Landing String Equipment Market Size 2024-2028

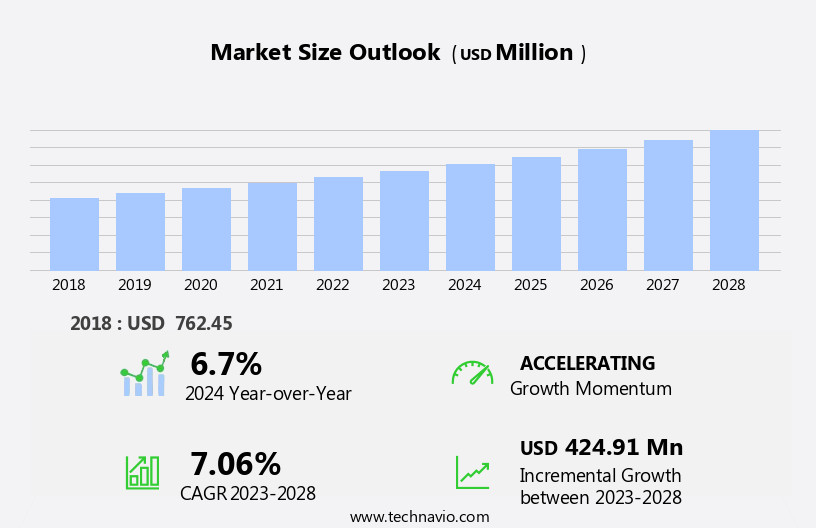

The landing string equipment market size is forecast to increase by USD 424.91 million at a CAGR of 7.06% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing deep-water and ultra-deepwater Exploration and Production (E and P) activities. The demand for landing string equipment is surging due to the complexities involved in drilling and completing wells in deeper waters. Moreover, advancements in landing string control systems are enhancing operational efficiency and safety, making them an indispensable component of offshore drilling operations. Another key trend shaping the market is the rise of renewable energy. As the world shifts towards sustainable energy sources, the demand for equipment used in offshore wind energy projects is expected to increase.

- Landing strings, which are essential components of wind turbine foundations, are expected to see significant demand in this sector. However, the market is not without challenges. The high capital investment required for the development and deployment of landing string technology, coupled with the volatile nature of oil prices, poses a significant challenge to market growth. Companies seeking to capitalize on the opportunities in this market must focus on cost reduction strategies, technological innovation, and strategic partnerships to navigate these challenges effectively.

What will be the Size of the Landing String Equipment Market during the forecast period?

- The market in the US exhibits growth, driven by the increasing demand for crude oil and natural gas, particularly from shale formations and deepwater reserves. This market encompasses drill and completion strings, subsea wellheads, and related equipment used in deepwater drilling, subsea processing, and well intervention activities. Key factors fueling growth include the expansion of shale gas production in the US, the ongoing development of shallow and ultradeep water resources, and the rising consumption of crude oil and fuel demand. Additionally, the market is influenced by trends such as the construction and maintenance of offshore rigs, the increasing use of floating vessels for drilling in challenging environments, and the growing adoption of renewable resources for energy production.

- Despite these opportunities, market growth may be hindered by adverse weather conditions and limited deck space on offshore rigs. Overall, the market is poised for continued expansion, driven by the dynamic interplay of oil demand, drilling activities, and technological innovation.

How is this Landing String Equipment Industry segmented?

The landing string equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Equipment

- Services

- End-user

- Deepwater

- Ultra-deepwater

- Shallow water

- Geography

- APAC

- China

- Middle East and Africa

- Europe

- Germany

- UK

- North America

- US

- South America

- APAC

By Type Insights

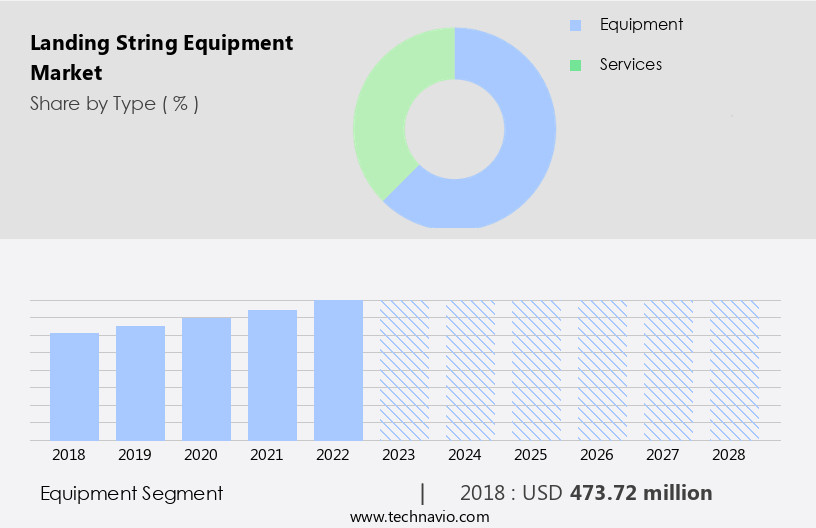

The equipment segment is estimated to witness significant growth during the forecast period.

