Private Security Services Market Size 2025-2029

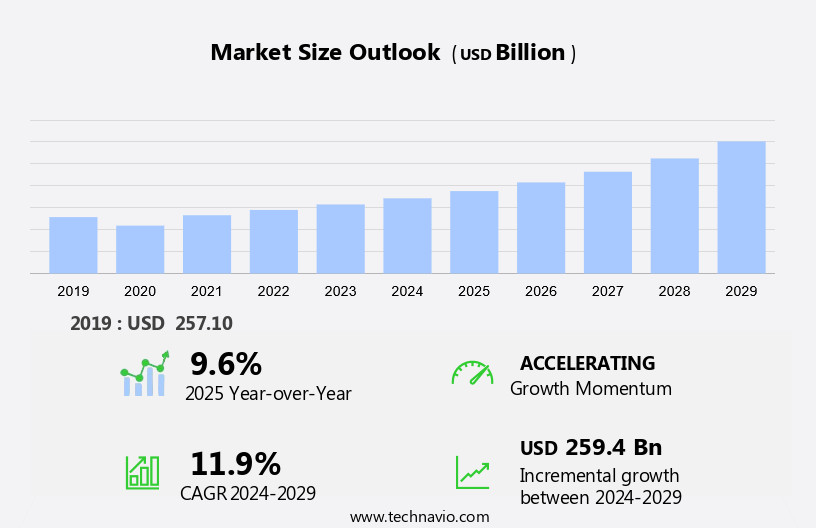

The private security services market size is forecast to increase by USD 259.4 billion, at a CAGR of 11.9% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven by the rapid urbanization and population growth that necessitate increased security measures. This trend is particularly pronounced in developing regions, where the demand for private security services is surging to address the rising crime rates and ensure public safety. Another key driver is the increasing popularity of virtual security systems, which offer cost-effective and efficient solutions for monitoring and securing properties. However, the market faces a significant challenge in the form of a shortage of private security personnel. This labor shortage is exacerbated by the growing complexity of security threats and the need for highly skilled personnel to effectively mitigate risks.

- Companies seeking to capitalize on market opportunities must invest in technology and training to address the labor shortage and stay competitive. Additionally, they must adapt to the changing security landscape by offering integrated security solutions that combine physical and virtual security measures. By doing so, they can effectively address the evolving needs of clients and navigate the challenges of the market.

What will be the Size of the Private Security Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping the industry's applications across various sectors. Threat analysis and penetration testing are crucial components of data protection, ensuring security standards are met and maintained. Security awareness campaigns, event correlation, and policy adherence are integral to ransomware protection and cybersecurity. Security technology, including analytics platforms and automation, plays a significant role in security education and assessment. Physical security, consulting, and intelligence are essential for perimeter security and incident management. Regulations such as PCI DSS and privacy laws necessitate compliance audits and security integration. Vulnerability assessments and management are ongoing processes that involve security infrastructure, asset protection, and best practices.

Security breaches and phishing prevention require robust emergency response and incident management capabilities. Disaster recovery planning and background checks are essential components of business continuity planning and security management systems. Security architecture and operations centers ensure security monitoring and reporting, while security certifications and outsourcing provide additional layers of protection. Network security, malware protection, and CCTV surveillance are integral to security hardware and software solutions. Threat intelligence and risk management are essential for maintaining a strong security culture and effective security testing.

How is this Private Security Services Industry segmented?

The private security services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Industrial

- Residential

- Financial institutions

- Others

- Service

- Manned guarding

- Electronic security services

- Cash services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The industrial segment is estimated to witness significant growth during the forecast period.

The market encompasses various offerings such as loss prevention, penetration testing, data protection, security standards, security awareness campaigns, security event correlation, security policies, ransomware protection, security technology, security analytics platform, security analytics, security training, cybersecurity training, security automation, security orchestration, security education, security assessments, physical security, security consulting, security intelligence, security protocols, business continuity planning, security planning, data privacy, perimeter security, security audits, security integration, security management systems, security architecture, security operations center, security monitoring, PCI DSS, security outsourcing, security hardware, security awareness, threat analysis, access control systems, red teaming, vulnerability management, security infrastructure, asset protection, best practices, security breaches, phishing prevention, emergency response, data breaches, privacy laws, vulnerability assessments, security regulations, security incident management, incident response, compliance audits, managed security services, disaster recovery planning, background checks, security patching, network security, mobile patrols, employee screening, security culture, security testing, threat intelligence, security guards, malware protection, CCTV surveillance, security compliance, cloud security, security reporting, security software, alarm monitoring, risk management, and security certifications.

Manufacturing industries, which consist of sophisticated manufacturing plants, warehouses, and assemblies, are significant consumers of these services. These industries require round-the-clock security and surveillance services due to the valuable assets they protect. Private security services like manned guarding and electronic security systems are popular choices for manufacturers. By outsourcing their security needs, manufacturers can concentrate on their core business activities, enhancing productivity and the efficiency of their operations. Consequently, the demand for private security services remains high within the industrial sector.

