Surgical Robots Market Size 2025-2029

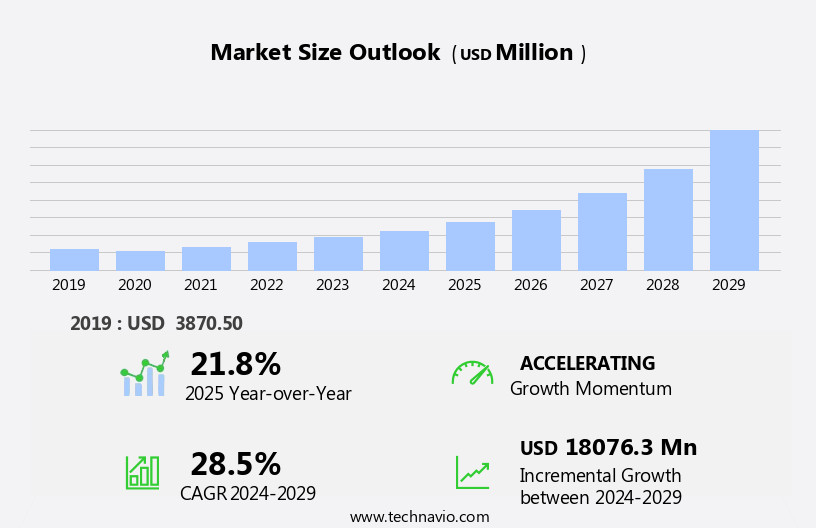

The surgical robots market is experiencing explosive growth, driven by advancements in robotic precision, rising demand for minimally invasive procedures, and increasing adoption across global healthcare systems. Valued at USD 8.5 billion in 2024, the market is projected to grow by USD 18.08 billion, reaching USD 26.58 billion by 2029, with a remarkable compound annual growth rate (CAGR) of 28.5%. From advanced hospitals in the United States to specialty clinics in Japan, surgical robots are revolutionizing patient outcomes and operational efficiency. However, the high cost and affordability remain a challenge, limiting their adoption in developing countries. HD cameras integrated into surgical robotic systems enable surgeons to perform complex procedures with minimal invasiveness, benefiting patients with chronic diseases such as bone degenerative diseases, arthritis, and osteoporosis, as well as those undergoing hip replacement surgeries, knee replacement surgeries, and joint repairs. the adoption of surgical robotic systems is not limited to inpatient facilities but also extends to ambulatory surgical centers and healthcare facilities.

This in-depth analysis explores the drivers, segments, trends, challenges, and recent developments shaping the surgical robots market, spotlighting key players like Intuitive Surgical, Medtronic, and Stryker, and delivering actionable insights for stakeholders in this dynamic industry.

What will be the Size of the Surgical Robots Market during the forecast period?

Key Drivers of the Surgical Robots Market

A powerful convergence of factors is fueling the surgical robots market, cementing its role as a transformative force in healthcare:

- Rising Demand for Minimally Invasive Surgery: Patients in the US and Europe prefer minimally invasive procedures for faster recovery, driving demand for robotic systems like Intuitive Surgical's da Vinci in general and urological surgeries.

- Aging Population: The growing elderly population in Japan and China increases the need for precise orthopedic and cardiovascular surgeries, supported by robotic technologies.

- Technological Advancements: Innovations in AI, haptic feedback, and 5G connectivity enhance robotic precision, boosting adoption in Germany and the UK for neurosurgery and thoracic procedures.

- Healthcare Infrastructure Growth: Expanding hospital networks in India and Brazil invest in robotic systems to attract medical tourism and improve surgical outcomes.

- Regulatory Support: Approvals from the FDA and European Medicines Agency (EMA) for advanced robotic systems accelerate market entry, particularly in North America and Europe.

