Manned Security Services Market Size 2024-2028

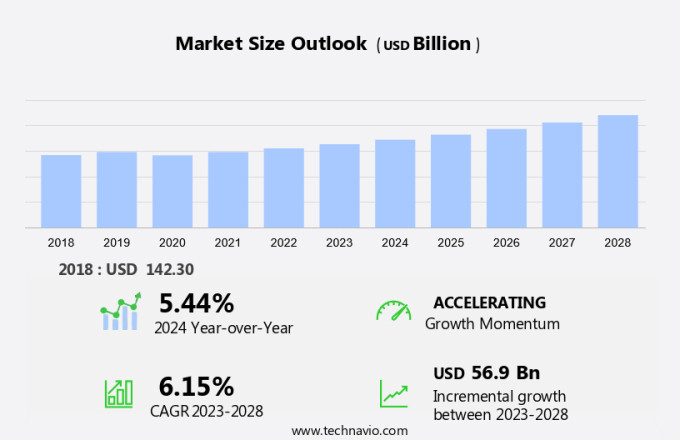

The manned security services market size is forecast to increase by USD 56.9 billion and is estimated to grow at a CAGR of 6.15% between 2023 and 2028. The market report provides a comprehensive analysis of the market's growth dynamics, with a focus on significant factors driving competition. The sector's high level of competition intensifies the need for companies to deliver superior services and innovations to maintain a competitive edge. This report delves into the market's trends, growth opportunities, and challenges, offering valuable insights for stakeholders and investors. By understanding the competitive landscape and market drivers, businesses can make informed decisions and capitalize on the market's potential.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The Market is witnessing significant growth due to the increasing global security concerns caused by natural disasters and terrorist attacks. International travel and the need for border patrol personnel have also boosted the demand for manned security services at airports. In addition, the rise in crime rates, theft, unlawful entry, and accidents have led commercial establishments to invest in manned security services for their Commercial infrastructure, Residential complexes, and Commercial complexes. The demand for manned security services is not limited to preventing physical threats but also includes protecting against cyber threats through IoT and cloud services. Private security companies offer various solutions such as training centers, gated societies, third-party security services, automated security, integrated guarding solutions, electronic surveillance, IP Surveillance, Burglar alarms, and more. These services ensure the safety and security of people and property in various settings. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

High level of competition in manned security services sector is notably driving market growth. Manned security services play a crucial role in ensuring the safety and security of establishments such as malls and hotels. These services provide a physical presence to deter potential threats and protect visitors and employees. According to recent market research, the demand for manned security services is expected to grow significantly in the coming years.

Significant Market Trends

Integrated facility management services in buildings is the key trend in the market. Manned security services play a crucial role in ensuring the safety and security of various establishments, including malls and hotels. These services provide a physical presence of security personnel to deter potential threats and protect visitors and employees.

Major Market Challenge

Innovations in electronic security equipment is the major challenge that affects the growth of the market. Manned security services play a crucial role in ensuring the safety and security of establishments such as malls and hotels. These services involve the deployment of trained security personnel to provide on-site protection. According to various market research firms, the demand for manned security services is expected to grow significantly in the coming years.

Exculsive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Allied Universal: The company offers a range of manned security services to help secure premises, people and assets, helping to minimise the security risk through its subsidiary G4S Plc.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADT Inc.

- China Security and Protection Group Co. Ltd.

- Control Risks Group Holdings Ltd.

- Corps Security UK Ltd.

- GardaWorld Security Corp.

- GMR Infrastructure Ltd.

- ICTS Europe S.A

- Northbridge Services Group Ltd.

- OCS Group International Ltd.

- Prosegur Compania de Seguridad SA

- Securiguard Services Ltd.

- Securitas AB

- SIS Ltd.

- Stalwart People Services India Ltd.

- The Brinks Co.

- Tops Security Ltd.

- Transguard Group LLC

- TSU Group Holdings (Pty) Ltd.

- WWSO Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

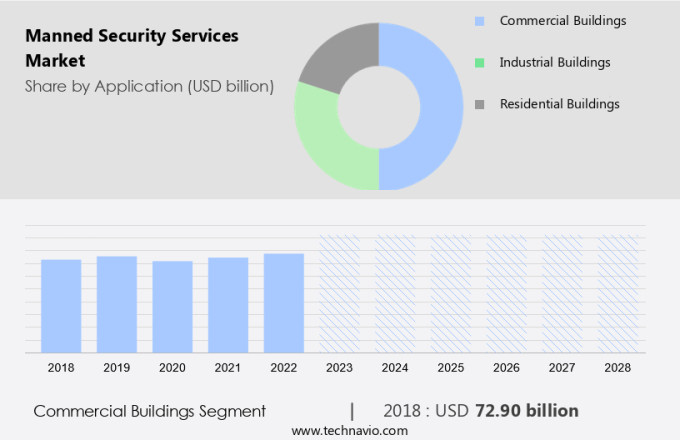

By Application

The commercial buildings segment is estimated to witness significant growth during the forecast period. Manned security services play a crucial role in ensuring safety and security in the face of global security concerns, particularly in the context of natural disasters and terrorist attacks. The demand for private security services is on the rise, especially in the context of international travel, border patrol personnel, and airport security.

