Intraoperative Neuromonitoring Market Size 2025-2029

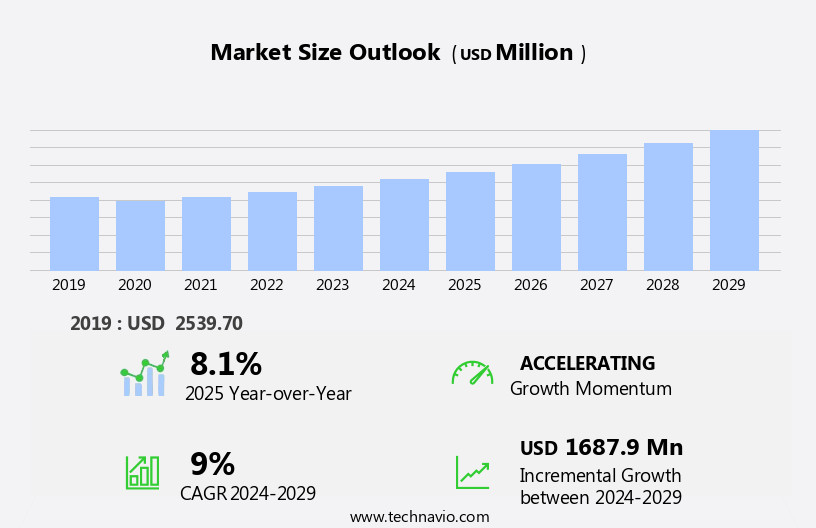

The intraoperative neuromonitoring market size is forecast to increase by USD 1.69 billion at a CAGR of 9% between 2024 and 2029.

- The Intraoperative Neuromonitoring (IONM) market experiences significant growth, driven by the increasing volume of surgeries and the emergence of portable IONM systems. These advancements enable real-time monitoring of neural activity during surgical procedures, enhancing patient safety and improving clinical outcomes. However, market expansion encounters challenges. Regulatory hurdles impact adoption due to stringent regulatory requirements for IONM devices and services. Furthermore, the high cost of devices and services poses a significant barrier to entry for many healthcare providers, potentially limiting market penetration. However, the high cost of IONM devices and patient monitoring equipment and procedures remains a challenge, limiting market accessibility and affordability for some healthcare service providers and patients

- To capitalize on growth opportunities and navigate these challenges, market participants must focus on regulatory compliance, cost reduction strategies, and the development of cost-effective, portable IONM solutions. By addressing these issues, companies can effectively expand their market presence and contribute to the ongoing advancements in IONM technology. Integration with surgical microscopes, ophthalmic surgical devices, and surgical robots further enhances its effectiveness in delivering accurate interventions.

What will be the Size of the Intraoperative Neuromonitoring Market during the forecast period?

- Intraoperative Neuromonitoring (IONM) market in the US is driven by the integration of advanced technologies such as robotics, artificial intelligence (AI), and medical imaging in healthcare. IONM systems, which include electrodes and sensors, enable real-time monitoring of neurological functions during surgeries, particularly in cardiovascular conditions. Reimbursement policies for IONM services have been established, ensuring their adoption in enterprise operations and consumer services. The economic recession led to a focus on cost-effective solutions, driving the growth of cloud-based AI and offloaded computation. IONM systems are increasingly being used in industry verticals like cardiovascular care, neurosurgery, and orthopedics, with teleoperation and service execution enhancing connectivity and improving patient outcomes. Moreover, the integration of artificial intelligence and machine learning in medical imaging enhances diagnostic accuracy and treatment planning, while favorable reimbursement policies support market expansion, particularly in addressing the needs of the aging population and patients with cancer and osteoarthritis.

- Technology giants are investing in core cloud technologies to develop AI-based systems and robotics services, expanding the market's reach in healthcare. The IONM market is expected to grow significantly as AI and medical imaging technologies continue to revolutionize healthcare and improve patient care. Alzheimer's disease and other neurological conditions are also driving the demand for advanced IONM systems, offering opportunities for growth in the US healthcare sector.

How is this Intraoperative Neuromonitoring Industry segmented?