The market encompasses various tools utilized in the construction and maintenance of landing strings, a crucial component in oil and gas industry well-completion and production processes. Landing strings, also known as completion strings, facilitate the transfer of fluids between the wellbore and the surface. Two essential components of landing strings are Tubing Hangers and Tubing Head Adapters. Tubing Hangers serve to seal off the wellhead from the tubing string, enabling the production or injection of fluids. They regulate flow through the wellbore and support the tubing string. Tubing Head Adapters facilitate the installation and removal of the landing string by joining the tubing hangers to the wellhead.

Factors influencing the market include elevator capacity requirements, adverse weather conditions, oil demand, and drilling activities in deepwater, deepwater drilling, and offshore rigs. The equipment segment includes drill pipes, completion strings, and other tools used in subsea processing and well intervention. In offshore drilling projects, floating vessels are employed in UltraDeep Water drilling, while oil consumption and fuel demand are essential considerations. The market is driven by the need for efficient and reliable landing string equipment in various applications, including subsea wells and offshore oil rigs.

Get a glance at the market report of share of various segments Request Free Sample

The Equipment segment was valued at USD 473.72 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

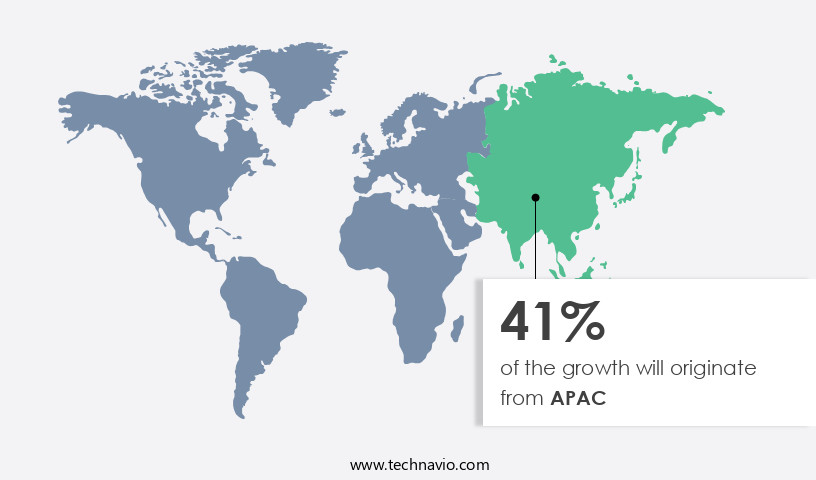

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the Asia Pacific region is experiencing significant growth due to the increasing number of deep-water and ultra-deepwater oil and gas projects in countries like China, Australia, and several Southeast Asian nations. The International Energy Administration (IEA) reports that global oil demand has reached an all-time high, driven by factors such as increased summer air travel, higher oil consumption in power generation, and surging petrochemical activity in China. According to the IEA, global oil demand is projected to rise by 2.2 million barrels per day to 102.2 million barrels per day in 2023, with China contributing over 70% of the increase.

In August 2023, Transocean's Dhirubhai Deep-water KG1 drillship received a binding notification of award from Oil and Natural Gas Corporation (ONGC) for a drilling assignment offshore India. Adverse weather conditions and the need for finishing and manufacturing of drilling and completion strings, as well as construction and maintenance of offshore rigs and subsea wellheads, further fuel the demand for landing string equipment in deep-water and offshore drilling activities. The oil industry's focus on subsea processing, deepwater drilling, and the use of floating vessels for crude oil production also contributes to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Landing String Equipment Industry?

- Rise in deep-water and ultra-deepwater E and P activities is the key driver of the market.

- Offshore oil and gas exploration and production (E&P) have gained significant importance due to the vast reserves of deep-water and ultra-deepwater resources. Upstream oil and gas companies have been extracting resources from offshore wells for several decades, transitioning from shallow waters to more challenging deep-water and ultra-deepwater environments. The production of oil in subsea conditions is more expensive than conventional methods, necessitating advanced technologies and techniques. The harsh offshore environment poses unique challenges to drilling operations, making it a more complex process than onshore drilling. According to the US Energy Information Administration (EIA), global offshore deep-water oil production is projected to grow by 2% annually between 2021 and 2026.

- This growth can be attributed to the increasing demand for oil and gas, advancements in technology, and the exploration of untapped deep-water reserves. Despite the challenges, offshore E&P remains a lucrative industry, offering substantial returns for companies that can navigate the complexities of deep-water drilling. The market dynamics of offshore E&P are influenced by various factors, including technological advancements, regulatory frameworks, and geopolitical risks. Companies must carefully evaluate these factors to ensure the success of their offshore E&P projects.

What are the market trends shaping the Landing String Equipment Industry?

- Growing advances in landing string control systems is the upcoming market trend.