The Industrial segment was valued at USD 109.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

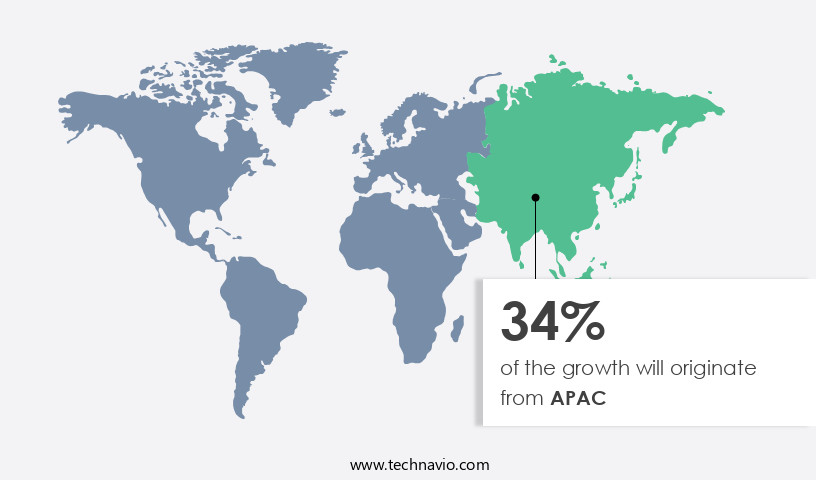

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, APAC experienced notable expansion in 2024, fueled by the economic development of countries like China, India, Thailand, and Indonesia. As per capita income increases in these rapidly developing economies, infrastructure growth ensues. Additionally, APAC is one of the world's fastest-urbanizing regions, with the increasing number of employment opportunities in urban areas driving population migration. This urbanization trend is leading to a surge in demand for residential and commercial complexes, thereby fueling the necessity for private security services in the region. Security services encompass various aspects, including loss prevention, penetration testing, data protection, security standards, security awareness campaigns, security event correlation, security policies, ransomware protection, security technology, security analytics platform, security analytics, security training, cybersecurity training, security automation, security orchestration, security education, security assessments, physical security, security consulting, security intelligence, security protocols, business continuity planning, security planning, data privacy, perimeter security, security audits, security integration, security management systems, security architecture, security operations center, security monitoring, PCI DSS, security outsourcing, security hardware, security awareness, threat analysis, access control systems, red teaming, vulnerability management, security infrastructure, asset protection, best practices, security breaches, phishing prevention, emergency response, data breaches, privacy laws, vulnerability assessments, security regulations, security incident management, incident response, compliance audits, managed security services, disaster recovery planning, background checks, security patching, network security, mobile patrols, employee screening, security culture, security testing, threat intelligence, security guards, malware protection, CCTV surveillance, security compliance, cloud security, security reporting, security software, alarm monitoring, risk management, and security certifications.

These services are essential for safeguarding businesses and individuals from various security threats, ensuring regulatory compliance, and maintaining a secure environment.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Private Security Services Industry?

- The primary forces fueling market expansion are the rapid urbanization and significant population growth.

- The market experiences significant growth due to the challenges posed by urbanization and population expansion. As more individuals and businesses move to urban areas, the demand for security services escalates. Crime rates often increase in densely populated urban environments, leading entities to seek private security solutions for protecting their assets and personnel. Moreover, law enforcement agencies face unique challenges in managing crime in urban areas, further emphasizing the importance of private security services. Loss prevention, data protection, and security standards are critical aspects of private security services. These services encompass security assessments, cybersecurity training, security policies, and security technology such as penetration testing, ransomware protection, and security analytics platforms.

- Security awareness campaigns, security event correlation, and security automation and orchestration are also essential components of private security services. Physical security remains a crucial aspect of private security services, with a focus on implementing harmonious and immersive security measures to strike a balance between safety and aesthetics. Security education and ongoing training for security personnel are also vital to ensure they are equipped with the latest skills and knowledge to address evolving security threats effectively. In conclusion, the market is driven by the unique challenges posed by urbanization and population growth. Providers of these services must offer a comprehensive range of solutions, including loss prevention, data protection, security analytics, cybersecurity training, and physical security, to meet the diverse needs of their clients.

What are the market trends shaping the Private Security Services Industry?

- The rising preference for virtual security systems represents a significant market trend. This trend is driven by the increasing recognition of the benefits these systems offer, such as enhanced security features and remote access capabilities.

- In today's business environment, ensuring security is a top priority. Advanced electronic security systems have revolutionized surveillance, making them more efficient and reliable. Innovations in security camera technology and digital video systems have significantly enhanced personal and business security services. The latest development in this field is virtual security systems, which are gaining popularity due to their remote monitoring capabilities. These systems consist of digital cameras connected to networks with an Internet connection, enabling businesses to monitor their premises from anywhere. This remote access expands the monitoring capabilities of security systems, making virtual security systems an attractive option for businesses worldwide.