Case Study: Enhancing Urological Surgery in California

A leading hospital in California adopted Intuitive Surgical's da Vinci Xi for urological procedures, reducing patient recovery time by 40%. The system's precision enabled complex prostatectomies with minimal complications, showcasing surgical robots' transformative impact on patient care.

Market Segmentation: A Comprehensive Breakdown

The surgical robots industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- General and laparoscopy surgery

- Gynecological surgery

- Orthopedic surgery

- Neurosurgery

- Urology

- Thoracic surgery

- Others

- End-user

- Hospitals

- Ambulatory service centers

- Specialty Clinics

- Academic and Research Institutions

- Component

- Instruments & Accessories

- Robotic Systems

- Maintenance and Support Services

- Training and Consulting Services

- Software and Connectivity Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application

- General Surgery: General surgery is a key application, leveraging robotic systems for procedures like cholecystectomy and hernia repair. In the US, hospitals use systems like the da Vinci for enhanced precision and reduced recovery times. The technology's ability to navigate complex anatomies drives its adoption. Growing demand for minimally invasive techniques fuels its use in Europe. Training programs are expanding to support surgeon proficiency.

- Gynecological Surgery: Gynecological procedures, such as hysterectomies, benefit from robotic precision in Japan and Germany. Systems like Medtronic's Hugo RAS minimize blood loss and scarring. The rise in women's health awareness drives demand in North America. Advanced imaging integration enhances surgical outcomes. The segment is supported by specialized training for gynecologic surgeons.

- Orthopedic Surgery: Orthopedic surgery, including knee and hip replacements, relies on robots like Stryker's Mako in the US and UK. These systems ensure accurate implant placement, improving patient mobility. Aging populations in China fuel demand for joint surgeries. AI-driven planning enhances procedural efficiency. The segment is expanding in ambulatory surgical centers (ASCs).

- Neurosurgery: Neurosurgery uses robotic systems for precise brain and spine procedures, with adoption growing in France and Canada. Systems like Zimmer Biomet's ROSA improve accuracy in tumor resections. The complexity of neural anatomy drives demand for advanced navigation. Training programs in Europe enhance surgeon skills. The segment is critical for addressing neurological disorders.

- Urological Surgery: Urological procedures, such as prostatectomies, are widely performed using robots in the US and Japan. Intuitive Surgical's da Vinci systems reduce complications in kidney surgeries. The rise in prostate cancer cases fuels demand in Europe. Enhanced visualization supports complex reconstructions. The segment benefits from robust surgeon training ecosystems.

- Cardiovascular Surgery: Cardiovascular procedures, like valve repairs, leverage robotic systems in Germany and the US for precision. Systems like Medtronic's Hugo RAS minimize invasiveness in heart surgeries. The growing prevalence of heart disease in China drives adoption. Advanced haptic feedback improves surgeon control. The segment is expanding in high-end hospitals.

- Thoracic Surgery: Thoracic procedures, such as lung resections, use robotic systems in the UK and Japan for minimally invasive approaches. The da Vinci system enhances precision in complex chest surgeries. Rising lung cancer cases in Asia fuel demand. 5G connectivity supports remote surgical guidance. The segment is gaining traction in specialty clinics.

- Others: This segment includes ENT surgery and pediatric procedures, with growing adoption in Brazil and India. Robotic systems improve precision in delicate ENT surgeries. Emerging applications in pediatric orthopedics drive demand in North America. Specialized software enhances procedural planning. The segment's versatility supports niche surgical needs.

By End-user

- Hospitals: Hospitals are primary adopters, using robotic systems for complex surgeries in the US and Germany. Large facilities invest in systems like the da Vinci to attract patients seeking advanced care. The integration of robotics enhances hospital reputations in Europe. Training programs ensure surgeon proficiency. The segment drives demand for maintenance and software services.

- Ambulatory Surgical Centers (ASCs): ASCs in the US and UK adopt robots for outpatient procedures like orthopedic surgeries. Their focus on cost-efficiency drives demand for compact systems like Stryker's Mako. The rise in minimally invasive surgeries fuels growth in Canada. ASCs prioritize maintenance services for system reliability. The segment is expanding in urban healthcare markets.