- Landing string systems have gained significant traction in the oil and gas industry as an essential safety solution for subsea well interventions and completions. These systems interface with the subsea wellhead on the seabed, enabling operations from floating vessels with enhanced safety. reveals advancements in landing string technology, optimizing their usage in subsea wells. The landing string system incorporates a subsea test tree within a blow-out preventer. This test tree comprises large bore hydraulically operated valves, offering improved well control and sealing and cutting capabilities. In emergencies such as adverse weather conditions and drive-off scenarios, these features enable quick shut-in of the well and vessel disconnection, ensuring safety and efficiency.

- Landing string systems play a crucial role in ensuring the successful execution of subsea drilling and production activities. Their ability to provide reliable well control and sealing capabilities, even in challenging conditions, makes them indispensable in the oil and gas industry.

What challenges does the Landing String Equipment Industry face during its growth?

- Rise of renewable energy is a key challenge affecting the industry growth.

- The market is experiencing significant shifts due to the increasing adoption of renewable energy sources. Renewable energy, including solar and wind power, is gaining popularity for its environmental benefits and government support. This transition from traditional fossil fuel-based power generation to cleaner, sustainable options has resulted in a growing demand for landing string equipment that can be utilized with renewable energy systems. Landing string equipment plays a crucial role in the construction and operation of offshore renewable energy installations, such as wind turbines and floating solar panels.

- However, The market faces challenges in catering to the unique requirements of renewable energy projects. As the energy sector continues to evolve, it is essential for market participants to stay informed and adapt to these changing market dynamics.

Exclusive Customer Landscape

The landing string equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the landing string equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, landing string equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aker Solutions ASA - The company specializes in supplying advanced landing string equipment for oil and gas drilling applications. Equipped with a Subsea Test Tree, Retainer Valve, and Lubricator Valve, these solutions cater to the most challenging drilling environments. Designed for superior functionality and durability, these components ensure efficient drilling operations and enhanced safety standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aker Solutions ASA

- Drilltech Services North Sea Ltd.

- ExPert E and P Co. LLC

- Expro Group Holdings NV

- Halliburton Co.

- Interventek Subsea Engineering Ltd.

- NOV Inc.

- Quail Tools LP

- Schlumberger Ltd.

- Superior Energy Services Inc.

- TechnipFMC plc

- Vallourec SA

- WellPartner AS

- Yantai Enerserva Machinery Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a crucial role in the oil and gas industry, particularly in offshore drilling operations. This market encompasses a range of components designed to facilitate the safe and efficient deployment and retrieval of drilling strings and completion tools in challenging deepwater environments. Renewable resources have gained significant attention in recent years, leading to a shift in focus away from traditional fossil fuels. However, the demand for crude oil continues to be , driven by industrial processes and fuel demand. Adverse weather conditions and the increasing trend towards deeper drilling in ultradeep water have necessitated advancements in landing string technology.

Finishing and manufacturing processes have undergone significant improvements to enhance the durability and performance of landing strings. These strings are essential components of drill pipes, which enable the transfer of drilling fluid and the transmission of drilling parameters between the rig and the seabed. Deepwater drilling projects in offshore rigs require specialized landing control systems to ensure the safe and efficient deployment and retrieval of drill strings. These systems are critical for well intervention and well control, which are essential for maintaining production from subsea wells. Construction and maintenance activities associated with offshore drilling projects necessitate the use of landing strings.

These strings are also used in drilling activities in shallow water, where the seabed may not be as stable as in deeper waters. The use of floating vessels for offshore drilling has increased in recent years, leading to an increased demand for landing string equipment. Subsea processing and completion strings are essential components of these operations, as they enable the processing of crude oil and natural gas at the seabed before it is transported to the surface. The deepwater drilling market is expected to grow significantly in the coming years, driven by the increasing demand for crude oil and the availability of new technologies that enable drilling in ultradeep water.

The equipment segment, which includes landing strings, is expected to benefit from this growth. Adverse weather conditions can pose significant challenges to offshore drilling operations, particularly in deepwater environments. Landing strings are essential for ensuring the safe and efficient deployment and retrieval of drill strings and completion tools in these conditions. The use of landing strings is not limited to drilling activities. They are also used in well intervention operations, which are essential for maintaining production from subsea wells. These operations involve the injection of chemicals, water, or gas into the wellbore to enhance production or address production issues.

The seabed plays a crucial role in the successful deployment and retrieval of landing strings. Advanced technologies, such as dynamic positioning systems and remotely operated vehicles, are used to ensure that the rig remains in the correct position above the seabed during these operations. In , the market plays a vital role in the offshore drilling industry. These components are essential for enabling the safe and efficient deployment and retrieval of drill strings and completion tools in deepwater environments. The market is expected to grow significantly in the coming years, driven by the increasing demand for crude oil and the availability of new technologies that enable drilling in ultradeep water.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.06% |

|

Market growth 2024-2028 |

USD 424.91 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

6.7 |

|

Key countries |

US, Saudi Arabia, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Landing String Equipment Market Research and Growth Report?

- CAGR of the Landing String Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Middle East and Africa, Europe, North America, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the landing string equipment market growth of industry companies

We can help! Our analysts can customize this landing string equipment market research report to meet your requirements.