The intraoperative neuromonitoring industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Insourced IONM

- Outsourced IONM

- Modality

- Motor evoked potentials (MEPs)

- Somatosensory evoked potentials (SSEPs)

- Electroencephalography (EEG)

- Electromyography (EMG)

- Others

- Application

- Spinal surgery

- Neurosurgery

- Vascular surgery

- ENT surgery

- Orthopedic surgery

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

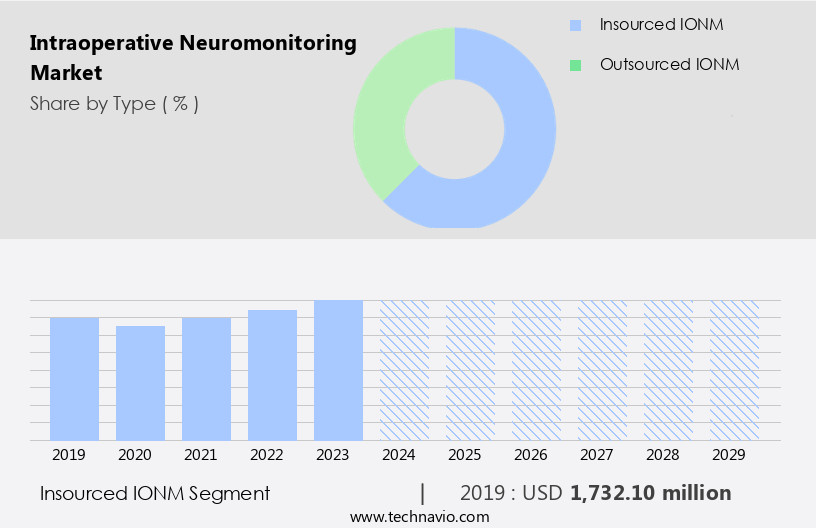

By Type Insights

The insourced IONM segment is estimated to witness significant growth during the forecast period. The Intraoperative Neuromonitoring (IONM) market is witnessing significant growth due to its application in various surgical procedures, including spinal surgery, neurosurgery, vascular surgery, ENT surgery, and orthopedic surgery. IONM technology plays a crucial role in minimizing post-operative injuries by monitoring neural pathways during surgeries. The aging population and the rising prevalence of chronic disorders such as neurovascular disorders, cancer, Alzheimer's disease, and cardiovascular conditions are driving market growth. Skilled professionals use IONM to ensure accurate neuromonitoring during surgeries, reducing neurological complications. The implementation costs and reimbursement policies vary depending on the type of system used, such as electromyography, electroencephalography, or somatosensory evoked potentials. Despite challenges like a lack of awareness and skilled personnel, artificial intelligence and machine learning contribute to improved outcomes.

IONM systems use sensors and electrodes to monitor neural activity and can be integrated with medical imaging for better patient care. The recession has had an impact on the market, but the increasing demand for remote patient monitoring and outsourced monitoring services is expected to offset this trend. Machine learning and artificial intelligence are being integrated into IONM systems to improve accuracy and efficiency. Medtronic, SpecialtyCare, and Frontiers Media S are some of the key players in the market. The World Health Organization emphasizes the importance of IONM in reducing neurological complications during surgical procedures, such as cerebral stroke and osteoarthritis (OA).

The global IONM market is expected to continue growing due to the increasing number of surgical procedures and the need for consistent monitoring to ensure patient safety.

The Insourced IONM segment was valued at USD 1.73 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 64% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Intraoperative Neuromonitoring (IONM) market in North America is experiencing significant growth, driven by the increasing demand for accurate neuromonitoring during surgical procedures. IONM technology plays a crucial role in preserving neural pathways during cancer surgeries and neurovascular disorders interventions, reducing the risk of neurological complications. Skilled professionals, including neurosurgeons and anesthesiologists, rely on IONM systems to ensure patient safety during complex surgeries. Cardiovascular conditions, such as cerebral stroke, and chronic disorders, like Alzheimer's disease, are major indications for IONM. IONM modalities include Electroencephalography (EEG), Somatosensory Evoked Potentials (SSEP), Motor Evoked Potentials (MEP), and auditory brainstem response (ABR). Accessories like electrodes and sensors are essential components of IONM systems. With applications in neurosurgery, ophthalmic diagnostic devices, and cardiovascular conditions, it aids in the treatment of chronic diseases like stroke, Alzheimer's disease, and cancer.