- Specialty Clinics: Specialty clinics in Japan and France use robots for targeted procedures like urological and gynecological surgeries. These clinics leverage systems like Medtronic's Hugo RAS for precision. The focus on niche expertise drives adoption in Europe. Software upgrades enhance procedural outcomes. The segment benefits from specialized training programs.

- Academic and Research Institutions: Academic institutions in the US and China develop robotic technologies and train surgeons. They use systems like Zimmer Biomet's ROSA for research in neurosurgery. Collaborations with industry players drive innovation in Europe. The segment supports advancements in AI and connectivity. Training programs fuel future market growth.

By Component

- Surgical Instruments and Accessories: Instruments like robotic arms and endoscopes are critical for surgical precision in the US and Japan. These components are tailored for specific procedures, such as orthopedic implants. Regular upgrades ensure compatibility with advanced systems. The segment thrives on recurring demand in Europe. Training enhances effective instrument use.

- Surgical Robotic Systems: Robotic systems, like Intuitive Surgical's da Vinci, are the market's core, used in hospitals across Germany and the US. These systems integrate AI and imaging for enhanced precision. Continuous R&D improves functionality in Asia. Maintenance services ensure long-term performance. The segment drives technological innovation.

- Maintenance and Support Services: Maintenance services, including calibration and repairs, are essential for system reliability in the UK and Canada. These services minimize downtime in high-volume hospitals. Demand is rising in India due to expanding robotic installations. Remote diagnostics enhance efficiency. The segment supports operational continuity.

- Training and Consulting Services: Training programs in the US and France ensure surgeon proficiency with robotic systems. Consulting services optimize system integration in hospitals. The rise in robotic surgeries in China fuels demand for training. Virtual reality enhances training outcomes. The segment is critical for market expansion.

- Software and Connectivity Services: Software for procedural planning and 5G connectivity for remote surgery are growing in Japan and Germany. These services enhance system performance in Europe. Cloud-based analytics support data-driven surgeries in the US. The segment is vital for integrating AI and IoT. Continuous updates drive demand.

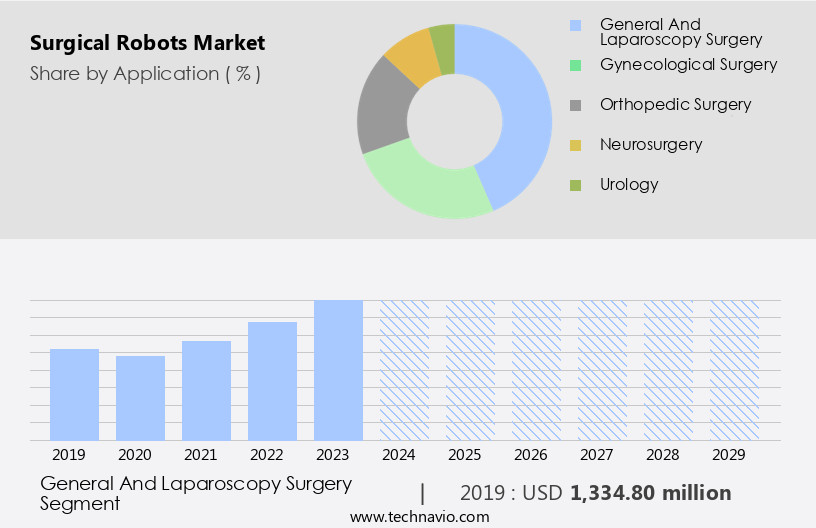

By Application Insights

The general and laparoscopy surgery segment is estimated to witness significant growth during the forecast period. Surgical robots have significantly transformed minimally invasive surgeries, including laparoscopic procedures, by offering surgeons enhanced precision and visualization. The global surgical procedures market is projected to grow due to the increasing number of surgeries performed annually, with an estimated 200-400 million procedures worldwide in 2023 (World Health Organization). Surgical robots have become increasingly popular due to their benefits, such as quicker patient recovery, shorter hospital stays, health insurance and reduced post-operative complications. In the United States, outpatient surgeries, including urological, sterilization, gynaecological, and general surgeries, have seen significant growth in ambulatory surgery centers and clinics.

