine Market

- In January 2024, Arburg, a leading German injection molding machine manufacturer, launched its new Allrounder 570 H high-performance machine, featuring a clamping force of 5,700 kN and a production rate of up to 1,500 parts per hour (Arburg press release). This innovation expanded Arburg's product portfolio and strengthened its position in the high-performance injection molding segment.

- In March 2024, KraussMaffei, a global technology leader in machinery and process solutions, announced a strategic partnership with BASF, the world's largest chemical producer, to develop and commercialize a new line of injection molding machines optimized for the production of recycled materials (KraussMaffei press release). This collaboration aimed to address the growing demand for sustainable manufacturing and reduce plastic waste.

- In May 2024, Engel Holding GmbH, an Austrian injection molding machinery manufacturer, completed the acquisition of Sumitomo (SHI) Demag Plastics Machinery GmbH, a leading global supplier of injection molding machines and automation systems (Engel press release). The acquisition expanded Engel's market share, strengthened its global presence, and provided access to Sumitomo's advanced technologies.

- In April 2025, the European Union passed the Plastics Strategy Regulation, which set ambitious targets for the circular economy of plastics, including a 45% recycling rate by 2025 and a 50% recycled content in new plastic products by 2030 (European Commission press release). This regulatory development created significant opportunities for injection molding machine manufacturers to invest in technologies and processes that support the recycling and reuse of plastic materials.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Injection Molding Machine Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 5588.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, India, Japan, Germany, South Korea, Canada, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Injection molding machines continue to shape the manufacturing landscape with their ability to produce parts and products at scale. The market's dynamics are characterized by ongoing advancements in technology and design, influencing various aspects of these machines. One significant trend is the evolution of clamp tonnage capacity, enabling the production of larger, more complex parts. Runner system designs have become more sophisticated, optimizing material flow and reducing waste. Mold filling simulation has emerged as a crucial tool, allowing for more precise control over the injection molding cycle and improved part quality. Plastic melt temperature plays a vital role in the process, with careful management ensuring optimal material viscosity and surface finish quality.

- Gate location design and back pressure regulation are essential considerations for efficient material handling and consistent shot size. Energy consumption rates are under constant scrutiny, with automated molding processes and plasticizing unit efficiencies driving down costs. Injection speed profiles and mold cooling optimization are essential for minimizing process cycle time and enhancing production throughput. Mold design software and maintenance procedures have advanced, enabling more accurate part dimensionality and longer equipment life. Quality control metrics, such as cavity pressure monitoring and hydraulic pressure systems, ensure consistent output and defect detection. Material selection guides and material handling systems have become increasingly sophisticated, allowing for greater flexibility and customization in the production process.

- As the injection molding market continues to evolve, these trends will shape the industry's future, offering new opportunities for innovation and growth.

What are the Key Data Covered in this Injection Molding Machine Market Research and Growth Report?

-

What is the expected growth of the Injection Molding Machine Market between 2025 and 2029?

-

USD 5.59 billion, at a CAGR of 4.5%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Plastics, Rubber, and Others), End-user (Automotive, Consumer goods, Packaging, and Others), Technology (Hydraulic, Electric, and Hybrid), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rising demand for Injection molding machines from various industries, High initial and maintenance cost of injection molding machines

-

-

Who are the major players in the Injection Molding Machine Market?

-

ARBURG GmbH Co KG, BORCHE North America INC., Chen Hsong Holdings Ltd., Cosmos Machinery Enterprises Ltd., Electronica Plastic Machines Ltd., ENGEL Austria GmbH, FANUC Corp., Haitian International Holdings Ltd., Hillenbrand Inc., Husky Technologies, KraussMaffei Group GmbH, L.K. Technology Holdings Ltd., NISSEI PLASTIC INDUSTRIAL Co. Ltd., Shibaura Machine Co. Ltd., Sumitomo Heavy Industries Ltd., Tederic Machinery Co., Ltd., The Japan Steel Works Ltd., Toyo Machinery and Metal Co. Ltd., Ube Corp., and WITTMANN Technology GmbH

-

Market Research Insights

- The market encompasses advanced technologies and continuous innovations, with a focus on enhancing mold design validation, ensuring melt homogeneity control, and achieving cycle time improvements. Notably, clamp force optimization and energy efficiency improvements are significant areas of development. For instance, modern injection molding machines can optimize clamp force to minimize material waste and enhance part quality, while energy efficiency improvements can lead to substantial cost savings. Furthermore, thermal stress analysis and injection pressure settings are crucial aspects of process capability studies, ensuring temperature sensor accuracy and statistical process control in the plastic injection process. Maintenance scheduling, hydraulic system maintenance, and preventative maintenance are essential for manufacturing process control, with cavity filling analysis and part ejection timing optimizations contributing to production line efficiency and defect rate reduction.

- Material degradation analysis and production cost reduction are also essential, with process parameter optimization, screw speed control, automated quality inspection, and mold cooling channels all playing integral roles in the market.

We can help! Our analysts can customize this injection molding machine market research report to meet your requirements.