Implementation costs and reimbursement policies are critical factors influencing the adoption of IONM. The recession and the aging geriatric population have led to an increased focus on remote patient monitoring and outsourced monitoring services. Healthcare providers are increasingly turning to insourced monitoring and service providers like Medtronic, SpecialtyCare, and Frontiers Media S for cost-effective and efficient IONM solutions. Advancements in medical imaging, artificial intelligence, and machine learning have significantly improved the accuracy and reliability of IONM systems. Companies are investing in research and development to produce technologically advanced IONM systems for various surgical procedures, including spinal surgery and osteoarthritis (OA) treatment. The World Health Organization emphasizes the importance of IONM in ensuring optimal patient care and reducing healthcare costs.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Intraoperative Neuromonitoring market drivers leading to the rise in the adoption of Industry?

- The significant increase in the number of surgeries performed is the primary factor fueling market growth. The Intraoperative Neuromonitoring (IONM) market is experiencing significant growth due to the increasing number of surgeries and the need to protect patients' neural structures during procedures. IONM technology offers accurate neuromonitoring by assessing the real-time status of nerves and the spinal cord, enabling surgeons to make informed decisions and prevent permanent damage to neural pathways. Neurovascular disorders and various chronic diseases, such as cancer, are driving the adoption of IONM in orthopedic, spine, neuro, cardiovascular, and ENT surgeries. Skilled professionals use IONM modality to continuously assess the functionality of the patient's nervous system, ensuring optimal outcomes and minimizing risks. Implementation costs, although a consideration, are offset by the benefits of real-time neurophysiological information during surgeries.

What are the Intraoperative Neuromonitoring market trends shaping the Industry?

- Portable Intraoperative Neurophysiological Monitoring (IONM) is gaining increasing popularity in the healthcare industry as the next major market trend. This innovative technology enables real-time monitoring of neurological function during surgical procedures, offering improved patient safety and enhanced surgical precision. Intraoperative Neuromonitoring (IONM) systems play a crucial role in ensuring patient safety during complex spine and brain surgeries. Companies in the healthcare industry are responding to the demands of fast-paced operating rooms by offering compact, portable IONM systems. Natus Medical's Nicolet Endeavor IOM Systems and NIHON KOHDEN's Neuromaster MEE-2000 are prime examples. These systems offer multimodality capabilities and superior IONM capabilities in smaller, portable designs. The compact size and reduced setup time of these systems make them ideal for operating rooms, where space and efficiency are essential. Moreover, the use of sensors, medical imaging, and artificial intelligence in IONM systems enhances their capabilities, enabling physicians to respond to the neurophysiological requirements of individual patients. Reimbursement policies for IONM services continue to evolve, making it a promising market for growth despite economic recessions and the emergence of conditions like Alzheimer's disease.

How does Intraoperative Neuromonitoring market faces challenges face during its growth?

- The escalating costs of devices and services pose a significant challenge to the industry's growth trajectory. The global Intraoperative Neuromonitoring (IONM) market experienced restrained growth in 2024 due to the high cost of IONM devices and services. IONM is increasingly adopted for spine and other complex surgeries to monitor the nervous system during procedures. However, the substantial financial burden associated with IONM adds an average procedural cost of around USD 5,000 per patient, making it less accessible in price-sensitive markets. This expense encompasses the cost of IONM equipment, neuro technicians, neurophysiologists, and disposables. As a result, the adoption of IONM remains limited, particularly in emerging economies, where affordability and insufficient reimbursements further hinder its utilization. Despite these challenges, remote patient monitoring technologies, such as Medtronic's Osteoarthritis Action and Frontiers Media S's electroencephalography (EEG) solutions, offer potential cost-effective alternatives for delivering IONM services. Patients and healthcare providers alike stand to benefit from these advancements, which may help increase the accessibility and affordability of IONM for chronic disorder management and spinal surgery. In summary, the IONM market is witnessing growth due to the increasing volume of surgeries, particularly in the geriatric population and those with cardiovascular conditions.

Exclusive Customer Landscape

The intraoperative neuromonitoring market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the intraoperative neuromonitoring market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, intraoperative neuromonitoring market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accurate Neuromonitoring LLC - The company offers intraoperative neuromonitoring that protects patients by continuously monitoring the central nervous system during surgery.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accurate Neuromonitoring LLC

- Bromedicon Inc.

- Cadwell Industries Inc.

- Check Point Surgical Inc.

- Comprehensive Care Services

- Computational Diagnostics Inc.

- EMOTIV

- inomed Medizintechnik GmbH

- IntraNerve Neuroscience Holdings LLC

- Medsurant Health

- Medtronic Plc

- Natus Medical Inc.

- Neuro Alert

- NeuroStyle Pte Ltd.

- Nihon Kohden Corp.

- NuVasive Inc.

- Orimtec

- SpecialtyCare Inc.