The General and laparoscopy surgery segment was valued at USD 1.33 billion in 2019 and showed a gradual increase during the forecast period.

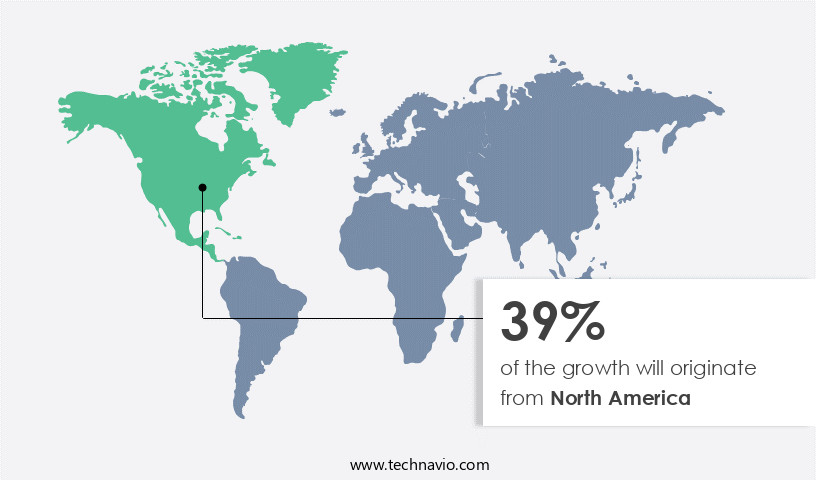

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Surgical robots have gained significant traction in the healthcare industry due to their precision, dexterity, smaller incisions, and faster recovery times. Chronic diseases, such as cardiovascular diseases and respiratory disorders, affect a large population in the US, with approximately 129 million individuals diagnosed as of February 2024. In response, healthcare facilities, including hospitals and ambulatory surgery centers, are integrating advanced surgical robotic systems to perform various procedures, such as urological, general, gynaecological, neurosurgeries, and orthopedic surgeries. These systems enable minimally invasive techniques for surgeries on soft tissues, bones, and lesions, including hernia repair, cholecystectomy, adrenalectomy, and small bowel resection.

Key surgical segments include outpatient surgery, ambulatory surgery centers, and hospitals, with a focus on minimally invasive surgeries for cancer treatment procedures, neurology, and cardiac surgery. Instruments and accessories are also essential components of these systems. The adoption of surgical robots is increasing due to their benefits, including reduced blood loss, quicker recovery times, and improved patient outcomes.

- North America (US, Canada): North America leads due to advanced healthcare infrastructure and high R&D investment. The US drives demand with systems like the da Vinci for urological and general surgeries. Canada's focus on orthopedic and neurosurgery fuels adoption of Stryker's Mako. Regulatory support from the FDA accelerates market entry. The region's hospitals and ASCs prioritize robotic precision.

- Europe (France, Germany, UK): Europe is a hub for neurosurgery and gynecological applications, with Germany leading in robotic R&D. France adopts systems like Medtronic's Hugo RAS for cardiovascular surgeries. The UK uses ToFMS for thoracic procedures. EU regulations drive demand for compliant systems. The region's focus on training supports market growth.

- Asia (India, Japan, China): Asia is a fast-growing market, with Japan leading in gynecological and urological surgeries using da Vinci systems. China's hospital expansions drive demand for cardiovascular robots. India's medical tourism sector adopts orthopedic systems like Mako. Regulatory reforms boost adoption. The region prioritizes cost-effective solutions.