Get a glance at the market share of various regions Download the PDF Sample

The commercial buildings segment was the largest segment and valued at USD 72.90 billion in 2018. Manned security services play a crucial role in ensuring safety and security in the face of global security concerns, particularly in the context of natural disasters and terrorist attacks. The demand for private security services is on the rise, especially in the context of international travel, border patrol personnel, and airport security. Hence, such factors are fuelling the growth of this segment during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

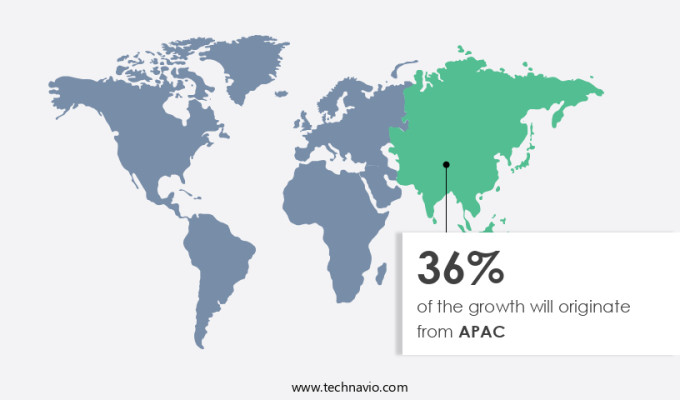

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Manned security services play a crucial role in ensuring safety and security in the face of global security concerns, particularly in the context of natural disasters and terrorist attacks. International travelers rely on airport security, border patrol personnel, and private security demand at commercial and residential establishments. Group housing in residential complexes and commercial complexes necessitates advanced security measures, including IoT and cloud services, to mitigate risks of theft, unlawful entry, and criminal damage. Hence, such factors are driving the market in APAC during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application Outlook

- Commercial buildings

- Industrial buildings

- Residential buildings

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

Private Security Services Market Analysis APAC, North America, Europe, South America, Middle East and Africa - US, China, India, Germany, UK - Size and Forecast

Security Services Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, Canada, China, Germany, UK - Size and Forecast

Drone Robots Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, China, Germany, UK, Japan - Size and Forecast

Market Analyst Overview

Fortifying Commercial and Residential Buildings Against Theft, Unlawful Entry, and Crime Manned security services have gained significant importance in today's world, where natural disasters, terrorist attacks, and global security concerns continue to pose threats. International travel, border patrol personnel, and airport security are some areas where manned security services are indispensable. In the commercial sector, manned security is essential for securing commercial infrastructure, including 2G and IoT-enabled residential and commercial complexes. Manned security services are vital for securing large enterprises, industrial buildings, and commercial buildings. Theft, unlawful entry, criminal damage, and accidents are common security concerns in these areas. Advanced data analytics and IoT-enabled cloud services are increasingly being used to enhance manned security services, providing real-time monitoring and response. Private security demand is high in residential buildings, including flats and gated societies, to ensure the safety and security of residents. Manned security services also play a crucial role in securing third-party commercial establishments and protecting against crime rates. Training centers for security guards ensure that they are equipped with the necessary skills to handle various security situations. Automated security systems, integrated guarding solutions, electronic surveillance, IP Surveillance, burglar alarms, and other advanced security technologies are being used to strengthen manned security services. Airports and embassies are high-risk areas that require robust manned security services to prevent potential threats. Manned security services are essential for securing critical infrastructure and ensuring the safety of people and property.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.15% |

|

Market growth 2024-2028 |

USD 56.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.44 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

US, China, UK, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ADT Inc., Allied Universal, China Security and Protection Group Co. Ltd., Control Risks Group Holdings Ltd., Corps Security UK Ltd., GardaWorld Security Corp., GMR Infrastructure Ltd., ICTS Europe S.A, Northbridge Services Group Ltd., OCS Group International Ltd., Prosegur Compania de Seguridad SA, Securiguard Services Ltd., Securitas AB, SIS Ltd., Stalwart People Services India Ltd., The Brinks Co., Tops Security Ltd., Transguard Group LLC, TSU Group Holdings (Pty) Ltd., and WWSO Group |

|

Market dynamics |

Parent market analysis, market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies