Laboratory Consumables Primary Packaging Market Size 2024-2028

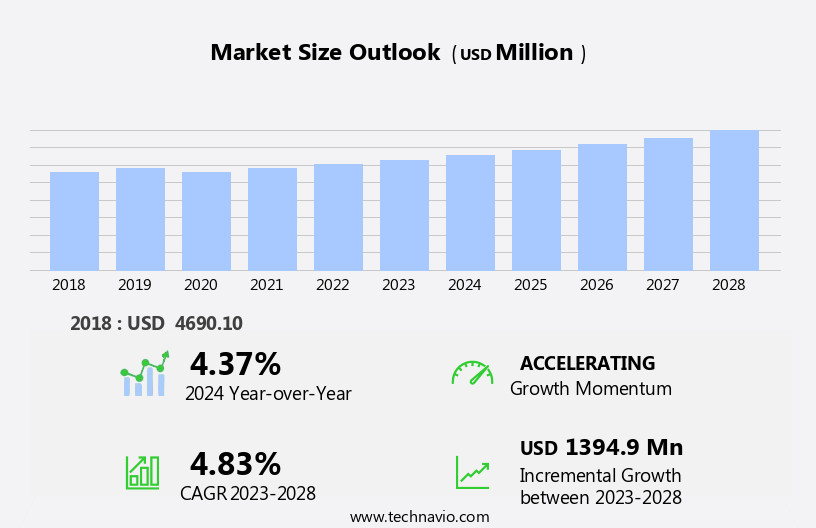

The laboratory consumables primary packaging market size is forecast to increase by USD 1.39 billion at a CAGR of 4.83% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing Research and Development activities in the healthcare industry. The healthcare sector's focus on innovation and advancements in diagnostic and therapeutic treatments is leading to an increased demand for high-quality laboratory consumables. Furthermore, the shift towards automated and point-of-care testing is fueling the need for specialized packaging solutions. Another key trend in the market is the growing demand for distribution through online channels. The convenience and accessibility offered by e-commerce platforms are making it easier for laboratories and research institutions to procure consumables, thereby expanding the market's reach.

- However, the market is not without challenges. Environmental concerns associated with the improper disposal of plastic labware are leading to stringent regulations and the adoption of eco-friendly alternatives. As such, companies in the market need to stay abreast of these trends and challenges to capitalize on the opportunities and navigate the competitive landscape effectively. By focusing on sustainable solutions, innovation, and strategic partnerships, players in the market can differentiate themselves and maintain a competitive edge.

What will be the Size of the Laboratory Consumables Primary Packaging Market during the forecast period?

- The market is estimated to experience steady growth, driven by increasing economic growth and the need for sustainable packaging solutions. Material costs and geopolitical tensions remain key factors influencing market outlook. Procurement strategies of leading players focus on cost reduction and innovation to stay competitive. Geopolitical analysis plays a crucial role in shaping market dynamics, with policy and regulatory frameworks significantly impacting market trends. Substitute materials continue to gain traction due to their cost-effectiveness and environmental benefits. Sustainability is a dominant trend in the market, with companies investing in eco-friendly packaging solutions to meet customer demand and regulatory requirements.

- Economic growth in end-user industries, such as pharmaceuticals and biotechnology, further fuels market expansion. Technological advancements, including automation and digitalization, are transforming the market landscape.

How is this Laboratory Consumables Primary Packaging Industry segmented?

The laboratory consumables primary packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Tubes

- Petri dishes

- Beakers

- Flasks

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

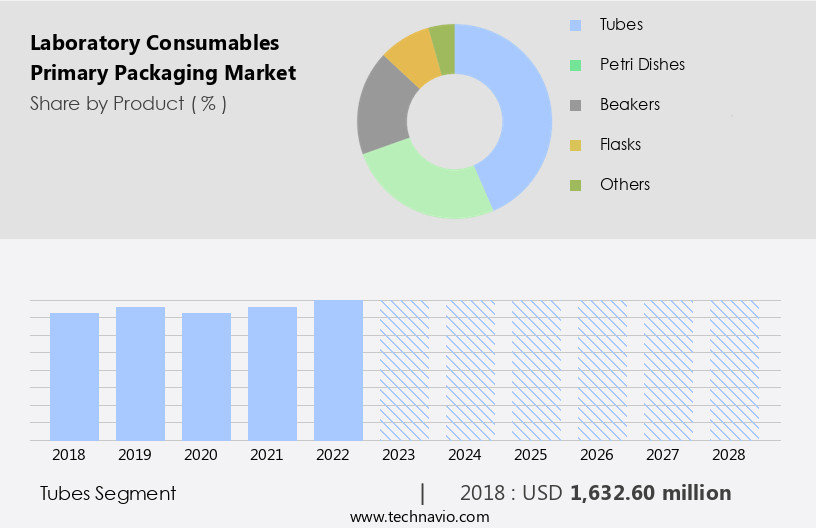

The tubes segment is estimated to witness significant growth during the forecast period.