- South America (Brazil): Brazil's healthcare sector invests in robotic systems for general and ENT surgeries to support medical tourism. Systems like Zimmer Biomet's ROSA are used in neurosurgery. The rise in private hospitals fuels demand. Training programs enhance surgeon skills. The region's focus on minimally invasive procedures drives growth.

- Middle East and Africa (UAE): The UAE leads with investments in robotic systems for cardiovascular and orthopedic surgeries. Hospitals adopt da Vinci systems to attract international patients. Environmental regulations drive demand for sustainable components. Training centers enhance adoption. The region's healthcare modernization fuels market expansion.

- Rest of World (ROW): ROW includes emerging markets like South Africa, where hospitals adopt robots for general surgery. The focus on cost-effective systems drives demand for compact robots. Training programs support adoption in academic institutions. Regulatory harmonization enhances market access. The segment is poised for steady growth.

Emerging Trends Shaping the Surgical Robots Market

The surgical robots market is evolving rapidly, with transformative trends redefining surgical precision and accessibility:

- AI-Driven Surgical Planning: AI algorithms, integrated by Intuitive Surgical, enhance preoperative planning in the US, improving outcomes in neurosurgery. These systems analyze patient data to optimize robotic movements, reducing complications. Adoption is growing in Germany for complex procedures. AI also supports real-time decision-making, boosting surgeon confidence. The trend is critical for precision medicine.

- 5G-Enabled Remote Surgery: 5G connectivity enables remote surgeries, with Japan leading in thoracic procedures. Low-latency networks allow surgeons to operate from distant locations, expanding access in rural China. The UAE is piloting 5G for cardiovascular surgeries. The trend enhances surgical reach but requires robust cybersecurity. It's transforming global healthcare delivery.

- Compact Robotic Systems: Compact systems like Medtronic's Hugo RAS are gaining traction in ASCs in the UK and Canada. These systems reduce costs and space requirements, ideal for outpatient surgeries. Adoption is rising in India for orthopedic procedures. Their portability supports emerging markets. The trend is driving accessibility in smaller facilities.

- Haptic Feedback Advancements: Enhanced haptic feedback in systems like Stryker's Mako improves surgeon control in the US for orthopedic surgeries. The technology simulates tactile sensations, enhancing precision in Germany's neurosurgery. Adoption is growing in Japan for delicate procedures. It reduces learning curves for surgeons. The trend is critical for complex surgeries.

- Sustainable Components: Eco-friendly robotic components, developed by Zimmer Biomet, align with green initiatives in Europe. These components reduce waste in high-volume hospitals in France. The trend is gaining traction in Canada's healthcare sector. Sustainability enhances brand appeal. It supports long-term market growth.

- Virtual Reality Training: VR-based training programs in the US and France enhance surgeon skills for robotic systems. These programs simulate complex surgeries, reducing errors in Japan. Adoption is rising in China's academic institutions. VR improves training accessibility in emerging markets. The trend is vital for scaling robotic adoption.

- Cloud-Based Analytics: Cloud platforms for surgical data analysis, adopted by Medtronic, improve outcomes in Europe. These platforms store procedural data for real-time insights in the US. China's hospitals use them for cardiovascular surgeries. The trend supports data-driven healthcare. It's essential for integrating AI and IoT.

Case Study: Orthopedic Surgery in India

A leading hospital in Mumbai adopted Stryker's Mako for knee replacements, improving implant accuracy by 30%. The system's AI-driven planning reduced surgery time, attracting medical tourists from the Middle East. This case underscores surgical robots' role in enhancing India's healthcare reputation.

Challenges Facing the Surgical Robots Market

Despite its rapid growth, the surgical robots market faces significant hurdles that could slow its expansion:

- High Initial Costs: Robotic systems like the da Vinci, priced at USD 1-2 million, limit adoption in smaller hospitals, particularly in India and Brazil. These costs include installation and training, straining budgets in emerging markets. The expense restricts market penetration in resource-constrained regions. Ongoing maintenance adds to the financial burden. Cost-effective alternatives are needed to drive growth.

- Skilled Surgeon Shortage: Operating robotic systems requires specialized training, which is scarce in China and South Africa. The lack of trained surgeons hampers system utilization, slowing adoption in Asia. Training programs are costly and time-intensive, delaying market expansion. This challenge limits the scalability of robotic surgeries. Investments in training are critical to address this gap.

- Regulatory Complexities: Varying standards across the FDA, EMA, and China's NMPA create compliance challenges for manufacturers. Navigating these regulations delays product launches in Europe, increasing costs. Differences in approval timelines hinder global market access. Regulatory harmonization is needed to streamline growth. This issue particularly affects new entrants in the market.

- System Downtime and Maintenance: Frequent maintenance for systems like Medtronic's Hugo RAS causes downtime in high-volume hospitals in Japan. This disrupts surgical schedules, impacting patient care and revenue. Maintenance costs strain hospital budgets in the UK. Remote diagnostics are emerging but not widely adopted. The challenge affects operational efficiency and market trust.

- Cybersecurity Risks: The integration of 5G and cloud platforms in the US increases cybersecurity risks for robotic systems. Data breaches could compromise patient safety and hospital operations. Emerging markets like India lack robust cybersecurity infrastructure. The challenge requires significant investment in secure systems. It's a growing concern as connectivity expands.

- Ethical and Legal Concerns: The use of robots in surgery raises ethical questions about liability in Germany, particularly in neurosurgery. Legal frameworks for robotic errors are unclear, slowing adoption in Europe. Patient trust is a concern in China's conservative markets. The challenge requires clear regulations to ensure market stability. It impacts consumer confidence and growth.

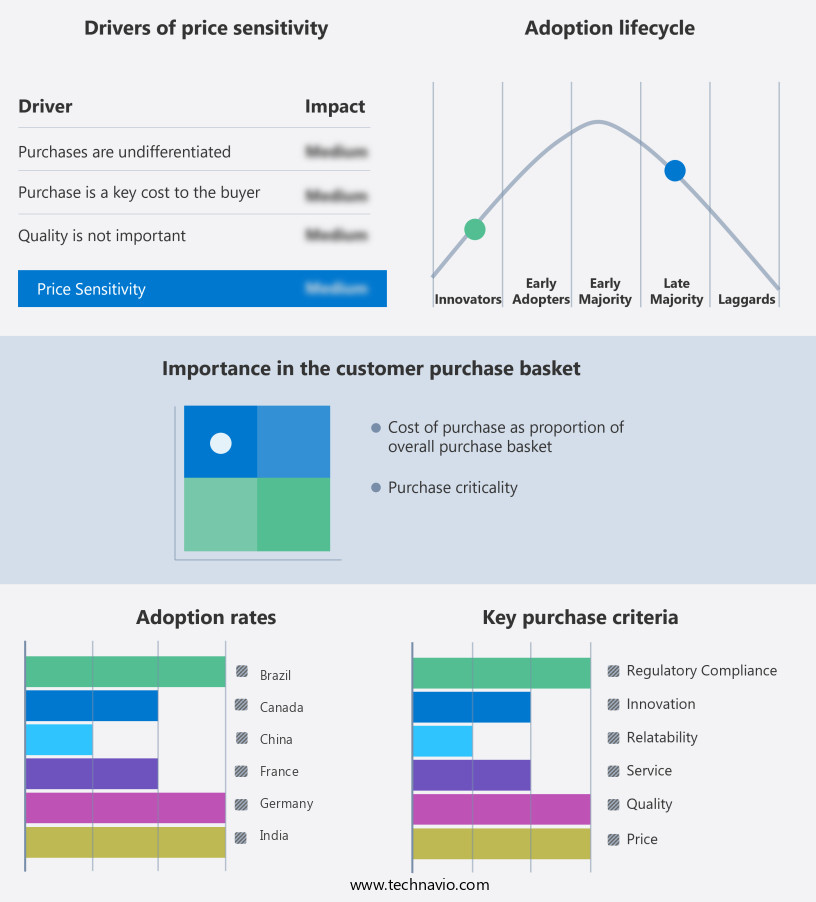

Exclusive Customer Landscape

The surgical robots market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the surgical robots market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Competitive Landscape: Key Players and Strategies