- Technomed

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Intraoperative Neuromonitoring Market

- In August 2022, Medtronic plc, a global healthcare solutions company, announced the launch of its StealthStation S7 System, an advanced neuronavigation platform designed to enhance the accuracy and efficiency of intraoperative neuromonitoring (IONM) procedures. This system integrates real-time data from various IONM tools, providing surgeons with a more comprehensive view of the surgical site and enabling faster response times to potential neurological complications (Medtronic Press Release, 2022).

- In January 2023, Natus Medical Incorporated, a leading provider of healthcare products and services, entered into a strategic partnership with Brainlab AG, a German medical technology company, to expand its IONM offerings. This collaboration aims to combine Natus' expertise in IONM with Brainlab's advanced neurosurgical navigation systems, offering healthcare providers a more integrated and effective solution for managing complex neurosurgical procedures (Natus Medical Press Release, 2023).

- In March 2024, Stryker Corporation, a leading medical technology company, completed the acquisition of Integra Neurosciences, a pioneer in neurosurgical devices and IONM services. This acquisition significantly strengthens Stryker's neurotechnology portfolio and positions the company as a major player in the IONM market. The deal is valued at approximately USD1.1 billion (Stryker Press Release, 2024).

- In October 2025, the U.S. Food and Drug Administration (FDA) granted clearance for the use of the Neurosigns System by Medtronic, marking a significant technological advancement in IONM. This system utilizes machine learning algorithms to analyze electromyography data and provide real-time feedback to surgeons, improving the accuracy and efficiency of IONM procedures (Medtronic Press Release, 2025).

Research Analyst Overview

Intraoperative Neuromonitoring (IONM) market is a dynamic and evolving field in healthcare, driven by advancements in technology and the growing demand for accurate neuromonitoring during surgical procedures. IONM technology plays a crucial role in identifying neural pathways and neurovascular disorders, ensuring the preservation of neural function during surgeries for various conditions, including cardiovascular conditions and cancer. Skilled professionals in the healthcare industry are increasingly recognizing the importance of IONM modality in patient care. IONM systems use a range of accessories, such as electrodes and sensors, to monitor neural activity during surgeries. Medical imaging is often integrated into these systems to provide real-time visualization of neural structures.

The implementation costs and reimbursement policies for IONM systems vary across healthcare settings. As healthcare faces economic challenges due to the ongoing recession, cost-effective solutions for IONM are becoming increasingly important. The World Health Organization and other healthcare organizations are advocating for the integration of IONM into routine surgical procedures to improve patient outcomes and reduce complications. Neurological complications during surgeries can lead to significant morbidity and mortality. IONM technology helps to mitigate these risks by providing real-time monitoring of neural activity during surgeries. The use of IONM is particularly important in high-risk surgeries, such as spinal surgery and surgeries for chronic disorders like Alzheimer's disease and osteoarthritis (OA).

The geriatric population, who are more susceptible to neurological complications, can benefit significantly from IONM. IONM technology can help to reduce the risk of complications during surgeries, leading to better patient outcomes and improved quality of life. Artificial intelligence (AI) and machine learning are being increasingly integrated into IONM systems to improve accuracy and efficiency. Remote patient monitoring and outsourced monitoring services are also gaining popularity, enabling real-time monitoring of neural activity from a distance. IONM technology is not limited to neurosurgery but is also being used in various other surgical procedures, such as cardiovascular and orthopedic surgeries.

The use of IONM in these areas can lead to improved patient outcomes and reduced healthcare costs. Medtronic and Frontiers Media S are some of the leading players in the IONM market, offering innovative solutions for accurate neuromonitoring. Specialtycare and other service providers are also offering insourced monitoring services to healthcare facilities, providing cost-effective solutions for IONM implementation. In conclusion, the IONM market is a dynamic and evolving field, driven by advancements in technology and the growing demand for accurate neuromonitoring during surgical procedures. IONM technology plays a crucial role in improving patient outcomes and reducing complications, particularly in high-risk surgeries and for the geriatric population.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Intraoperative Neuromonitoring Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

232 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 1.69 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.1 |

|

Key countries |

US, Canada, Germany, UK, China, France, Japan, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Intraoperative Neuromonitoring Market Research and Growth Report?

- CAGR of the Intraoperative Neuromonitoring industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the intraoperative neuromonitoring market growth of industry companies

We can help! Our analysts can customize this intraoperative neuromonitoring market research report to meet your requirements.