- Security consulting, intelligence, and planning are essential components of these systems. Business continuity planning, data privacy, and security protocols are integrated into security management systems, ensuring comprehensive protection. Security architecture, operations centers, monitoring, PCI DSS compliance, and security outsourcing are also integral parts of these systems. Security hardware, awareness, and training are crucial elements that complete the security solution. Virtual security systems offer businesses a harmonious blend of advanced technology and professional security services.

What challenges does the Private Security Services Industry face during its growth?

- The private security industry faces significant growth impediments due to a persistent shortage of personnel. This workforce deficiency poses a substantial challenge that must be addressed to ensure the industry's continued expansion.

- The market experiences continuous growth due to increasing security threats and the need for advanced security solutions. Threat analysis, access control systems, red teaming, vulnerability management, and security infrastructure are essential components of comprehensive security strategies. However, private security service providers face challenges such as the shortage of skilled personnel, which can impact their financial health and market expansion. This issue is primarily related to manned guarding services. The scarcity of private security personnel is attributed to factors like a lack of career progression, pay disparities, and long working hours. To mitigate this challenge, providers are adopting strategies to retain existing personnel and attract new talent through competitive compensation packages during the forecast period.

- Best practices, security breaches, phishing prevention, emergency response, data breaches, privacy laws, vulnerability assessments, security regulations, security incident management, incident response, and compliance audits are crucial elements of private security services. Managed security services also play a significant role in ensuring robust security infrastructure and asset protection.

Exclusive Customer Landscape

The private security services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the private security services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, private security services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ADT Inc. - The company specializes in providing comprehensive security solutions, encompassing Home Security Systems, Smart Security Cameras, and Life Safety Alarms. Our advanced technology ensures optimal protection for residential and commercial clients. Home Security Systems include access control, burglar alarms, and remote monitoring capabilities. Smart Security Cameras offer high-definition video and motion detection, while Life Safety Alarms provide early warning for potential fires or carbon monoxide leaks. By integrating these services, we deliver a holistic approach to security, enhancing peace of mind and safeguarding assets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADT Inc.

- Allied Universal

- AMZ Sicherheitsdienste GmbH

- Corps Security UK Ltd.

- Hanwei International Security Services Co. Ltd.

- ICTS Europe SA

- Indian Facility Solutions Pvt. Ltd.

- ISS AS

- Kingdom Protection Services Pvt. Ltd.

- Loomis AB

- Mitie Group Plc

- OCS Group International Ltd.

- Peregrine Guarding Pvt. Ltd.

- Prosegur Compania de Seguridad SA

- Securitas AB

- SIS Ltd.

- The Brinks Co.

- Top IPS Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Private Security Services Market

- In February 2024, Securitas, a leading global security services provider, announced the launch of its innovative remote guarding solution, Securitas Secure Remote Video Services (SRVS). This service utilizes advanced technology, including AI and analytics, to monitor client sites from a secure operations center, reducing on-site security personnel requirements (Securitas Press Release, 2024).

- In May 2024, G4S, another major player in the market, entered into a strategic partnership with Microsoft to integrate Microsoft's Azure IoT and AI technologies into their security services. This collaboration aims to enhance security offerings through real-time threat detection and predictive analytics (G4S Press Release, 2024).

- In August 2025, Allied Universal, the largest security and facility services company in North America, completed the acquisition of United Security, a leading security services provider in the Midwest region. This acquisition significantly expanded Allied Universal's presence and market share in the United States (Allied Universal Press Release, 2025).

- In November 2025, the European Union approved the new EU Cybersecurity Act, which includes provisions for enhancing the private security services sector's cybersecurity capabilities. This regulation mandates that security providers implement specific cybersecurity measures and undergo regular certification processes (European Commission Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant advancements, driven by the integration of technology into traditional security solutions. Smart security systems, including security cameras and video analytics, are increasingly being adopted for real-time threat detection and response. Security drones and AI-powered security solutions are revolutionizing outdoor surveillance and perimeter protection. Biometric authentication and facial recognition are enhancing access control systems, ensuring higher security and convenience. Security compliance software and security automation software are streamlining regulatory compliance and routine security tasks. Security monitoring software and security orchestration software are enabling centralized management and response to security incidents. Security robotics and security sensors are augmenting guard services and providing round-the-clock surveillance.

- Security consulting services and security integration services are essential for organizations seeking expert advice on security infrastructure design and implementation. Security management software and security software suites are providing comprehensive solutions for managing security operations and risks. Security auditing services and security awareness programs are crucial for maintaining a strong security posture and mitigating insider threats. In summary, the market is evolving rapidly, with a focus on technology integration, automation, and enhanced security capabilities. These trends are transforming the way organizations approach security and are essential for staying ahead of evolving threats.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Private Security Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.9% |

|

Market growth 2025-2029 |

USD 259.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.6 |

|

Key countries |

US, China, Japan, Germany, UK, India, Brazil, Canada, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Private Security Services Market Research and Growth Report?

- CAGR of the Private Security Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the private security services market growth of industry companies

We can help! Our analysts can customize this private security services market research report to meet your requirements.