The surgical robots market is highly competitive, with leading companies driving innovation and expansion:

- Intuitive Surgical: A market leader with the da Vinci system, Intuitive excels in urological and general surgeries, dominating in the US and Europe.

- Medtronic: Known for the Hugo RAS, Medtronic leads in cardiovascular and gynecological applications, with a strong presence in Germany and Japan.

- Stryker: Specializes in the Mako system for orthopedic surgeries, driving growth in the UK and Canada.

- Zimmer Biomet: Focuses on the ROSA system for neurosurgery, with sustainable innovations in France and Germany.

- CMR Surgical: Pioneers the Versius system for remote surgeries, leading in Japan and China.

- Others: Johnson & Johnson, Asensus Surgical, and Smith & Nephew compete through niche innovations and regional expansion.

Why the Surgical Robots Market Matters

Surgical robots are more than cutting-edge tools-they're reshaping healthcare. In hospitals, they're enabling life-saving procedures with unmatched precision. In ASCs, they're making outpatient surgeries more accessible. In emerging markets, they're elevating healthcare standards. By enhancing patient outcomes, reducing recovery times, and driving innovation, the surgical robots market unites regions like North America, Europe, and Asia in a shared mission to transform surgery and improve lives.

Accuray Inc. - The company specializes in advanced surgical robots, including the Cyberknife S7 system, delivering precision and accuracy in various medical procedures. These robots facilitate minimally invasive surgeries, enhancing patient outcomes and reducing recovery time. With continuous advancements in technology, surgical robots are increasingly becoming an essential tool in modern healthcare systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accuray Inc.

- Asensus Surgical US Inc.

- CMR Surgical Ltd.

- Intuitive Surgical Inc.

- Johnson and Johnson Services Inc.

- Medtronic Plc

- Momentis Innovative Surgery Ltd.

- Neocis Inc.

- Novus International Inc.

- OMNI Orthopaedics Inc.

- Renishaw Plc

- Siemens AG

- Smith and Nephew plc

- Stryker Corp.

- Titan Medical Inc

- United Orthopedic Corp.

- Virtual Incision

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Unlock Deeper Insights into the Surgical Robots Market

Ready to explore the surgical robots market further? Download Free Sample Report for exclusive data on market size, segment trends, and key players like Intuitive Surgical and Medtronic. Contact our team to discover how this market can elevate your business.

Conclusion: A Market Redefining Surgical Precision

The surgical robots market is a dynamic force, propelled by technological innovation, rising demand for minimally invasive procedures, and global healthcare advancements. Growing by USD 18.08 billion at a 28.5% CAGR from 2024 to 2029, it offers immense opportunities for hospitals, manufacturers, and researchers. Companies like Intuitive Surgical and Stryker are leading the charge, overcoming challenges to unlock new possibilities. Stay ahead, embrace precision, and join the surgical revolution shaping a global future.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Surgical Robots Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.5% |

|

Market growth 2025-2029 |

USD 18076.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

21.8 |

|

Key countries |

US, UK, Germany, China, Canada, Japan, France, Saudi Arabia, Brazil, India, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Surgical Robots Market Research and Growth Report?

- CAGR of the Surgical Robots industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the surgical robots market growth of industry companies

Talk with the Author

Have questions about our market research report? Connect with our Principal Consultant for exclusive insights.