In the realm of laboratory consumables primary packaging, tubes represent a significant segment due to their extensive applications in holding, mixing, and heating various chemicals during experiments, as well as for cultivating microorganisms. These tubes, available in both glass and plastic variants, are employed by a diverse range of industries, including pharmaceutical and biotechnology firms, research laboratories, diagnostic laboratories, and chemical companies. The market growth for tubes is driven by several factors, such as the increasing number of academic institutions, the burgeoning chemical manufacturing sector, and the expanding array of tube options available. Moreover, the competitive landscape of this market is shaped by various elements, such as technological advancements, price dynamics, and regulatory frameworks.

Geopolitical tensions and economic slowdowns can also impact the market's trajectory. Inventory management and cost analysis are crucial aspects for market participants, as the cost of substitute materials and the potential for mergers, acquisitions, and expansions can significantly influence market share. Major players in the market focus on product innovation, strategic partnerships, and sustainability initiatives to stay competitive. Regulatory compliance and adherence to stringent quality standards are essential for market entry and maintaining a dominant position. As the global economy continues to grow, the demand for laboratory consumables primary packaging, including tubes, is expected to increase, driven by the need for advanced analytical testing procedures and research and development activities.

Get a glance at the market report of share of various segments Request Free Sample

The Tubes segment was valued at USD 1.63 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

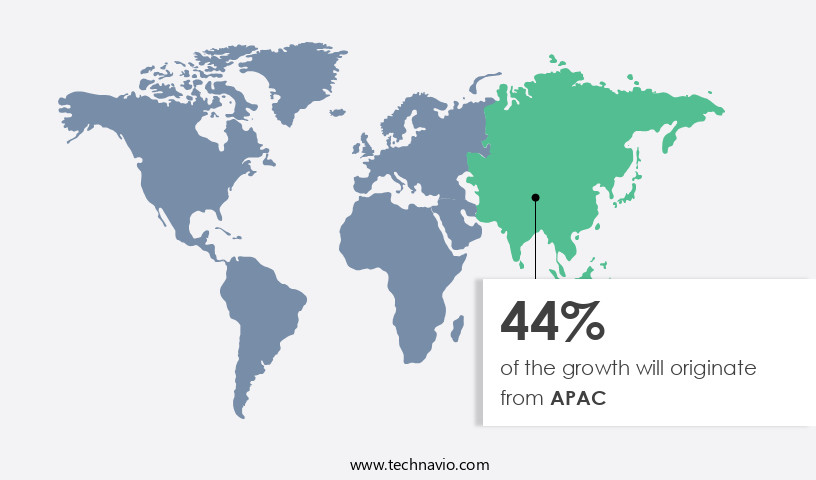

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing significant expansion due to several key factors. The increasing prevalence of infectious and chronic diseases, coupled with the rising development of new therapeutic drugs, is driving demand for analytical testing in various industries, including pharmaceuticals and biotechnology. Furthermore, the presence of numerous global and local companies in the region is providing ample competition and innovation. Government funding for research activities and the growing number of chemical manufacturers and food and beverage companies are also contributing to market growth. However, geopolitical tensions and economic slowdowns may pose challenges for market expansion.

Inventory management and cost of substitute are crucial considerations for market players, while mergers, acquisitions, and partnerships are common strategies for gaining a competitive edge. Sustainability and energy transition are increasingly important factors, as are regulatory frameworks and entry barriers. Market dynamics are influenced by various factors, including material costs, capabilities, technologies, and consumer preferences. Competitive intelligence and price analysis are essential tools for staying informed and making strategic decisions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Laboratory Consumables Primary Packaging Industry?

- Increasing R and D activities in healthcare industry is the key driver of the market.

- The market has witnessed significant growth due to the increasing research activities in the pharmaceutical and biotechnology sector, driven by the rising number of infectious diseases such as COVID-19, MERS, influenza, SARS, West Nile Virus, Ebola virus, and Monkeypox. The demand for laboratory consumables primary packaging products is on the rise as these companies and research institutes require high-quality packaging solutions to ensure the integrity and safety of their research samples and finished products.

- The prevalence of these diseases necessitates the development of drugs and vaccines, leading to an increase in the production of pharmaceuticals and biotechnology products. This trend is expected to continue, fueling the growth of the market.

What are the market trends shaping the Laboratory Consumables Primary Packaging Industry?

- Growing demand for distribution through online channels is the upcoming market trend.

- Laboratory consumables primary packaging products, including test tubes, beakers, Petri dishes, micropipettes, and flasks, are experiencing significant growth in distribution channels. Manufacturers are expanding their reach beyond traditional distributors to include direct sales and online retailers. This shift allows end-users, such as research laboratories, academic institutions, pharmaceutical and biotech companies, healthcare facilities, and chemical laboratories, easier access to these essential products. Major e-commerce platforms, such as Amazon, IndiaMart, and Alibaba, serve as prominent sales channels for these items.

- This trend is driven by the increasing adoption of digital marketing strategies, enabling manufacturers to broaden their customer base and enhance market penetration.

What challenges does the Laboratory Consumables Primary Packaging Industry face during its growth?

- Environmental concerns associated with improper disposal of plastic labware is a key challenge affecting the industry growth.

- The market for laboratory consumables primary packaging has witnessed notable growth due to the escalating need for various laboratory activities. These packaging products, primarily made of glass and plastics, are essential for measurements and testing processes in laboratories. However, the improper disposal of contaminated or radioactive laboratory consumables primary packaging products can pose a significant threat to the environment and public health. Plastic labware, which is non-recyclable if disposed of in landfills, can contribute to environmental pollution. It is crucial for laboratories to adopt sustainable disposal methods to mitigate the potential environmental impact.

- The adoption of eco-friendly packaging solutions, such as biodegradable plastics and glass, can offer a viable alternative to traditional laboratory consumables primary packaging products. In , the increasing demand for laboratory consumables primary packaging products necessitates a responsible approach towards their disposal to ensure sustainability and minimize potential hazards.

Exclusive Customer Landscape

The laboratory consumables primary packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the laboratory consumables primary packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, laboratory consumables primary packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Becton Dickinson and Co. - Vacutainer blood collection tubes, engineered for research applications, deliver precision and consistency in specimen acquisition. These tubes cater to the scientific community, enabling accurate and reliable data collection essential for research purposes. Engineered with rigorous quality standards, they ensure sample integrity, reducing variability and enhancing reproducibility in laboratory experiments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Becton Dickinson and Co.

- Bellco Glass Inc.

- Berlin Packaging LLC

- Borosil Ltd.

- BRAND GmbH and Co. KG

- Chemglass Inc.

- Citotest Labware Manufacturing Co. Ltd.

- CoorsTek Inc.

- Corning Inc.

- DELTALAB SL

- DWK Life Sciences GmbH

- Eppendorf SE

- Gerresheimer AG

- Gilson Co. Inc.

- Mettler Toledo International Inc.

- Poulten and Graf GmbH

- Savillex Corp.

- Thermo Fisher Scientific Inc.

- VITLAB GmbH

- XRF Scientific Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a dynamic and evolving industry that plays a crucial role in the scientific community. This market encompasses various materials and capabilities that cater to the unique requirements of different applications in the bio-chemical sector. The market's growth is driven by several factors, including technological advancements, competitive intelligence, and economic conditions. Material costs are a significant factor influencing the market's dynamics. The availability and pricing of raw materials, such as plastics and glass, can significantly impact the profitability of manufacturers. Prospective segments, including pharmaceuticals and biotechnology, are continually seeking cost-effective and sustainable solutions for their primary packaging needs.

Geopolitical tensions and inventory management are also essential considerations for market participants. The cost of substitute materials and the impact of mergers and acquisitions on market share can significantly affect the competitive landscape. Expansion into new markets and partnerships with leading players are winning strategies for companies looking to gain a foothold in this industry. The regulatory framework is another critical factor shaping the market. Regulations governing the use of specific materials and the implementation of sustainable practices are driving innovation and investment in the sector. Sustainability is becoming increasingly important, with many companies focusing on developing eco-friendly alternatives to traditional packaging materials.

Historically, the economy has had a significant impact on the market's growth. Economic slowdowns can lead to decreased demand for laboratory consumables, while economic growth can fuel increased investment in research and development. Price analysis is also a critical component of market intelligence, with companies continually seeking to optimize their pricing strategies to remain competitive. Bio-chemicals are a significant application area for primary packaging in the laboratory consumables market. The demand for bio-chemicals is driven by the growing need for advanced medical treatments and research in various fields, including biotechnology and pharmaceuticals. Consumer preferences for eco-friendly and sustainable packaging solutions are also influencing the market's direction.

The market for laboratory consumables primary packaging is highly competitive, with a diverse range of players vying for market share. Companies are continually seeking to differentiate themselves through their product portfolios and innovative technologies. The entry barriers for new players are relatively low, making the market highly dynamic and competitive. In , the market is a complex and evolving industry, influenced by various factors, including technological advancements, economic conditions, and regulatory frameworks. Companies must continually adapt to remain competitive and meet the evolving needs of their customers. The market's future growth is expected to be driven by factors such as sustainability, innovation, and cost-effectiveness.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 1394.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Key countries |

Germany, China, India, Japan, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laboratory Consumables Primary Packaging Market Research and Growth Report?

- CAGR of the Laboratory Consumables Primary Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laboratory consumables primary packaging market growth of industry companies

We can help! Our analysts can customize this laboratory consumables primary packaging market research report to meet your requirements.